Margin Rules Changes Force New Private Funding Of Public Debt

by Daniel R. Amerman, CFA

TweetThe Federal Reserve and other regulators around the world (including all members of the G-20) have recently agreed to alter margin rules, which will allow them to claim new powers over lending and leverage. In the United States these developing regulatory changes will not be restricted to the Fed's legal oversight over banks alone, but will affect all financial companies.

The new margin rules will impact about $4.4 trillion in investments in the US. In combination with new rules for $2.7 trillion in money funds, the regulations are changing for about $7 trillion in investments. And the combined effect of these changes may be to drive up to $2.5 trillion out of the private investment markets and into purchasing the debts of a heavily indebted US government, thereby providing a very low cost source of funds.

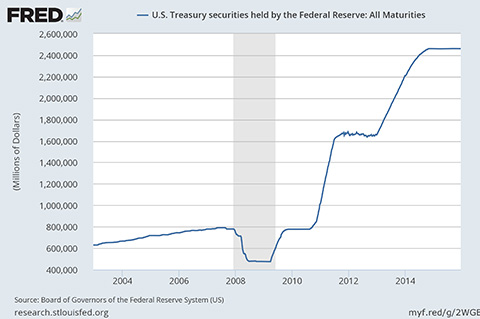

In a matter of a few months and with almost no notice, changes in obscure regulations are being used to create a new captive market for US Treasuries and agencies that is approximately equal to the total amount of federal debt purchased by the Federal Reserve over the course of many years of quantitative easing.

The headlines are that the United States is starting to slowly release its control over interest rates, and return them to private market control. The reality is that the government is doing just the opposite, and is capturing formerly free and private money at a fantastic rate. Which brings up the question: just why is the government quietly deploying two massive financial stabilizers for the federal debt in 2016?

The effects are likely to persist far beyond 2016, and could help depress interest rates for all investors for potentially years and decades to come. Yet, because these trillions of dollars of major changes are hidden inside of obscure financial regulations, the general public is completely unaware of what is happening, or how it could change their investment results, their lifestyle in retirement, or even their ability to retire at all.

Margin Rules & The New Regulations

A detailed overview of the new rules in process can be found in a Wall Street Journal article published on January 11th. 2016 and linked here. As of November 12th, 2015, the US and the other member nations and organizations of the Financial Stability Board agreed to implement margin rules changes (although there was almost no notice at the time). The intent of so many nations doing so simultaneously is to keep investors from dodging the regulations by moving their assets offshore.

Traditionally, stock purchases were the primary focus of margin rules. The Federal Reserve's Regulation T requires a minimum of a 50% margin on new stock purchases. This means that if an investor purchases $200,000 in stock, no more than $100,000 of that can be with borrowed money.

Increasing margin requirements requires investors to either come up with more cash or to very quickly sell their assets – at a time when the market is potentially being flooded with other sellers who are also forced to sell at almost any price because of their own unexpected margin calls. Because of this power to push prices downwards, it is considered to be a textbook means of dampening speculative bubbles. Of course, the regulatory power of margin rule changes to rapidly change prices can also be used for other purposes and with other instruments, such as futures and options.

Perhaps the most infamous series of margin rules changes in recent years occurred in 2011, when the Chicago Mercantile Exchange repeatedly and sharply raised margin requirements for silver futures contracts, with most increases occurring in late April and early May of that year.

In the spring of 2011, silver prices were soaring above $45 an ounce, but were rapidly sent to below $35 an ounce as repeated margin increases forced investors to either come up with large sums of cash overnight, or liquidate into a plunging market as everyone around them faced the same dilemma. Prices then slowly rebuilt to above $40 an ounce, until a new margin increase in September inflicted another round of pain and quickly knocked the price of silver below $30 per ounce.

The new Federal Reserve regulations will vastly expand the reach of margins rules because it is proposed that they will apply to securities financing transactions, such as repurchase agreements. In this market, which the US Office of Financial Research estimates to be approximately $4.4 trillion in size, high quality collateral is provided to secure a very short term and very low interest rate loan. The value of the collateral provided is somewhat more than the amount of loan, with the excess collateral (the margin) securing the lender against a reduction in the value of the collateral.

