Negative Interest Rates In The U.S. Go Mainstream - With Some Glaring Omissions

By Daniel R. Amerman, CFA

TweetThe discussion of negative interest rates in the United States has now officially gone mainstream, with the front page of the August 12, 2019 print edition of the Wall Street Journal carrying a prominent discussion of the possibility.

Most of the article consists of various institutional investors talking about why this could be a real possibility. However, as will be explored herein, there were three glaring omissions in the article.

1) What the real source of the negative interest rates would be.

2) The historically unprecedented profits that would be created by such a move.

3) Who those unprecedented profits would mostly go to (and it isn't to the average investor).

This analysis is part of a series of related analyses, which support a book that is in the process of being written. Some key chapters from the book and an overview of the series are linked here.

Omission #1: The Source Of Negative Interest Rates Is Not The Market

The possibility of negative interest rates coming to the United States in the not too distant future has been the subject of increasing speculation. I have been exploring the reasons for such a potential move and the implications in the book that I am currently in the process of writing, particularly in Chapter Fourteen.

When the Wall Street Journal covers a previously obscure concept for (most) investors on page one and "above the fold" - one could say that it is no longer being treated as wild speculation, but has instead become a respectable possibility, something that is getting the full attention of professional investors. The article is linked here, and for those with WSJ subscriptions, it is well worth reading if you have not already done so.

While the article was significant - what was even more significant was what was left out of the discussion. If negative nominal interest rates do indeed come to the United States, it will be one of the most significant financial events in a lifetime for most financial professionals, as well as for retirement and other investors.

The first issue is one of where negative interest rates come from. In reading the WSJ article there was only minimal discussion of the central banking policies that create the highly artificial conditions necessary for negative interest rates. Instead, there was a discussion of slow growth and falling yields, along with trade and currency concerns, as if (implicitly) a lack of growth itself could create negative interest rates in a free market.

The problem with that way of thinking is that we have a very long history of slow or negative growth periods around the world, as well as trade and currency disputes - and we know those don't lead to markets creating negative nominal interest rates on their own (meaning rates that are explicitly negative, rather than just being less than the rate of inflation).

No matter how low growth rates or rates of inflation go, all of financial history shows us that they don't directly create the bizarre anomaly of negative interest rates, where an investor literally pays a borrower for the privilege of losing money.

What creates negative interest rates is extraordinary and massive interventions by central banks - such as the Bank of Japan and European Central Bank - that use monetary creation to completely override natural market forces. If negative interest rates come to the United States - it will not be a true market development, but a change in the degree of the already massive interventions of the Federal Reserve that dominate all investment markets in the U.S. today.

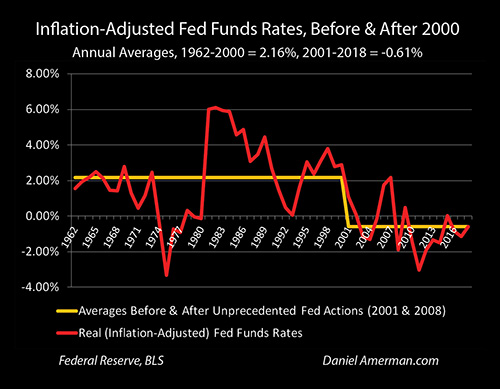

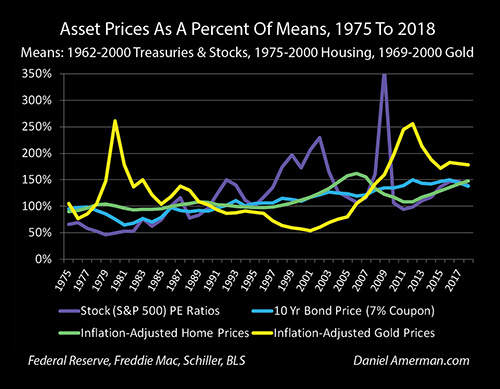

As a starting point, and as can be seen above, negative interest rates in inflation-adjusted terms would not be new in the United States. As explored in earlier chapters, the Federal Reserve went into new territory in the attempt to contain the damage from the crises created by the tech stock asset bubble collapse in 2001, and the Financial Crisis of 2008 (which was caused in part by the collapse of the real estate bubble).

