Can Computer Data Entry Banish Investment Risk Forever?

by Daniel R. Amerman, CFA

Can the mere act of someone typing numbers into a computer transform our financial future and the standard of living for all of us?

To many people this may seem a quite theoretical or even absurd question. Surely the mere act of entering data into a computer – data whose only existence is electronic and which never takes physical form – is not enough to change the actual global economy and real world investment results for entire nations, as well as our day to day standard of living for possibly many years to come?

Understandable though skepticism may be, let me suggest that those who believe this to be merely a theoretical or an absurd concept simply haven't been paying attention to events in the real world since the financial crisis of 2008. And indeed, there is a chance that this process of using data entry to overrule markets is still just getting started, at least if the advice of the International Monetary Fund is going to be followed.

Let's say that a rout develops in the stock market, or the bond market – or both. As a result, all around the world, investors run for exits at the same time. As sellers try to simultaneously unload trillions of dollars of securities, there are no buyers. Prices plunge, as bankruptcy looms for the global financial system.

Unless... someone types a few keystrokes, and instantaneously creates a trillion dollars. And then steps forward, and buys every share of stock for sale at the very same price they were at before the market collapse started. Even as someone else types a few keystrokes, thereby creating a trillion euros to buy bonds at pre-plunge levels.

Now that helps, but it's not enough. Because five trillion more dollars of stocks are now for sale, with the institutional investors of the world desperately wanting out of their positions. So a "5" is typed into the computer instead of a "1", and voila – another five trillion dollars is instantly created. With this new cash – five trillion dollars of stocks are purchased.

This continues until there are no more sellers. With the markets ending the day at about the same place they started, appearing stable and prosperous for all the world to see. Perhaps even with new highs being set the next day.

The IMF Proposal: Central Banks As Market Makers

Jose Vinals, a top official with the International Monetary Fund, has recently suggested that the world's central banks be prepared to step forward and become "market makers" in the event of financial crisis. That is, in the event of a developing market crash at any given point in the future, the IMF is calling for the central banks of the world to use their monetary creation abilities to purchase securities without limit.

So to keep stock prices from collapsing, to keep bond prices from collapsing, to keep a financial rout from developing and wreaking havoc around the globe, the central banks merely enter numbers into their computers, and just like that – create money in unlimited amounts. Taken to the extreme (though it would never need to go so far), they could indeed in theory buy every single share of stock and every bond in the world.

Can this really work? And if so, for how long? What happens to those who have savings and investments if it works for a while, but then it stops working? These are the new compelling questions for the current investment age, which is a very different time than anything the world has seen before (and is also a very different time from what most investment plans had anticipated).

However, what needs to be understood that while the intent behind the proposed use of these extraordinary tools will be to maintain stability in the short term, there is no "free lunch". Indeed, the price of such a computer keystroke-driven rescue of the financial system could prove catastrophic to global investors over the longer term.

The Surface Source Of Danger – Rotation

The possible dangers within the current situation can be likened to a surge in atmospheric energy – a weather radar map of sorts that has recently been lighting up from one end to another – as explored here. Crucially, however, tornadoes don't actually form in the exact time and spot that they do because of just general atmospheric energy alone, but rather they develop when we have the specific and localized elements of rotation. The energy can be there, but the rotation may or may not begin – and it is the onset of that rotation that creates the devastation.

When it comes to financial system risk, there are two classic sources that come together to create rotation. One is contagion and the other is liquidity risk.

What contagion comes down to is that there is a substantial change in market sentiment or investor psychology that rapidly becomes self reinforcing.

Across the nation or perhaps around the world, investors who had been in agreement on one particular pricing as being appropriate for an asset class – be it stocks, bonds or something else altogether, all quickly change their minds and decide the valuations are too high. This change in valuation perception is contagious as it rapidly jumps from one investor to another.