Under the still developing new regulations, the Federal Reserve will be able to set a minimum margin, rather than the market. The theory then is that by raising margin requirements, the Fed will be able to reduce leverage in the system at will. And because the margin rules will apply to all financial companies and not just the banks, the Fed will have new powers to control the behavior of the entire financial system.

Now some might portray this extraordinary expansion of powers via regulatory fiat to be a good thing. After all, there is a lot of risk in the system, highly leveraged systems are generally riskier, and it is said to be in all of our interests for the government to have additional new powers to reduce that leverage and pull risk from the system as needed. Or at least that seems to be the publicly presented justification for this change.

Interestingly enough however, there happens to be a rather major loophole, whereby if the private sector more closely aligns its behavior with what the government wants it to do, then market participants no longer have to worry about this new generation of regulation induced financing risks.

The Danger & The Loophole

The key loophole is that when US Treasury obligations and agency securities are used as the collateral, the borrower will be immune from the new margin regulations. This then creates a split market, with two kinds of secured financings.

For those who own Treasuries and agencies and use them as collateral, they are not subject to the planned new rules. According to the US Office of Financial Research, about two thirds of the collateral currently being used is Treasuries and agencies, so this will be true for most of the current market borrowers.

For the remaining one third of borrowers, however, there is a potentially substantial increase in risk. The dangers are those of liquidity and market risk. If the Fed increases margin requirements in order to pull leverage from the system, then more or less by definition, that action creates a liquidity crunch for borrowers who were not invested in Treasuries and agencies.

For that is what reducing leverage is all about – short term loans cannot be rolled over, as they usually are, but have to be actually paid off. Which means a scramble to come up with the cash to pay down the borrowings. Which likely means forced asset sales as well, because that is the essence of what financial companies do – they purchase assets with borrowed money. And to pay back the money, they need to sell the assets.

These asset sales and borrowing reductions may potentially occur on a massive scale, because that is more or less the point of the Fed expanding the reach of its powers - to be able to make the entire financial system, and not just the banking system, quickly and simultaneously reduce their borrowings.

Because these asset sales are occurring on a system wide basis, this then sets up the possibility of a feedback loop. Too many companies simultaneously selling the same type of assets drops the price of those assets. Which reduces their value as collateral. Which means that still more loans must be paid down, as the existing collateral will not go as far. Which forces still more asset sales, which then further reduces the market value of the assets, and requires the payback of still more loans – and so forth.

The alternative is to sell the other collateral up front, use the proceeds to buy Treasuries and agencies as replacement collateral, and thereby escape any exposure to increases in margin requirements and the abrupt need to reduce borrowings.

The Stick & The Carrot

Viewed from the perspective of market participants, what the Federal Reserve is really doing is creating a "stick" and a "carrot".

The stick applies to all financial companies who refuse to buy US Treasuries and agencies, and use them as collateral for their secured borrowings. Once the new rules take effect, then these participants can be forced into a liquidity crunch and/or asset losses at will, as they are made to reduce their borrowings and sell assets. It should also be noted that liquidity crunches, i.e. not being able to come up with the cash to pay off overnight or other borrowings, are an existential risk for financial companies, as they can take down what previously appeared to be a healthy company in a matter of days.

So the stick of margin rules changes is potent indeed in general, as silver market participants found out in 2011, and there are particularly powerful aspects when it comes to highly leveraged financial companies.

And then there is the carrot, which is the safe harbor of buying US Treasuries and agencies to use as collateral for secured financings. For the financial companies willing to do their part in helping to finance the national debt – then all these newly created problems go away. Just sell the other collateral, buy the debt of the government to use instead, and the risk of margin rules changes, the risk of the potential associated liquidity crunch and the risk of the potential associated forced rapid sale of assets are all no longer a concern.

Because the total market is about $4.4 trillion, and about a third of the market uses non-exempt collateral, that means that roughly $1.5 trillion dollars of investments are stake. An enormous incentive is being created for financial companies to sell about $1.5 trillion in other types of investments which are currently being used as collateral, and to purchase Treasuries and agencies instead.

