How The Red/Black Matrix Performed: Seven 2019 Scenario Results

By Daniel R. Amerman, CFA

TweetThe seven major investment market and economic changes listed below, including new highs for stocks, bonds and home prices, all occurred in 2019 - and all were discussed in advance in the DVD set “2019 Overview: Cycles Of Crisis & The Containment Of Crisis”, which was released in December of 2018.

The methodology used to discuss in advance what would be some of the largest determinants of investor results in 2019 was not random, but rather all seven developments were the internally consistent results of the application of the “Red/Black Matrix”, a framework and system for understanding how the heavy-handed interventions of a trapped Federal Reserve are changing stock, bond and housing prices and returns in ways that are very different from the historical patterns that most investors rely upon.

Information about a free book which explains the matrix and the methodology which were used is linked here.

As reviewed in more detail in the “Red/Black Matrix Framework” section that follows, these were not firm forecasts per se, and there was no “crystal ball”. Instead the premise of the framework (and the 2019 Overview) was that if one starts by understanding the constraints faced by the Fed, and its plans for dealing with economic problems within those constraints, then a set of scenarios can be identified, which could lead to potentially unprecedented results in multiple investment categories in ways that may make little sense from a conventional investment perspective - but that are logical, self-consistent and can even be discussed in advance within the perspective of the framework. As explored below, this discussion within the framework did indeed include - as one of two of the major scenarios - the new highs in stock prices, bond prices and housing prices that did later occur in 2019.

Seven Major Developments In 2019

1) One key component of last year’s “2019 Overview: Cycles Of Crisis & the Containment of Crisis” DVD set (released at the end of 2018) was a detailed exploration of the multiple and converging reasons why the Federal Reserve would likely need to abruptly cease its plans for 3 interest rate increases in 2019. (DVD #1: Chapter 1, Chapter 2, Chapter 4; DVD #2: Chapter 6.)

That is what indeed happened in 2019 - the Fed did have to stop raising rates, in a dramatic reversal of its plans and expectations.

2) There was discussion of the strong possibility that in the attempt to avert the increasing chances of a recession, the Federal Reserve would not just stop the cycle of increasing rates, but would reverse course, and enter into a preemptive lowering of interest rates. (DVD #1: Chapter 1: DVD #2: Chapter 6.)

That is also what happened in 2019, the Fed decreased rates three times instead of the planned three increases, these were the first rate decreases since 2008.

3) How rapidly rising government deficits could pressure interest rates, and how the growth in the national debt could begin to change Federal Reserve actions was discussed as well. (DVD #1: Chapters 2 & 3.)

That is what happened, nine months later, beginning in September of 2019, when the need to fund new deficit spending and tax collections in the same month created a liquidity crisis and spiking overnight repo rates.

4) How the preemptive containment of a developing crisis could cause the Fed to reverse direction, cease shrinking its balance sheet, and to create the money for an early and aggressive expansion of its balance sheet, including unprecedented funding of the U.S. government debt was discussed. (DVD #1: Chapter 3; DVD #2 Chapters 6 ,7 & 9)

That is what happened, seven months later in July when the Fed ceased shrinking its balance sheet, and then two months later after that, beginning in September of 2019, when the Fed began rapidly growing its balance sheet again and resumed its major monthly purchases of U.S. Treasury obligations using newly created money.

5) How in the face of developing economic issues, the Fed could be forced to reverse course and how this could in turn lead to the highest stock prices in history, was quite explicitly discussed in detail. (DVD #2: Chapters 6, 7 & 9.)

At the time the “2019 Overview” DVDs were prepared the stock markets were reeling, with punishing declines in all of the major indexes in October, and with the Dow losing 1,500 points in two trading days in early December of 2018. Yet, ten months later, after a double reversal and the resumption of both lowering interest rates and the expansion of the Fed balance sheet - the Dow, S&P 500 and NASDAQ were all simultaneously setting record highs. (And as further discussed in the DVDs, there is a scenario with strong historical precedent that shows the possibility that the rally could still just be getting started.)