In each case a cycle of crisis was followed by a cycle of the containment of crisis, which involved extraordinary interventions by the Federal Reserve. The Fed forced inflation-adjusted interest rates to the irrational place of being negative for 12 of the 18 years since then (annual averages), with a cumulative average inflation-adjusted interest rate for the 18 years of 2001 to 2018 being an extraordinary negative 0.60%.

Many people say that the current low level of interest rates is due to lower inflation rates, which should happen as the result of free market forces, and there is an element of truth to that. But forcing real interest rates down from a previous 39 year average of being a completely rational 2.16% above the rate of inflation, to an irrational 0.60% below the rate of inflation - is not the result of purely market forces, but is the product of heavy-handed Fed interventions distorting the investment markets.

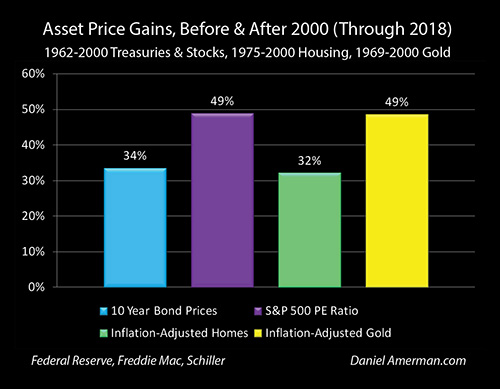

As covered in previous chapters, forcing the effective "risk free" rate into a negative range for an extended period of time has changed the very fundamentals of investment pricing, creating much higher averages for stock, bond and real estate valuations than what is historically normal.

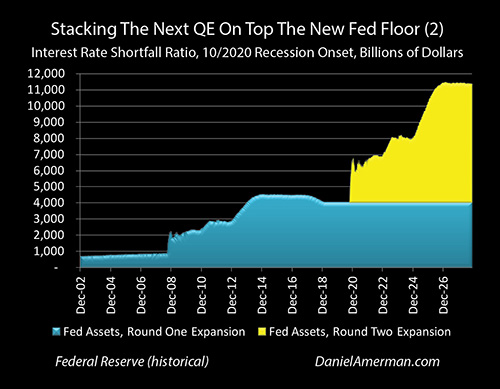

The other extraordinary change is the Fed taking the unprecedented step of literally creating trillions of dollars out of the nothingness, and using the money to buy medium and long term Treasury notes and bonds (as well as mortgage-backed securities) at artificially high prices. This can be seen in the blue area above (from a previous chapter).

So, we have artificially low medium and long term interest rates not because of market forces - but because of the most extraordinary and direct instances of the Fed using its power to override market forces, that we have seen in financial history.

Let's return to this idea of the market anticipating that lower growth or trade disputes or currency wars (or some combination thereof) could lead to explicitly negative interest rates, and therefore dropping interest rates in advance. There is certainly an element of truth to that, in that the input of lower growth or trade war may very well lead to the output of negative interest rates coming to the United States, as they have already come to Europe and Japan, and it is logical for investors to therefore change investment prices in anticipation of this.

However, what is missing is "the middle", the causality - why that happens. It has less to do with the markets, and everything to do with the known policies, agenda and tools of the Federal Reserve and other central banks.

Highly sophisticated institutional investors anticipate that lower economic growth, recession, or trade/currency warfare, will lead the Federal Reserve to force short term interest rates down to zero percent or below.

In an earlier chapter, we looked at key language from a recent Federal Open Market Committee (FOMC) meeting, and looked at how (if needed), the Fed intends to aggressively and preemptively use quantitative easing (QE) to create what could be trillions of dollars of new money (illustrated by the yellow area in the graph above), and use that to pursue a Maturity Extension Program (MEP), which would create potentially fantastic profits for investors who understood the Fed's unprecedented plans.

One of the potential uses of QE is to create negative interest rates. Negative interest rates would not exist in Japan and Europe if the Bank of Japan and European Central Bank had not engaged in massive monetary creation to get the money to force the markets to the completely unnatural place of negative interest rates.

