Five Reasons Why The Government Is Destroying The Dollar

By Daniel R. Amerman, CFA

TweetThe United States government has five interrelated motivations for destroying the value of the dollar:

1. Creating money out of thin air on a massive basis is all that stands between the current state of hidden depression, and overt depression with unemployment levels in excess of those seen in the US Great Depression of the 1930s.

2. It is the most effective way to meet not just current crushing debt levels, but to deal with the rapidly approaching massive generational crisis of paying for Boomer retirement promises.

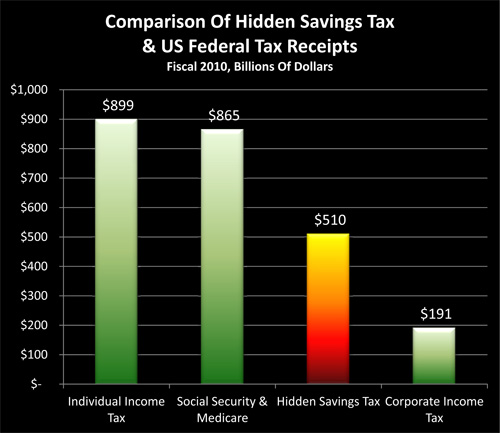

3. It creates a lucratively profitable $500 billion a year hidden tax for the benefit of the US government which is not understood by voters or debated in elections.

4. It is the weapon of choice being used to wage currency war and reboot US economic growth; and

5. It is an essential component of political survival and enhanced power for incumbent politicians.

In this article we will take a holistic approach to how individual short term, medium and long term pressures all come together to leave the government with effectively no choice but to create a substantial rate of inflation that will steadily destroy the value of the dollar.

If you have savings, if you rely on a pension, if you are a retiree or Boomer with retirement accounts - any one of these five fundamental motivations is by itself a grave peril to your future standard of living. However, it is only when we put all five together and see how the motivations reinforce each other, that we can understand what the government has been and intends to continue doing, and then begin the search for personal solutions.

Reason One: The Political Interests Of Self-Serving Politicians

As further covered herein, almost 9% of the US economy is currently funded by deficit spending. From a political perspective, this $1.3 trillion a year is "free money" that politicians get to disburse on a political district and favored special interest group basis. In other words, roughly $1,000 per month, per American household can be used to reward friends and can be withheld from enemies, with personal credit being taken by the benevolent politicians for this never-ending largess.

In past decades, politicians were restricted to spending perhaps $200 or $300 per month per household over and above what the government was collecting in taxes, with the difference being borrowed in the bond market. Anything above that would require the unpleasantness of raising taxes, which might put individual politicians in danger of actually losing their position and privileged lifestyle if he or she wasn't in a "safe" district. However, in the current climate all limitations are gone, the pork is rolling out on a historically unprecedented basis, and the politicians are wielding unprecedented power.

So why do the limitations usually exist on at least some level, and why are they gone now? Historically, the US government has directly created money out of thin air on a massive basis to fund deficit spending during the Civil War, and also during the Revolutionary War. There is a very good reason such governmental actions are so rare: the value of the US dollar was rapidly destroyed in both instances. So, this spending without limit would not ordinarily be a sensible path. Unless, from the government's perspective, there were other dangers that were considered a greater threat, that could be addressed only through destroying the value of the dollar.

Reason Two: To Hide A Depression

I have written numerous articles about various aspects of Reasons Two through Five for some years now, and my long term readers and subscribers have been well aware of the building pressures. While the emphasis of this article is on the interweaving of the short, medium and long-term relationships between the five reasons, we will first set the stage by taking a few paragraphs each to briefly review the individual government motivation, with a link to a full length article that covers the problem in more depth.