6) Housing prices were sputtering with fast rising mortgage rates reaching a seven year high of almost 5% in late 2018, and home prices were in danger of reversing course and falling, much like they did in 2007. Why the Fed might reverse directions on interest rates and quantitative easing, and how this could lead to plunging mortgage rates that would allow housing prices to climb, even as stock prices climbed were all discussed. (DVD #1: Chapter 3; DVD #2: Chapters 6 & 8.)

The Fed did reverse direction, mortgage rates did plunge to extraordinary lows in 2019, the housing market was supported, and home prices did rise over the course of 2019 to record levels on a national basis.

7) How sophisticated institutional investors anticipating the possibility of a recession, and then anticipating the Fed’s response, could change the yield curve and create a potential “major arbitrage opportunity” in long bonds was discussed, as was how we could see “larger bond profits than what we have seen in the past”. (DVD #1, Chapters 3 & 4; DVD #2: Chapters 6 & 7.)

In practice, there was a huge bull market in long bonds in 2019, with returns of 25%+ over the first eight months of the year, in what would become one of the most popular investment strategies of the year for sophisticated institutional investors.

The Red/Black Matrix Framework

As it turns out, a series of really bad things happened in 2019. The U.S. nearly went into recession. Things were so bad that the Federal Reserve had to abruptly reverse direction, and reduce interest rates three times in the effort to rescue the economy and the markets.

Things were so bad, that the Fed had to reverse course, and stop reducing its balance sheet. Things were so bad that the repo market nearly blew up, and the Federal Reserve is committed to spending $60 billion per month to buy U.S. Treasury obligations, using monetary creation as the source of the funds to do so, in order to keep interest rates from exploding upwards .

But for most investors - the idea that 2019 was a bad year (now that it has mostly happened) would be ludicrous. The stock markets set a series of new highs - and housing market also set new highs. Bond prices soared, creating extraordinary profits for investors along the way. If that is a bad year - there are probably quite a few investors and homeowners who would like to see a lot more bad years just like it!

From the usual financial perspective - none of this should have happened. With the extraordinary trade tensions with China slowing down the global economy and the widely recognized and discussed imminent danger of a recession - the stock market should have been in deep trouble, and in worse shape than it had been in December of 2018. The markets should not have been so completely dominated by the extraordinary market interventions of the Federal Reserve, for such interventions are completely outside of the usual investment theory that conventional financial planning is based upon. But - that is what happened, and the results were record stock highs, that did not come from the usual sources.

From the usual “doom and gloom” perspective - none of this should have happened either. With these extraordinary problems in multiple areas, with the elevated asset markets, with the huge and growing personal, corporate and government debt levels - there should have been a financial Armageddon event. There should have been (from that perspective) a simultaneous collapse of the stock and real estate bubbles, a collapse in the value of the U.S. dollar, and a new great depression. But yet, none of those happened, just as they did not happen in previous years in spite of those many very real and genuine underlying issues, and we instead saw yet another round of record highs.

However, when we apply the framework below, then not only did 2019 make perfect sense when looking backwards, but many of the critical elements and the relationships between them could even be anticipated and discussed in detail when looking forward from December of 2018, before any of it actually happened - as they were, as one of the two main scenarios (more below).