So, if negative interest rates come to the United States - it will be because the Federal Reserve creates the money to make negative interest rates come to the United States as a matter of policy. Where market forces come in is in anticipating the change in interventions by an extraordinarily powerful outside agency, which then change investment prices across all the major categories. (In the extreme, there is a case that the markets could create negative interest rates in the U.S. before a new QE, but it would be the anticipation of the QE and change in Fed policies that would do it, and while possible, this scenario is in my opinion unlikely.)

And yes, once negative interest rates exist, then the markets can indeed expand or shrink the amount of bonds carrying negative interest rates on their own - but the process involved begins with an artificial situation that would not exist without massive central banking interventions. What causes the movements will then be dominated by the anticipation of what will happen in "the middle", what the input of economic and financial changes will do to central bank policies and the degree of intervention.

It is all in "the middle" - the outside interventions. Leave the middle out, and try to connect the input of changes in economic growth directly to the output of negative interest rates, without going through unprecedented and heavy-handed changes in Federal Reserve policies - and nothing will make any sense.

Something else to keep in mind is that markets so thoroughly dominated by central banking interventions are also completely outside the assumptions governing conventional financial theory and conventional retirement planning. Indeed, they invalidate the presumptions for returns and safety that most retirement planning is implicitly based upon - even as the new sources of artificial returns are missed.

Omission #2: Historically Unprecedented Profits

Keep in mind - those trillions of new dollars are created to be spent. They are spent in creating the highest investment prices in history in some categories, prices that are so high that they are completely unnatural. So the creation of negative interest rates will involve the Federal Reserve creating new money on an extraordinary scale to overpay some investors in an unprecedented manner. Those new profits will be entirely real, they will be spendable - and they will go to someone.

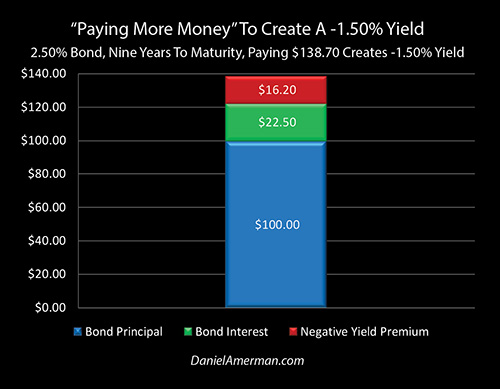

How this happens, where the money comes from and where it goes was explored in more detail in Chapter 14, and I won't fully repeat it here. However, as a quick review, negative interest rates do not usually involve literal negative interest payments, as in investors literally paying money to borrowers. Instead, negative interest rates are more commonly created by so overpaying for an investment, paying so much money up front, that it becomes impossible to earn a positive return, and a negative return is locked in at the time of purchase.

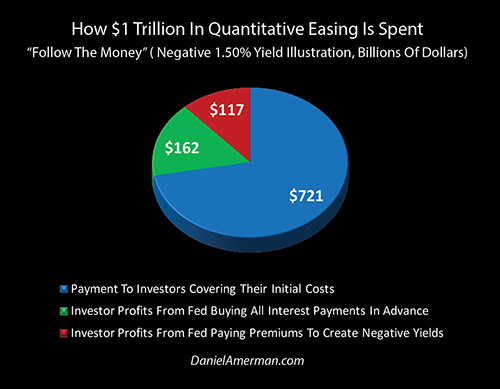

The graph above is from an illustration example in Chapter 14. The blue area is paying for $100 in bond principal, in full and up front. The green area is paying for all future interest payments, in full and up front. By combining the blue and green areas - it becomes impossible for the investor to earn any money. Those would by themselves lock in a zero percent rate of return, where $122.50 is invested, $122.50 is returned, and there is not a penny of earnings over the entire holding period.

The bizarre anomaly of negative interest rates - which could be on the way to the United States - involves the creation of the red area, where the investor deliberately pays more money than they will get back, in order to lock in a major loss - of $16.20 in the illustration above. (With that loss then being compounded by the inflation being created by the Fed or other central bank over that time, as a matter of policy).