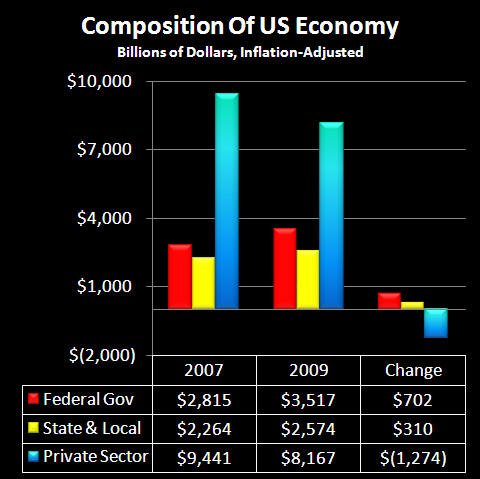

While you wouldn't know it from government press releases or media headlines, there has been a gaping hole in the US economy since 2008, as illustrated below:

During the first round of the financial crisis, the US private economy nearly collapsed, threatening to send the US economy straight into deep depression. We're talking about a $1.3 trillion private sector collapse that was contained only by the government fantastically increasing the money it spent, even while tax revenues were falling. The creation of huge government deficits has been all that has maintained even a facade of semi-normalcy. Remove the mechanism of the government creating money so that it can spend what it doesn't have, and it is straight to official Great Depression-level unemployment in months.

Even as the true gravity of the situation is hidden from the general public, so too is the true cost of the grossly irresponsible short-term "band-aid" that is being used to cover the hole in the US economy. The destruction of the value of savings in general, as well as the impoverishment of Boomers and retirees in particular, is explained in my article linked below, "Hiding A Depression: How The US Government Does It."

http://danielamerman.com/articles/Hiding.htm

Reason Three: A Desperate Attempt To Escape Depression By Waging Currency War

The US government has been waging currency war since September of 2010. Simply put, the US would have great difficulty emerging from the depression described above so long as the US dollar is "strong", because a strong dollar translates to "expensive" US workers who have difficulty competing for market share even in the US economy, let alone abroad. One solution is that when a nation slashes the value of its currency, its workers become relatively cheaper, and they then cannot only better defend their domestic market share, but can begin to take market share in foreign economies as well. However, when a major nation goes on the offensive, many trading partners will counterattack and try to defend their economies, not by making their own currencies stronger, but by making their own currencies weaker, so that their domestic workers remain relatively inexpensive and will be better able to compete for market share.

To successfully go on the currency offensive and negate attempted counterattacks, Federal Reserve Chairman Bernanke chose a radical tool - he publicly announced that the Fed would be directly creating money on a massive scale equal to 9% of the US economy, with the proceeds going to purchase US government debt in the secondary markets. Ultimately, the only protections for a symbolic currency (such as the US dollar) are the policies deployed by the central bank to maintain that value. And when the nation's chief central banker directly threatens to use his power to destroy the symbol rather than preserve it - the threat is extraordinarily effective.

There is no free lunch, however. While the US government is insisting to the world-at-large that it is not engaged in currency warfare, in order to maintain the plausible deniability that is essential to diplomatic doublespeak, it is also hiding the heavy cost from its own citizens. The US standard of living since the late 1990s has been based on having a "strong" dollar and huge trade deficits - meaning we haven't actually been able to pay for what we consume for a long time. Therefore, even as jobs and the real economy grow, there is a drop in the overall standard of living, that is not evenly weighted - but is disproportionately born by savers, Boomers and retirees.

Much more information on how this works and the specific ways that older citizens will be bearing most of the pain can be found in my article linked here, "Bullets In The Back: How Boomers & Retirees Will Become Stimulus, Bailout & Currency War Casualties".

These second and third elements of hiding a depression and waging currency war are tightly interwoven, and could even be called "killing two birds with one stone". The money doesn't exist to keep the US from openly plunging into depression, it simply isn't there for a fiscally responsible government. And covering the economic hole by creating money out of thin air at a rate equal to 9% of the total US economy is so fiscally irresponsible that few nations dare a counterattack of such magnitude. For now, massive monetary creation allows the US to not only cover over the current hidden depression, but also to wage all-out currency war to try to emerge from that depression.

However, to fully understand the agenda of the US government, we have to look at the greatest financial problem of all, and how destroying the value of the dollar is the intended solution.

Reason Four: Dodging National Bankruptcy

Sometimes households reach the unfortunate point where when they add up the credit cards, mortgage payments, and 2nd mortgage payments - they realize that they will never be able to pay their bills. They know they are bankrupt and there is no way of dodging that. But instead of reducing their spending - they may even step up the spending, until all the lines of credit are maxed out, and the bills are all in arrears. Because, once you know bankruptcy is inevitable anyway - why slash your standard of living before you absolutely have to? Partying it up now for another few months won't change the destination, so why not?