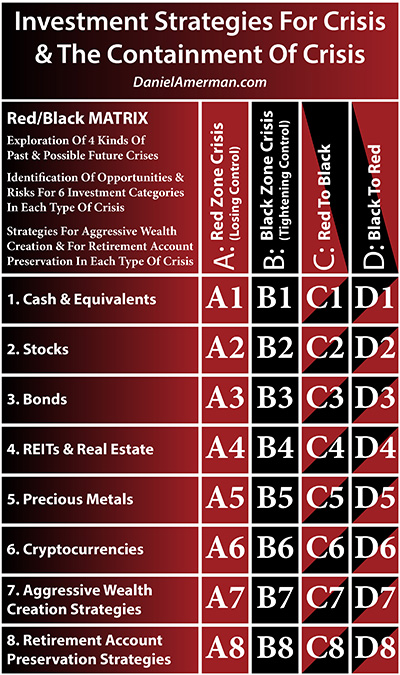

The Red/Black Matrix is the product of many years of development and there have been quite a few successful anticipations along the way. However it was not introduced as a complete framework until a workshop in April of 2018, which was followed by the release of the “Investment Strategies For Crisis & The Containment Of Crisis” DVDs in June of 2018.

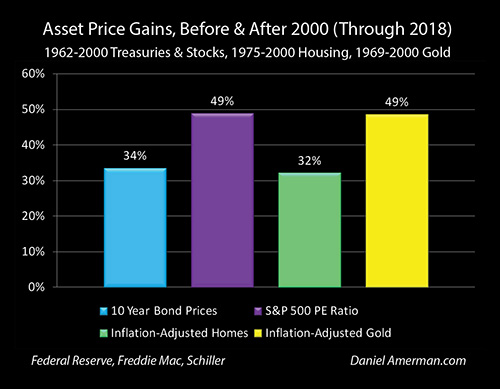

Since 2001, we have seen the collapse of two asset bubbles, with results that include the Financial Crisis of 2008, and the most severe recession since the Great Depression of the 1930s. We have also had unprecedented Federal Reserve interventions to contain those crises, including creating trillions of dollars out of the nothingness, and forcing the lowest interest rates in history.

Most importantly, we have also seen record or near record valuations for stocks, bonds, real estate and precious metals (Chapter One link here).

While very much focused on the future, the Red/Black Matrix framework uses an ability to successfully explain that strange juxtaposition of deep crisis and elevated asset prices in ways that make a lot more sense than the models underlying conventional financial planning, or the “doom and gloom” alternative. This ability to logically explain the actual events of the past is referred to as “Ex-Post” and is a crucial part of both economics and finance.

That said, there is something much harder to do than “Ex-Post” and that is to come up with something that starts out as “Ex-Ante”, which is the expectations or the anticipation of how a theory or framework (or earnings, or sales growth, or whatever) would work in the future - and then having things actually work out that way. (Ex-Post actual data and Ex-Ante anticipations always merge over time, the question is how far the gap is.)

The October of 2018 workshop and the subsequent release of the first annual overview DVDs (the “2019 Overview”) in December of 2018 were each “Ex-Ante” - focused on “wargaming” a few major scenarios for 2019 using the following framework and methodology (which is explored in more detail in the free book and in the foundational “Investment Strategies For Cycles Of Crisis & The Containment Of Crisis” DVD set):

a) start with potential changes in the cycles and the reasons for them (matrix columns);

b) incorporate the motivations of the Fed and its constraints (matrix columns);

c) identify the major interventions or changes in direction and policies that would likely occur in response to the cyclical changes (or in anticipation of the cyclical changes), given the Fed’s motivations, available tools, constraints and publicly stated intentions (matrix columns);

d) feed the combined impact of the outside Fed interventions through the economic changes, the market psychology changes and the underlying financial mathematics of the Red/Black Matrix (the rows, given the columns);

e) explore the potential financial impact on stocks (matrix row);

f) explore the potential financial impact on bonds (matrix row); and

g) explore the potential financial impact on housing (matrix row).

This framework worked in practice for 2019, and in advance. It was this application of this methodology which produced the seven interrelated major changes that are listed above, and which would end up dominating stock, bond and housing prices during the year that followed.

Now, this is a very separate thing from some purported ability to precisely predict a single path for what will definitively happen in the future. In this highly complex world that is traveling a path that we have never seen before, with a great deal of randomness and uncertainties - to make or believe such a claim of infallibility would seem to strain the limits of believability.

