How Do The Social Security Trust Funds Really Work & Can We Rely On Them?

by Daniel R. Amerman, CFA

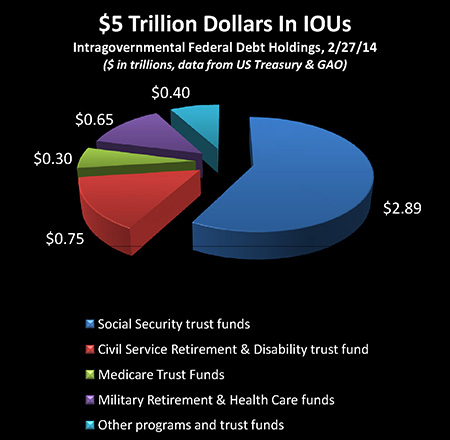

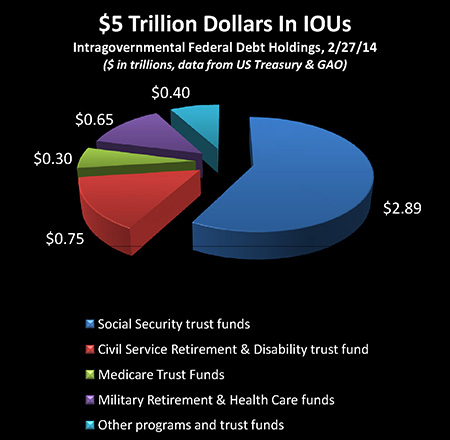

TweetSocial Security and other federal government guaranteed retirement programs are secured by about $5 trillion in trust funds, that are entirely invested in US Treasury obligations.

What is another name for those US Treasury obligations? That would be the national debt.

So here's a question to consider: where does the money come from to pay off the national debt?

And if the national debt isn't repaid – then how is it that Social Security benefits get paid, as well as military and civil service retirement benefits?

Good questions?

Now, there is a way that $5 trillion in Social Security and other retirement benefits which are backed by the Trust Funds assets can get paid in full without even $1 of the national debt being truly repaid.

This can also happen without taxes increasing or the annual deficit increasing (at least at the time that each benefit is first paid out). And this could indeed happen in a highly reliable manner, so that you never miss a dollar of the promised payments that are secured by those assets.

But the source of those payments is not what the public generally believes it to be. In fact, the underlying source of cash to make benefit payments is almost the direct opposite of what we are often told, and instead of being reassured by the trillions in the Trust Funds, the average person might be quite worried if they knew where their retirement benefits were actually coming from.

For those with the curiosity and courage to seek the answer to this mystery, be prepared "to go down the rabbit hole", because as explored herein, the real mechanics of where the Trust Funds money will come from to pay for your Social Security benefits is likely stranger than you think it is.

The First Level Of Reality: $5 Trillion Of The Safest Possible Assets

The way that Social Security taxes are officially presented is that they are not really an income tax – but a government-mandated and guaranteed retirement fund that exists for the benefit of American workers.

The government takes a portion of each worker's income, as a matter of law. Most of that money goes to make retirement benefit payments to current retirees. For decades there was an ongoing surplus as well. Those surplus monies were taken by the US government and responsibly invested in the safest of all assets –obligations of the United States Treasury, which are held within the Trust Funds for the safety and benefit of future retirees.

As the population ages and reaches the point (as it now has) where the monies coming in from payroll taxes are no longer enough to pay out what is required, the US government will then begin to responsibly draw down this available cash that was invested for the benefit of retirees, so that payments can be made to retirees without needing to either increase taxes or increase borrowings.

The whole thing looks and sounds pretty darn good.

But is that what's really happening?

The Second Level Of Trust Fund Reality: Economic Literacy

There is a quite different – and I would argue much more reality-based – view of Social Security and other trust funds, that has been understood among the most financially and economically literate parts of society for some decades now. One of my favorite quotes on the subject is from Peter Peterson, who was at the time chairman and founder of the Blackstone Group, one of the world's largest and most prestigious money-management firms:

"The term 'government trust fund' is a fiscal oxymoron. You shouldn't trust them and they are not funds. In fact, government trust funds accomplish no savings at all. The money is spent as soon as it is collected. Whether you have a trust fund or not is economically irrelevant. With or without the trust fund, you're either going to have to undertake huge, and I think, unacceptable tax increases, or sudden and draconian cuts in benefits." (CFA Magazine, January/February 2004 issue)

What really happened with Social Security payments over the decades was that the government took the receipts from payroll taxes, sent most of the payments to current beneficiaries, and immediately spent every penny of what remained on general government purposes.