Fortunately, relatively few ordinary people think that way. There is ample evidence, however, that a good number of politicians hold that mindset when it comes to budget deficits that appear impossible to repay, at least in the conventional manner.

There is a lie that is being frequently repeated, which is that our children and grandchildren will be slaving away for decades to pay back the money that we've been borrowing to fund this reckless deficit spending. The assumption underlying the lie is that if it weren't for the current spending, the nation would be fine, and therefore increased taxes will be needed to pay back the borrowing.

Except that the nation isn't fine. Like most other major developed nations in the world, the United States has been effectively bankrupt for quite some time, with a day of reckoning that is approaching fast with or without the current outrageous level of deficit spending.

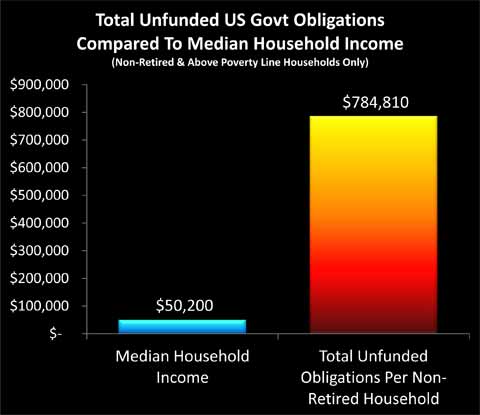

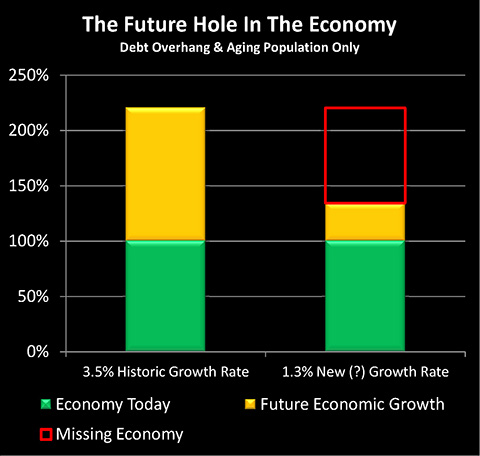

The graph below is from my article, "Six Layers Of Deficit Impossibilities Mean Retirement Catastrophe".

http://danielamerman.com/articles/2011/LdeficitC.html

As developed step by step in "Six Layers", when we add up current and future Federal deficits, as well as unfunded Social Security, Medicare and other unfunded government promises, the total comes to over $785,000 per non-retired household (over the coming years) that has an above poverty line income. And this isn't even the total cost - it is the excess cost over and above current estimated tax receipts, which assumes a healthy and growing economy. When we drop the assumption of an economy growing at the same rates of the last 50 years, then the shortfall goes far higher - perhaps over $200 trillion for Social Security and Medicare alone by some recent estimates. That would raise the total shortfall to over $2 million per non-retired and above-poverty-line household.

If taxes can’t pay (and it’s ludicrous to think they can), and the US doesn’t declare bankruptcy, then just how do we cover the gap?

Short answer: pay in full, but make the dollar worth five cents. This drops the per household cost for everything from almost $800,000 down to about $40,000. Painful, but manageable over a period of 20-30 years.

Merely make a dollar worth five cents, and impossible government promises become quite payable. The problem with this "solution" is that it also requires making most people's life savings worth five cents on the dollar.

Reason Five: Create A Massive Hidden Tax

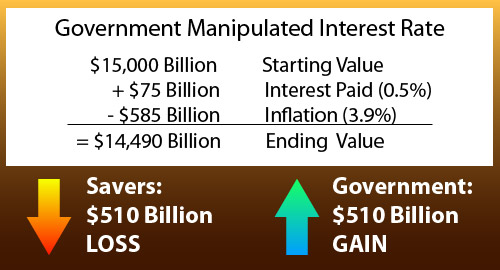

The Federal Reserve effectively controls short, medium and long-term interest rates in the United States, and this means that it controls the borrowing costs of the United States government. As developed my article linked below, "Hiding A $500 Billion Tax On Savings: How The Government Deceives Millions", by forcing interest rates below the rate of inflation, the Federal Reserve creates about a half trillion dollar per year "windfall" gain for the Federal government.

