Failing Financial Defenses & The Changing Politics Of Money

By Daniel R. Amerman, CFA

TweetThe traditional form of bank failure is a bank run. Bank runs have happened over and over again over the centuries, and they have taken down many banks and banking systems. In March of 2023, we saw bank runs take down three banks in quick succession: Silicon Valley Bank, Signature Bank and the systemically important Credit Suisse. They seemed to come out of nowhere - but that is how bank runs work, they happen very quickly and they are deadly when they get started.

Whether there will be more bank runs between now and the Spring of 2023 workshop is an interesting question. I don't know - and I doubt that anyone else does either. If there are more runs, they will be discussed in the workshop, as we review in detail the financial situation as of that weekend.

Whether there are more bank runs before that weekend or not, the world has changed significantly since the last workshop, and we may still just be getting started in terms of what the next year holds.

The basic problem, as we will be reviewing is that we have a number of fundamental risks and problems that have been building for many years when it comes to elevated asset prices, interest rates, inflation, the safety of the banking system, and the value of the dollar. There are profound conflicts built in that may be unsolvable, such as how to get interest rates high enough to bring inflation back to lower levels, without crashing the investment markets and the banking system. Even with dedicated, brilliant economists and regulators doing the very best work they can, there just may not be a solution.

Unfortunately, we don't have those economists or regulators.

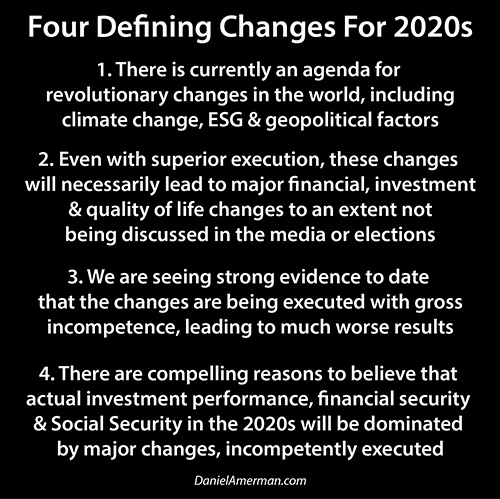

The slide above was an important part of our October 2022 workshop, it was one of the keynote slides we started Saturday morning with, and it will be even more important for the May workshop.

The slide above was an important part of our October 2022 workshop, it was one of the keynote slides we started Saturday morning with, and it will be even more important for the May workshop.

The has been a consistent Narrative, one could even call it a press release of sorts, that the Western financial banking industry is strong and profitable - the strongest it has ever been - run by some of the most brilliant financial minds that have ever existed. It is, of course, an updated version of the Narratives in 2007 and 1999 - this time is always different because this time we are WAY SMARTER than those dummy pretend geniuses in the before times.

Then a crisis happens, some layers get peeled back, and we got a look at the state of the real world that has been there the whole time, it just never seemed to make the media. So, let's take brief looks at some of those layers that have just been revealed.

1. Silicon Valley Bank. Silicon Valley Bank (SVB) was supposed to be a shining example of what banking could be in the 21st Century. It was the best of the best, much of the Tech venture capital industry banked there. SVB was also well known in the San Francisco area as being a ready source of funds for nonprofits and causes that were focused on DEI and social justice goals, which were unable to get funds from other banks. SVB was also noteworthy when it came to the quality of its management, they supposedly had excellent people skills, and were very good at socially mingling with the cream of the Tech industry and letting people know the good their money at SVB was doing for the world.

When the layers were peeled back, however, it was revealed that SVB was remarkably incompetent at even the basics of bank risk management. Loading up on long-term bonds that are subject to major price risk, and funding those bonds with very short term deposits - while not hedging those risks - is a rookie-level mistake for a financial professional. By definition, any competent person with a degree in finance would know the speculative risks that were being taken, even with bonds being held for supposedly long term investment.

2. Silicon Valley Financial Community. The venture capital community in Silicon Valley made extensive use of SVB. It was routine to maintain large deposits there, which were far in excess of the insured $250,000 limits. SVB was a lender to start-ups, and often required the proceeds from the loans to be deposited at SVB prior to being dispersed. This was a sweet deal for SVB, that was apparently accepted without question.

