A Video Guide To Bail-Ins, Transcript Of Video Two

Comparison Of Bail-Outs vs Bail-Ins For Banks

By Daniel R. Amerman, CFA

Tweet

(Go to Topic Outline with all videos in this series)

This is video two of a video guide to bail-ins and our subject is going to be comparing the effects of bank bailouts versus bank bail ins for both you and the government.

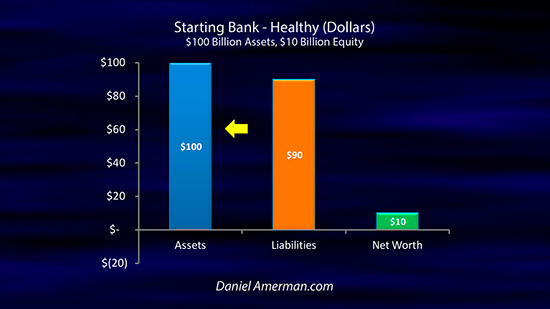

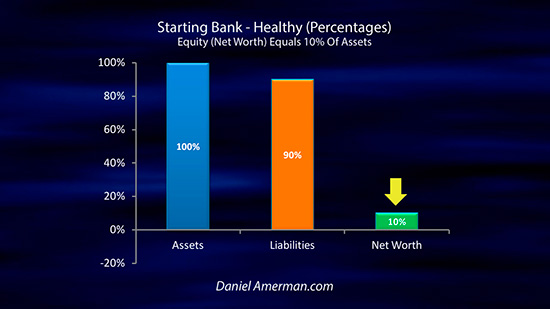

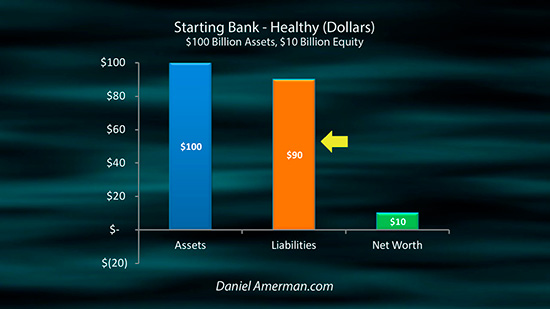

Let's start off with an example. Here is a nice, big round number example of a big bank that's in healthy condition. It's not a huge bank, but it's a big bank so we're going to assume $100 billion in assets and $90 billion in liabilities.

(While I know many of my regular readers prefer transcripts, this is very easy to follow in the video with the graphs on the screen.)

While banks aren't really the same as our individual net worths the process is similar. We start off the total assets of $100 billion we subtract total liabilities of $90 billion and we're left with a $10 billion equity or net worth.

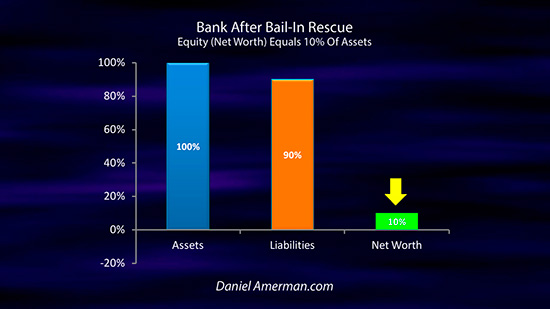

What really matters from a regulatory perspective when we're looking at the safety and health of a bank is not so much the dollars but the percentages. So the way we would look at this healthy bank before anything happens, is that the assets are equal to 100%, the liabilities are equal to 90% of those assets, so we have a healthy 10% equity ratio, our net worth ratio.

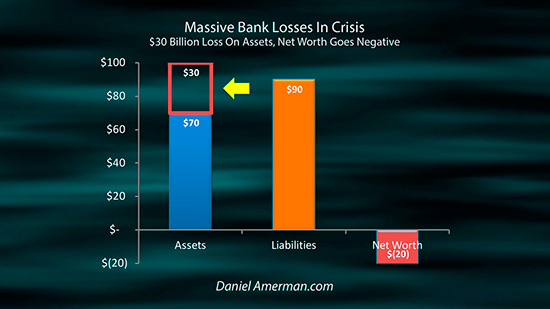

Then something bad happens - something really bad happens. It could be just to this individual bank, it could be to the national banking system, it could be to the global financial system.