http://danielamerman.com/articles/2011/SaveTaxC.html

This is not "free money", far from it. Every dollar of benefit for the government from interest rate manipulations comes directly out of the pockets of savers. That is, for the government to come out ahead by $500 billion per year requires savers and pension funds to come up short by $500 billion per year. This makes it a tax in all but name. It is also essential to note that two elements have to come together to make this hidden tax work: 1) there have to be low interest rates, and 2) there also has to a substantive real rate of inflation (which can be quite different from the official rate).

From a politician's perspective this massive tax - almost three times the size of federal corporate taxation - is a "dream tax". Half a trillion dollars a year is available to spend without raising taxes or increasing deficits. Sure, there is a cost, which is the entirely deliberate destruction of retirement dreams and promises for tens of millions of US workers and retirees - particularly Boomers - as well as pushing forward the insolvency of state and local government pension funds around the country. But the deliberate bankrupting of a generation is a long term problem with no clear accountability and almost no voter understanding, which means it is more or less irrelevant for how political decisions are made today.

The Convergence Of The Five Overwhelming Governmental Motivations

The Long-Term

Let's add our five powerful motivations together, and see how they interrelate. The truly big picture for both the United States and most other major developed nations is that population growth has been shrinking, long term promises to current and future retirees have been extravagant, and for the most fundamental of demographic and economic reasons, the nations simply can't afford to pay for those promises.

On a global basis, governments are left with a choice between breaking promises openly – reneging on their legal commitments on a massive scale, possibly having to actually declare bankruptcy in many cases (effectively) - or they can follow the time-honored route that almost every nation which has found itself in the situation and has had the ability do so has done: they can pay their promises in form, but not in substance. They can inflate away the value of their national currency, and pay everything in full, but that currency will only be worth a fraction of what it is right now.

So the larger the future shortfall, the more overwhelming the motivation to destroy the value of the currency, and the greater the degree of destruction of the currency that is necessary in order to turn impossible promises into possible promises.

The Short Term

Let's look at the short term in the United States. As previously discussed, there is currently a gaping hole in the US economy that is equal to about 9% of the size of the economy if we look to official deficits, and about 12% if we include the hidden $500 billion tax on savings. This economic hole in the private sector is being covered over by massive overt deficit spending and hidden taxation which account for about one in every eight dollars spent in the nation this year. If this massive deficit spending were to cease abruptly, then the US would go straight to an overt Great Depression level of unemployment.

So, if you're in the political establishment and you don't want outright political revolution, then you have enormous incentives to try to keep an appearance of normalcy in the economy, no matter how much damage you need to do to the long-term value of your nation's currency.

Tying Together Long-Term & Short-Term

Short term interests are served by recklessly risking the long-term value of the nation's currency, thereby providing the funding to cover over the hole in the economy. Long term interests in terms of impossible government promises that must be inflated away, are served by the destruction of the value of the nation's currency. The more severe this destruction, the less the cost of repaying impossible promises. Arguably then, the more risk that is taken in "papering" over the hole in the current economy, and the more severe the long term consequences, the better off the government will be in the future when it comes to its ability to cheaply repay debts that are otherwise unpayable.

The Medium-Term & The Real Economy

Now, let's go to the medium term and consider the real world factor that bridges the current economic crisis and the long term economic crisis. That bridge is ultimately all that really matters, and it is the real economy. Without a powerful and rapidly growing real economy, there is no way out of the hidden depression in which the United States currently finds itself. American workers must be competitive if they are to regain both domestic and international market share (a situation many other nations are in as well).

Mixing Medium & Long Term

Nobody knows the true extent of the trouble the US economy is in over the next ten, twenty and thirty years as Boomer retirement promises come due in full. But we do know that:

1) It would take a historically unprecedented rate of economic growth to meet the promises in current dollars without bankrupting the nation; and

2) The financial devastation could be far, far worse than most estimates if the US economy does not perform like it has historically, but instead continues the downward spiral of a wounded empire that is losing prominence and economic power on the world stage.