This is another Finance 101 issue. Anyone with training in finance knows about deposit insurance limits, and short term cash management, including sweeping accounts as needed, is part of the basics. Per the Narrative, the Silicon Valley venture capital industry contains some of the most brilliant financial minds in the world. Yet, when the layers were peeled back a bit, there was rampant and unnecessary risk taking going on to a degree that would have earned an "F" in any undergraduate finance course. (How much of this is going on elsewhere?)

3. The Fed Regulating ESG Banks. The Federal Reserve knew that SVB had risk management issues as early as 2019. Even in early 2021, Federal regulators noted that SVB had a major exposure to rising interest rates - but the regulators at the Fed were also quite confident that there was essentially zero chance of seeing substantially higher interest rates (aka, "the blind leading the blind"). With four years of regulators watching particularly bad risk management, they did nothing to correct the issue. (How widespread is this?) There are allegations that this was specifically because of the goals of the San Francisco Federal Reserve Bank, and because SVB was such a leader in what mattered the most to regulators.

Whether this is a positive, negative, or neutral development I will leave to the reader, but as visiting the home pages of different Federal Reserve Banks will show, achieving Diversity, Equity and Inclusion goals are now front and center for our entire banking regulatory system. The home page of the San Francisco Federal Reserve is particularly noteworthy in this regard. All tasks from hiring staff to hiring contractors to educating banks on how to act are now primarily based on achieving strict racial and gender goals - there is also a prominent link to this explicit policy on the home page for the Federal Reserve itself. The Fed system is in rapid transition as it pivots from financial to social justice and climate goals, and this is not at all theoretical, as can be seen by the Congressional questioning of Federal Reserve Governor and Bank President nominees. Powell himself is resisting at this stage, but all around him the personnel are changing - and as the saying goes, personnel are policy.

Both Silicon Valley Bank and Signature Bank were leaders - exemplary banks - when it came to things like ESG and DEI. Now, I'm not saying that they directly failed for those reasons. The failures were due to bad investment decisions being funded by uninsured deposits that led to bank runs. However, when the top-down focus of regulators and bank managers is on other issues rather than financial safety, with hiring and promotion (and therefore risk management) being based on those other issues, then this absolutely changes the behavior of banks and banking regulators - which is indeed, the stated goal, changing behavior.

While it is unfortunate that the Federal Reserve is so overtly pursuing race-based hiring procedures that many believe to be illegal, the much bigger problem than the color of anyone's skin is the philosophies and policies. Social justice and "equity" are not based on building wealth or protecting wealth, that the abundant wealth will always be there is taken for granted. The emphasis is on the redistribution of existing wealth on the basis of race and gender. This is a radically different approach to economics than we have ever seen before, the people believing this are being put in charge of the conduct and safety of our monetary and economic systems in real-time, and it should be expected to lead to quite different outcomes in some areas.

It can also be anticipated that one of the primary initial approaches will be to redistribute the wealth in the nation's bank accounts, using the back-door method we reviewed earlier today, which is also described in detail in "The Stealthy Raid On Our Bank Accounts." The public can't defend itself against what it can't see and doesn't understand. If the encouraged perspective is taken that no reasonable ordinary person should need to understand what is actually going on with their banks or bank accounts, then the wholesale utilization of that money by those who do understand should be more or less expected.

I have no interest in talking about partisan politics, race, gender or social issues at this workshop. We are all about economics and investments, and there are other venues that are much more appropriate for other subjects. However, changes in the very nature of money and banking are of critical importance, and we do need to consider the monetary and investment implications. It is the explicit goal of the current Administration - and the San Francisco Fed - to redirect the banking system to battle climate change and to promote equity and other social justice goals. Viewed from this perspective - Silicon Valley Bank was one the best banks in the United States. This is a change in goals and purpose that is in a process of rapid implementation. We're just getting started, compared to where we are likely to be in the coming years.

That this is happening simultaneously with an extraordinarily complex and highly leveraged global financial system that is starting to experience key points of failure in real time, is... worth noting. This goes back to #4 in the slide above, and anticipating "major changes, incompetently executed." Because they are so highly leveraged, banks are inherently prone to failure unless they are managed using truly professional level asset/liability management skills. In practice, giving someone a title as a financial expert does not make them a financial expert, and the lack of genuine financial expertise on the part of both Silicon Valley Bank and its regulators at the Fed is what caused the failure.

