Deposit Insurance & Bail-In Risks, Video 3 of A Video Guide To Bail-ins, Illustrated Transcript

By Daniel R. Amerman, CFA

TweetDeposit insurance and bail-in risks are the subject of this third financial education video in a series. The topic outline, video and an illustrated transcript are below. The other videos and topic outlines in this series can be found on this page, and videos on other subjects can be found here.

This is video three of a video guide to bail-ins and our subjects include the unlimited transfer of risk, taking deposit insurance into account, and whether there is more to think about than just money in the bank.

Let's return to something we explored in an earlier video. There was that maybe a bit academic or clinical sounding phrase: "Bail-ins transfer the financial risk of another round of crisis from governments to savers, investors and pensioners".

That is what we were just watching in the previous video. The transfer of risk, and how it works. And the most important part of this transfer of risk from the perspective of the governments and banks - is that it is unlimited.

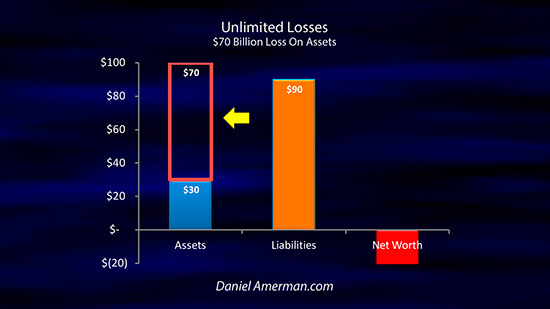

To see what I mean by that, let's take another visual look at our bank, and this time instead of a 30% loss on assets, we're going to assume a 70% loss. Wow! Those bankers really screwed up this time, and that bank is now fantastically broke.

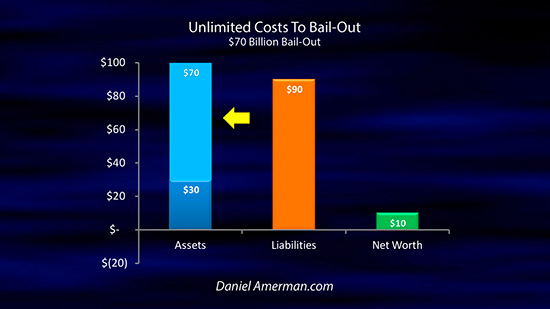

And if we look at the traditional method of rescue, using the power of addition, the government would have to come up with $70 billion. And if that one bank takes a 70% loss, then probably every other major bank in the world in taking big losses too, and how can the already heavily indebted nations of the world possibly pay for that?

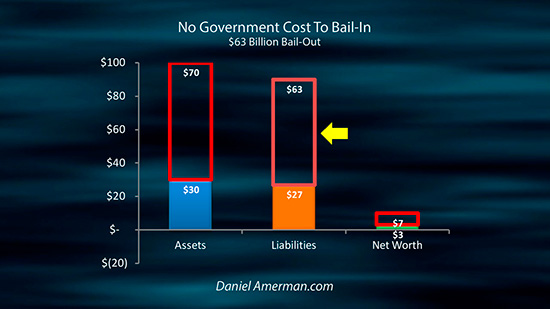

Unless... unless the power of subtraction is used. All we have to do is increase the size of the hollow red box, until it consumes 70% of the bank's former liabilities- and the bank gets a healthy green net worth bar, even if it is quite thin now. It doesn't matter how big the mistake the bankers made, the banks stay solvent.

It doesn't matter badly the governments of world messed up in failing to control the banks, and letting this situation occur in the first place. The governments all stay solvent, and furthermore, it doesn't cost them a dime. (Or at least not directly from the rescues, the economic and tax impact would be something else entirely.)