And in exchange for taking that money and spending it, the government wrote itself an IOU in the form of US Treasury bonds.

This is somewhat akin to your writing yourself a check for $1 billion.

The only way that you can pay off that check is to come up with $1 billion.

If you don't come up with $1 billion, the check isn't good – and if you do come up with $1 billion, well you didn't need the check in the first place. So the existence of the check is irrelevant either way.

This is really very simple. There are no stocks in the trust fund, there are no corporate bonds, there are no bonds from other nations – there are no real investments in the sense that most people would view savings or assets.

The government collected a steeply regressive tax from many millions of lower and middle-income workers, it spent every dime, and what is called the Social Security Trust Fund is nothing more than a collection of IOUs written to itself. And the government needs to come up with the money to pay off those IOUs, or they won't get paid.

This could also be likened to funding your retirement by following a disciplined schedule of writing yourself a check each month and putting it in a drawer, but not making any corresponding deposits to cover the checks. Everything looks great – until you retire and start trying to cash the checks.

While this is all very sound and simple logic, it is simultaneously a perspective that politicians won't touch with a 10 foot pole – and the media doesn't seem all that eager to shine a light on it either.

The Third Level Of Reality: The Assets Aren't Real, But The Liabilities Are

To understand the third – and governing – level of reality for Social Security and other government trust funds invested in government bonds, let's continue with the analogy of writing a monthly retirement check and putting it in a drawer.

Except this time, the check isn't written to ourselves – but to our employees, as part of a legally-binding pension obligation. When the checks start getting pulled out of the drawer to be cashed many years later by those now retired employees, we must either find the money to make good on the checks – or we have to declare bankruptcy.

What a reversal! Instead of having a drawer full of assets, we now have a drawer full of legally-binding obligations. And if we don't scramble to come up with the money to put into our account to pay off those checks over time, it's game over – default and bankruptcy.

To understand that analogy is to understand the true relationship between the Federal Government and the Social Security trust funds.

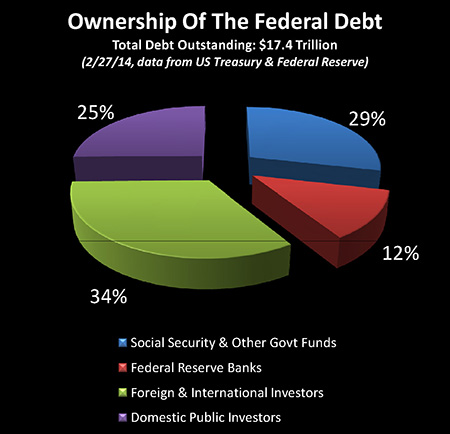

Now while there may not be any real assets in Social Security or other government trust funds, the liabilities are entirely real. Indeed, as can be seen in the graph above, the Social Security trust funds hold about $2.9 trillion in US Treasury obligations, and other government retirement trust funds hold about $2.1 trillion worth, for a total of $5 trillion.

That $5 trillion must be paid – or the US government has failed to meet its contractual obligations and is insolvent.

Following The Money

To understand what is really happening in the face of apparent financial complexity, a basic tool can often be used – just follow the money.

So to unravel how Social Security and other government retirement Trust Funds actually work, we merely need to follow what is actually going on at four distinct points: 1) when the money comes in; 2) the years during which the money is "invested"; 3) the redemption of the principal due; and 4) the aftermath of the redemption.

1. When the Money Comes In

As the money comes in, it is immediately spent in full by the US government, either in payments to payroll tax beneficiaries or for general spending purposes. And the money which went for general spending is effectively replaced with an IOU, which is an obligation of the United States government to itself.

2. The "Investment" Of The Trust Funds

Over the decades that follow, interest is paid by the US government to itself on an ongoing basis.

However, this is a purely paper transaction and does not require spending any actual taxes or cash.

Instead, the Treasury looks at the interest that is due, and it effectively pays that interest in the form of new government bonds.

No new cash – just new IOUs, written to itself.

And over the years, compound interest on the Trust Funds compounds the amount of IOUs that the government owes to itself, with no economic reality in terms of actual cash or economic activity.

3. The Redemption Of The Bonds

This is perhaps the most fascinating part in following the money trail, given it is a complete inversion of what's being presented, and it is the least understood part.

The simple truth is that the government is not making principal and interest payments on its debt out of tax revenues – because it doesn't have the cash available to do so (as further explored here).

Instead, when principal payments come due, the government borrows the money to make those payments, and when interest payments come due, the government borrows the money to make those as well.