Every time someone who is not a true financial expert is put into a key role requiring high level financial expertise, then another potential time bomb has been put into a highly leveraged system. The high leverage and direct connection between decisions and financial stability are what make this different from most vast government bureaucracies, where pervasive incompetence can be more or less taken for granted, and the price is inefficiency that is just accepted as being the way things are. In contrast, incompetence in key banking positions - blows things up, as we are perhaps only starting to see.

Banks are not piggy banks, to be tapped for wealth at will for political purposes. Yet, the now dominant political faction that views them as such is currently taking over not just banking but banking regulation. The money that is being disbursed is not actually the banks, it comes from the lenders to the banks, the depositors among others. So, it is the bank depositors who are the actual piggy bank, as the depositors at Silicon Valley Bank almost found out (the depositors of the rest of the nation turned out to be the piggy bank instead).

People often split the world into different pieces. In one world, we have a very high rate of political and social change. In the other world, we implicitly have money and investments working the same way they have for decades. This compartmentalization is an illusion - there is only one world, and money and investments are also changing at a rapid pace. This is not a footnote or technicality, but these quite deliberate changes are intended to dominate money and investments. If banking is becoming explicitly political - which is now a stated goal - what are the implications today and in the future for money, stocks, bonds, real estate and precious metals, as well as global systemic financial risk?

4. Global Banking Financial Defenses. As covered in detail in my analysis "SVB And Collapsing Global Financial Defenses" (link here), in the aftermath of the Financial Crisis of 2008 the leading financial powers of the world decided to restructure the global banking system to prevent a repeat. The issue was that the too-big-to-fail banks, aka the Systemically Important Financial Institutions (SIFIs), had become so large that nations could no longer afford to bail them out, and they were also tied together in an elaborate network of interlocking contracts. If one SIFI went down, it could pull down all the others with them, and essentially bankrupt the nations of the West.

This was a newly recognized problem, and one obvious solution was to break the big banks up into pieces that were small enough that individual banks could fail. Another obvious solution was to reduce the intertwined globalization of the financial system so that a failure in one country would not quickly become a global failure. These were the obvious solutions, and they are also how the world worked for previous decades and centuries.

However, there was a problem - the obvious, proven solutions were politically untouchable. The banks that were so large that they threatened the financial viability of nations were too politically powerful to be broken up. Too many wealthy and influential people were making money from a globalized financial system, so there was politically no going back from there. The global financial system had moved to a place that was susceptible to catastrophic collapse, pulling down not only the banks but the nations, but because it was so profitable to the people who mattered, the risks couldn't be removed. What to do?

This was something we discussed in detail at the October workshop, well before the Silicon Valley Bank failure. I'm going to include my detailed presentation notes below, that can be found on pages 80-83 of the "Detailed Topic Outline" handout. Please note that these are not the presentation itself, but are merely the framework for the presentation, with greater detail in the oral presentation as well as the frequent questions from and discussions with the group.

- It is important to understand that the guiding philosophy behind the global Basel III banking accords was NOT the protection of the general public, but the protection of the SIFIs and banking systems, the central banks, and the governments

- The goal is to financially protect the system from a future financial crisis, so that the system is still standing after the crisis, with the financial hit being distributed elsewhere

- The “elsewhere” is of course ultimately - us

- On a closely related note, the 2022 Nobel Prize in Economics went to Ben Bernanke, and the award cited a paper he wrote in 1983 that blamed the Great Depression on bank failures

- He and his two fellow Nobel winners redefined the relationship between banks and crisis, so that instead of the previous belief that banks failed because of crises, the new economic argument became that crises happen because of bank failures

- So save the banks to stop the crises - this was very well received by global banks and central bankers

- This may sound like academic theory - but it now dominates the world financial system, and if we see another round of crisis, it is this paradigm that will make the next round of the containment of crisis different from every prior crisis

- The eventual downstream result of this philosophy is the most fundamental Basel III change of all, which is the move from bail-outs to bail-ins if there is another round of banking crisis

