Medicare Premiums Are A Shared Pool - Eight Coming Changes That Will Transform Retirement

By Daniel R. Amerman, CFA

TweetA critical component of financial planning for retirement is that many healthcare expenses are a shared expense for those 65 and older, as a matter of current law and design. A 65 year old pays the same Medicare Part B premiums as a 95 year old, and someone in perfect health pays the same premiums as someone with multiple serious health issues.

By law, 25% of total Medicare Part B expenses are funded by Medicare premiums, which are usually withheld from monthly Social Security benefits. So, when the average expenses of Medicare increase on a per person basis - then so do the premiums.

Anyone who is in Medicare is participating in a shared pool, via the amount of their premiums. And if the characteristics of the other people in the pool change in such a way that average expenses rise - then everyone shares in that rise through increases in the size of their premiums, and the resulting decreases in the standard of living that can be supported by Social Security net of Medicare.

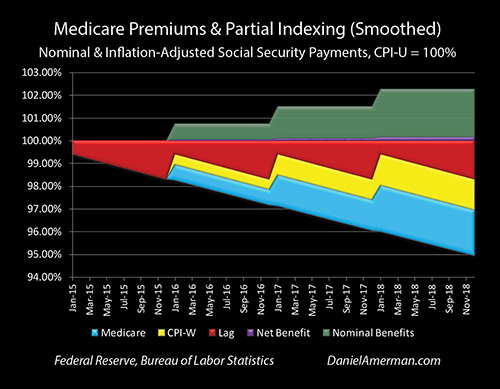

A key issue that was examined in detail in the Part 4 analysis (which is linked here) is that in recent years there have been almost no increases in net Social Security benefits for the average retiree, because just the rapid increases in Medicare Part B premiums alone have been enough to almost entirely consume the minor increases in Social Security benefits.

This situation is being presented as a short term anomaly, due to the unusual combination of lower than normal general inflation and higher than normal medical expense inflation. In this Part 5 analysis we will take a look at the longer term future.

There is also the critically important consideration that the "hold harmless" provision of Social Security means that the division of shared and rising medical expenses is not equal within the pool. When we properly include this factor - that by itself can be enough to change many retirement decisions. As we will explore, this also means that many people are volunteering to potentially pay excess Medicare premium increases for other people in the pool for up to five years - without realizing they are doing so.

The goal of this fifth analysis in a series is to give you an early and comprehensive understanding of what is likely to become a defining challenge for an entire nation when it comes to both personal and average standards of living in retirement. An overview of the rest of the series is linked here.

Factor #1: The Average Age Of The Shared Pool

The easy shorthand explanation might be to say that the issue with Medicare premiums is that actual medical expenses have been increasing at a faster rate than what the government reports as the general rate of inflation - which is true.

However, the coming increases in Medicare premiums are not fundamentally just an inflation index mismatch issue - but rather that is only one of eight major problems. Entirely aside from whatever the future rate of inflation may be - there are other fundamental factors in play created by the aging of the Boomers that are expected to change the "pool", and to substantially increase the average expenses of that pool in the coming years and decades.

The first consideration is that average health - and average medical expenses - are different at age 75 than they are at age 65, and are different at age 85 than they are at age 75. Aside from end of life expenses, the number of medical issues on average increases with age.

Medicare currently has a disproportionate number of still quite healthy Boomers in their mid 60s to early 70s paying their premiums into the pool, compared to a smaller generation in their mid 70s and older who are in their most expensive years.

Indeed, the early impact of the Boomers reaching retirement is that the per person expenses of the shared pool are less than they otherwise would be, and Medicare premiums are also therefore lower than they otherwise would be.

However, as ever more Boomers age in retirement, that ratio is expected to shift, and the average age of those in the shared pool is expected to rise. That changes the characteristics of the pool as those who are in their higher expense years become a greater percentage of those participating, and that then increases the premiums. (And yes, not everyone over 65 is retired, but it really simplifies the language to treat it that way herein.)

Everyone 65 and over will share the increase in premiums, and everyone will also share the resulting decrease in the standard of living that can be supported by Social Security net of Medicare.