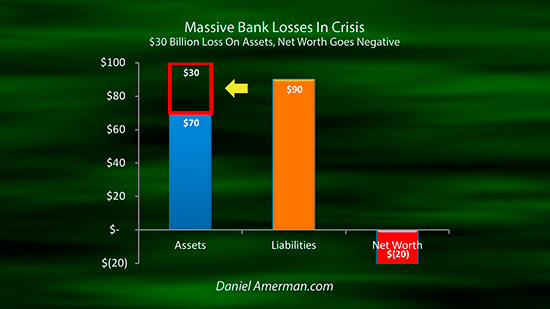

For our round number example we are going to assume that the bank takes a $30 billion loss so instead of having $100 billion in assets the bank now has $70 billion in assets. But they still have $90 billion in liabilities, which creates a real problem, because our net worth or our equity is the excess of assets over liabilities.

Now we have a deficiency. So what we do is we take our $70 billion in assets, we still subtract our $90 billion in liabilities, that same formula still applies, assets less liabilities equals net worth.

But now we have a negative net worth of $20 billion. But this is a very interconnected big bank and triggering a bankruptcy for this bank is viewed as being financially disastrous.

So this is a problem that needs to be solved without going through bankruptcy for the bank. This is what the governments of the world been wrestling with since the financial crisis of 2008, is how to solve this?

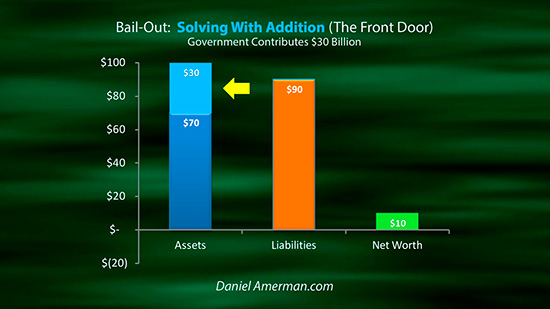

Well the traditional method is the power of addition. We do a bail-out and as you can see, how a bail-out works is the government contributes $30 billion to the bank. So we take the $70 billion in assets we had before, we have the $30 billion that's put back in, we're back up to a total of $100 billion, we take off the $90 billion in liabilities, that never changed, and we still have a $10 billion net worth, which is 10 percent.

It's as if that financial crisis never happened.

But the problem is the government has to come up with $30 billion, and if you have a lot of big banks around the world, they're getting a lot of trouble let's say in some possible future financial crisis that could be just too expensive for them (the governments) to handle.

They were looking for a different way of doing this. That brings us to our second basic method which is the power of subtraction.

Bail-outs use the power of addition and bail-ins use the power of subtraction.

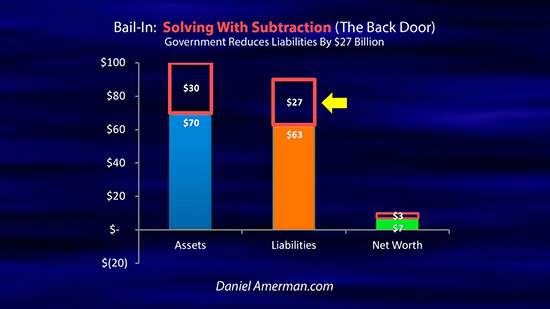

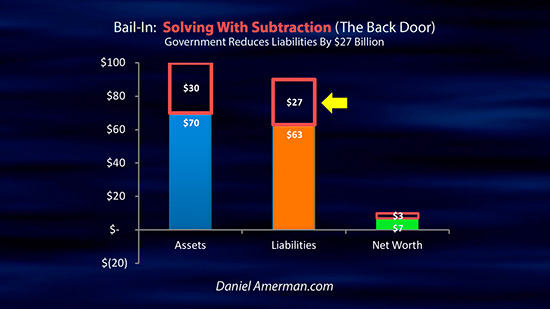

Now if we're looking at a bail-in, you can still see the empty box for the $30 billion is still there. In this case the government isn't putting any additional money in to the bank.

Instead what is being done is that the value of the liabilities are reduced by the government by $27 billion. Then we take $70 billion in assets, we subtract $63 billion in liabilities and we have a $7 billion net worth.