- Bail-ins are described in detail in pages 207 to 236 of the manual, and we can go there for some more discussion

- There is also a much more fundamental way of looking at bail-ins

- As developed in “The Stealthy Raid On Our Bank Accounts” - money is debt

- Money can be the debt of the Federal Reserve if printed, but most money is the debts of the banks (manual pages 17, 23, 34)

- When we put it all altogether, this is kind of mind-blowing

- All money is debt, the debts are set up so that they can be canceled in the event of crisis, so money itself can be canceled at the exact time it is needed the most

- From there, it is just a matter of specifics

- Junior debts, stock equity, senior debts and uninsured deposits are all supposed to come before most money in the bank

- However, as was discussed when the bail-in structure was being set-up, it really comes down to the specifics, and they came very close to giving haircuts to small depositors in Cyprus

- The path that ended up being chosen in both Cyprus and Poland was to stick it to the foreigners

- On a domestic basis, it likely all comes down to the specifics - but keep in mind, the US government was the driving force behind Basel III, and this is true even if the average citizen has never heard of bail-ins or Basel III

- The DEI aspects are also interesting, for both financial repression and bail-ins - the Fed and large banks are fully committed, and there are times that people mean exactly what they say

- On an international basis, this gets even more interesting

- The Wealth of the West is in our financial power, and most importantly - the value of our currencies, because that is what determines the exchange rates

- The G20 through Basel III set up the right for the West to partially cancel the value of their currencies in the event of crisis - with the question then becoming who gets canceled

- To the extent that we have seen real-world bail-ins, the common thread was that ultimately the decision was made to make the foreigners pay, while sheltering the domestic population for political purposes

- That brings us back to Eurodollars

(The second to last bullet point from October is worth thinking about in terms of what developed with Silicon Valley Bank and Credit Suisse in March.)

People tend to think that the nature of "money" is more or less of a fixed concept. Unfortunately, that isn't even close to being true. The nature of money is quite variable depending on the rules that govern it. We've been seeing a fundamental redefinition of those rules - for the benefit of insiders - that goes far beyond what most people likely realize.

What Bernanke helped to set in motion was a forty-year process, that was intended to redefine money and how the financial world works. What was different about the 2008 Financial Crisis is that the great majority of the major banks that made grievous errors and would have ordinarily gone bankrupt were instead spared - with their bailouts being paid for by a new law allowing the Federal Reserve to access the spending power of the bank accounts of the general public. As documented in my book "The Stealthy Raid On Our Bank Accounts" (link here), our bank accounts were the source for the money for the unprecedented bail-out of the global banking industry.

It cannot be emphasized enough that this new way of dealing with crises is a matter of quite intentional design, that was decades in the intellectual development. When the general public was financially devastated, but the banks that created the crisis were passing out record bonuses in 2009, this was no accident, but the way things were supposed to work. Banks take extraordinary risks in order to make fantastic profits, the risks go bad, the public pays the terrible price, and the bankers just keep chugging right along, keeping their bonuses and adding new ones. By design.

As discussed in my book, the fantastic scenario of the Federal Reserve reaching into our bank accounts to help the government run up the national debt by trillions of dollars in order to send out stimulus checks was no wild, spur-of-the-moment reaction to the pandemic shutdowns. Bernanke was giving speeches in 2002 about how this could be done, this was a major reason why he became Fed Chairman, and it is why the enabling legislation for the 2008 bail-outs and the 2020 stimulus checks was passed in 2006. Money was redefined in advance to give the Fed, the government and the big banks more power than they had ever had before - even if no one was bothering to tell the general public or the voters.

The new global monetary regime as defined in the Basel III accords was about changing the nature of money itself. Banks no longer go bad because they made bad decisions, but because they owe too much money. Banks must be rescued for the good of the public! Therefore, the banking system is now allowed to simply cancel the debts owed. Because money itself is the debts of the banks, when the bad decisions of bankers blow up the financial system (again), the banks are now rescued by simply canceling the money of the public.

People sometimes speak of a "debt jubilee", where all our debts get canceled. A form of debt jubilee is indeed now a matter of law. The difference is that it is the bank's debts that get canceled, and it is our money that therefore gets canceled. That a government purportedly of the people and for the people, would set up the laws to do this to its own citizenry without public discussion or resistance is rather interesting.