Factor #2: An Eventual Decrease In Younger Retirees

For the near term, the sheer volume of newly retired and healthy Boomers in their 60s is expected to help contain the costs of the growing numbers of Boomers in their 70s and then 80s. But by around 2030 - that changes. Now the maximum number of Boomers are aging together and getting more expensive together - and there is the smaller generation behind them now reaching age 65 and entering the pool.

Sixty-five years after the medical revolution of the widespread usage of reliable female birth control in the form of the Pill (which ended the Baby Boom), another medical revolution of a sort will arrive. There will be the maximum number of Boomers alive and aging together in retirement, getting more expensive each year, even as the numbers of young retirees entering the pool to share the premiums are decreasing.

The resulting potentially rapid annual increases in premiums will be shared amongst the entire pool of those participating in Medicare.

Factor #3: Increasing End Of Life Expenses

Another issue that of end of life expenses. A disproportionate share of lifetime medical expenses are on average incurred in the last year or two of life.

Not to be morbid - but as anyone who is of an age and is seriously thinking about long-term retirement financial planning is well aware, sickness and death are core considerations. An issue that perhaps some are not taking into account is that Medicare is a shared experience. So it isn't just your personal health or personal mortality that need to be taken into consideration. For even if you are individually fine, the health and death rate of the overall pool will be directly impacting your monthly financial situation through your premiums.

We have a likely major boost in end of life expenses to be shared by the pool as truly large numbers of Boomers begin to enter their last year or two of life together.

There is obviously a huge variation in how long people live as well as what expenses associated with dying will be going into the shared pool. But if we look at 84 or 85 as being about an average lifespan for someone who has reached 65 - that means the first age year of the Boomers, those born in 1946, will be reaching their average expected lifespan by 2030 or 2031. And then the numbers will be rapidly building each year thereafter as an ever larger percentage of the Boomers are in their 80s - and they represent an ever larger percentage of the shared pool.

Now the interesting thing about the year 2030 is that the final year of Boomers who were born in 1964, will have already all reached 65 in the year 2029. So 2030 becomes the first year where there are significantly fewer young and healthy retirees entering the pool and sharing the premiums.

This relationship has not always been there - average life spans were shorter when the Boomers were born. But the extensions in average life spans since then have created an almost perfect correlation.

The round number of 10,000 Boomers retiring a day eventually (more or less) becomes 10,000 Boomers dying a day. We have never seen those numbers before - and it will be expensive. Those exact same years are expected to be the same years where the money provided by younger retirees is dropping another notch each year.

So, even if you are much younger, or even if you live to be 100 and are in great shape the entire time - because Medicare Part B is a shared pool, this will still directly financially impact you. The financial bottom line is that the costs will be coming out of the shared pool in the form of higher premiums - and therefore lower net Social Security benefits - for the tens of millions of retirees trying to cover their ongoing monthly expenses.

Factor #4: Decreasing Relative Medicare Payroll Taxes

A fourth issue is that Medicare is funded by the combination of Medicare taxes and Medicare premiums. Over time, there will be a steadily decreasing ratio of current workers paying in relative to the number of retirees collecting.

This issue is different, because those workers are not yet in the shared pool - but in some ways, this could turn out to be the most important factor of all.

Those who are enrolled in Medicare are only paying 25% of the expenses of Part B through their premium pool. The other 75% is paid by the current workers through payroll taxes, as well general government revenues and borrowing.

So as Part B expenses rise - 3/4 of that is being borne by a group that is shrinking in comparison to the number of people they are supporting. Even as they are supporting the other components of Medicare. Even as they are paying what are scheduled to be far higher Social Security benefits. Even as they try to make the interest payments on the much larger national debt that is being left for them.

So, if things are looking bleak for Medicare premiums, there is the temptation to think that the government will just step in and take care of it. However, simply because of a limited capacity for what younger workers can support - that may not be possible. Indeed if there is a reworking or reform of Medicare, it is more likely to go the other direction, with negative consequences for retirees.

Factor #5: Medical Inflation Is Higher Than General Inflation

The fifth issue is relative rates of inflation. The rate of inflation in medical expenses for the nation as a whole has been higher than the general rate of inflation - as well as the actual increases in Social Security benefits.