And if we look at what really matters from a regulatory and governmental perspective - which is our percentage equity - if we have $70 billion in assets equal to 100%, then $63 billion in liabilities is 90 percent of that, and $7 billion in equity is equal to 10% of our 100% in assets.

So if we're looking at a percentage basis which is how regulators look at the situation, how accountants look at the situation, then it really doesn't matter whether were doing a bail-out or a bail-in. Either way we end up with 100% assets, 90% liabilities and 10% net worth. The financial situation has been fixed, the institution has been rescued.

But there is an enormous difference in expense when it comes to the governments. Because with a bail-out they're coming up with $30 billion, with the bail-in they're coming in with zero.

So where is the money coming from to do the bail-in?

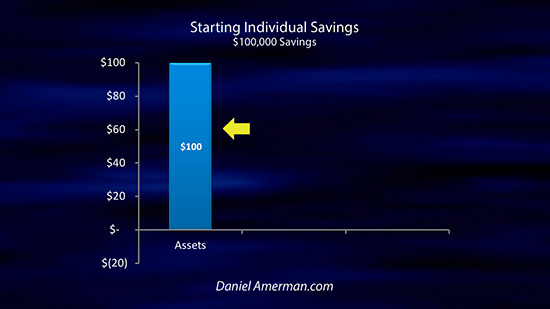

To understand this we need to look at the money you may have in a bank account in a very different way than people usually do. When we think about cash in the bank that's supposed to be the ultimate asset, that's the ultimate safety.

Your bank account is an asset for you - but this is where we have to do kind of a flip - what your bank account is for the bank is it is a liability. Now banks have many different kinds of liabilities but fundamentally what is a liability for the bank is an asset for someone else. And that's true of checking accounts, of savings accounts, of certificates of deposit, and of bonds that may have been issued by that bank or that banks holding company.

Let's take a like at this visually, and we will start with someone's personal net worth. Here is our asset, money in the bank, which is considered by most people to be the very definition of financial security. But what is that asset, really?

Let's flip it over and look at our ultimately safe asset, our money in the bank from the bank's perspective. And what a change! Our asset is the bank's problem, our asset is the banks liability.

We put money in the bank, and from our perspective - that money is our asset. But from the bank's perspective, our deposit is money they have taken in, that they have pay us back when we want. So their need to pay us back is their liability.

Now let's go down one more level here. What, ultimately, is the security for us of having money in the bank, whatever the form is?

Well, ultimately, our money is gone, we deposited it, and all we have for security is the promise by the bank that they will pay us our money.

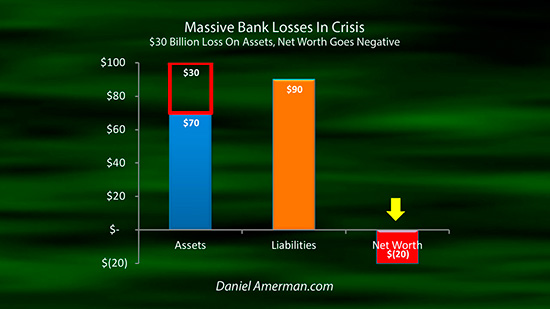

And if we look at the bank visually again, once the bank is in trouble - what's the bottom line source of their trouble?

The old way of looking at this was saying the bankers made some huge, whopping mistakes, and lost too much of the value of their assets.

The new way of looking at this is much more detached, and not so judgmental. The simple math is that the bank's liabilities are too large relative to their assets, they've entered into too many promises to pay that money back. So that brings us back to our basic solutions here.

We can go the old route, use the power of addition, and the government can contribute massive sums of money potentially to make the bank healthy again and make the bank able to pay its promises. Except that could be a fantastically expensive solution if another round of major global crisis hits - how could the governments possibly afford it?

The new way of doing this, the modern way as of the 2010s is to instead do a bail-in where we recognize the problem as not being one of an insufficiency of assets - but rather, an excess of liabilities.

So, the governments uses the power of subtraction on the liabilities, as we can see with the hollow red box, assets now again exceed liabilities, and the bank gets saved.

Because subtraction is being used instead of addition, there may be no cost to government, so there is no limit to how many banks can be saved. And if you want to know why governmental policies are changing on a global basis from bail-outs to bail-ins, that is exactly the reason.