So when Social Security and other retirement fund programs are drawn down to make payments to beneficiaries, the government isn't actually using tax revenues to do that, but rather it is rolling over the debt, and borrowing to make the principal payments to pay off the trust funds.

Let's say that $1 million of bonds in the Trust Funds mature, and the money needs to be paid out in the form of retirement benefits for Social Security and retired government employees. If this were a normal pension fund, the fund would take the cash that comes in from the maturing bond, and use it to pay benefits. Or it might go to a cash balance being held somewhere, and use that cash. Or it might sell an existing bond to someone else at market value, and use that money to pay the benefits.

Now, if the bonds really matured in the normal sense with the Social Security Trust Funds, then tax monies would be used to make the principal and interest payments on the maturing security, that cash would be used pay retirement benefits, and the national debt would be reduced by that amount. So redeeming a $1 million bond would require $1 million in taxes, and that $1 million bond would no longer be an outstanding debt, which means the indebtedness of the US government would be reduced by $1 million.

This is much like an individual making a $1,000 credit card payment, over and above any interest due. The only way to make the payment is to come up with the cash, but once that has been done, the outstanding balance is reduced by the amount of our payment.

And if the Trust Funds were real normal assets and worked the way most people have been encouraged to believe they do, then redeeming $5 trillion in total Trust Funds assets would require the government coming up with $5 trillion in tax money to pay off the bonds (plus interest), and this would then reduce the national debt by $5 trillion.

What actually happens however, is that the US government issues a new Treasury bond, which is sold for $1 million in real cash to an outside dealer in government debt. That $1 million in cash is then used to pay off the bond that is held in the Trust Funds, and that then gives the Social Security Administration $1 million in cash, which is used to cover any shortfall between money coming in from payroll taxes, and the money going out to retirees.

So what we really have is a swap of debt, where an internal IOU that existed only in bookkeeping form is replaced, dollar for dollar, by an external and very real debt in the form of a completely normal Treasury bond.

Because the $1 million was funded by the sale of external debt, there is no need to use tax monies to redeem the bond, or increase taxes in general (initially anyway) to pay off all of the Trust Funds.

Because the reduction of old debt (the internal IOU in the Trust Funds) was matched dollar for dollar by the issuance of new external debt, there is no direct change in the level of the national debt.

And because of the dollar for dollar swap of old debt for new debt and the lack of any need for additional tax monies, there is no increase in the annual deficit.

(The new external bonds issued to make the cash interest payment on the maturing internal bond do, however, increase both the annual deficit and the outstanding national debt because unlike the principal payment, there is no swap of old for new. So if a semiannual payment of $10,000 in interest is made along with the $1 million in principal, the deficit and national debt each increase by $10,000.)

In general terms and with normal externally held Treasury bonds, a situation of continually rolling over the debt has been the unquestioned norm for decades as the national debt has grown in almost every year. A bond is sold, it comes due, another bond is issued, and the proceeds from the new bond are used to pay off the old bond. Then when that "new" bond comes due, a still newer bond is issued, and so forth. This means that government debts that were originally taken out in 1950, and in 1970, and in 1990, are almost entirely still with us, although they may have been effectively "refinanced" ten or more times in the interim.

With the exception of short term revenue timing situations or the few years with budget surpluses, the modern era federal government never pays back the principal of its debt with our tax monies, but rather it always uses new debts. This is something the general public likely rarely thinks about, but the security for Social Security simply can't be understood without understanding how these debt "repayments" actually work.

This ongoing swap of old for new can be an almost invisible process if we are just looking at the United States government budget, or annual deficits or total debt outstanding.

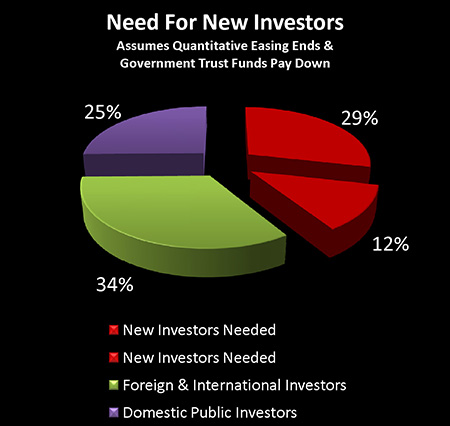

However – and this is of absolutely crucial importance – what is different about the Social Security and other government Trust Funds is that this borrowing to pay down borrowings does over time substantially change the sources of funding for the federal debt.