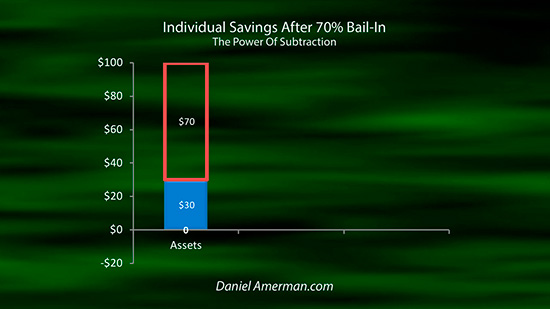

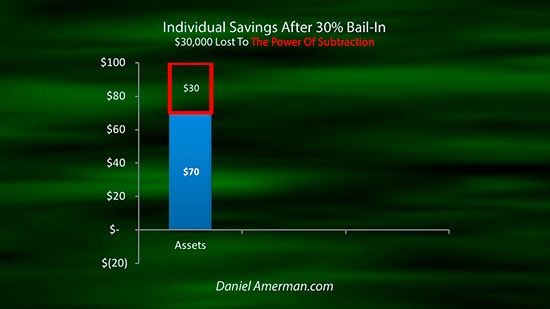

It's like magic. And to see the price of magic, look at hollow red bar in the bank's liability column, do the flip over to our personal financial situation, and see how the hollowness jumps into to our assets column, removing most of our savings and most of our financial security. If we had $100,000 in the bank, we now have $30,000. And the rest of our money disappears - just like magic. Because our safest assets - are the bank's liabilities.

Now hopefully, nothing like that ever happens. Hopefully this is an extreme example that is just being used for illustrative purposes.

But the G-20 nations and the International Monetary Fund and other organizations did spend years developing how bail-ins would work, and agreeing to all move to bail-in policies, for a reason.

They had an impossible problem in that they faced potentially unlimited risk. They thought and still think, that there is reasonable possibility - not a certainty, but a reasonable possibility - that there could be another round of crisis at some point.

For whatever the reason, and I'm not going to go into it in this video, the politicians were and are unwilling to take the obvious step of just, I don't know, maybe reforming the global banking system? This problem didn't used to exist, and fundamentally there is no reason that it has to exist, if the purpose of governments is to serve their citizens rather than special interests. But, while in theory there is no need for any of this, in practice, the political reality at this time is that there is a great deal of risk in the system.

So instead of removing the risks, the governments solved the problem of having potentially unlimited risk, by creating a mechanism for the potentially unlimited transfer of risk. From the banks and governments, and to you and me.

And as we will be going over in later videos these sorts of things have already been occurring in some countries and with some institutions.

Now the other really big question that ties in here is one of deposit insurance. Because in the United States and in Europe, generally speaking, we have deposit insurance up to certain dollar levels.

So, should you have a real concern about bail-in risks on your bank deposits, if like the great majority of the population the amount you have in the bank is below the deposit insurance limit, which is currently $250,000 in the US?

To properly answer that question, we have to understand something that most people probably don't think about, which is the difference between "uncorrelated risk" and "correlated risk". And I know, I know, those sound like two incredibly geeky and obscure phrases.

But they are important. The difference between them is enough to change all of our daily lives and standards of living, potentially for decades. And we can't understand why bail-ins exist - or the likelihood of having our personal insured deposits bailed-in - without understanding the difference. Which is why, if you look down the topic outlines, I have an entire video devoted to explaining the difference between correlated risk and uncorrelated risk, in an easily understandable manner, because this is just so vital.

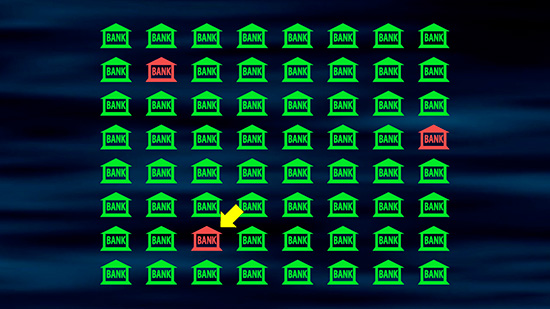

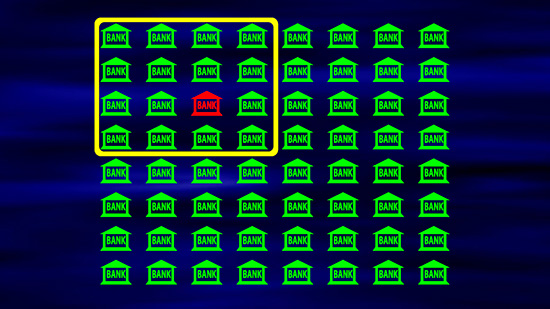

As an illustration, and to help understand where the threats are to deposit insurance - and where they aren't - let's take a look at a healthy banking system. We have all these banks, they're all this healthy green, everything looks just fine - and then uncorrelated risk hits.