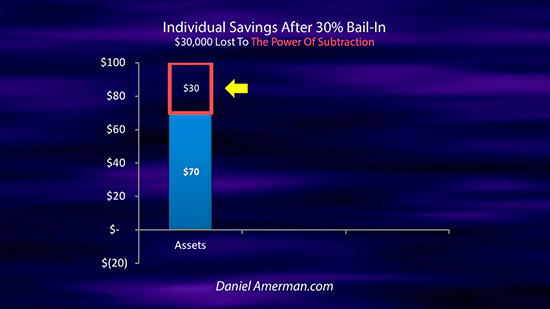

But there is a price, and to see it, let's flip back to a visual look from an individual's perspective. The major reduction in the value of the bank's liabilities, by definition all comes out of the value of someone else's assets.

So, the hollow red box jumps from the bank's liability column into our asset column, and it is possibly our checking account, possibly our savings account, and possibly our CDs that are getting hollowed out.

Another way of understanding this, is that the core cause of a banking crisis is no longer about bankers making bad investments, I mean, that is such a ridiculously old-fashioned way of looking at things.

No, the problem is YOU.

That's right, YOU are the problem.

YOU and YOUR selfish, selfish expectation that YOU are entitled to get all of YOUR money back.

As long as YOU expect to get all YOUR money back, then the world melts down.

And if YOU would just not be so selfish, and maybe a little more of a team player, then everything would be awesome.

Is that just not the most crazy, twisted, perverse logic you have ever heard of? I think it's insane. But if you look at the essence of what bail-ins really are, that is it the heart of it. The source of crisis is people expecting to get all their money back. And the cure for crisis - is for that to not happen.

In the next video we will explore the unlimited transfer of risk, taking deposit insurance into account, and whether there is more to think about than just money in the bank.

(Go to next video & transcript)

(Go to Topic Outline with all videos in this series)

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

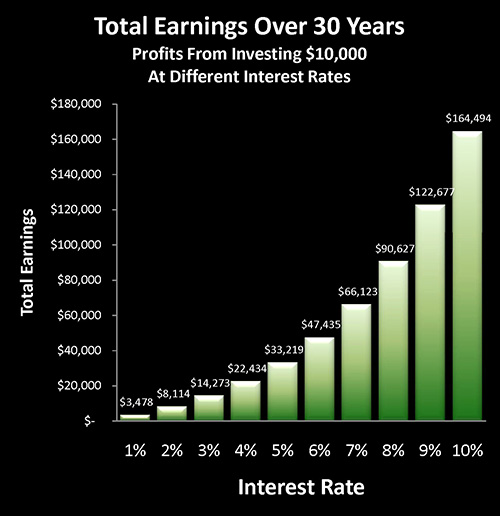

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

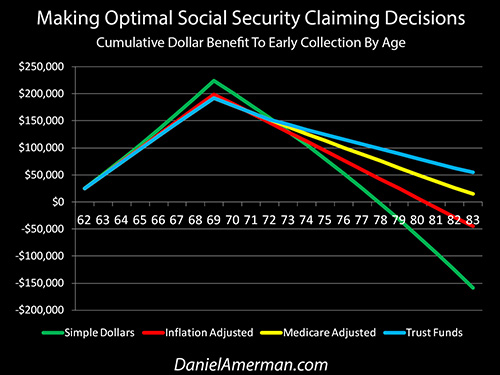

Much has been written about a $150,000+ advantage to waiting until age 70 before collecting Social Security. However, as explored in the analysis linked here, once we "raise our game" a bit, and use a more sophisticated type of analysis than some of the simplistic Social Security decision aids in wide circulation ─ all of that advantage can vanish.

National debts have been reduced many times in many nations ─ and each time the lives of the citizens have changed. The "eye-opener" linked here reviews four traditional methods that can each change your daily life, and explores how governments use your personal savings to pay down their debts in a manner which is invisible to almost all voters.

If you find these "eye-openers" to be interesting and useful, there is an entire free book of them available here, including many that are only in the book. The advantage to the book is that the tutorials can build on each other, so that in combination we can find ways of defending ourselves, and even learn how to position ourselves to benefit from the hidden redistributions of wealth.