No rational investor would ever do this in ordinary circumstances. This is not about free markets or rational investors - but the antithesis thereof. This is why we don't have a history of negative interest rates in the previous many bouts of recession, depression and trade wars the world has experienced - no sane person would go there, all else being equal.

Omission #3: Where The Money Would Go

Again, this is all about "the middle" - sophisticated investors anticipating the tools and intended policies of the Federal Reserve in the event of slow growth, recession or trade/currency wars, and how the Fed's response could create lucrative investment opportunities.

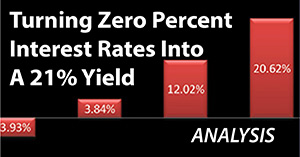

How the possibility of the Fed using quantitative easing to create negative interest rates would necessarily involve putting massive amounts of money into the pockets of (predominately) insiders can be seen in the illustration above (also from Chapter 14).

The Fed creates a trillion dollars - and that money is in no way theoretical, but is every bit as good as the money in your savings or retirement account. The money is created in order to spend it.

The Federal Reserve spends $721 billion to buy the bonds at par, call it the basis for the bond owners. It spends another $162 billion to pay for all the interest payments in advance. The Fed then pays another $117 billion to create the highly artificial state of locking in $117 billion in losses. This is something no rational investor would do with their own money - but it is something that the Bank of Japan and European Central Bank have been doing with money created via quantitative easing, and something the Fed may be doing as well in the not too distant future.

With this illustration, $279 billion of the $1 trillion in the new money would be handed out as up front profits. With potentially trillions in new money being created it would be one of the largest wealth redistributions in history, and it would disproportionately be going to a somewhat geographically concentrated group of insiders and "elites" - rather than to average investors and voters around the nation. Very few people would understand what was happening, even as it happened.

This brings us back to "the middle", and rational market behavior. The average investor (or voter) may have no idea what is going on, but for the sophisticated investors who do understand the very different ways in which our financial world currently works - if they think recession or trade difficulties could lead to negative interest rates, then they are going to want a piece of that action.

If the Fed is going to use the situation of a national emergency to hand out hundreds of billions of dollars in easy money, then those investors are going to want to own some long term bonds in order to participate. So, as the chances of intervention rise, the prices of those bonds should rise fast, which means that yields should be plunging - and that is exactly what has been happening with the prices and yields for the 10 year bonds illustrated above.

This is something that I have been writing about for more than a year now, which is why yield curve inversions matter. The point isn't statistical treatises about how different portions of the yield curve moving correlated with recessions and stock market movements in the 1960s and 1970s. Those days are long gone, and detailed statistical analyses that don't distinguish between the more free market yield curve changes of days long gone by, and yield curve changes during a time of massive central banking interventions that deliberately target and change the yield curve - are likely to be more or less worthless (in my opinion).

Yield curve inversions happen, as covered in previous analyses, because of (predominately) institutional investors seeking profits. This has worked great in the past, and it has worked very well for many investors through 2019 to date. When we take into account "the middle", and our current very different situation, then this increases the profit potential, even while having less and less in common with the past.

Markets Anticipating Unnatural & Cyclical Interventions

So, let's put a few things together.

1) We have huge problems with economic growth in Europe and Japan, and these problems could be getting worse there while also spreading to the United States.

2) Over the last couple of decades, central banks have moved to using massive and historically unprecedented market interventions to try to contain crises and stimulate growth.

3) These extraordinary interventions in the United States have already radically changed the investment markets - creating record or near record asset prices across all the major investment categories, with record or near record capital gains being generated along the way.

4) Much of the focus of the institutional markets has moved to anticipating how economic changes will create changes in the central banking interventions, that could create some of the largest profits seen in history in the still coming years.

5) These sophisticated investors are not investing for the naive assumption of free market forces and prices being determined in a discovery process by investors acting in their own self-interests - but for our modern reality of the overriding of free market forces on a deliberate and massive scale by the Federal Reserve.

6) The great majority of individual investors do not at this time fully understand the new sources of profits, and are therefore unlikely to participate except by happenstance (or education).

7) These amplified cycles of ever greater interventions creating ever more artificial prices could persist for years to come - but are likely to end very badly at some point, with life changing implications for millions of retirees and other individual investors who do not understand how the new sources of risk completely override the assumed protections for long term investors that are built into conventional financial planning.

