A Video Guide To Bail-Ins, Transcript Of Video One

Introduction & Why Bail-Ins May Matter For You

Tweet

(Go to Topic Outline with all videos in this series)

Hello, my name is Dan Amerman and thank you for joining me.

What are Bail-Ins? And perhaps more importantly - why should you care?

My goal for this series of instructional videos is to explain in understandable terms what Bail-Ins are and why they exist. My hope is that I will be able to give you enough information where you can make your own decision about whether Bail-Ins are something that you need to be concerned about or not.

As a starting point Bail-Ins are a relatively new method for rescuing banks, pension funds, retirement systems, and any other entity, public or private, that has made too many promises and then gets into deep financial trouble.

And the problem is, as we found out in 2008, when these large institutions get in trouble, sometimes it isn't just one or two of them that get in trouble, but they all get in trouble together. Which can create very, very expensive problems.

So what happened was that after the financial crisis of 2008 which came very close to taking down the global financial system, is that the G-20 group of nations, including the United States, Canada, Australia and many Asian and European nations, got together and they decided to find some new solutions to reduce their financial risk. And if you look down the topic outlines for these videos, you will see that in later videos we will talk in much more detail about why this happened and what has been done to date.

Fundamentally, Bail-Ins are a method of risk reduction for governments and the global financial system, and what they do is that Bail-Ins transfer the financial risk if there's another round of financial crisis from governments to savers, investors and pensioners.

So if you want to rephrase that, another way of looking at this is what Bail-Ins do is they transfer the risk from the governments to you and me.

Now, while bail-ins were designed to be a new tool for handling a system wide crisis, a big global crisis is not necessary to trigger a bail-in. Instead it is the new method of choice for many kinds of financial rescues, that occur just in the normal course of events. And what we've seen recently is bail-ins being used with individual countries, banks and pension funds.

What are some of the asset categories that could be vulnerable to bail ins? Well the first group is bank deposits, money in savings or checking accounts, certificates of deposit and bonds that would usually be issued by the bank holding companies.

Another category is pensions, many pension funds are underfunded sometimes severely underfunded and people who have public or private pensions are vulnerable to Bail-Ins.

Another category is bond mutual funds and exchange traded funds that are invested in bonds. Bonds as a category have a broad exposure to bail in risk and another possibility is insurance policies and annuities. If you are counting on money from an insurance company there is the potential that at some point you could be bailed in.

We can define Bail-Ins in different ways, either in a very narrow way or more broadly, but in the broadest sense, any time financial promises have been made to you, and there isn't enough money to keep those promises, then bail-ins are a possibility for how that will be resolved, instead of the more traditional bail-outs.

So what's really different about bail-ins?

Both bail-outs and bail-ins are financial rescues, which means they are done to prevent bankruptcies. Because the issue is that when it comes to large banks or governments, and all the interlinked promises they have made, large bankruptcies can pose a danger to global stability, so those need to be avoided.

Bail-outs are the traditional way of dealing with this problem, and bail-outs go in the front door and use the power of addition. Which can be very expensive.

However, there is a back door, too, and that is to use the power of subtraction. Bail-ins are the new way for rescuing banks, corporations, pension plans and governments, and bail-ins use the power of subtraction.

As an example of how this works, let's take a look at a concept that we're all familiar with, which is coming up with our personal financial net worth.

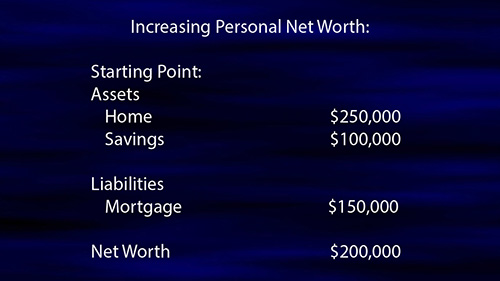

For our starting point - we look at our assets. Let's say that we have a home which is worth 250,000 dollars, and we have savings that are worth 100,000 dollars. So we have 350,000 dollars in assets with this example.

But that's not our net worth. We have to subtract our debts to come up with what we're really worth. And in this case we going to look at our debts, that is our liabilities and say we just have one liability - no credit cards or anything like that - just a mortgage for 150,000 dollars.

So if we take 350,000 dollars as our assets, and we subtract 150,000 dollars for our mortgage, which is our liability, we then have a net worth of 200,000 dollars.

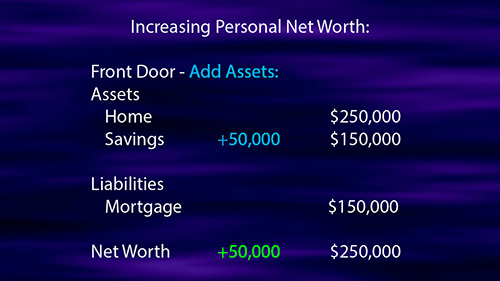

Now, let's say our goal is to increase our personal net worth by 50,000 dollars and there's two ways we can do this. We can go in the front door and add assets. So if we add 50,000 dollars to our savings, we now have a 250,000 dollar home, and 150,000 in savings, that's 400,000 dollars in assets, we take off that 150,000 dollar mortgage and we now have a 250,000 dollar net worth.

