Misleading The American Public: Social Security & The National Debt

by Daniel R. Amerman, CFA

Below is the 2nd half of this article, and it begins where the 1st half which is carried on other websites left off. If you would prefer to read (or link) the article in single page form, the private one page version for subscribers can be found here:

Multiple Contradictions

Variations of each of the following assertions can be found much of the time whenever there is a discussion by the media, the government and many financial authorities about the national debt, the financial viability of Social Security, the financial viability of the United States, and how astute people optimize their personal decisions when it comes to Social Security:

1. Financially literate people know that not all of the national debt is real, because $5 trillion is just a bookkeeping entry for what the government says it owes to itself, with little real economic significance.

2. Your Social Security and government retirement benefits are absolutely safe because they are secured by $5 trillion of the safest of all investment assets, those being treasury obligations backed by the full faith and credit of the United States government.

3. Financially literate people know that the well-publicized claims of the US government being $80 to $100+ trillion in debt are simply not true, because while the massive projected shortfalls do exist, the government hasn't actually legally promised to cover those shortfalls, and under current law the shortfalls can instead be covered by large future reductions in Social Security and Medicare payments.

4. Your receipt of future Social Security benefits as scheduled can be absolutely relied upon, and therefore you can comfortably make the retirement decisions that will determine your future standard of living for decades based on the certainty that the government will make its payments in full and with no reductions.

Now, the interesting part is that all four assertions are quite reassuring for the general public, and they are all presented simultaneously. What enables this simultaneous presentation – and keeps the otherwise glaring contradictions from being evident – is that the national debt and public retirement benefits are treated as being two entirely different subjects.

Conversely, our protection from such contradictions can be found in one sentence:

The national debt is the security for Social Security.

Even though this truth is self-evident, it is rarely presented in this manner. Because when we accept this underlying reality, then we also see that there are no longer two entirely separate issues, but rather the national debt and government retirement benefits are two sides of the same coin.

And the moment this becomes clear, then the many contradictions also become crystal clear.

Because the national debt is the source of the payments from the Trust Funds that Social Security is dependent upon, we can't say that the national debt isn't as bad as it appears – without also saying that the security for Social Security isn't nearly as good as we think it is.

Yet, if we say that the security of Social Security making cash payments to retirees is rock solid – then the other side of the coin is that coming up with the cash to make payments of principal and interest on the national debt needs to be absolutely rock solid as well.

More fundamentally still, where does the money come from to pay off the national debt? And if the national debt isn't repaid – then how is it that Social Security gets paid?

(There is a way that $5 trillion in Social Security and other retirement benefits get paid in full without even $1 of the national debt being truly repaid. However, for those with the curiosity and courage to seek the answer, be prepared "to go down the rabbit hole", because as explored here, the real mechanics of where the Trust Funds money will come from to pay for your Social Security benefits is likely stranger than you think it is.)

Similarly, the amount of money which the federal government must come up with in coming decades, and the future of Social Security payments, are also two sides of the same coin, albeit on a much larger scale.

If the government is actually required to make those payments in full, and cover the shortfall difference between what comes in from payroll taxes and what has been promised to retirees, then it has to come up with many tens of trillions of additional dollars, an amount that dwarfs the current national debt. Is it feasible to believe this could happen?

Yet, if we believe that the scheduled payments will be made in full into the indefinite future, then doesn't the money have to come from the government?

Serial Contradictions & Conflicting Futures

Finally we need to consider just what it is that creates the future scheduled payment shortfalls. The shortfalls come into being because those are the years when the Social Security Trust Funds are projected to be have been depleted. Which means we have serial contradictions.

If we are to believe the good news about the national debt, then there are no real assets to support Social Security, this continues until the bookkeeping entries run out, and then there are huge shortfalls when it comes to making scheduled payments in full, because the government has not legally promised to make those payments.

Conversely, if we are to believe the good news about Social Security, then the government has to come up with the money to repay $5 trillion of the national debt over the next 12 to 18 years (when we include other government retirement programs), and then another $60 – $100 trillion over the decades after that.

When we accept that it is the government that has to come up with the money to cover government retirement payments, then obvious as that sounds – we lose the ability to have what is routinely presented as being two completely different futures. There can no longer be one future where the government isn't broke because it isn't legally obligated to make the payments. While simultaneously having another future where everyone delays collecting their retirement benefits as long as possible, because the government does make all the payments.

Instead, the reality is that there is only one future, and either the government comes up with all of the money, or it doesn't. And if it is improbable to believe that it will come up with all of the money, then it is improbable to believe that the full payments will be made.

What you have just read is an "eye-opener" about critically important retirement decisions.

What you have just read is an "eye-opener" about critically important retirement decisions.

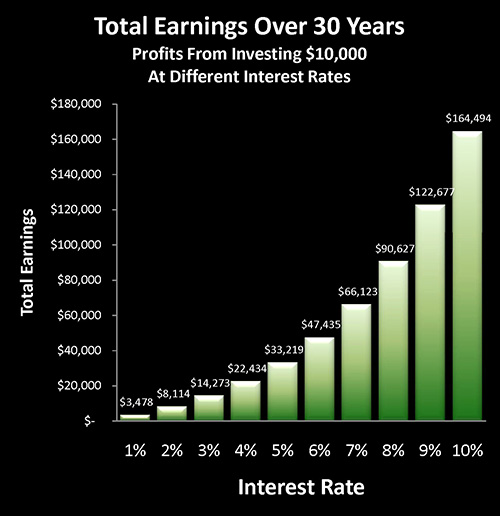

Retirement lifestyle is determined by both benefits and savings. Linked here is a related "eye-opener" that shows two sides of a related coin, including how the government's suppressing interest rates can reduce retirement investment wealth accumulation by 95% over thirty years, and how low interest rate policies are profoundly reducing standards of living for those already retired.

National debts have been reduced many times in many nations ─ and each time the lives of the citizens have changed. The "eye-opener" linked here reviews four traditional methods that can each change your daily life, and explores how governments use your personal savings to pay down their debts in a manner which is invisible to almost all voters.

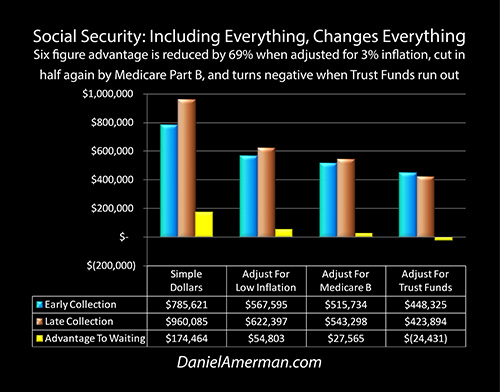

The stakes are high for the government when it comes to the national debt – and that is also true of Social Security. And once again, the numbers don't quite work the way many people think. The government strongly encourages people to wait as long as possible before collecting their retirement benefits – but as explored here, is that truly in your best interest, or are a few factors being left out?

If you find these "eye-openers" to be interesting and useful, there is an entire free book of them available here, including many that are only in the book. The advantage to the book is that the tutorials can build on each other, so that in combination we can find ways of defending ourselves, and even learn how to position ourselves to benefit from the hidden redistributions of wealth.