Getting to this place involved a very long intellectual journey by the economists of the Federal Reserve, European Central Bank, IMF, World Bank and the leading universities of the world. Numerous peer-reviewed papers were written, and the "best" ones were then cited in other papers, as the most highly credentialed economic experts in the world developed new theories for money, banking and crisis. As this process built, there were of course shared perspectives, and shared simplifying assumptions. For those who view Truth as being what the most highly credentialed experts in the top positions agree upon - there was a new and irrefutable method for preventing bank crises.

The whole thing fell apart in the space of a couple of weeks, within the last month. It turns out that Reality has three components that were not part of the commonly agreed upon simplifying assumptions for academic papers.

A) Political Untouchables. In the academic world, there is the assumed consistent application of the rule of law by the government and the regulators for the good of the system and the public. In the real world, the rule of law has been becoming increasingly superseded by raw political power and influence. What should have happened to Silicon Valley Bank's uninsured depositors was crystal clear.

In the real world, however, there was simply never a question that a group as wealthy and politically influential as the Tech venture capital community should have to bear the consequences of their own remarkably bad choices. Instead, in the course of a weekend, the government did a 180-degree turn and bailed out Silicon Valley using money the Federal Reserve borrowed from... wait for it... the bank deposits of the rest of the nation that had done nothing wrong. What used to be illegal is now the routine go-to when a lot of money is needed and fast.

B) National Self-Interests. As developed in the previously linked analysis "SVB And Collapsing Global Financial Defenses", the United States was the global leader in pushing the development of international agreements that were supposed to obligate the nations of the world to act within the constraints of the international rule of law. This is what the Basel III accords absolutely depended on, the academic assumption that the rules-based international order would govern, it would be dependable. (There are a lot of similar assumptions running around, especially for things like climate change policies.)

It took one weekend for the United States government to throw the international rules book out the window, when it decided it had a compelling national/political interest in doing so. Bam! There went the theoretical foundation for the safety of the global banking system. (Do theoretical foundations deliver votes or make campaign contributions?)

When Switzerland had its own much larger and existential crisis with Credit Suisse immediately afterward - it did the same thing, ignoring the agreements that were supposed to be the rules-based international order. There was not primarily a bail-in, but a fantastically expensive bail-out of a SIFI by the government, in terms of the guarantees it had to make to UBS to get the deal done and the depositors kept whole. The Swiss also turned the core fundamentals of bail-ins upside down for political reasons, sticking the full $17 billion in junior bond losses on (primarily) foreign institutional investors, while keeping some of the value of the equity intact for their own citizens as well as powerful Middle Eastern interests.

The development of an elaborate new rules-based international financial order that was supposed to reliably keep the Western financial system safe for decades to come, collapsed within a couple of weeks after its first contact with the Reality of actual politicians and national self-interests. Governments rewrite and break rules when they have compelling reasons to do so and always have, even if it violates the academic assumptions. There is no backup.

C) The Psychology Of Bank Runs. If there were to be a museum set up that was dedicated to memorializing Remarkably Stupid Ideas, the relationship between the theory of bail-ins and the practice of bank runs should hold a place of honor. Bank runs, which consist of too many depositors trying to get their money out at the same time, are the most traditional source of banking failures. For a banking regulator, achieving financial stability through preventing bank runs should be job number one.

Over the many years, the "genius" strategy that some of the most renowned economists in the world worked out for saving the banks in the event of crisis was to cancel the debts. In addition to equity and bonds, the debts that were uninsured deposits were also subject to cancellation if needed, in order to save the banking system. This could be called a first-order effect, as canceling the money of the depositors would indeed save the banks. This works great on a theoretical basis. It is based upon an unspoken but apparently universal assumption, however, which was that the money would obediently stay in place to be canceled.

In practice, when depositors think they are about to lose their money in a bank failure - they get their money out, as fast as possible. When a bunch of depositors do this at the same time, aided by the current near instant travel of information, there is a near instant bank run, that can itself destroy the bank.