Is This Really About Controlling Leverage At All?

The other fascinating implication is that so long as most market participants act rationally – the power of the new margin rules disappear, as does the ability to pull leverage from the system. Two thirds of the market is already exempt from the margin rules changes. If the market reacts rationally to both the new rules and the safe harbor, and changes to the place where 90% to 95%+ of the collateral is Treasuries and agencies, then the Fed has very little power to pull leverage from the system.

The new margin rules therefore make no sense when it comes to their stated purpose, which is giving the Federal Reserve the power to reduce risk by mandating a reduction in leverage. Why create a rule to control market conduct, if a wide open loophole is simultaneously created such almost all of the market can be expected to be exempt from the rule?

Crucially, there is no difference in systemic risk from leverage if Treasuries are used as collateral rather than high quality private instruments. The issue is the borrowing level in the system, and not the credit quality of the collateral.

The new rules are likely to be of little use when it comes to the stated purpose of reducing leverage – but are likely to be very useful indeed in motivating investors to seek safety in the loophole, and thereby increase the funding of the national debt by private investors for potentially many years to come.

Textbook Financial Repression

The regulatory changes planned by the Federal Reserve are a textbook example of what economists refer to as Financial Repression. For those who are not familiar with the term, or are unsure about exactly what it means, I have written an understandable tutorial on the subject which can be read here.

Financial Repression is one of the four core tools available for heavily indebted governments to manage and reduce their debts, along with austerity, high rates of inflation and outright default. While the least known by the general public, Financial Repression has an extensive history in the United States and other nations.

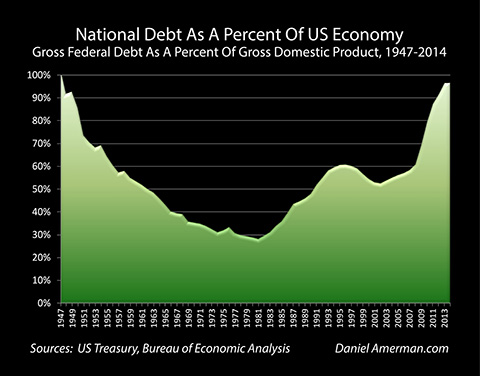

What most people don't realize is that the United States has been here before, in terms of a national debt approximately equaling the size of the national economy. This was the situation after World War II. And as shown below, that debt steadily came down over a period of decades, when measured as a percent of the economy.

Financial Repression is exactly how it was done, from the 1940s until the early 1970s. Indeed, the previously linked Wall Street Journal article does point to the not at all coincidental timing, even though the words "Financial Repression" are never used:

"The Fed's return to margin requirements is symbolically significant, a kind of throwback to an earlier era of empowering regulators to try to steer markets. Until 1974, the Fed regularly tinkered with the amount of margin, or collateral..."

The very high levels of debt are back - and increasingly, so are new variants of the old tools.

In general terms, Financial Repression can be used to refer to one half of a long term cycle between free market-dominated economies (Financial Liberalization), and more government-dominated economies (Financial Repression).

The heavily indebted US government moved to Financial Repression in the 1940s. The cycle changed to Financial Liberalization in the 1970s and 1980s as the national debt dropped to about 30% of the size of the economy. And the cycle then swiftly moved back to Financial Repression as the national debt surged in the aftermath of the financial crisis of 2008.

There is much more specific meaning for Financial Repression as well, which involves governments forcing negative real (inflation-adjusted) returns on savers over a period of decades. The idea is that unmanageable national debts are held down or reduced while economic growth continues, so that the economy gradually pulls away from the level of national debt, until a now manageable level of debts allows a return to the alternating cycle of Financial Liberalization (in theory anyway, many other issues are at play in this current round that were not there in the 1940s).

As part of that process, there is an effective checklist for how governments can accomplish this, as covered in the linked tutorial.

The first principle is that financial institutions will be made to participate through regulatory means, and because the institutions are really just intermediaries, that means the public is being forced to participate, without realizing that is happening.

Margin Rules Changes – Check.

