Will Capital Controls Return?

by Daniel R. Amerman, CFA

Below is the 2nd half of this article, and it begins where the 1st half which is carried on other websites left off. If you would prefer to read the article in single page form, or share via Facebook or Twitter, the one page version for subscribers can be found here:

Enabling More Extreme Measures

It also needs to be recognized that there are much more extreme forms of "monetary policy" being discussed. For instance, if global stock markets were to truly go into free fall, then as explored here, the International Monetary Fund has already suggested that central banks be ready to step forward and create as much money as needed to buy the entire market until the situation stabilizes.

That kind of extreme monetary policy is deeply unstable. It can make a very large wave, to return to our analogy. A free flow of capital is deeply incompatible with such policies, as they would amplify the wave to an even greater degree. The more aggressive the monetary policy, the greater the incompatibility with the free flow of money between nations, the greater the instability which economic theory says would be created by the "impossible trinity", and the more likely a quick return to capital controls.

With this potentially occurring in a very messy and unplanned manner, on a nation by nation basis. Indeed, the snap imposition of capital controls – inbound, outbound, or both – is one way of mitigating the damage from currency warfare, so as nations continue to competitively strive against one another for economic advantage, they also increase the chances that capital controls could be re-imposed in a competitive manner rather than in a coordinated way.

And if any of those bleak scenarios do develop, then nations may find themselves with their "backs against the wall", and in an existential crisis. With a clearly understood and historically proven stabilization method on the table, and with their economists urging them to use it and use it fast.

At that point - it may not matter how many Wall Street and Silicone Valley business models could be collapsed by the return of a historical force that was previously not even considered a remote possibility in this day and age.

It might not matter how many investors or investment funds were to suddenly find themselves unable to get their assets back into their own jurisdiction.

It could be considered irrelevant how many expatriate retirees were to suddenly find themselves financially cut-off from their home countries.

Financial survival would be financial survival for the governments.

And as improbable as the above scenarios may seem to someone who is making judgments based only upon what they have personally seen in recent decades:

1) We are currently in the midst of a global financial rout in the equities and oil markets;

2) Desperate acts by central banks in the form of negative interest rate policies are becoming ever more common;

3) Imposing capital controls is a well accepted economics solution for crises, for mitigating the effects of desperate central banking actions, and for strengthening Financial Repression;

4) Senior officials at the International Monetary Fund, Bank of Japan and European Central Bank are all now talking about the advantages of capital controls in at least some situations; and

5) That paragon of the financial establishment in the United States, the Wall Street Journal, just prominently referred to the concept of capital controls being good for the global economy as being "The Hottest Idea In Finance".

Put that all together - and there is certainly no guarantee of capital controls.

But what we do now have is the very real and serious possibility that capital controls could be returning from the distant past for the major economies of the world, in some form as yet unknown. Carefully planned capital controls could be deployed over a period of years by the G-20 with ample warning and discussion, and with a reduced impact on most lives and businesses. Or they could arrive in uncoordinated chaos in the midst of crisis, and abruptly turn national economies, employment and our lives upside down.

Regardless, we need to be aware and prudently incorporating at least the possibility of some form of capital controls into our planning, so that we are not blindsided either personally or professionally.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

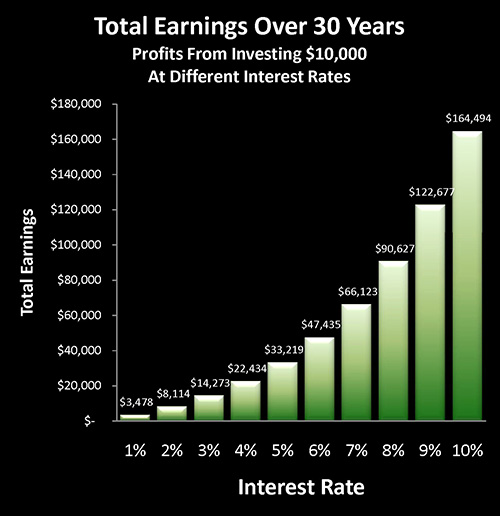

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

National debts have been reduced many times in many nations ─ and each time the lives of the citizens have changed. The "eye-opener" linked here reviews four traditional methods that can each change your daily life, and explores how governments use your personal savings to pay down their debts in a manner which is invisible to almost all voters.

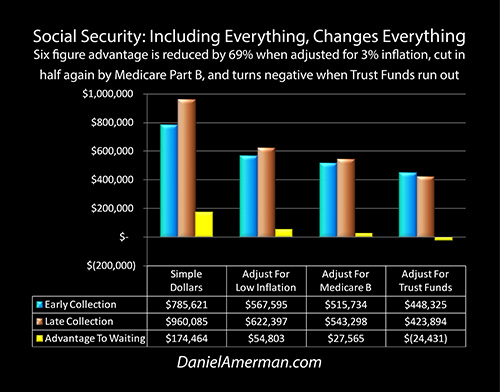

The stakes are high for the government when it comes to the national debt – and that is also true of Social Security. And once again, the numbers don't quite work the way many people think. The government strongly encourages people to wait as long as possible before collecting their retirement benefits – but as explored here, is that truly in your best interest, or are a few factors being left out?

If you find these "eye-openers" to be interesting and useful, there is an entire free book of them available here, including many that are only in the book. The advantage to the book is that the tutorials can build on each other, so that in combination we can find ways of defending ourselves, and even learn how to position ourselves to benefit from the hidden redistributions of wealth.