It starts here, this bank here develops a problem, then it moves over there, that bank develops an independent problem. And then it moves here, and we have this bank has a problem too.

But there's only three banks having a problem with this illustration, and they're for different reasons. This type of uncorrelated risk is something that the 1-2 combination of the FDIC and the full faith and credit of the United States government should be able to easily handle. With that situation, with uncorrelated risk, we don't need bail-ins at all, the traditional bail-out structure works just fine.

So for someone who does not have large sums of money in the bank, meaning they are fully covered by deposit insurance, and we have a situation of uncorrelated risk, then no worries, their money should be fine

However, what hit the world in 2008 was something quite different, which was correlated risk. To this day I think most people have no idea of just how close we came to total global financial disaster in September and October of 2008, and how only extraordinary interventions were sufficient to hold things together.

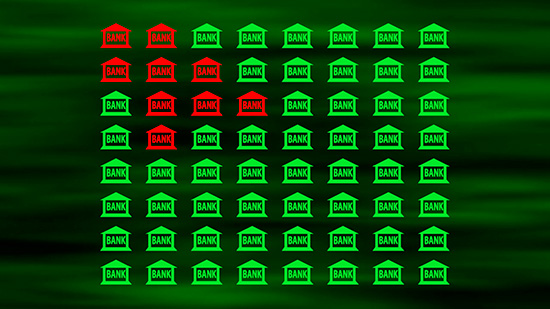

So let's take a look at a different scenario here. We'll start off with the all green banks. And then we have correlated risk developing, and it's happening in a cluster because it is happening for very closely related reasons. And it starts to grow quickly, firewalls are put up to try to contain the damage - but the firewalls fail.

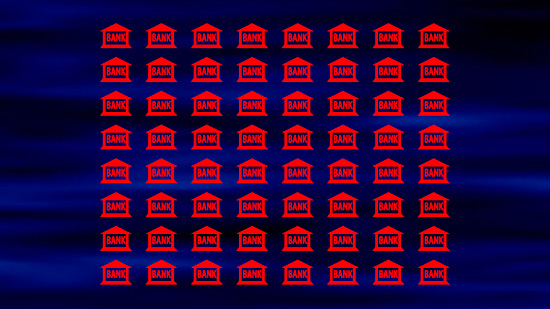

And now we have uncontrolled, correlated risk moving through the system, expanding, until the entire system has been taken over by correlated risk. We have every bank having turned red in this illustration.

Now all these banks need to turn back green, they need to get back to their healthy equity percentages, or we have a financial collapse scenario. And for that to happen, they're going to have to be either bailed-out or bailed-in.

But the federal deposit insurance cannot possibly handle a crisis of this magnitude, the FDIC is designed to handle the uncorrelated risk of individual bank problems, its reserves are not even remotely sufficient to cover a system wide crisis. The backup is the full faith and credit of the United States, but with a crisis of this magnitude those guarantees are getting pulled into too many places, trying to pay for too many impossibly expensive things and all at the same time.

This possible situation is precisely why the world has moved to bail-ins. And in this situation, no, we can't necessarily rely on deposit insurance because that would require a potentially fantastically expensive bail-out of the FDIC, which creates an impossible situation, which is resolved by using bail ins instead.