Social Security and other government retirement funds are really just paper liabilities to a large extent because the government simply owes the money to itself, and no one else has to participate in terms of coming up with cash or agreeing on an interest-rate or so forth. The Trust Funds are a captive source of funds, with no negotiating power, that passively accept whatever the government does.

As these retirement funds including Social Security get paid down, what happens is there is an ongoing rollover of principal from the private captive market of these Trust Funds, to bringing in actual real money from actual investors who want actual cash back.

As we go forward through time and these Trust Funds pay down, they don't on the surface increase the level of government debt. What they actually do instead is that over time they radically increase the amount of money that the US government must take in from external investors – in a manner that does not show up in the usual bottom line.

So the source of security for Social Security and other government retirement programs isn't saved money or investment assets at all - it is the solemn promise from a heavily indebted nation to go borrow more money and use that money to make the actual payments to the retirees.

Which, so long as the government maintains the ability to borrow the money, could turn out to be every bit as reliable as a source of funds, as would be actually having the assets. But, it is also the direct opposite of what the government tells us, and a good deal more disturbing.

4. The Aftermath

While this change in funding from internal to external never appears in the annual deficit or total federal debt outstanding calculations – it is quite likely to have extraordinary implications that could last for years and decades to come.

The Trust Funds are captive because they can't invest anywhere else – they have to buy US government debt. They can't move to corporate bonds or stocks in the search for higher yields. They don't negotiate for the yield, and they must be content with accepting payment in paper. They have no choice but to passively accept payment in additional IOUs each time principal is paid and rolled over, and must accept payment in still more IOUs every time interest payments come due.

From the perspective of the US Treasury, then, Social Security and other government Trust Funds have arguably served as the "ideal investors" for many decades. Indeed, as explored here, making sure that much of the funding for the national debt is "captive" is a critical component of how the United States and other heavily indebted nations attempt to maintain control over debt levels and interest payments.

However – at least in theory – everything changes when bonds that were held in the Social Security Trust Funds are redeemed and the cash sent to beneficiaries, even as this is funded by the sale of Treasury bonds to external investors.

As can be seen above, Social Security and other government trust funds hold about 29% of the US federal debt outstanding. This is larger than total private investment in US Treasury obligations, and second only to the 34% lent to the US government by foreign and international investors.

So, if the US government is to borrow the money to pay off the bonds held in the government trust funds, then it is going to need a very great deal of new money, whether that money comes from banks, individuals or obliging foreign governments. There has to be a steady increase in demand for Treasuries that goes well beyond the stated annual deficit.

Now – supposedly – to bring these investors in, a market interest rate has to be paid. So the government has to compete against other investments on a risk/return basis, and may, in theory, have to increase interest rates, particularly if they need to more than double the size of their investor pool (not including foreign investors).

And this process is not a one-time event. The Treasury will need to go to outside investors again each time an interest payment comes due – because remember, the government doesn't have the money to make the interest payments. And indeed, most of the annual deficit consists of money borrowed to make interest payments on the national debt.

Each interest payment means that another new investor has to be found to come up with the cash to make the interest payment. Which is one of the big problems (from a governmental perspective) with moving from internal to external investors. For while the captive audience of government trust funds have no choice but to accept interest payments in the form of IOUs from the government, external investors expect cash.

Each time that a bond matures and needs to be paid off, it is (in theory) another potential exposure to the vagaries of markets and interest rates as yet another bond needs to be sold to come up with the cash to pay off the first one, potentially meaning another investor needing to be found.

This is an exposure that did not exist so long as the bond was held internally by a captive investor.

So when the "assets" in Social Security and the other trust funds are drawn down to make payments to beneficiaries, what is really happening is a steady – and massive – shifting of the US national debt from what are purely paper assets and paper interest payments into actual cash borrowing and actual cash interest payments, which also compound over time.

Real To Fiction To Real

Perhaps the best way to summarize our "trip down the rabbit hole" in our search for answers is that a real asset becomes a fictional asset until it needs to be paid out as a benefit, at which time it becomes real again, but as a debt, and not an asset.

The beginning is entirely real. A worker does real work for real money – which is a real asset. On a mandatory basis, they have to take part of that real money and pay it to the federal government, either in the form of payroll taxes, or as federal government retirement plan withholdings.

The federal government now has a real asset – and it spends every penny of it. Most of the money goes to retirement benefits for then current retirees, and some is spent for general purposes.

All the real money is now gone, but the future retirees are told that at least part of their money has gone into buying the safest of all possible investments - obligations of the United States Treasury.