So everyone heads for the exits at the same time. But because everyone is going in one direction, a liquidity problem rapidly develops and most would-be sellers can't sell even at the new and falling market prices because there simply aren't enough buyers coming from the other direction to purchase their securities. A panic ensues as sellers drop their prices even more rapidly, trying to exit and sell to the few buyers there are before prices drop even further.

This lack of liquidity reinforces the contagion, which compounds the liquidity crunch in terms of even fewer buyers, which further reinforces the contagion in terms of a panicked selling psychology. Once the two elements of rotation converge, they begin spinning around each other. This rotation rapidly accelerates as each continues to feed energy to other, and in a matter of days or even hours we have a full-fledged financial crisis that has the power to rapidly collapse what previously appeared to be a quite stable financial system.

This is the classic model, and it is this combination of contagion and liquidity risks that has historically been the immediate source of many bank panics and market collapses in so many nations over the centuries. Now the energy that is being released is a quite different matter – there may be have been fundamental pressures building for many years, often in the form of asset bubbles or other mispricings. Such fundamental pressures do not necessarily mean a collapse in any given month or year, however, because absent rotation (or some other trigger), those pressures can remain pent up for many years.

What central banks acting as market makers on an unlimited basis does is to instantly remove one half of the rotation. Because they stand ready to buy the entire market, liquidity risk evaporates, and the source of energy for contagion is in theory not only removed, but potentially reversed altogether. Indeed, just the public statement that the central banks stand ready to act as market makers could be enough, with no actual purchases needed, just as the announcement of enhanced powers for the European Central Bank in 2012 was enough by itself to change the markets for "peripheral" government debts, even without the actual use of the new powers.

The Irony: The Underlying Source Of "Energy" Is The Artificial Stabilization Attempts

Now while the central banks sometimes quite openly talk about the dangers (at least outside the United States), they only rarely are willing to address a more fundamental question – which is where does all this atmospheric energy come from? Why is there such a explosive change in market prices that is potentially waiting to be set off if the elements of rotation develop?

The issue is that this "energy" is itself the result of previous central banking market interventions that ironically were used to create market stability. They have quite successfully created an artificial world so to speak, where interest rates are artificially low, and asset prices in the form of stocks and bonds are artificially high.

Now such a relationship can indeed foster stability for years at a time (even if artificial), but it is toxic when it comes to economic growth and building genuine wealth for society. It's not just that the very low interest rates slash individual and pension fund investment income as well as standards of living for retirees, but we have a fundamental misallocation of the rewards of investment.

It is no longer the act of genuine wealth creation that is the primary source of wealth, but rather it is being aligned with the redistributions of wealth brought on by Central Bank policies in government-dominated markets.

So, firms are propped up that should not be propped up. Capitalism loses its energy of creative destruction. And as wealth is allocated to those who understand and align with Central Bank policy rather than to those who are actually creating the wealth, there is less and less incentive to create real wealth.

Now the central banks and governments have strong incentives to at least partially back off from this position, and to come at least somewhat closer to genuine free markets in which investor decisions about risk and return drive market levels.

There is, however, a major problem with that. Which is that the stability that we have seen in markets in recent years has been based upon a very deliberate "retraining" of investors around the world. That is, they've been taught that they can safely ignore fundamentals – indeed they must ignore fundamentals – and instead base their actions on the central banks' ability to dominate markets through the creation of trillions of dollars of cheap money out of the nothingness.

Indeed, everyone has been trained together to buy stocks and to buy bonds at high prices if the central banks are driving values in that section – regardless of whether they would otherwise do so in a market that was not dominated by governmental interventions.

So the question vexing the central banks is, how does one exit that artificial position without collapsing the markets?

If everyone has been taught together that they can ignore the fundamentals, and then everyone starts to see the new day coming when fundamentals may return to being at least a key part of the valuation picture, yet the fundamentals cannot support anything close to current market values – then many or most rational investors will not only seek to exit the market, but they will have an incentive to do so on the front end, rather than risk waiting too long.