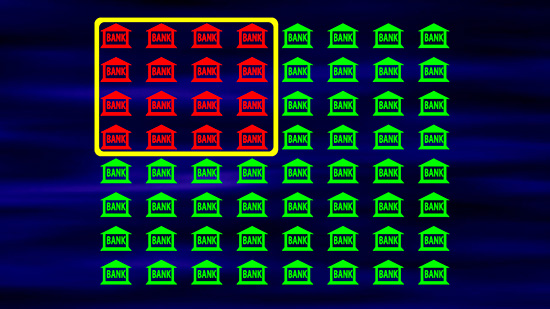

Now let's move back a bit and consider an intermediate scenario. Let's assume another systemic crisis, that's the jargon for it, a "systemic crisis", hits the system and correlated risk leads to massive losses - but the defenses hold. The firewalls are able to contain the damage inside the yellow boundary, and our insured deposits are safe.

Well what are these firewalls that are used to contain correlated risk?

People don't talk about it much in that way but we're seeing the effects of firewalls all around us right now throughout the markets and throughout the global financial system.

Because, we did have correlated risk racing through the global banking system in 2008, much like what is illustrated here, and emergency firewalls were thrown up at that time, and in the following years. What is shown here is not some wild, hypothetical situation - this has already happened, and it could happen again. Because the risks are still there, unnecessarily I would argue, but the political reality is that they are still there nonetheless.

What were and are some of those firewalls?

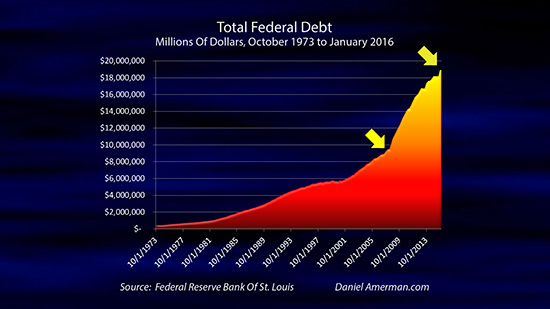

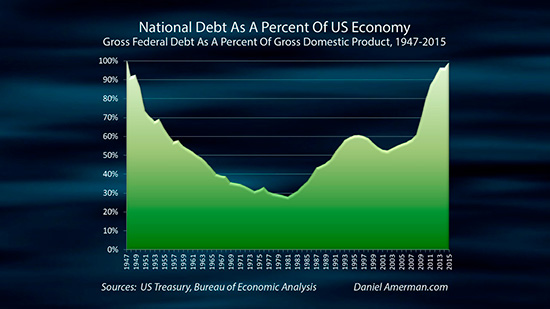

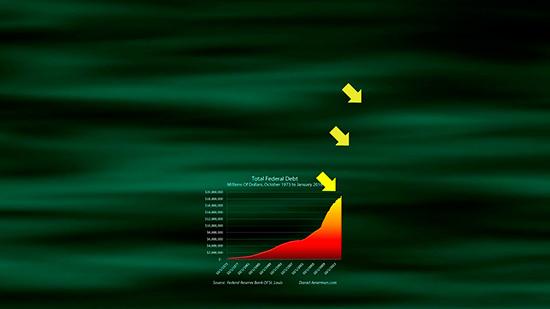

We had a doubling of the federal debt in the United States in a very short period of time, as literally trillions of dollars in money was pumped into the economy by the government in the attempt to prevent a depression.