8) The great majority of the population is likely to miss out on most of the profits while bearing most of the risk (again) - even while a relatively small minority of elite institutions and individuals will (again) take most of the huge but artificial profits that will be created as a matter of national policy.

9) The largest determinants of financial security for retirement and other investors over the coming decade are not likely to be based on financial history, or the assumption that the past endlessly repeats itself for each asset class in an environment of free markets, but rather the ability to anticipate and participate in the new forms of artificially induced wealth redistributions, while being prepared for and mitigating the effects of the potentially disastrous downside when it does arrive.

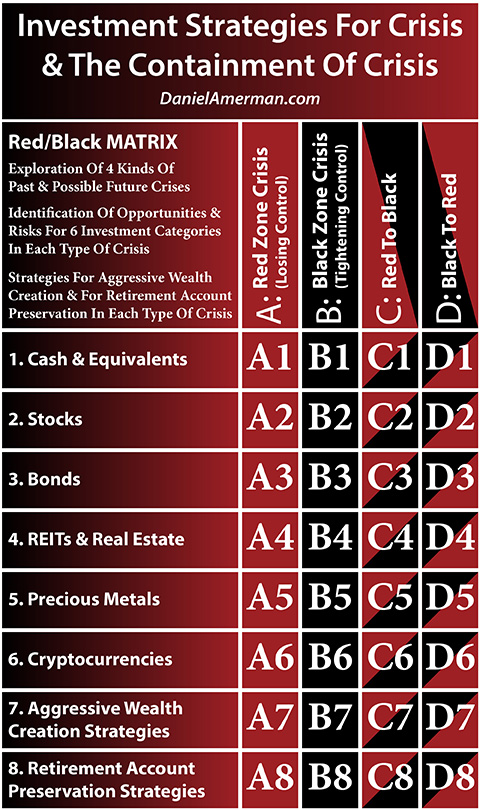

As regular readers know, I've worked out an organizational framework for exploring how cycles of crisis and the containment of crisis change investment decisions across all asset categories, including stocks, bonds, real estate and precious metals. What we've been exploring in this analysis could be useful in better understanding how the Red/Black matrix works.

(More information on the matrix and how to use it is linked here).

In the past, we had the ordinary business cycles, which included ongoing Federal Reserve interventions, but they weren't anywhere near as powerful as what we see today. What the matrix above is about is what was referred to in this analysis as being "the middle."

If we have a crisis developing, then that will change investment prices and results for all the major categories. For instance, recessions will bring down stock prices and real estate prices all else being equal, even as bond prices increase (also all else being equal).

The difference since around 2000 or so, is that we have far more pervasive Federal Reserve interventions, so we are no longer just looking at the ordinary investment responses to ordinary changes in the business cycle. Because the Fed is using massive interventions that distort interest rates, investment prices and the yield curve - all investment prices are increasingly being driven not by the market fundamentals, but by the markets anticipating and responding to the outside interventions by the Federal Reserve.

What applying the matrix does is that it adds "going to the middle", so we look not just how a recession would ordinarily change stock prices - but how a recession could trigger extraordinary interventions by the Federal Reserve, and how the 1-2 combination of recession and the resulting interventions would change stock prices, in ways that are potentially quite different from long term norms.

To better understand this future, we need to better understand the past, and just how it is that stock, bond, real estate and precious metals prices have been working differently inside the cycles of crisis and the containment of crisis over the years since around the turn of the millenium.

As developed in the book, and as can be seen above, we have seen sharp differences in all four major asset categories, which come down to what is now in "the middle" - the unprecedented and extraordinary central bank interventions including zero percent interest rates and quantitative easing.

When the Wall Street Journal put possibly imminent negative interest rates for the United States on page one and above the fold - it is (effectively) saying these changes are not in the past, but may just be getting started. The greater the degree of distortions, the less important that long term investment history in freer markets becomes, and the greater the importance of having a framework for understanding what is in "the middle" and how these extraordinary and heavy-handed interventions by the Fed transform the investment decision making process.

*******************************