And once this situation develops – just exactly who is going to step forward to buy all of the securities for an orderly transition?

The Price Of Tornado Containment

That interesting question brings us back to the suggestion from the International Monetary Fund, which is that in the event of contagion creating a liquidity crisis the central banks should step forward and become market makers. First just make the announcement of the change in policy, hoping that is enough, and if not, then (effectively) enter the new money into the computers and directly purchase however many trillions of dollars of stocks and bonds as are needed to cut off the rotation and thereby stop the crisis in its tracks.

But the catch is that the source of energy in the atmosphere – and within the financial systems – grows that much greater, even as the creation and redistribution of wealth becomes that much more dysfunctional.

There is a second round of retraining of investors which is likely to be highly effective. Once the major investors of the world understand that central banks are not only willing to do this but are actually doing it, they lose all incentive to exit the markets. Instead, they concentrate on never, ever going against the interests of those who quite concretely run the markets.

This would tend to destroy any lingering concerns about valuing securities based upon actual fundamentals like a rational investor would choose, even as the dominant role of the central banks is reinforced.

Which in turn creates even more pent up energy and dysfunction as markets move even further away from being actual free markets, and more to being arenas for central banking policy.

A Dystopia Where The Informed Prey On The Uninformed

An end result of the central banks becoming market makers on a global basis in a much more overt form than they are right now is to make a complete mockery out of conventional investment theory and practice.

Decades of financial education and financial planning just go out the door and become (effectively) meaningless, when it comes the determinants of return as well as how to make the best decisions. Historical stock returns and the sources of investment wealth become obsolete in a new world where central banks openly create however much money is needed for the direct control of market prices in all markets.

So we continue to have the ongoing issues with very high asset price levels that are divorced from underlying realities. Even as we continue to have extremely low rates of return that are below the rate of inflation.

There remains an extraordinary latent instability in terms of the difference between fundamental values and what market values actually are.

And the redistribution of wealth enters into an even more extreme form.

Oh the financial media will continue as they are, with the cable network talking heads using the appropriate financial jargon in simplified form, but underneath the surface – nothing is as it once was.

And as we can already see around us, but is likely to become even more evident in the future, investors will fall into two classes.

On the one hand there will be the insiders, who understand perfectly well that there is very little left to hold up conventional investment theory. It all comes down to a matter of aligning their interests with the powers that be on a monetary and political basis.

Meanwhile there will be many millions of investors who, knowingly or not, are risking everything they have by following the traditional investment strategies. Strategies that simply don't take into account the reality of the world in which we've been living over the last few years, nor the potential reality that could come to pass in the years ahead.

The Eventual Reconciliation

Eventually at some point – in one form or another, the day will come when the markets return to reflect economic and financial reality. Artificial stability simply cannot be maintained forever. And the most likely sources of change are not the markets themselves or some kind of investor revolution, but as previously discussed in some of my writings – political change and geopolitical risk.

Something comes up to turn the system on its side, be it a key nation experiencing a tremendous political change, a war, or some other form of geopolitical upset.

As strong as they may appear, central banks are quite weak in the face of such real and fundamental changes, and that is the most likely time when cracks will develop in stability which the central bankers will scramble to attempt to fix – but be unable to do so.

With the key question being, how long until that occurs? It could be much further off than many people expect, or perhaps not – it really all depends on what unfolds in areas that are not necessarily directly connected with finance and economics.

There is certainly the possibility that we could have this artificial and dysfunctional stability and ongoing redistribution of wealth from the "have-nots" to the "haves" for 5 years, 10 years, 15 years or more.

Yet at the very same time, political and geopolitical change is very difficult to predict, and there is currently enough geopolitical risk in the world that stability could be overturned in any given month.