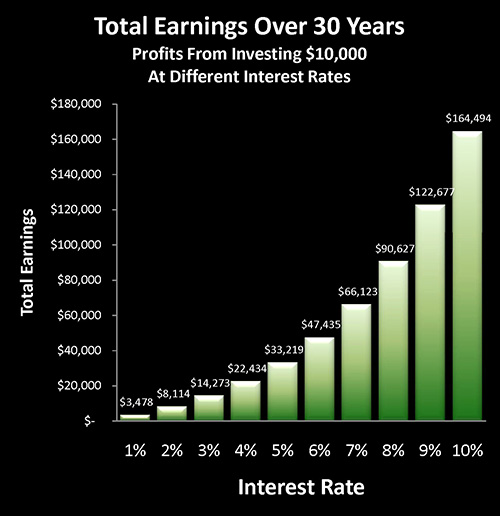

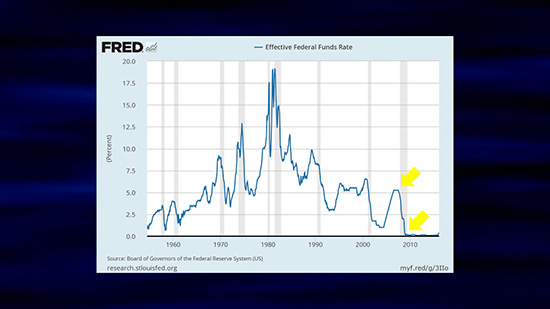

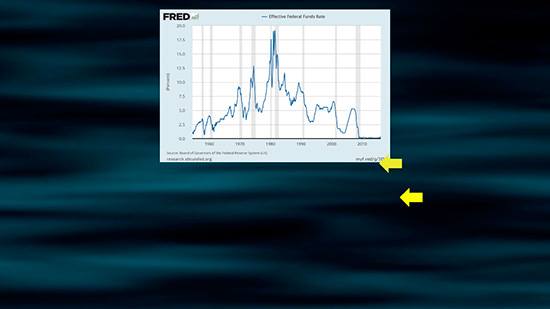

This fantastic increase in the federal debt required forcing interest rates very low. Now there's a tight relationship between the two of those and if you haven't looked at it yet, I suggest you look at my analysis of the linkage between the sharp increase in the federal debt and the sharp decline in retirement income and retirement account earnings as a result of very low interest rates.

And if you look at what history shows, when government debts grow that large, interest rates can be forced down for decades, as we saw between the late 1940s and late 1960s, because that is part of the process for bringing large debts under control, and in this case, the fantastic increase in debt was part of the containment of crisis.

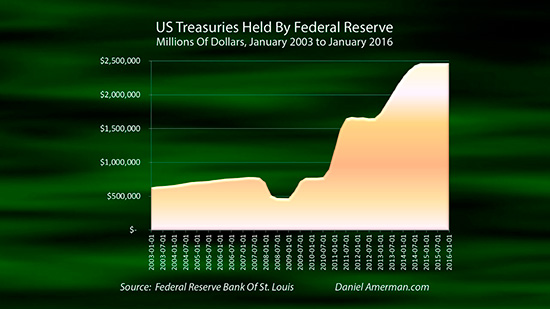

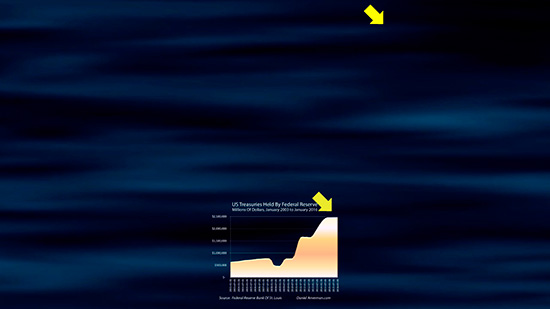

In the short term, a key component for putting a firewall up in 2008, and then in the years since, was the Federal Reserve creating at first hundreds of billions of dollars, and then trillions of dollars, just out of thin air in a process called quantitative easing.

The Fed used those newly created dollars to massively intervene - first by directly funding the banks and stopping the bank run that was already in process, and then in the mortgage markets, and then in the funding for the US debt, and here's a graph of how that funding has grown. These interventions still dominate the US markets today, including the stock markets as well as the bond markets.

The economy, employment, interest rates, stock market levels, retirement account earnings, standards of living in retirement, all of these are all still impacted today by the containment of crisis in 2008, and I think in many cases, "dominated" is a better word than "impacted"

So what happens if correlated risk hits again, and threatens to race out of control, like it did before?

Can we use the same firewalls?

There are major issues with doing that. Are we going to let the national debt jump to 30 trillion dollars this time, or 40 trillion dollars?

How do we afford the interest payments on 30 or 40 trillion in debt? What does that do to interest rates and for how long? Do we go to negative interest rates in the United States, much like we are seeing in Europe and Japan, or maybe deeply negative interest rates?

