Did The Fed Just Admit to Deep Uncertainty About Our Financial Security In Retirement?

by Daniel R. Amerman, CFA

Generally speaking, the chairperson of the Federal Reserve is treated by the mainstream financial media as being the very paragon of respectability. If the Fed says it – then the voice of economic authority has spoken, and we need to listen carefully.

Yet, recent comments by Janet Yellen have instead made her a source of "controversial" economic ideas, with some financial reporters and their editors apparently feeling a duty to protect their reading audience – and let them know this is not acceptable economic thinking, but rather is "far outside the mainstream."

Now what could the head of the world's most powerful central bank possibly say that would get the mainstream media to try to flip the narrative upside down, and turn her from the heart of authority to being a holder of unreliable and perhaps even fringe ideas?

Chairwoman Yellen's offense was to openly speak the truth about an issue that has been widely discussed by some of the leading economists around the world over the last couple of years, which is the concern about "secular stagnation".

As described in the CNBC article linked here, secular stagnation is an academic concept that has been around since the 1930s, and the article frames it as an "obscure" topic that correct-thinking economists don't worry about today.

What is not discussed in the various media articles is what matters, which is the wide ranging and potentially life-changing implications for all of us. For if it does turn out to be secular stagnation, then bond returns remain very low, stock returns fall, the chances for a new financial crisis increase, the risk of pension insolvencies increases, retirement standards of living fall, and the financial viability of Social Security and Medicare is undermined as well.

Why Secular Stagnation Matters To All Of Us

As explained in my tutorial on the subject linked here, secular stagnation refers to a long term (generally interpreted as 10 years or more) period of very little to no economic growth.

The tutorial is intended to serve as a quick introduction for the general public, but for those who are comfortable with macroeconomic theory, this linked e-book titled, "Secular Stagnation: Facts, Causes and Cures", edited by Coen Teulings and Richard Baldwin, is well worth reading. Published by the Centre for Economic Policy Research (CEPR), the Contributors to the book include Lawrence Summers and Paul Krugman, as well as numerous economists from such institutions as Harvard, MIT, Oxford, Cambridge, the International Monetary Fund and also the Principal Economist for the Executive Board of the European Central Bank.

Unfortunately, what was left out of the mainstream financial media's treatment of Yellen's comments was not only the extraordinary implications of secular stagnation, but also the tools being used to fight long-term stagnation. Instead, all that was discussed in the CNBC article for example was the concept of very low interest rates over a long term period of time.

While technically accurate, it misses the most important part, as you can easily see if you review the tutorial or go directly to the CEPR e-book.

That is, what matters most is the way that the nations of the world fight secular stagnation, which is not so much low interest rates – but rather creating negative interest rates in inflation-adjusted terms.

What so many leading economists agree upon is that if we're truly facing a long-term environment of stagnation, then investor behavior has to be changed. And the recommended tool of choice for changing investor behavior is effectively to punish those who follow traditional investment strategies. Interest rates are thus forced below the rate of inflation, creating a negative return in inflation-adjusted terms as a matter of policy.

In other words, the "cure" is what we've been seeing in practice for about the last five years or so with short-term interest rates.

So if you've wondered why you've been getting almost no interest in your checking, savings or money market account even while food and utilities and medical care continue to increase in price – this is the reason.

If you're a traditional investor, the pain you're feeling is a direct result of deliberate government policy. You're supposed to feel the pain. Pain is what makes people change their behavior. In this case the desired change in behavior is to pull your money out of the bank, and go take some risks. So you can at least stay ahead of inflation, and alleviate the pain.

These risks are ones you would not ordinarily take, but the theory is that the more people who are driven to seek out risk, then the greater the supply of low cost money to corporations and innovators, and the greater the resulting business development, and the more jobs that become created, until the stagnation is eventually broken.

This is happening right now on a major scale in Europe, and again – it's entirely intentional. A new massive program of quantitative easing by the European Central Bank is driving yields into negative territory, which has investors scrambling for alternatives, and is intended to drive them into taking risks that will help create economic development and jobs.

What needs to be understood is that for conventional investors, the implications are completely upside down compared to what is generally assumed in financial planning and retirement planning strategies. The entire basis of those plans, as we're taught, is that we will receive market-based positive returns, and that this interest will compound over time and thereby create wealth for us and fund our retirements.

If we accept the chairperson of the Federal Reserve as a knowledgeable authority, and thereby accept the possibility of secular stagnation, then we have to accept the possibility that for years to come as a matter of governmental policy we will lose money if we follow the usual investment advice, as the process of what is supposed to be wealth creation is reversed into a process of wealth destruction.

Now from the perspective of a financial firm whose livelihood depends upon one's clients following the usual investment advice, perhaps one could see how this is extremely dangerous information that is being circulated. If the general public ever genuinely understood the potential implications – there could be changes in investor behavior on a massive basis.

