First Republic And The Problems With Funding The Fed

By Daniel R. Amerman, CFA

TweetThe second largest bank failure in U.S. history just occurred, with the failure and takeover of First Republic Bank. Once again, it was the combination of rising interest rates and fleeing uninsured deposits that dealt the fatal blow.

As of the end of 2022, U.S. commercial banks had a little over $19 trillion in deposits, of which an estimated $10 trillion were insured, meaning that about $9 trillion were uninsured as of the end of December. While there is no other major bank publicly in trouble right now, there are nonetheless massive other non-recognized losses out there in the banking system, from long term bonds, mortgages, and commercial lending.

The Federal Reserve may need to come up with vast sums of money to contain crisis if more banks start to go - but, as explored in this analysis, there is a big problem with that. The Fed's primary source of funding is ultimately the bank deposits, and if the financial crisis results from fleeing deposits, then the Fed loses much of its funding even as it needs the money the most. Add in the conflicts with maintaining the reserve status of the dollar, and we are indeed in uncharted waters.

Debt, Not Printing

The May 13-14 workshop is coming at an extraordinary time, 2023 could yet turn out to be the biggest year of financial change in our lifetimes, with the bank failures to date potentially being the appetizers before the arrival of the main courses. For those of you who will be at the workshop, this is just a small taste of what we will be reviewing, and will hopefully give you something to think about before then. For those of you who will not be at the workshop, there is some important information here for your consideration.

There is a popular but highly dangerous and misleading perception that the Fed simply "prints" the money - and the Federal Reserve itself likes the public to think about it this way. The advantage to the Fed is that the public then thinks that printing can be done at will and in whatever dollar amounts are needed. "It's worked so far, and there is no need for concern, the infinite money printing capacity of the system means the Federal Reserve is financially omnipotent and the banking system is safe!"

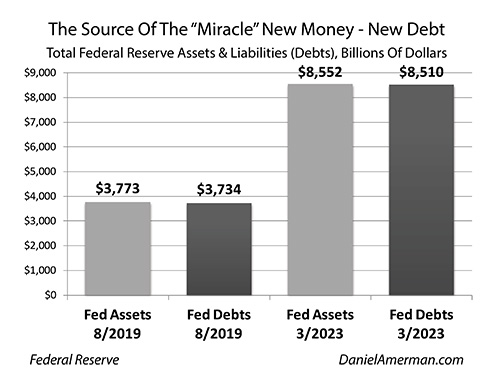

Reality is quite different, banks and the Federal Reserve do indeed create money, but they do so by borrowing the money. All new money is new debts. Many forms of debts have interest payments and need to be repaid. As can easily be seen above, the entire approximately $4.8 trillion in new money that the Federal Reserve pumped into the U.S. government and other places between August 2019 and March 2023 came from taking on new debts.

The primary source of new debts is the banking system, which lends the money to the Fed. The primary source of new money for the banks is increases in deposits, with deposits being money that the public lends to our banks. That is all our deposits are - unsecured debts of the banks to us, that are hopefully insured.

As tracked in detail and illustrated with numerous graphs in my book "The Stealthy Raid On Our Bank Accounts" (Chapter One link here), the Financial Services Regulatory Relief Act of 2006 opened up a back door route to the spending power in our bank accounts, and it was this new source of massive sums of money that the Federal Reserve used to bail out the global banking industry in 2008. Effectively, the public lent the money to the banks, the banks lent the money to the Fed, and the Fed lent the money back to the banks in redistributed form, saving the financial system from collapse. It was our money that did it, we just weren't asked about it, told about it, or compensated for it.

Since then we've lived in a "miracle" new world of sorts, where the Fed can fund successive QEs, solve liquidity crises in the repo market, and even lend the money to the U.S. government to fund the stimulus checks that were sent out in the midst of the pandemic shutdowns. There was a miracle new source of money in town, that nobody really understood, but that changed the rules for market safety, interest rates, and government deficit spending. In each case, it was primarily the Fed tapping the deposits of the public via the banks, that was the miracle source of the trillions in cash.

Slight problem. Deposits are falling fast, and the banking industry is having liquidity problems as a result. So, the Federal Reserve needs to be able to come up with trillions of dollars if needed to save the banking system. Unfortunately, the funding for the Fed is dropping along with the decline in deposits from the banks.

See the problem? It seems almost no one does, but this is happening in real time right now, and it is one of the biggest financial stories of our time. As we are reviewing this morning, we have emergency financial maneuvers in process, with an unprecedented combination of nine different ways of easing liquidity pressures on the banks and the Fed. All of these sources have their issues and limitations, there is no magic money spigot to guarantee all bank deposits as the Fed is effectively doing - particularly since those deposits are the primary money spigot for the Fed.

In total, as we are reviewing, two trillion dollars of assets and liabilities have been moved around and rearranged between the nine sources, to try to keep both the banking system and the Fed solvent and with their needed liquidity.

One of those nine sources with issues and limitations is now the Federal Deposit Insurance Corporation, which was effectively half consumed by just the First Republic takeover. Per the Wall Street Journal on 5/1/23, the FDIC will cover $13 billion in losses, and lend JP Morgan another $50 billion as part of the terms of the transaction. The total assets of the FDIC are only $123 billion, so that is half their balance sheet with only one bank failure. That means that the FDIC is now guaranteeing $10 trillion in insured bank deposits, with what is now only about $60 billion in free assets. That is about 0.6% of insured deposits.