What would paying money on their savings do to retiree standards of living?

Does the Federal Reserve just create $10 trillion out of thin air this time? Could that, oh, I don't know, maybe impact the value of the dollar at some point?

Or do we see even stranger things happening with money and the financial system than we have seen so far?

There's strong reasons to avoid using the same firewalls that were used last time, so that brings us back to bail-ins.

What are bail-ins? They are a form of firewall that is very different from the previous generations of firewalls.

What bail-ins do is they take correlated risk, systemic risk, and they contain the damage. Let's take a look at this one bank in the system, which is green, until it goes red, triggering danger for the whole system.

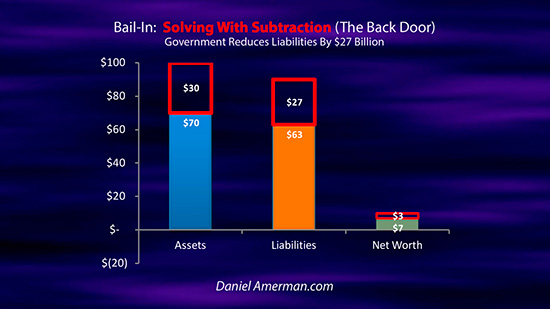

Going to the bank level, the assets went from whole, to having a $30 billion loss. We do not use the power of addition for the firewall this time, that is much too expensive. Instead, the power of subtraction is used on the liabilities, at no cost to the government. This brings our percentage equity back in the healthy green zone.

So we go back to our banking system, and the bank just flipped back to green. The bank next to it goes red - remember, this is correlated risk - the power of subtractions is used on the liabilities, and it flips back to green as well. The same happens with this bank. And with that bank.

And the damage is contained within the firewall, without spending massive sums of money that are added straight to the national debt, or taking the central bank monetary creation process to an even more bizarre place.

That is the twisted, evil genius behind bail-ins. From a governmental perspective, they are a surprisingly affordable firewall against what is otherwise unaffordable, which is a second round of correlated risk hitting the system.

But bail-ins are not free. Oh, they may be free for the governments, but someone has to take the losses. Somebody pays the price.

No, in this intermediate scenario if the governments aren't paying, if they're refusing to bail-out, and if the insured depositors aren't paying, because the correlated risk was contained, then the damage still has to go somewhere.

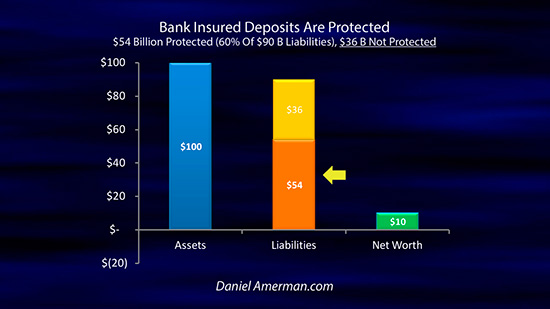

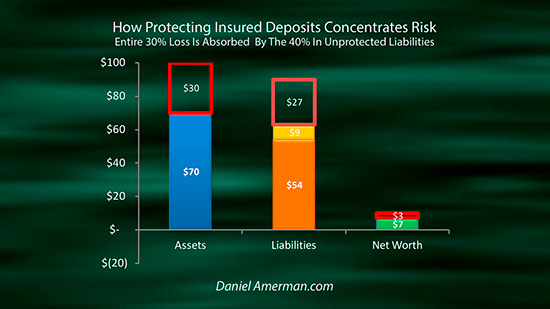

What happens is that it concentrates. Let's look at this example of a bank where 60 percent of the liabilities are insured deposits and they're protected. And let's say we're taking a 30 percent hit to assets, which means we need a 30% offsetting hit to liabilities (which is 27% of assets), if the power of subtraction is going to be used.

Well for that to happen the 40 percent who aren't protected have to take that entire hit for everybody. And if we look at the size of that hollow box, and see that all the losses are being taken by that much smaller group, the 30% is consuming most of the 40%. Indeed as we can see visually, if we divide 30 into 40, we can see that the unprotected investors are taking a 75% hit.