Which means the payroll taxes of the worker just funded the national debt in other words, in a process that went on for decades. And as explored here, this is just one of the multiple contradictions & deceptions that are enabled by treating the source of security for federal retirement programs as being separate from the national debt, when they are in fact two sides of the same coin.

So we now have an economically fictional asset, that can exist for those decades as a pure bookkeeping transaction. Each year, the amount of the asset grows, as interest is paid in the form of more bookkeeping entries. With each passing year, the government in truth grows more indebted, and with each passing year, the government assures future retirees they are now safer than ever, because the "assets" in the Trust Funds keep growing.

Until, the day finally arrives that the Trust Funds are being spent down, instead of built up, as is happening now and will likely be substantially accelerating over the years ahead.

Now real money is needed to make a real benefits payments. But how do you get real money from a fictional asset? How do you cash in the national debt, without actually raising taxes to make the cash payments to reduce the national debt?

The trick is to for the first time – issue a real debt to a real outside investor. The real money from selling the real debt, is used to pay off the fictional asset, and make a real benefit payment to the retiree.

And again – so long as the US government maintains the ability to borrow money on advantageous terms, this process can work. The money the retirees get is real, it can be exactly on time and in full (for so long as the Trust Funds last), and this can happen without (initially) increasing taxes or the stated annual deficit or the stated outstanding national debt.

But all of that notwithstanding – this process of swapping real assets for fictional assets for real debt is far, far riskier than merely saving the real assets.

Because each year, the government must go ever deeper into real debt – that can't be paid interest with bookkeeping entries, but requires cash. Debt that can't be reduced with debt swaps, but instead requires real cash. With terms that could very well change with changing markets, and interest rates that may not be controllable in all circumstances.

And if a nation $18 trillion in debt which must borrow to even cover the cost of its interest payments were to ever lose control of the size of those interest payments, then every aspect of the economy, the investment markets, the value of money, and retirement security could change in a very rapid manner indeed.

What you have just read is an "eye-opener" about critically important financial and retirement information.

What you have just read is an "eye-opener" about critically important financial and retirement information.

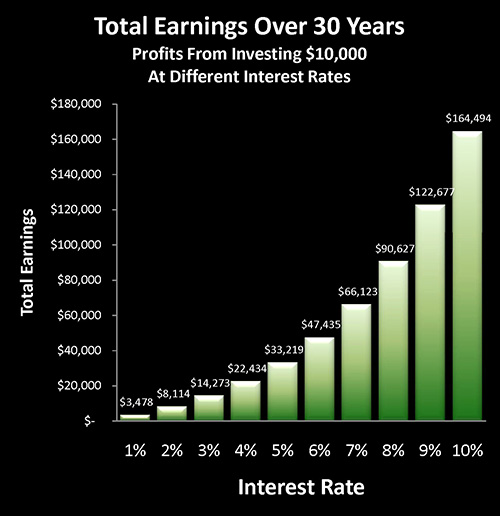

Retirement lifestyle is determined by both benefits and savings. Linked here is a related "eye-opener" that shows two sides of a related coin, including how the government's suppressing interest rates can reduce retirement investment wealth accumulation by 95% over thirty years, and how low interest rate policies are profoundly reducing standards of living for those already retired.

National debts have been reduced many times in many nations ─ and each time the lives of the citizens have changed. The "eye-opener" linked here reviews four traditional methods that can each change your daily life, and explores how governments use your personal savings to pay down their debts in a manner which is invisible to almost all voters.

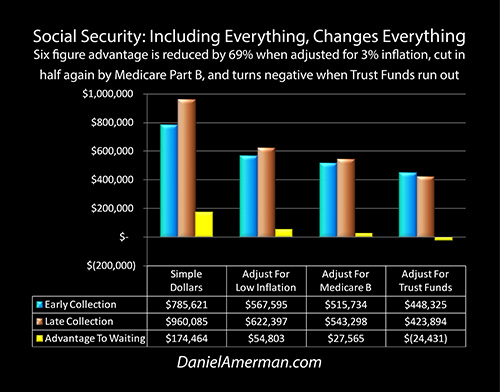

The stakes are high for the government when it comes to the national debt – and that is also true of Social Security. And once again, the numbers don't quite work the way many people think. The government strongly encourages people to wait as long as possible before collecting their retirement benefits – but as explored here, is that truly in your best interest, or are a few factors being left out?

If you find these "eye-openers" to be interesting and useful, there is an entire free book of them available here, including many that are only in the book. The advantage to the book is that the tutorials can build on each other, so that in combination we can find ways of defending ourselves, and even learn how to position ourselves to benefit from the hidden redistributions of wealth.