By explicitly basing the financial safety of the banking system not on bail-outs, but on the ability to cancel debts/money, the global banking regulators created the incentive for catastrophic bank runs, that could in a matter of days take down a bank, or a national banking system, or the international banking system.

And somehow, the idea that the first-order effect of canceling the money of the public to save the system in the midst of a developing banking crisis, would then logically trigger the second-order effect of a near-instant system-crashing bank run as the public races to get its money out first, in a contagion that spreads to many more banks, just... doesn't seem to have occurred to the powers that be, in all the years that this elaborate theoretical system was developed. It wasn't part of the commonly agreed-upon simplifying assumptions, who could have known?

This takes us back to the slide: "4. There are compelling reasons to believe that actual investment performance, financial security & Social Security in the 2020s will be dominated by major changes, incompetently executed."

Inflation Incompetence

Unfortunately, this theme of economists developing elaborate theories used to create an extremely complex and highly leveraged financial system that they do not control or understand is not limited to banking regulation. Our current problems are instead the result of another massive theoretical failure that has already happened but is far from being fixed.

As long-time readers and participants know, I've been talking about "rational bubbles" since 2014 - before the current "everything bubble" came into existence. As explored in Chapters 10-12 of my free book (link here), very low interest rates will rationally produce highly elevated investment prices for stocks, bonds and real estate over time - and that is what happened. These very elevated prices will indeed be rational given the very low interest rates, and can therefore be stable for long periods of time, meaning that most investors will come to think the new prices are stable, perhaps even a reliable source of financial protection in retirement.

If you will excuse me for saying so, that is exactly what happened. We did get a tremendous bubble in asset pricing. Tens of millions of long-term investors now believe this is the natural order, and they are basing their long-term financial planning upon this.

As we have also been talking about since the beginning, while it could be expected that the population would come to believe the rational bubble was the new normal, it would not actually be stable but would be dependent on the indefinite continuation of the very low interest rates. Should interest rates increase to anything near historic norms, then the bubble pricing would become irrational and would be subject to catastrophic collapse (Chapter 12). Most importantly, this would not be cyclical, not unless there was a long-term return to very low interest rates. This means that a retiree who lost half or more of the value of their portfolio never would get that back in inflation-adjusted terms, current financial planning theory notwithstanding.

This risk of bubble collapse with higher interest rates is not new - it has been here continuously, ever since asset prices started to climb above historic norms (Chapter One). There has always been what I've termed the "Fatal Flaw" (link here), where rising inflation can't be contained without increasing interest rates to the place where the bubble would be popped with catastrophic consequences.

This was not a problem for the Federal Reserve, or so they thought. Four decades of academic research followed the inflationary cycle of the late 1960s to early 1980s. The top economic minds at the leading universities, through a process of writing peer-reviewed papers that would then become the citations for later peer-reviewed papers, came to an agreement amongst themselves that they understood inflation, and could reliably control it.

Because they so thoroughly understood inflation, so much better than academics of previous generations, modern economists could with confidence do things that no previous generation of prudent economists would have considered doing. For instance, in the midst of a recession, the government could send out trillions of dollars in stimulus checks, borrowing the money from the Federal Reserve, with the Fed getting the money by borrowing the money from our bank deposits (via the banks). An old-time economist would have considered that to be a major inflationary risk, particularly at a time when the government was shutting down Supply in terms of much of the economy. However, for those experts familiar with the body of work that comprised modern economic thinking, there was no problem, no real risk of inflation. The accepted equations proved it!

Four decades of advancing academic theory met Reality, and Reality turned out to be the highest and most persistent rates of inflation seen in four decades. As explored in my analysis "Economists Can't Account For 98% Of Rising Inflation" (link here), the economics profession had a model collapse when it came to understanding inflation. As admitted to by such economics luminaries as Larry Summers, economists don't have a working understanding of what caused the current inflation, it shouldn't be there based upon the widely accepted models. But yet, it persists.

What has brought us to this point then is a chain of "#4s" from the beginning slide, a chain of "major changes, incompetently executed."

A major change was the unprecedented multitrillion-dollar Shutdown / Stimulus strategy - and it was executed incompetently, leading to high and persistent inflation.

