A Continuous Cycle Of Crisis & The Containment Of Crisis

By Daniel R. Amerman, CFA

TweetConventional financial planning is based upon the assumption of financial normality. "Normal" returns are assumed for the long term performance of stocks, bonds, real estate and other investment categories, with the definition for that normality often being based upon the last 50 or so years of the 20th century.

However, a problem has developed over the almost 20 years since then - we've had almost continuous "abnormality". The disastrous popping of the tech stock bubble was followed by the quick growth of the real estate bubble. The popping of the real estate bubble and the financial crisis of 2008 then nearly destroyed the global financial system.

The containment of the financial crisis of 2008 required some of the most "abnormal" market conditions in financial history, including a quick doubling of the federal debt and the use of quantitative easing. Literally trillions of dollars were created out of the nothingness by the Federal Reserve and used to manipulate bond markets and interest rates, thereby forcing rates down to the lowest levels in modern history.

Ten years later, while there is talk of a return to normality, trillions in created money and unusually low interest rates are still here, meaning that we have not once had "normal" markets in the entire time since the financial crisis. Indeed, actual performance in every major investment category over almost the last two decades has been dominated by sequential "abnormalities" in practice.

There is an alternative to taking the usual approach, and dismissing what we have actually experienced over these many years as being aberrations and abnormalities. This alternative, which will be explored herein, is to intensely focus on understanding what has actually been happening - a continuous cycle of crisis and the containment of crisis.

What if this cycle is our new reality? What if in this time of record national debt, soaring budget deficits, trade turmoil, political turmoil and sky high stock and real estate markets - we get another crisis? And what if the government then intervenes to try to contain the crisis?

This is what has happened in reality twice in a row now - is it really so radical to think it could happen a third time?

This question is of critical importance, because investment strategies based on the assumption of "normality" - with abnormality being excluded by definition - can be not just wrong, but dangerously wrong if what we get instead is a continuation of the cycle of crisis and the containment of crisis. Many millions of current and future retirees would likely once again face devastating financial damage if that were to happen.

On the other hand, for those who see the world in terms of an ongoing cycle of crisis and the containment of crisis - quite different investment strategies can be implemented. And the major asset price movements associated first with crisis, and then second with the containment of crisis, can become an opportunity rather than a danger.

This analysis is part of a series of related analyses, an overview of the rest of the series is linked here.

The Popping Of The Tech Bubble

As covered in the analysis "The ABCs Of Popping A Third Asset Bubble" (linked here), the Federal Reserve responded to a recession in 1990, by pushing interest rates to their lowest levels in 30 years, in an attempt to stimulate economic growth. The economy did strongly rebound, and this was one of the factors in creating record stock market prices in the second half of the 1990s.

Indeed, as has happened many times in financial history, so much money was being made that rationality was left behind, and a major asset bubble formed in stocks, particularly with tech stocks. Profits became irrelevant for some leading pundits, and stock prices completely disconnected with reasonable projections for revenues or dividends or market share, or any of the traditional valuation measures. Many millions of people thought they had found the secrets of unending wealth - and they risked everything they had to get more of it.

Until the bubble popped and the market plunged - as had also happened many times before in financial history. This created a red hot crisis of the well understood type, as shown represented with the red graphic below of a "Red Zone Crisis".

Stock prices plunged uncontrollably. Investors were devastated in general, and this was particularly true for those who had gone all in, such as those who had quit their jobs to day trade the market. Spending fell with the evaporation of paper wealth, and there was a new and powerful recession.

Crisis Containment - The Lowest Interest Rates In 50 Years

The Federal Reserve responded vigorously to this crisis, and indeed on a scale that had not been seen in a half century. In the effort to contain the market and economic crisis, the Fed pushed the Fed Funds rate down to the lowest levels seen in 50 years (more information on the specifics of rates and dates can be found in the previously linked "ABCs" analysis).

The containment worked. Despite its steep downward start, the recession ended fairly quickly, and economic growth began again.

There were also now the lowest mortgage rates seen in 50 years, and homes became far more affordable. Indeed, much higher prices could be paid for homes because the very low mortgage rates were holding down the mortgage payments.

There were other factors as well, but a real estate bubble formed. Just a few years after the tech stock bubble, once again, many millions of people had found the secret of quickly building unending wealth, and they went all in on real estate speculation. Prices didn't matter, income documentation didn't matter, and neither did affordability or rental income. Buy, flip, take the profits, and do it again was the new formula as prices endlessly climbed.