However, if we are to have a model, or a belief system, or a framework that we use today to make decisions for the state of uncertainty that is the future - then it should not only be able to explain the past, but if we go a year forward in the future - we shouldn’t have to violate the framework, or make major changes in order to explain what actually turned out to have happened. It should continue to make sense in a rational and self-consistent manner at the end of the year, just as it did at the beginning of the year.

To be very clear - the seven discussions listed above were not the entirety of the “2019 Overview” DVDs. There were some fundamental uncertainties as of the end of 2018, and the biggest was whether the United States would indeed enter into a recession in 2019. If that had happened, or if the Fed had chosen not to reverse course - then we would have likely seen entirely different results for stocks, bonds and home prices in 2019.

Instead of taking a stand one way or another on a recession - which was realistically unknowable at the time - both possibilities were explored in depth. There was quite a bit of exploration within the DVD chapters of the possibility of what would happen if there were an actual recession, how the Fed would likely attempt to deal with it, the tools that would likely be used, and the radically different investment implications across multiple categories. (And if we do get a recession at the end of 2019 or in 2020 - those discussions could yet be the most valuable content within the 2019 Overview DVDs, particularly DVD #1: Chapter 3.)

The other most discussed possibility (including parts or most of 8 out of the 10 DVD chapters) was that of the Fed reversing direction, going “Black to Black” and attempting to prevent recession with preemptive deployment of crisis containment tools - which, Ex-Post, is what actually happened in 2019. All seven of the economic and market changes reviewed herein were interrelated parts of that possibility as discussed in the 2019 Overview, including the major reversals of direction, the tools used, the resulting increases in stock and home prices, and the creation of a major opportunity in long bonds. The framework for anticipating what could happen in all three major investment markets if a cornered Fed took aggressive actions to try to prevent a recession - stood the test.

Ex-Post, it is very easy to look back at the seven different major changes or developments that actually occurred in 2019, and say, well of course they did. However, if we go back to October and December of 2018, during a time when the Federal Reserve was still publicly quite committed to further increases in interest rates, while being committed to further reducing its balance sheet, and we look at the 1,500 point loss in the Dow in two trading days in early December, with 10 year Treasury yields above 3% in November, and the fears of 5%+ mortgage rates were sending shivers through the housing market - exploring Ex-Ante the potential seven interlinked components of the radically different path that would be traveled in 2019 would have seemed quite unlikely indeed for many people.

Simply put, if the framework we are relying upon to make financial decisions does not work Ex-Post, if it cannot explain the past - then it is also unlikely to deliver the future results that are desired. In my opinion, any investment model at the end of 2018, whether mainstream or contrarian, that did not take into account the compelling reasons why the Fed might reverse direction in 2019, and how such a reversal could create extraordinarily powerful ripple effects that would then dominate the stock, bond and housing markets in 2019 - would have failed, Ex-Post.

Having a framework that could set out the logical reasons for an unprecedented multi-part and interrelated set of economic and investment market changes in advance, and to have those hold up close to a year later, Ex-Post, with the anticipated end results in all three of the major investment categories - is not the same thing as being able to do the undoable, which is to predict the future with certainty. With that said and understood, there is nonetheless immense value for those seeking to achieve and maintain financial security, in having a comprehensive framework that can actually work in putting the pieces together and identifying in advance what is reasonable to happen - as one of a broader set of possibilities - and to then have that confirmed seven times over by what actually happened later, in this highly complex and fast-changing world of ours.

This analysis is part of a series of related analyses, which support a book that is in the process of being written. Some key chapters from the book and an overview of the series are linked here.

More information on the 2019 DVDs is linked here.

For those who are interested in the workshops and DVDs - I will be doing it again for 2020. The best information resource will be the January, 2020 workshop, where we will be taking a long look at the very different situation for 2020 and beyond. There is a "two week sale" in the linked brochure, for advance workshop registrations and advance purchases of the 2020 Overview DVDs as part of value packages, more information is linked here.

********************************************