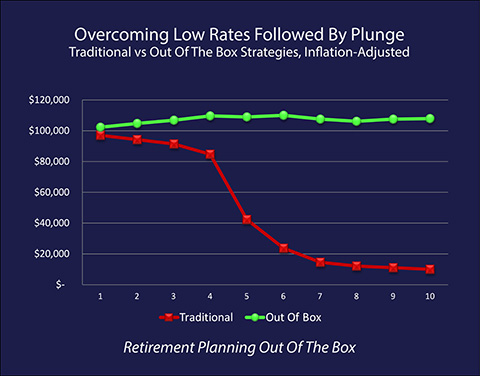

Graphic adapted from the Retirement Planning Out Of The Box DVD tutorial set.

This creates the situation shown by the red line in the graph above, where traditional investors are slowly squeezed in after-inflation terms, when it comes to what they can buy with their savings and investment assets, until the change happens (shown in this example as occurring in the 5th year). That's when the bottom drops out, reality reconciles with prices and there is a fantastic market plunge – and prices in purchasing terms don't return for many years or decades to come.

This translates to all too many millions of investors potentially dealing with the 1-2 combination of a steady squeeze on their real income for year after year as the price for maintaining temporary stability, until the day the bottom eventually drops out anyway, and their financial security is devastated.

So when the International Monetary Fund or others speak about creating a miracle effectively, which is the banishment of investment risk through massive monetary creation as central bankers simply step in and purchase as many stocks and bonds as are necessary to keep market levels stable – it needs to be understood that this can come with an extraordinary price at some point.

Now there is an alternative path for releasing the pressure that we can all certainly hope for, which is that economies grow in such a robust manner that current valuations can be justified by new fundamentals, so that the gap is closed by the creation of genuine wealth, and a future crisis need not happen.

But what needs to be recognized is that the greater the scale of interventions used to maintain artificial stability, then the more dysfunctional the economy and the redistribution of wealth, and the lower the likely real rate of economic growth – which means the less likely it is that this more positive path of surging economic growth will be what closes the gap and releases the pressure.

Be Careful What You Wish For

For many millions of individual investors around the world, the abilities of central banks and governments in the face of a developing financial disaster to simply enter a few keystrokes in a computer and potentially stop a multitrillion dollar crisis in its tracks – may offer a sense of reassurance, and indeed seem highly desirable.

If a potentially devastating financial crisis does develop, then yes – in theory – the central banks can become market makers for the global financial system. And a devastating financial blow to the face value of their investments and the value of their retirement accounts may indeed be dodged, with current and even higher price levels maintained for possibly years to come.

Now theory is one thing, but in practice and as explored here, there is also a chance that the difficulty of the execution will exceed the abilities of the economists, and the whole attempt will just blow up in their faces.

Yet, even if the intervention is successful – there is always a price.

And unfortunately the price of magic in this case is a continuation of dysfunction and the redistribution of wealth, with an even greater crisis still waiting down the road.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

An "eye-opener" tutorial of a quite different kind is linked here, and it shows how governments use inflation and the tax code to take wealth from unknowing precious metals investors, so that the higher inflation goes, and the higher precious metals prices climb - the more of the investor's net worth ends up with the government.

An "eye-opener" tutorial of a quite different kind is linked here, and it shows how governments use inflation and the tax code to take wealth from unknowing precious metals investors, so that the higher inflation goes, and the higher precious metals prices climb - the more of the investor's net worth ends up with the government.

Another "eye-opener" tutorial is linked here, and it shows how governments can use the 1-2 combination of their control over both interest rates and inflation to take wealth from unsuspecting private savers in order to pay down massive public debts.

Another "eye-opener" tutorial is linked here, and it shows how governments can use the 1-2 combination of their control over both interest rates and inflation to take wealth from unsuspecting private savers in order to pay down massive public debts.

If you find these "eye-openers" to be interesting and useful, there is an entire free book of them available here, including many that are only in the book. The advantage to the book is that the tutorials can build on each other, so that in combination we can find ways of defending ourselves, and even learn how to position ourselves to benefit from the hidden redistributions of wealth.