This cool containment of crisis is represented by the black graphic below, that of Black Zone Crisis.

From a governmental perspective, what was happening was an example of crisis containment and re-establishing control. The recession ended, and income and payroll taxes rebounded. A floor was found for the market, and then the rebound began, and taxes on capital gains and investment income returned along with it.

What needs to be noted however, was this was not normality and containment was not free for investors, far from it.

By slashing interest rates, the government also slashed investor income, and the ability to build wealth through buying bonds or certificates of deposit. Any retiree planning to live off of interest income - lost standard of living. Anyone attempting to build wealth for retirement through the time-tested power of compound interest - had a radical and artificial reduction in their ability to build wealth (The analysis linked here shows just how radical the wealth impact can be as the result of a reduction in interest rates.)

At the same time, many millions of people were at the least paying much higher prices for homes than they otherwise would have done, even if they were thinking only in terms of shelter rather than investment potential. For those who were trying to make money in real estate - artificially low interest rates helped create an artificial pattern of wealth creation and bubble inflation that drew millions of people and all their savings in like moths to a candle.

So, when we look at government crisis containment in individual terms - we have a Black Zone crisis, with losses that are every bit as real as the better understood Red Zone crisis. The losses for individuals are completely real, they can exist in many different ways, and asset prices in general can move in patterns that have little to do with "normality".

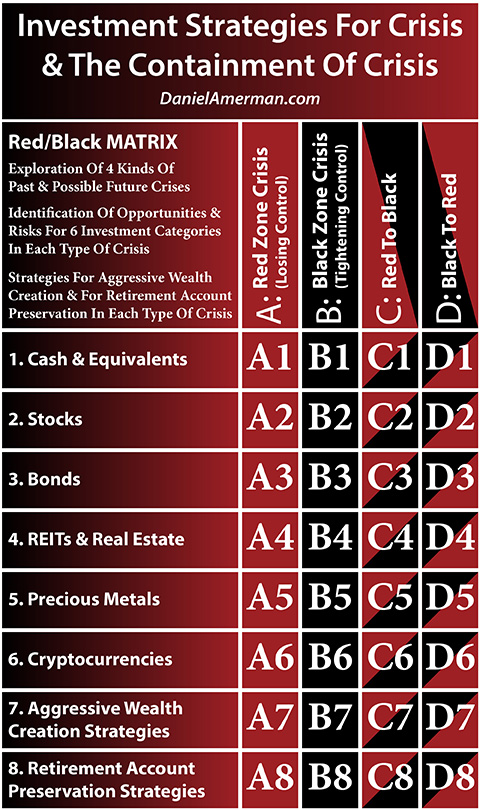

Another way of looking at this is that what was experienced by the nation was a cycle of Red Zone Crisis to Black Zone Crisis, as shown in the graphic below.

There were quick and massive losses for stock investors during the "hot" Red Zone Crisis of the tech bubble popping.

The direct result of this abnormality was the Black Zone governmental interventions to contain the crisis.

The Black Zone interventions then created a long, "cold" Black Zone individual saver crisis of lost interest income, a lost ability to compound wealth, having to pay far above historically average prices to buy a home, and the drawing in of the savings of millions of investors into an unsustainable bubble in real estate.

The Black Zone Crisis was the direct result of the Red Zone Crisis, there was a Red to Black cycle. With major asset price movements in all the major investment categories that occurred twice - once in the Red Zone, and once in the Black Zone.

Both types of major asset price movements are not consistent with the assumptions underlying conventional financial planning. Indeed, from the traditional perspective that still dominates the industry, there were two unrelated abnormalities, each of which can be safely ignored when it comes to investment strategies and confidently making plans for the future that are based on "normality".

It is also worth considering that many savers and much of the population did not participate in the creation of the Red Zone Crisis - they may have been skeptical of the high stock prices, or not stock investors at all. But, nonetheless, the Black Zone containment of crisis was far broader based, and impacted everyone who saved or bought a home.

The Popping Of The Real Estate Bubble & The Financial Crisis of 2008

By 2007, the financial danger signs were beginning to flash loudly, and then in 2008 a much larger financial crisis arrived. Real estate and stock prices began to plunge, and a powerful new recession began, the so-called "Great Recession" which would become the most powerful since the Great Depression of the 1930s.