A second principle is that a combination of sticks and carrots will be used to compel participation, and create a captive audience for government debt.

Margin Rules Changes – Check.

A third principle is that the regulatory changes which compel the purchase of government debt will be described as being done in the name of public safety.

Margin Rules Changes – Check.

A fourth principle is that this be done in a manner where history shows that most voters won't understand what is happening, and there will therefore be few if any political consequences.

Margin Rules Changes – Check.

A fifth principle is that for the few people who are aware of what is happening, they will be prevented from leaving a rigged playing field by the use of capital controls.

Margin Rules Changes – Check. This is why the entire G-20 simultaneously said (via the Financial Stability Board) that they would be doing this, so that wherever the financial companies go, they can't get away (at least not in the major markets).

The Federal Reserve's plan to change margin rules checks all five of those boxes. The rules changes may be a poor and strange way to attempt to control financial system leverage, but they are likely to be highly effective as a straight out of the textbook example of Financial Repression.

An Extraordinary & Almost Unnoticed Combination

Some regular readers may be feeling a bit of deja vu – didn't they just read an analysis on a very similar subject a few months ago?

I know that I personally felt a strong sense of deja vu when I first learned about the new margin rules, and identified on a checkpoint by checkpoint basis how they were an almost perfect example of Financial Repression.

But the interesting and remarkable part – and perhaps the greatest source of information value – is that the two analyses address entirely different regulatory changes, in different markets. Changes that are nonetheless occurring at about the same time.

As analyzed here, the regulations are being changed for money funds as well. And what is happening with money funds is quite similar, as 1) there is the stick of more stringent regulatory treatment of investments for an entire multitrillion dollar industry; 2) there is the carrot of a safe harbor exemption from those expensive new regulations when Treasury and agency securities are owned; 3) the official reason offered is that of increasing safety for the public; and 4) the general public has no idea that anything is going on at all.

In the case of money fund regulation, the industry is about $2.7 trillion in size, and about $1 trillion was previously not invested in Treasuries and agencies. In the case of the particular type of secured financings addressed by the Fed, the industry is about $4.4 trillion in size, and about $1.4 to $1.5 trillion is not currently invested in Treasuries and agencies.

(There is some overlap, as money funds do invest in repurchase agreements. In this case, the two rules changes are cumulative for those using non-government collateral, as the new money fund rules penalize the investor and the new margin rules penalize the borrower.)

So in combination (and before any overlap), the government is increasing the demand for Treasuries and agencies by up to about $2.4 to $2.5 trillion – which is a serious amount of money. Not all of that money may initially change, but there are powerful incentives to do so.

By way of comparison, the US Treasury securities held by the Federal Reserve primarily as the result of quantitative easing (QE) are about the same amount, in the $2.4 to $2.5 trillion year range.

One of the differences is that QE was intensely controversial, and it took about five years to reach that level, with screaming headlines each step of the way, at least in the financial media.

Yet, the combined regulatory changes for money funds and secured lending may reach close to that same level in a matter of months, or perhaps a year, but with almost no notice, and very few headlines even in the financial media.

The Short-Term Question For 2016

Effectively, what the US government is doing is deploying two massive stabilizers simultaneously, when it comes to sources of funding for the national debt. They may be doing it silently – but it is also happening very quickly.

And the question has to be – why now?

As covered in the linked tutorial, most of the initial round of bringing back Financial Repression occurred in a relatively short time period in 2010. The policies have been maintained continuously since that time, to the devastation of savers, but there haven't been regular increases since then.

And yes, there has been extensive quantitative easing since that time, but the level stabilized more than a year ago. Indeed, we are supposed to be attempting to begin a bit of Financial Liberalization, or so the Fed would have us believe is its intent, at least when it comes to interest rates.

If there were just one major change, that would be very interesting – but not necessarily fascinating. For two such events to happen at almost the same time - after all this time – and on such a large scale... now that is fascinating.

Coincidence seems unlikely. The decision-makers and economists involved are not amateurs, there is nothing accidental or inadvertent about the creation of the stick of onerous new regulatory controls, or the simultaneous creation of the carrot of the safe harbors for escaping the regulations, or the effect on market participants, or the resulting increased demand for Treasuries and agencies.