Of Stocks & Bubbles

The implications go well beyond just interest rates, for secular stagnation also means very little economic growth in real terms.

Again, as with interest rates, this is something we've been seeing in practice with the US economy for some years now. The economy is continuously presented as being on the edge of a breakthrough, and then another round of disappointing economic news comes out that things aren't quite working as planned.

Now when it comes to stock returns, they are of course usually driven by economic growth on a fundamental basis. So if the economic growth is low or nonexistent, then we should expect much lower stock market returns in the future than what we've seen in the past.

Also, as covered in this analysis linked here, when you study the research – there is another danger with secular stagnation.

The basic idea is that when enough people are forced to take higher risks with their money and investments than they would otherwise like to – which is the whole essence of the measures for fighting secular stagnation – then all of this cheap and easy money leads to a very strong possibility that a series of financial bubbles will be created.

And as history has taught us well, the popping of those financial bubbles can lead to severe financial crisis.

So we face the potential 1-2 combination of much lower interest income, indeed negative returns, and much lower stock market returns – unless investors around the world take the actions that these theoretical economists want to force, which is to take on more risk.

Which then creates the possibility of financial bubbles, which leaves us with very low returns – until the floor drops out.

Financial Security In Retirement

There is a potentially even bigger issue, which is that the projected funding for Social Security and Medicare is based upon the assumption of historic rates of economic growth continuing into the long term future.

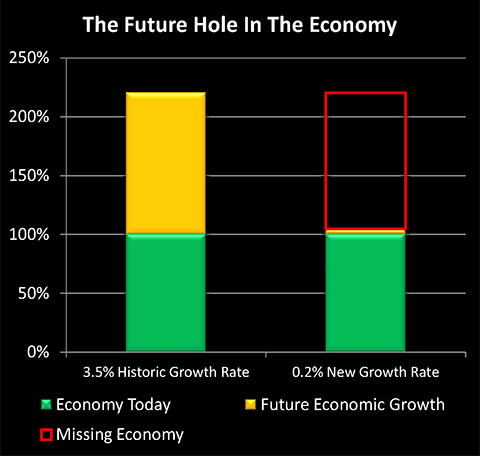

The following two graphs may be helpful in understanding this essential point. When people talk about future shortfalls, usually they are talking about projections which are themselves based upon the assumption that we know the future, and that it is one of steady economic growth at historical rates.

As shown in the first graph, and as developed in more depth in this analysis, the economy is expected to double in size in a little more than 20 years – assuming historical growth rates. There are a number of reasons why this growth might not happen, including the slower growth rates of heavily indebted nations, or the slower growth rates of nations with rapidly aging populations, or future potential economic and/or financial crises, or a shift in economic growth from the West to Asia... or it could be "all of the above" coming together into one package labeled "Secular Stagnation."

What does secular stagnation look like? That would be the hollow part of the right-hand bar. What a long-term lack of economic growth means is a necessary void in the future, an emptiness where the phantom wealth which was assumed and counted upon – fails to materialize in practice.

People don't usually think about it that way, but when we talk about the solvency of Social Security, or Medicare, or the value of long-term stock returns – those are generally all based on wealth that doesn't actually exist yet. Rather it is wealth that is merely assumed into existence, by taking historical growth for the United States during a time of economic prosperity and even world domination, and projecting them forward indefinitely into the future.

To be clear, then, to have the rug pulled out from underneath what we are told the financial future will be doesn't actually take any great crisis, or catastrophe, or collapse, or any other sort of world-changing "high drama" scenario. Oh, those could indeed happen, but they aren't actually needed for the future to unfold in an entirely different way than what the voice of financial authority tells us will be the case.

All it takes is for the assumed growth to not occur.

That's what secular stagnation truly is – not a doomsday event, but a big, gaping hole in the future. It's hypothetical wealth that simply fails to materialize. With any financial security or investment returns based on assumptions about that future wealth – also failing to materialize.

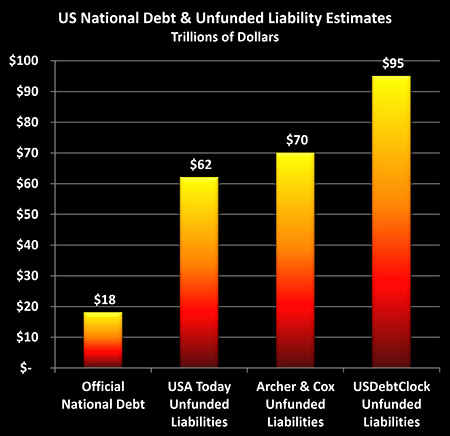

To understand the next level of risk posed by secular stagnation, we need to consider the difference between officially recognized national debts and what accountants call "unfunded liabilities". That is, when a corporation or even a state or local government takes on a financial obligation for the future, and they have not set aside the money to pay for it, then they have to recognize the cost of that promise as a debt, in current dollars.