By adding 50,000 dollars in assets we've increased our net worth by 50,000 dollars, that's the front door.

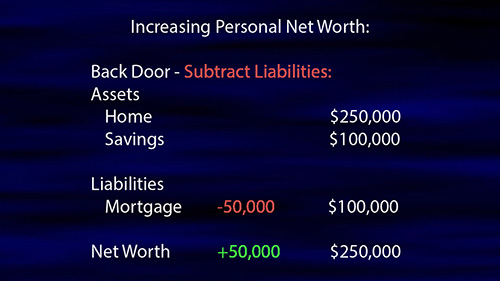

Now let's take a look at the back door. The back door is to use the power of subtraction on our liabilities. So in this case we work hard, and instead of increasing our savings we reduce our mortgage by 50,000 dollars. So we have our house that's worth 250,000, our savings are now unchanged at 100,000 dollars, but we've knocked that mortgage down - sending in those prepayments - to 100,000 dollars.

Now we take 350,000 in assets, we subtract a 100,000 dollar liability, and we have a 250,000 dollar net worth. It's gone up 50,000 dollars. And what needs to be understood is that these two methods are equally effective if we're going to make a 50,000 dollar change.

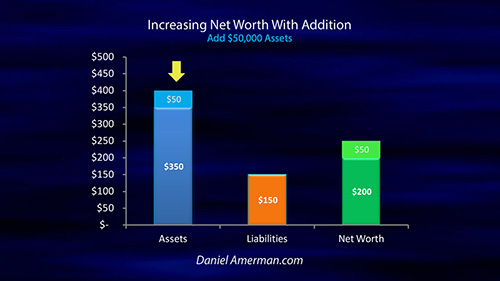

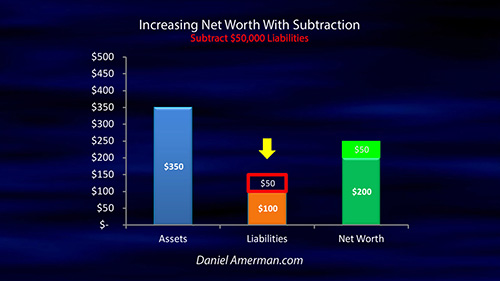

Let's take a very quick visual look as well.

We start with assets, we subtract liabilities, and we get net worth.

We want that pleasing green bar of our net worth to grow bigger, and we have two basic paths for getting there. We can apply addition to our assets, or we can apply subtraction to our liabilities, and both get us to the exact same point.

These same principles also apply to banks, pension funds and governments.

And fundamentally, moving from the power of addition, to the power of subtraction, is a transfer of risk from governments to investors, savers and pensioners. Which can have a potentially life changing impact on the people involved.

Exactly how that transfer of risk works if a big bank fails is what we will be exploring in the next video.

(Go to next video and transcript)

(Go to Topic Outline with all videos in this series)

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

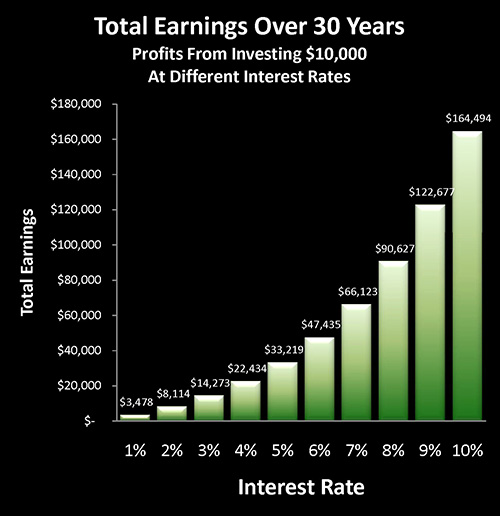

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

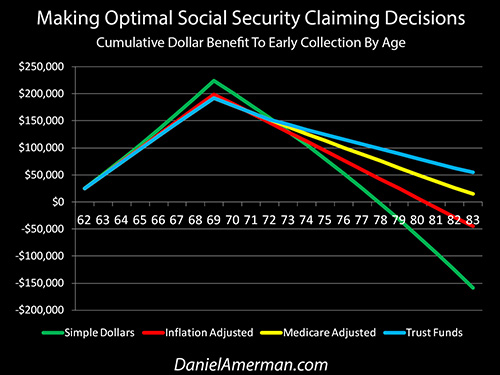

Much has been written about a $150,000+ advantage to waiting until age 70 before collecting Social Security. However, as explored in the analysis linked here, once we "raise our game" a bit, and use a more sophisticated type of analysis than some of the simplistic Social Security decision aids in wide circulation ─ all of that advantage can vanish.

National debts have been reduced many times in many nations ─ and each time the lives of the citizens have changed. The "eye-opener" linked here reviews four traditional methods that can each change your daily life, and explores how governments use your personal savings to pay down their debts in a manner which is invisible to almost all voters.

If you find these "eye-openers" to be interesting and useful, there is an entire free book of them available here, including many that are only in the book. The advantage to the book is that the tutorials can build on each other, so that in combination we can find ways of defending ourselves, and even learn how to position ourselves to benefit from the hidden redistributions of wealth.