When we strip away the common assumption of endlessly compounded 3% real economic growth, and say that we are either losing economic growth or just breaking even, then the future shortfalls grow even more staggering. Indeed, when we include the academic evidence of the growth-slowing effects of large government deficits, and then add in the reduction in consumption expected for an aging population, then we may already be in an effectively zero per capita growth mode, as covered in my article linked below.

http://danielamerman.com/articles/2012/OverC.html

Bridging Medium, Long & Short-Term

What the short-term and long-term both have in common is that the only true solution is ultimately to grow the real economy. The real economy has been hampered since the mid-1990s by a short sighted "strong dollar" policy that has enormously benefited major international corporations and major banks, while creating a debt-driven illusion of personal prosperity for many of the citizens of the United States. It's a standard of living that could never be paid for, but rather was reliant on other nations lending the US the money to fund that lifestyle, so long as we agreed to keep the dollar "strong". The effective terms were that certain other nations lent us the money to live it up without our being able to pay for the goods that delivered our subsidized standard of living, and in exchange we let them take our industries and jobs.

To re-grow the real economy and regain economic competitiveness, the US must remove the handcuffs on American workers, which requires driving down the value of the US dollar. This has to be done in a competitive world, where other nations want to defend their own market share by driving down the value of their own currencies. So for the US to be "successful" - it has chosen a strategy of taking more radical actions in a threat to destroy the value of its currency than other nations dare counter.

In other words, the other nations aren't as willing to recklessly and rapidly wipe out the value of their citizen's savings as the United States is, which gives the US a temporary "advantage" in currency brinksmanship.

Most conveniently, the otherwise impossible cost of covering over the gaping hole in the US economy can be paid for through open monetization on deliberate, prominent display for the whole world to see. The strategy is to simply manufacture the money out of nothingness, which then lets the rest of the world know that the US dollar is in grave peril of swiftly diving in value. This then drives down the value of the dollar, and reboots the real economy and real American competitiveness, even as the hole in the economy is temporarily covered over. Perhaps most important of all, this begins the rapid destruction of the value of the dollar as necessary to avert formal US bankruptcy when it comes to paying the enormous retirement and health care obligations that are coming due over the next ten, twenty and thirty years.

To understand the true extent of the danger to your savings, you need to see how all three of these levels work together: hiding the depression in the short-term, rebooting the real economy in the medium-term, and the long-term destruction of the value of the dollar so that impossible promises can be paid in form, but not in substance. All three strategies effectively require the destruction of the value of the savings of older Americans and retirees in particular. It is your future lifestyle that must be sacrificed for all of these goals to happen together.

Adding In Short-Term Political Benefits

And finally, and not of incidental importance although perhaps not quite as fundamental as the other factors, there are enormous political rewards for those currently in power when it comes to pursuing this approach. As covered in the "Hiding A Depression" article, the government's share of the US economy swiftly went (with very little commentary) from 35% of the total economy to 43% of the total economy. In the real world of politics, what is most important is that this growth comes in the form of discretionary spending, that (normally) rare commodity that is the currency of pure power. In normal circumstances, between government transfer payments, the military, and the established bureaucracy, there isn't all that much discretionary money for politicians to channel for their partisan desires. That has turned upside down, as discretionary money was created so fast, that Congress and the Administration initially had trouble figuring out how to spend it.

The government has enormously increased its control over the day-to-day economic life of the nation. This control is not being exercised on an altruistic basis, but is being used in the exercise of raw political power. Politicians have the unprecedented ability, almost without limitation, to take the $1000+ per month per American household in money that is being created out of the void ($1,300 with the hidden savings tax), and to use it to reward their friends and hurt their enemies. And many are doing so.

These five motivations all exist simultaneously, they all wrap around each other in their numerous interrelationships, and they all reinforce each other. What they all have in common is an overwhelming incentive to make sure that a dollar does not remain worth a dollar.

The Personal Implications

The implications of the five powerful motivations all coming together are that we have multiple overwhelming reasons to believe that the value of the US dollar (and many other currencies) will be mostly or near entirely destroyed in coming years. Now, when paper wealth is wiped out for much of the population, and real wealth (goods and services) for a nation has taken a blow – but is not wiped out – then what we necessarily have is a massive redistribution of wealth. And there is very good reason to believe that the largest redistribution of wealth that has been seen in modern times is likely to be occurring over the coming years.

