Margin Rules Changes Force New Private Funding Of Public Debt

by Daniel R. Amerman, CFA

Below is the 2nd half of this article, and it begins where the 1st half which is carried on other websites left off. If you would prefer to read the article in single page form, or share via Facebook or Twitter, the one page version for subscribers can be found here:

An Extraordinary & Almost Unnoticed Combination

Some regular readers may be feeling a bit of deja vu – didn't they just read an analysis on a very similar subject a few months ago?

I know that I personally felt a strong sense of deja vu when I first learned about the new margin rules, and identified on a checkpoint by checkpoint basis how they were an almost perfect example of Financial Repression.

But the interesting and remarkable part – and perhaps the greatest source of information value – is that the two analyses address entirely different regulatory changes, in different markets. Changes that are nonetheless occurring at about the same time.

As analyzed here, the regulations are being changed for money funds as well. And what is happening with money funds is quite similar, as 1) there is the stick of more stringent regulatory treatment of investments for an entire multitrillion dollar industry; 2) there is the carrot of a safe harbor exemption from those expensive new regulations when Treasury and agency securities are owned; 3) the official reason offered is that of increasing safety for the public; and 4) the general public has no idea that anything is going on at all.

In the case of money fund regulation, the industry is about $2.7 trillion in size, and about $1 trillion was previously not invested in Treasuries and agencies. In the case of the particular type of secured financings addressed by the Fed, the industry is about $4.4 trillion in size, and about $1.4 to $1.5 trillion is not currently invested in Treasuries and agencies.

(There is some overlap, as money funds do invest in repurchase agreements. In this case, the two rules changes are cumulative for those using non-government collateral, as the new money fund rules penalize the investor and the new margin rules penalize the borrower.)

So in combination (and before any overlap), the government is increasing the demand for Treasuries and agencies by up to about $2.4 to $2.5 trillion – which is a serious amount of money. Not all of that money may initially change, but there are powerful incentives to do so.

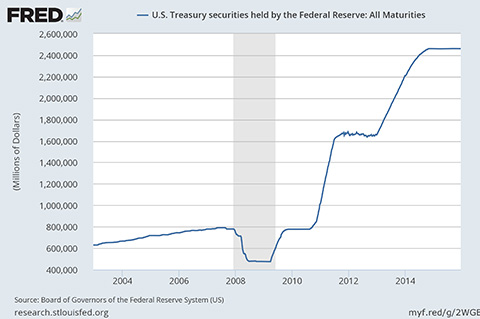

By way of comparison, the US Treasury securities held by the Federal Reserve primarily as the result of quantitative easing (QE) are about the same amount, in the $2.4 to $2.5 trillion year range.

One of the differences is that QE was intensely controversial, and it took about five years to reach that level, with screaming headlines each step of the way, at least in the financial media.

Yet, the combined regulatory changes for money funds and secured lending may reach close to that same level in a matter of months, or perhaps a year, but with almost no notice, and very few headlines even in the financial media.

The Short-Term Question For 2016

Effectively, what the US government is doing is deploying two massive stabilizers simultaneously, when it comes to sources of funding for the national debt. They may be doing it silently – but it is also happening very quickly.

And the question has to be – why now?

As covered in the linked tutorial, most of the initial round of bringing back Financial Repression occurred in a relatively short time period in 2010. The policies have been maintained continuously since that time, to the devastation of savers, but there haven't been regular increases since then.

And yes, there has been extensive quantitative easing since that time, but the level stabilized more than a year ago. Indeed, we are supposed to be attempting to begin a bit of Financial Liberalization, or so the Fed would have us believe is its intent, at least when it comes to interest rates.

If there were just one major change, that would be very interesting – but not necessarily fascinating. For two such events to happen at almost the same time - after all this time – and on such a large scale... now that is fascinating.

Coincidence seems unlikely. The decision-makers and economists involved are not amateurs, there is nothing accidental or inadvertent about the creation of the stick of onerous new regulatory controls, or the simultaneous creation of the carrot of the safe harbors for escaping the regulations, or the effect on market participants, or the resulting increased demand for Treasuries and agencies.