So... why both changes now? And on so large of scale?

Investors & The Long-Term Conflict Of Interest

On a longer term basis, the implications seem (unfortunately) to be more clear.

As explored here, there is a powerful conflict of interest between investors and the United States government. Low interest rates are required for Financial Repression. Any substantial and sustained increase in interest rates could send the deficits and the national debt spiraling upwards and out of control.

Simultaneously, investors very badly need higher interest rates, and this is particularly true in retirement.

There is talk of increasing interest rates, which would increase investor returns and lifestyle in retirement.

Yet, when it comes to action, instead of incipient Financial Liberalization we are seeing a massive structural reinforcement of the tools of Financial Repression in 2016.

Now, a small increase in interest rates is not incompatible with Financial Repression. Near zero interest rates are unusual, and an increase to 1% or even 2% short-term interest rates can work for governments, so long as the real rate of inflation is still significantly higher.

But what tens of millions of Boomers and other investors badly need is interest rates that are a good bit higher than that, and as soon as possible.

What we know from history is that the last time the US government was this heavily indebted (as a percent of the economy), it kept interest rates low for another 25 years as one critical aspect of effectively lowering those government debt levels.

And we also know that as of 2016 – new and major Financial Repression tools are being deployed.

When we put that information together, then it would seem that the most reasonable long-term interpretation of the money fund and margin rules changes is that the government is concretely showing through its actions that it will be attempting to keep interest rates in the lower end of the historical range for at least many years to come, and possibly even decades.

Which then means that a generation of Boomer retirement investors and other retirees may never get the relief they are hoping for when it comes to substantially higher interest payment cash flows. If that is, the government has its way and is able to maintain both stability and control over interest rates.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

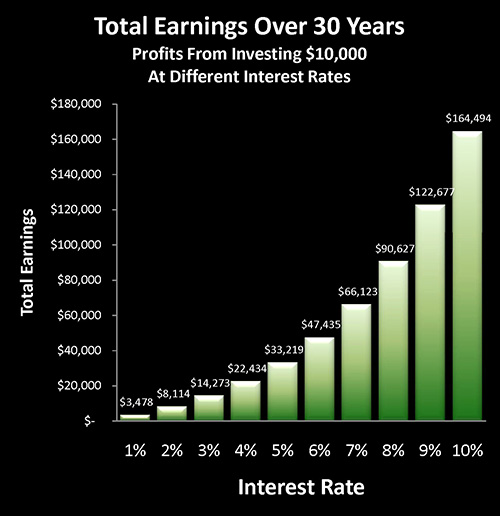

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

National debts have been reduced many times in many nations ─ and each time the lives of the citizens have changed. The "eye-opener" linked here reviews four traditional methods that can each change your daily life, and explores how governments use your personal savings to pay down their debts in a manner which is invisible to almost all voters.

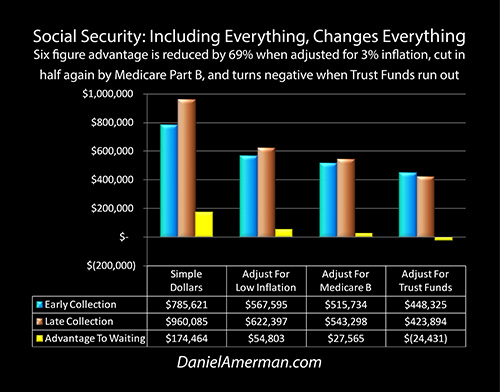

The stakes are high for the government when it comes to the national debt – and that is also true of Social Security. And once again, the numbers don't quite work the way many people think. The government strongly encourages people to wait as long as possible before collecting their retirement benefits – but as explored here, is that truly in your best interest, or are a few factors being left out?

If you find these "eye-openers" to be interesting and useful, there is an entire free book of them available here, including many that are only in the book. The advantage to the book is that the tutorials can build on each other, so that in combination we can find ways of defending ourselves, and even learn how to position ourselves to benefit from the hidden redistributions of wealth.