Inherently, the older that you are – the more likely that wealth will be redistributed away from you instead of towards you. A giant "Reset Button" will likely be pressed for the dollar, and with it the value of your savings and investments will likely evaporate – that is, if you have been following the conventional wisdom for retirement investing. You may not have that many working years left to recover from the damage, and jobs may be difficult to come by even if you want to work.

So you are competing against younger workers not just for jobs, but for goods and services, where they have the current income in inflation-adjusted terms to buy these desirable goods – and you don't. Thus, the older citizens become impoverished relative to the younger citizens. This is a history that has been repeated time and again across nations and across the centuries – it is the pensioners that get nailed when the currency reset button gets pressed.

Making it even more difficult is that the hidden savings tax acts as a giant anchor, making it near impossible for fixed income savers to break even on an inflation-adjusted basis, let alone compound their wealth like all the financial planning models promised. Simultaneously, the likely reduced economic growth rate associated with a heavily indebted and aging nation will likely slash further stock returns, or even turn them negative in after-inflation and after-tax terms.

Both of the pillars underlying conventional financial planning have shattered and fallen, which leaves traditional retirement investors with two negative return asset classes (in inflation-adjusted terms) that are steadily destroying wealth over the long term rather than compounding it. Even as the slick investment firm ads featuring vibrantly healthy and wealthy retirees enjoying their active and prosperous retirements, continue to fill the airwaves and financial media.

There are personal solutions. There are other schools of investment finance that can handle what is coming, methodologies that are used by the most sophisticated investors in the world - but they are quite different from the simplistic strategies that dominate both the mainstream and contrarian flavors of personal finance.

The first step is to see what is coming. Once you see how all five factors work together - you have to do something that most people will never do, and that is take personal responsibility for your own future in a deeply unfair world. Neither the government nor Wall Street are going to bail you out of the mess they have created, and the conventional financial "wisdom" isn't going to do it either. You're on your own, and that means rolling up your sleeves and taking individual actions to protect what you and your family have.

Once you've decided to accept this personal responsibility for your future, then you have to be open to changing how you see money and your investments. To find personal solutions, you have to be open to education leading to paradigm change. When you have that education, and have changed the "lenses" through which you view money and investments - then you can also start to see the professional grade tools that can be used to handle the simultaneous destruction of the value of money, and the value of assets. Surprising tools found in places you never expected, often without even calling a broker, that can be accessed by most people, and used in a dynamic sequence for the stages of crisis - when we step outside the usual personal finance boxes.

Your financial profile can't look at all like that of an ordinary older person - or you will share the fate of most older people. To survive and even thrive in the very different financial environment of this and the decades to come, requires changing that profile so that inflation systematically redistributes wealth to you, rather than away from you, and the more of the value of the dollar that is destroyed - the better off you become on an after-inflation basis.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

An "eye-opener" tutorial of a quite different kind is linked here, and it shows how governments use inflation and the tax code to take wealth from unknowing precious metals investors, so that the higher inflation goes, and the higher precious metals prices climb - the more of the investor's net worth ends up with the government.

An "eye-opener" tutorial of a quite different kind is linked here, and it shows how governments use inflation and the tax code to take wealth from unknowing precious metals investors, so that the higher inflation goes, and the higher precious metals prices climb - the more of the investor's net worth ends up with the government.

When we look at all government retirement promises over the coming decades – the total is simply unpayable. As explored in the "eye opener" linked here, this means that there is a high probability of an eventual tax code "revolution" that could rewrite all the rules when it comes to the future treatment of our current retirement accounts.

When we look at all government retirement promises over the coming decades – the total is simply unpayable. As explored in the "eye opener" linked here, this means that there is a high probability of an eventual tax code "revolution" that could rewrite all the rules when it comes to the future treatment of our current retirement accounts.

If you find these "eye-openers" to be interesting and useful, there is an entire free book of them available here, including many that are only in the book. The advantage to the book is that the tutorials can build on each other, so that in combination we can find ways of defending ourselves, and even learn how to position ourselves to benefit from the hidden redistributions of wealth.