The Dow Jones Industrial Average would fall by over 50%, falling from around 14,000 in late 2007 to around 6,600 in early 2009.

However, the red-hot core of the crisis this time around was not stocks but a new type of security that few among the general public had ever heard of: "subprime mortgage derivatives". Driven by greed and without full consideration of the risks, the major banks and financial institutions of the world had entered into an interlocking web of promises, where the failure of a few major players could literally destroy the entire financial world.

Bear Stearns failed, and the damage was barely contained. The failure of Fannie Mae and Freddie Mac was in process, and was only stopped by the federal government taking them over. Lehman Brothers failed, and the interlinked dominos were set into motion.

The institutional lenders who provided much of the short term money for Wall Street's speculative investments began to demand their money back. Wall Street couldn't sell the securities to repay the cash - even if there had been buyers - because the staggering losses they would have had to recognize would have driven them straight into bankruptcy. This would have then flashed into an acceleration of the falling of the dominos, as the failure of individual firms cascaded into an annihilation of the entire financial system.

By the middle of October of 2008 the global financial system stood on the precipice, with what was effectively an old fashioned bank run in progress, and facing the impossible dilemma of having no way to get the cash needed to meet lender demands for getting their money back without selling deeply underwater securities and taking losses that would have themselves caused collapse.

A useful framework for understanding what was happening was that the nation was going through a cycle of Black Zone Crisis (or crisis containment) to Red Zone crisis, as shown in the graphic below.

The Black Zone interventions of the Federal Reserve creating between 2000 and 2003 creating the lowest interest rates in 50 years had been intended to shorten the 2001 recession that resulted from the previous tech stock bubble Red Zone crisis, by encouraging higher asset prices and an environment where investors taking risks would be rewarded.

The interventions worked. Asset prices soared, to all time historic highs for real estate. There was rampant speculation and risk taking.

There is an inherent dilemma with the Fed's policy of rebooting the economy by using low interest rates to create artificially high asset prices while encouraging risk taking, and that is that if another crisis develops - there is an amplification of the losses, and of the crisis.

Asset prices are artificially higher than they should have been - so the plunge from those heights is greater than it should be. Investors are encouraged to take more risks than they otherwise would be - so they have a higher exposure to that greater degree of losses.

A higher exposure to larger losses means that the net result of the Federal Reserve Black Zone interventions is a multiplication of losses occurring, which produces a worse Red Zone Crisis than would have happened in "normal" market conditions.

The Black to Red cycle created staggering gains and losses that were outside the range of what conventional financial planning would say was "normality". The price increases in (some) asset categories during the Black Zone Crisis phase were extraordinary, albeit "abnormal". The collapse in prices in (some) asset categories when the cycle flashed to Red was also extraordinary, albeit also "abnormal" from the usual perspective.

If an investor is blind to the Black to Red cycle, because it is dismissed as an "abnormality" that shouldn't exist, then there is a combination of missed opportunities and heightened losses, which can produce quite different results than expected. On the other hand, if one recognizes the existence of the cycle and properly positions for two major price changes in sequence in the correct asset categories, then the results could be highly positive rather than highly negative.

Crisis Containment - Creating Trillions From Thin Air & The Lowest Interest Rates In Modern History

The most important part of what happened in October of 2008 was that there was no collapse - the system held together. Oh yes, there was a financial crisis and the subsequent Great Recession, but each were a mere pale shadow of what they would have been if it were not for the largest Black Zone intervention to contain crisis that we have seen in modern financial history.

There were two key events that happened in October of 2008. What was presented to the nation was the very public face of the TARP program, which gave the endangered financial institutions a way to get cash for their distressed toxic security portfolios so they could pay back lenders, without recognizing the severe losses that would have created a bankruptcy cascade.

More importantly, the Federal Reserve began a program of quantitative easing, and on a massive scale. The core problem was that the money did not exist to lend to the banks to repay their lenders - but the solution was that for central banks, "money" is a much more flexible concept than the average person has any idea.

By expanding "excess asset reserves" the Fed effectively created over $400 billion in new money out of the nothingness in a week, it lent that newly created money to Wall Street and European banks so they could repay their lenders, and it thereby stopped the bank run in progress in its tracks. More importantly, the Fed let the world know that it stood ready to create as much new money as would be needed to keep a bank run from occurring, which then gave the lenders the assurances they needed to keep them from pulling more cash out.