The federal government on the other hand makes its own rules for its own accounting, and for the obvious political reasons – it chooses to ignore that requirement. Unfortunately, however, ignoring it doesn't make it go away. The three right-hand columns in the following graph are various estimates of what the real debt of the US government is after taking those unfunded liabilities into account, over and above future expected tax receipts.

As explored here, the cost per above poverty-line household is over $900,000, and that means that the rules governing retirement investment accounts are likely to be changed, and in ways that most of us are not currently expecting.

But here's what almost no one is taking into account: those towering red and yellow bars with their tens of trillions of dollars of shortfalls are all based on "normal" economic growth. They assume that most of the future cost of retirement promises will be funded by taxes on wealth that does not yet exist, but which will materialize from ongoing economic growth over the coming decades.

Now obviously if that growth doesn't occur – then those taxes aren't collected. And the shortfalls grow much, much larger. Even as they move much closer in time. And that means that the day that the rules change on Social Security, Medicare, pension payments and potentially retirement accounts – also moves forward in time.

The Inadvertent Spread Of "Dangerous Knowledge"

There is a fascinating contrast between Janet Yellen and her predecessor, Ben Bernanke.

I've written about Mr. Bernanke many times, and while often in vigorous disagreement – one of the things I came to understand was just how disciplined he was. That is, he was keenly aware that one poorly chosen sentence could send a tremor through the markets, and that one of his primary roles as Fed Chairperson was one of Perception Management. I don't know that he ever spoke his actual mind in a public speech, but rather everything passed through a mental filter of sorts, screening out any thoughts or opinions that might invite negative consequences.

Ms. Yellen, in contrast, seems to every now and then – just say what she is thinking. She is a top-level economist, she is immersed in the professional puzzle of a lifetime as the nation's chief economist during difficult times, and there are so many complicated factors involved that she spends her time thinking about. And with her personality, it seems that occasionally a thought does slip through the screen, and she shares what she is actually concerned about, with an inconvenient truth thus being spoken.

One could call this habit a bit klutzy, or characterize it as a welcome breath of fresh air.

So, just as Bernanke surely was, Yellen is very well aware of the danger of secular stagnation. Of course she is! This is cutting edge stuff, with a global conversation among economists in process.

Yes, there is controversy about whether secular stagnation does exist right now, or if it doesn't – whether an aging population and heavily indebted nations will bring it about in the future. And yes, there is controversy about the macroeconomic tools to fight it, and whether they will be effective in overcoming the stagnation.

But there is absolutely nothing "obscure" about it – unless one defines "obscure" as being something the media almost never chooses to cover.

When Janet Yellen spoke of secular stagnation, she was only making a clarification about what could affect future interest rates, and she didn't pursue any further implications. Nonetheless, she publicly and inconveniently used the term – and in the process helped to disseminate knowledge into the world. She let people in on the "controversial theory" that even the highest levels of government, economics or finance don't actually know for sure what future economic growth will be, or even whether it will be positive.

Now after cutting through all the economics jargon, some might call this common sense.

Hey, guess what – maybe the "experts" don't actually know the future after all.

So maybe we should reconsider betting everything we have for retirement on wealth that doesn't actually exist yet, and which in fact may not ever materialize?

Yet, that same common sense, aka highly "controversial theory" – poses a very dangerous threat indeed to those people and institutions whose wealth and political power are aided by the current dominant belief system that assumes we know what the size of the economy will be in 2025 or 2035.

When we don't.

Let me suggest that there is an enormous difference between planning for genuine uncertainty, versus planning based on false certainties. Both can be done – but the specifics are quite different.

And what America's chief economist just let slip is that as far as she knows – there is genuine and profound uncertainty.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

An "eye-opener" tutorial of a quite different kind is linked here, and it shows how governments use inflation and the tax code to take wealth from unknowing precious metals investors, so that the higher inflation goes, and the higher precious metals prices climb - the more of the investor's net worth ends up with the government.

An "eye-opener" tutorial of a quite different kind is linked here, and it shows how governments use inflation and the tax code to take wealth from unknowing precious metals investors, so that the higher inflation goes, and the higher precious metals prices climb - the more of the investor's net worth ends up with the government.

Another "eye-opener" tutorial is linked here, and it shows how governments can use the 1-2 combination of their control over both interest rates and inflation to take wealth from unsuspecting private savers in order to pay down massive public debts.

Another "eye-opener" tutorial is linked here, and it shows how governments can use the 1-2 combination of their control over both interest rates and inflation to take wealth from unsuspecting private savers in order to pay down massive public debts.

If you find these "eye-openers" to be interesting and useful, there is an entire free book of them available here, including many that are only in the book. The advantage to the book is that the tutorials can build on each other, so that in combination we can find ways of defending ourselves, and even learn how to position ourselves to benefit from the hidden redistributions of wealth.