Very reluctantly and slowly, the Federal Reserve began raising rates in response. This triggered the "Fatal Flaw", with the higher rates leading to major losses at a highly respected bank that turned out to be incompetent (there's that word again) at the basics of risk management.

A major change, the complete restructuring of the defenses of the global financial system was supposed to stop the risk, but the defenses had major design flaws as a result of incompetence, and the agreed upon defenses and rules immediately fell apart, even as Credit Suisse fell as well.

That is a single chain: the massive stimulus in the midst of supply shortfalls led to the inflation that led to the interest rate increases that led to the bond losses that led to the SVB bank run that led to the Credit Suisse bank run that led to the global banking defenses failure. The problem is that we may still be early in this chain, with more and potentially much bigger #4s to come.

As we will be going over today (problems today, potential solutions tomorrow), what has happened so far is fairly simple and safe compared to what could happen if the market gets its expected pivot, and the Fed moves rates down while stimulating and rescuing with potentially massive new sums of money. The market seems to think there is some sort of infinite money out there to pay for this, as do the politicians - but, that is entirely incorrect. The cumulative actions of economists, bankers, regulators and politicians have together created a system that is highly leveraged, that is fragile, and that is so complex that it demonstrably exceeds the abilities of those who created it. This is going to be all new and quite risky territory, and a cornered Federal Reserve will have to be not just competent but brilliant if it is to pull off this high-wire act. The chain of poor decisions must stop and soon, because if it doesn't...

Yet, those in charge seem to take financial stability and the brilliance of the decision-makers for granted, and are currently charging down a path of rapid politicization instead, with quite different criteria for setting policy, hiring, and other decisions. That this is all coming together at the same time in 2023 is... extraordinary. None of us have ever seen this situation before, there is no prior place in the history of the U.S. markets to find this.

We also have another closely related chain of #4s going on right now, "major changes, incompetently executed", that are feeding the de-dollarization that seems to be picking up speed. If those two chains meet - and it looks like they might - then we are going to be seeing changes like we have not seen in our lifetimes, a lot of what people take for granted today will likely be gone. The rest of the world is watching from a place outside of the internal Narrative of the West, a place of national self-interests, and by their rapid actions in testing and implementing trade alternatives to the dollar, in Asia, Africa, the Middle East and South America, it can be seen they do not like what they see.

Setting aside the current rapid geopolitical realignment that is going on, on a longer term basis the idea that the entire world will keep their reserve savings in a nation that quite openly plans to use those very savings as part of an internal social plan to redistribute wealth and achieve "social justice" is... unprecedented. This is mind-blowing stuff - how could someone expect to do this without impacting the reserve status of the dollar? If the framing is an internal one, then yes, control of the Fed can force money changes that will force political and social changes, like it or not. When we move to external players, however, leaving the internal Narrative and moving to other sovereign nations - they absolutely have the ability to choose not to fund a dollar that has been repurposed. But yet, the internal political dynamic here seems to be so dominant that those rational external considerations don't appear to enter into the decision-making process.

The more that the value of a currency becomes dominated not by sound banking but by internal political considerations, and the more likely it is that a government will change the rules on foreigners for political purposes, then the less other nations will want to hold that currency, or to own investments denominated in that currency. In that case, they also will not fund national debts or excessive trade deficits. The perception of the reliable rule of law by others is critical if a nation wants to have a reserve currency, and the financial benefits that come from that.

Change is not always a crisis. Crises are common with fundamental monetary changes, but they aren't a requirement. When we merge the changes in banking, money and global currencies, there is something fundamental going on. An issue with people doing hundred year studies of the US dollar, in order to project what may be happening next, is that the nature of the dollar is treated as constant. The problem is the last hundred years include a dollar that was exchangeable for gold by the public, then a dollar that wasn't, then fixed exchange rates that were backed by the value of gold, then floating exchange rates that were not backed by gold, and for the last 15 years by a dollar that was manipulated by unprecedented central banking interventions that were funded by back-door access to our bank deposits.

Those are five different types of currencies, even if all share the name "United States Dollar". Every one of those redefinitions of the dollar then changed inflation, interest rates, exchange rates, and investment markets. A sixth fundamental change appears to be in process right now, unless it is rolled back. This means the rules for how money works, who has it - and investment results in each asset category - are also likely changing.