The FDIC does have an additional $100 billion credit line from the Treasury, but then the Treasury has to get the money, and that can get us back in the deposit loop. Additionally, while I think most of us assume that the debt ceiling problems will be resolved like the ones before were, in terms of Murphy's Law, the current situation is a remarkably bad time for the government to potentially run out of money. (Speculatively speaking, it does seem like choosing to use up half the FDIC in the midst of a bank run could be a means of creating pressure to force the debt ceiling increase. If so, that is a dangerous game to play in the midst of a banking crisis.)

This is an extraordinary and unprecedented situation as we start the month of May. The Fed and banks are reaching out in multiple directions simultaneously - with potentially profound effects on the ability of the banking industry and Federal Reserve to continue to fund the U.S. government. But yet, no one is talking about these concerns, as most investors seem to believe in some fictitious money printing machine that can create and spend unlimited trillions at will - without increasing inflation. Interesting belief system.

Effectively, most of the institutional markets as well as tens of millions of individual investors have come to believe in Santa Claus, a Santa Claus that never existed before 2008. Well, as it turns out that Santa never really existed, and the actual Santa we have has some major cash flow issues. So, let's talk about the real Santa.

The Other Santa Claus

We have another and even bigger "Santa Clause in trouble" on the loose right now, and that is the reserve status of the dollar, with all its attendant privileges. The belief of (almost) all respectable financial authorities has been that the U.S. dollar is so awesome and powerful that it will be the reserve currency of the world into the indefinite future. So things like grossly irresponsible budget deficits, rising inflation, very low manipulated interest rates (we are still very low relative to inflation by historic standards), extraordinary trade deficits and ferocious geopolitical competition can be blithely dismissed as irrelevant. It doesn't matter how badly we behave, Santa Claus will make sure that the United States will retain its exorbitant privilege of consuming more than we produce, even while the rest of the world scrambles for the privilege of paying for our debts.

The dollar has been king for much longer than the markets have believed that the Fed can create limitless money at will, so there is arguably a stronger case for believing in the endless power of the dollar.

Perhaps the most remarkable part of what is happening in the world right now, and what we are discussing this weekend, is that the Federal Reserve and banking system funding problems are occurring at the same time that the international status of the dollar is under unprecedented assault at multiple levels. The threats to the dollar have been the subjects of my previous two analyses, "Thinking Through The Unimaginable: America After The Fall Of King Dollar" (link here), and "Economic Fragmentation And Dollar Hegemony" (link here).

It is the linkage between the two, the Fed's attempted containment of crisis, and the Fed's attempts to maintain the reserve status of the dollar, that truly put us into uncharted waters in this spring of 2023. For those of you who have been here, this is the third workshop in a row where we have been exploring something new, looking at the external forces threatening the internal status quo. The external forces have gotten stronger each time.

The Federal Reserve has awesome powers over internal markets. If we had a purely internal financial system there is no telling how far the distortions could go before something broke. We do not have purely internal markets, however, and as we discussed in the fall, what happened with the Bank of England was a prime example of how external market forces can override internal financial manipulations. The United Kingdom was about to attempt a fairly generic Quantitative Easing, the external currency markets said "Oh no you're not!", and there was an instant reversal to save the pound. Trade in a globalized world is a more powerful force than irresponsible domestic financial games - as the U.S. may be in the process of finding out as well.

In the extremes, the linkages are obvious. King Dollar goes down, and there go the financial markets and banking system. On the other hand, if we get another major financial crisis in the West, then the speed of the de-dollarization of the rest of the world goes up by an order of magnitude or two, and there may be no path back.

However, we don't need those dramatic examples - the intermediate linkages govern as well, and they are not merely theoretical but are in play today. Whether we are talking about interest rates, inflation, or very "creative" central banking money games, the Fed is constrained by the need to protect the dollar. It simply does not have the maneuvering room that it did five or ten years ago. At the same time, as the Fed tries to protect the dollar, it can't undertake many traditional currency defenses as it used to be able to do, as those could bring down the highly leveraged and fragile domestic financial system.

Incidentally, it is the external factors that may keep the Federal Reserve "honest", i.e. keep it from using its ultimate powers. The Fed can indeed theoretically create infinite money via infinite borrowing, much like Weimer Germany, or Zimbabwe did in the past. In a push comes down to shove scenario, if they are a few trillion short of having the funds to save a banking and financial system that is in crisis, they could indeed "cheat" and just create the money. They haven't done this yet. But if they do - the moment the other central banks catch on, particularly in places like China, India and Saudi Arabia, the flight from the dollar becomes a stampede.

As always, I lack a crystal ball when it comes to the future. What I can state, however, based upon what we know right now is that we have never seen the three major developments that are currently underway.

1) Three of the four largest bank failures in U.S. history have occurred within the last two months even while the Federal Reserve runs into problems with its largest source of funding as bank deposits decline;

2) The sole reserve status of the U.S. dollar is under assault from numerous nations around the globe, as problems develop with the three core sources of reserve status of i) national interests, ii) markets and iii) mechanics; and

3) There are direct conflicts between the tools for the containment of crisis and the tools for the protection of the dollar, where preserving the dollar could cause the loss of containment, while containing a banking crisis could lose the dollar.

I have not seen anyone else putting all three of those together, but we will be doing so this weekend. Even if there is no breakdown with 1 & 2 above, the conflicts in 3 may take the markets to some quite different places, as we will be discussing during our Solutions day on Sunday. I look forward to seeing some of you in just under two weeks, and for the rest, I hope that you found this analysis to be of interest.

******************************************

The brochure for the May 13-14 workshop is linked below. There is still space available at this time.