Quantitative easing would then be used to accomplish a series of goals. These included rebooting the real estate market through purchases of mortgage-backed securities, as well as funding the rapidly increasing United States national debt through purchasing over a $2 trillion portfolio of Treasuries.

However, the most important aspect of quantitative easing - after the initial containment of crisis - was that it was used to force interest rates to the lowest levels in modern history.

In successive and amplifying Red to Black cycles, the Red Zone of the recession of 1990 was contained by the Black Zone of creating the lowest interest rates in 30 years; the Red Zone of the crisis/recession of 2001 was contained using the Black Zone of the lowest interest rates in 50 years, and the Red Zone of the financial crisis / Great Recession of 2008 was contained using the Black Zone of the lowest interest rates in modern history.

In the following decade, there were major pricing implications for all the major asset categories. As I have been writing about since 2008, we have experienced quite different asset prices for stocks, bonds, real estate and precious metals than we would have without the Black Zone containment of crisis. Indeed record highs were eventually reached in many major markets as a direct result of the containment, which is the opposite impact of what would be expected with a Red Zone crisis with no containment.

However, the price of the Black Zone containment was also the effective destruction of many of the basic foundations of saving money and financial planning.

For decades, savers and depositors had received interest rates that were above the rate of inflation - but short term rates went to 0%, and were negative in inflation-adjusted terms. The nature of savings turned upside down for an entire nation.

The mathematics of compound interest - which involves the continuous reinvestment of interest (and dividend) payments over time - is the single most reliable form of building wealth in history. As explored in more detail in the analysis linked here, the Black Zone Crisis for individuals inverted compound interest, so that wealth was lost over time rather than being built in after-inflation terms.

The most reliable form of income for retirees in retirement was supposed to be interest payments. With the forced collapse in interest payments, this no longer worked, and retirees were given the choice of safely settling for almost no interest income, or taking risks for higher interest or dividend payments that could lead to major investment losses in the future.

For decades, two of the core tenants of financial education and financial planning were 1) the Investor Life Cycle, one component of which included retirees reliably earning most of their cash flow in retirement from interest payments; and 2) the reliable ability to build wealth in the decades prior to retirement through the use of the mathematics of compound interest (including reinvested dividends as well as interest payments).

Both of these supposedly rock-solid tenants have been almost entirely invalidated for a decade now, as a direct result of the Black Zone Crisis which is the result of the government interventions to contain the last Red Zone Crisis.

But yet - "the band plays on" when it comes to the "solved science" of conventional financial planning and the reliable ways in which educated and disciplined investors can create wealth over time.

The extreme asset price movements in the Red Zone Crisis of 2008 are ignored as abnormalities.

The extremely low interest rates and resulting major asset price moves in the ten years of Black Zone containment and crisis are also ignored as abnormalities.

Indeed, when one comes right down to it - the great majority of the last two decades is effectively ignored as a series of abnormalities which are not supposed to have happened in the first place, and therefore the possibility of their happening again can purportedly be safely dismissed by reasonable and financially educated investors.

While not usually phrased in this way, that perspective is the dominant perspective - but is it truly the safest and most reliable way of making long term financial decisions?

Seeing The Cycle

There is an alternative approach, which involves recognizing and accepting that we have spent the last almost 20 years in a near continuous cycle of crisis and the containment of crisis.

If we take that perspective, then perhaps the single most important question becomes - will the cycle continue? If it does continue - what form will it take?

Will there be another crisis? Will it be a pure Red Zone Crisis with no containment? If there is further amplification, will it be the largest crisis yet?

Will the Federal Reserve recognize the warning signs this time around and create a Black to Black cycle, intervening to preemptively prevent the formation of another Red Zone Crisis?

Could it be Red to Black, where another "hot" Red Zone Crisis occurs, and where subsequent containment for another decade or more is achieved with a new Black Zone of unprecedented size and (market distorting) power?

Could it be Red to Black to Red, where there is another crisis, it is again followed by the attempted containment of crisis, but this time around the attempt fails after a period of months or years, and the crisis does ultimately go out of control?

Could it be a return to normality with no crisis, where we exit the cycle for hopefully many years or decades to come? (That is indeed a possibility - but the problem comes when one assumes that it is the only possibility.)

Whatever the path turns out to be, it could produce a possible sequence of very large asset price movements, with some of those movements being perhaps the largest of our lives. Depending on the particular investment choices, these could include some of the large losses in modern financial history - as well as some of the largest gains.

*******************************************