They have to, that is the unfortunate but mandatory price, because if we protect most people, then the risk concentrates for those who are not protected, that is the only way the numbers can add up, and therefore those who are not protected really get nailed.

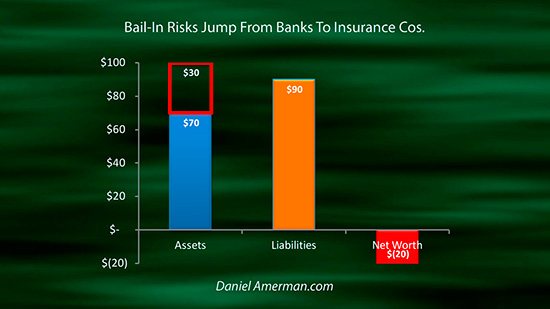

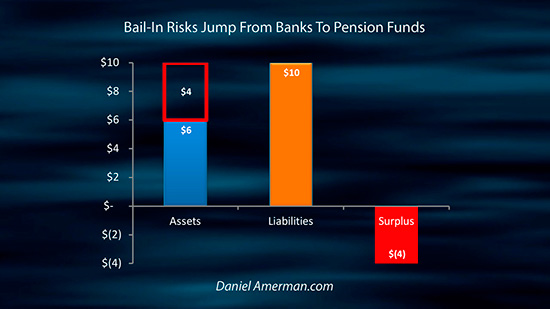

This concentrated risk then jumps to other places. What are some of the places this 75% loss could jump to?

Well, one possibility is uninsured depositors. If someone's has more money in the bank than what is covered by deposit insurance, then they could be running into a very unpleasant surprise.

Another place where a lot of this risk is going to jump is to the bonds of the bank holding companies. So people who hold bond funds or bond ETF's either directly or in their retirement accounts, whether those be IRAs and 401(k)s, whatever the case is, they could have a really nasty surprise coming when it comes to the value of those bond funds or ETFs in a bail-in scenario.

Where is another place the risk could jump? It could jump to insurance companies. Insurance companies buy a lot of bonds, there's a lot of yield in these bank holding company bonds, and the devastating losses could certainly jump to the insurance industry.

There's another consideration that's even more important. There are a lot of troubled pension funds today who are reaching for more yield and taking some risks to get it. What is one way of picking up some yield? Well, buying bonds of bank holding companies that are subject to bail in risk is one way of doing it.

Indeed as we will explore in the next video, for a variety of reasons the biggest exposure that most people have today to bail-in risk may not be their bank at all - but their pension fund.

(Go to Topic Outline with all videos in this series)

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

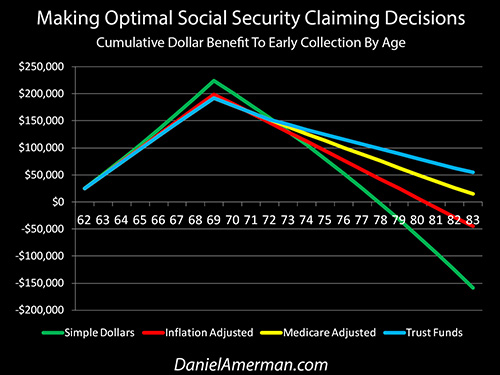

Much has been written about a $150,000+ advantage to waiting until age 70 before collecting Social Security. However, as explored in the analysis linked here, once we "raise our game" a bit, and use a more sophisticated type of analysis than some of the simplistic Social Security decision aids in wide circulation ─ all of that advantage can vanish.

National debts have been reduced many times in many nations ─ and each time the lives of the citizens have changed. The "eye-opener" linked here reviews four traditional methods that can each change your daily life, and explores how governments use your personal savings to pay down their debts in a manner which is invisible to almost all voters.

If you find these "eye-openers" to be interesting and useful, there is an entire free book of them available here, including many that are only in the book. The advantage to the book is that the tutorials can build on each other, so that in combination we can find ways of defending ourselves, and even learn how to position ourselves to benefit from the hidden redistributions of wealth.