So... why both changes now? And on so large of scale?

Investors & The Long-Term Conflict Of Interest

On a longer term basis, the implications seem (unfortunately) to be more clear.

As explored here, there is a powerful conflict of interest between investors and the United States government. Low interest rates are required for Financial Repression. Any substantial and sustained increase in interest rates could send the deficits and the national debt spiraling upwards and out of control.

Simultaneously, investors very badly need higher interest rates, and this is particularly true in retirement.

There is talk of increasing interest rates, which would increase investor returns and lifestyle in retirement.

Yet, when it comes to action, instead of incipient Financial Liberalization we are seeing a massive structural reinforcement of the tools of Financial Repression in 2016.

Now, a small increase in interest rates is not incompatible with Financial Repression. Near zero interest rates are unusual, and an increase to 1% or even 2% short-term interest rates can work for governments, so long as the real rate of inflation is still significantly higher.

But what tens of millions of Boomers and other investors badly need is interest rates that are a good bit higher than that, and as soon as possible.

What we know from history is that the last time the US government was this heavily indebted (as a percent of the economy), it kept interest rates low for another 25 years as one critical aspect of effectively lowering those government debt levels.

And we also know that as of 2016 – new and major Financial Repression tools are being deployed.

When we put that information together, then it would seem that the most reasonable long-term interpretation of the money fund and margin rules changes is that the government is concretely showing through its actions that it will be attempting to keep interest rates in the lower end of the historical range for at least many years to come, and possibly even decades.

Which then means that a generation of Boomer retirement investors and other retirees may never get the relief they are hoping for when it comes to substantially higher interest payment cash flows. If that is, the government has its way and is able to maintain both stability and control over interest rates.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

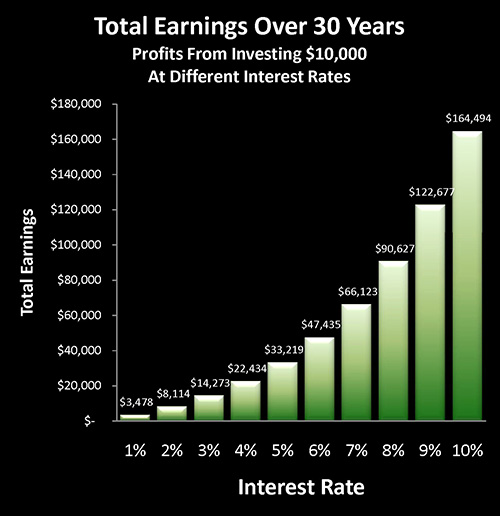

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

National debts have been reduced many times in many nations ─ and each time the lives of the citizens have changed. The "eye-opener" linked here reviews four traditional methods that can each change your daily life, and explores how governments use your personal savings to pay down their debts in a manner which is invisible to almost all voters.

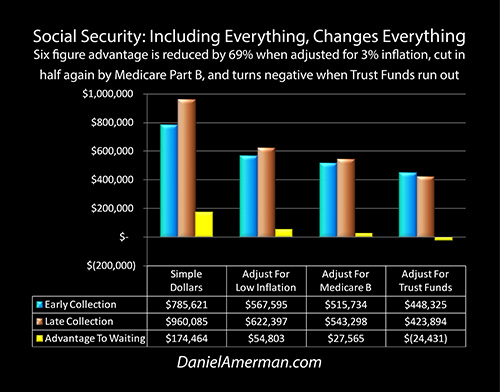

The stakes are high for the government when it comes to the national debt – and that is also true of Social Security. And once again, the numbers don't quite work the way many people think. The government strongly encourages people to wait as long as possible before collecting their retirement benefits – but as explored here, is that truly in your best interest, or are a few factors being left out?

If you find these "eye-openers" to be interesting and useful, there is an entire free book of them available here, including many that are only in the book. The advantage to the book is that the tutorials can build on each other, so that in combination we can find ways of defending ourselves, and even learn how to position ourselves to benefit from the hidden redistributions of wealth.