That relationship acts as a multiplier when it comes to each of the individual demographic/medical issues. The farther out in time we go, then the bigger the underlying problem - and the bigger the multiple, to the extent that medical expenses continue to grow at a rate that is higher than the general rate of inflation.

The Federal government projects in the Congressional Budget Office Long Term Outlook that per capita health care spending for Medicare as a whole will exceed the growth rate in GDP by a little over 1% per year over the next 30 years. Another way that the government presents the projections, is that excess medical cost growth will comprise 26.4% of real Medicare spending in 30 years.

So for a rough "ballpark" estimate, the government is saying that just from "excess cost growth" and leaving the other factors out, people in Medicare should expect their premiums to rise by an average of about 0.90% per year, over and above the general rate of inflation and into the indefinite future.

As with many long-term government forecasts - this could called quite optimistic. If we simply compare the medical expense component of the CPI-U inflation index versus the overall index, then over the 20 years from September of 1997 to September of 2017, national medical expenses grew at 3.58% average rate, while the reported general rate of inflation was 2.15%.

So over the long term, medical costs as reported by the government grew at a rate which was 67% greater than the annual rate of inflation, which was a differential of 1.43% per year. This is about 50% higher than what the Congressional Budget Office is projecting for the future.

However, there are other issues. How does the government calculate medical expenses and is it realistic? If you are covered by a corporate health care plan and you include both premiums and deductibles - are medical expenses really only rising about 3.5% per year? If you have a plan under the Affordable Care Act - does 3.5% per year sound like it is even remotely in the ballpark?

There is also a particular concern with what has been happening with Medicare Part B premiums in recent years. We should be in a "golden age" for Medicare premiums, right now, the situation should be just be about as good as it gets for the shared pool. We have what the government reports are low rates of general inflation and even medical cost inflation. We have a flood of new people into the Medicare shared pool in terms of the younger Boomers, who are still in the healthiest years of their retirement, but are paying equal premiums with the older retirees.

If there were ever a time that Medicare Part B premiums should be falling each year instead of rising - it should be right now, at the golden peak of "summer" for the shared pool. And indeed, large numbers of "young" and healthy Boomers flooding into the shared pool are what created flat premiums for several years before 2016.

But that isn't happening anymore. Instead, even in what should be a perfect environment for the shared pool, we are in practice getting punishing increases in Medicare Part B premiums.

Base Medicare Part B premiums increased from $104.90 in 2015 to $134 in 2018. That is an increase of 28%, which over three years works out to an annual growth rate of just over 8.50%. That is 1) far above the medical component of the CPI-U which was growing at a 2.96% annual rate in the comparable period; 2) far above the general reported CPI-U inflation rate of 1.22%; and 3) far above the average annual rate of Social Security benefit increases of 0.75%.

Something is badly wrong - this should not be happening and it is more dangerous than it looks.

As analyzed in Part 4, it is this situation of premiums rising at an 8.50% rate while benefits are only rising at a 0.75% rate that has allowed Medicare Part B to almost completely consume the inflation indexing of Social Security in recent years, and created a situation where if recent results persist, the average retiree will lose a full month of purchasing power by 2022 (relative to 2015).

Having a nation of retirees who have 12 months of expenses but only 11 months of income purchasing power would be a bad situation. But, what we have to keep in mind is that what has been happening with Medicare Part B expenses has been so powerful that it has been able to overcome what should be "summer" for the shared pool.

If something analogous were to hit in "winter" - and "winter" is on the way - when the first four factors are working together to increase expenses of the shared pool - then the damage would be much worse. The damage would be much worse to the average retirement standard of living that can be supported by Social Security net of Medicare Part B. The financial damage to the Federal government would also be much worse, and would drive deficits and the debt to higher places than what is currently forecast.

While Medicare Part B premiums are a shared pool, however, the damage is not always equally shared. Indeed, the greater the financial pain in any one year, the more unequal the sharing, as is reviewed with Factors #6 & #7.

Factor #6: The Shared Pool Is Not Always An Equal Pool

Another essential consideration is that Social Security and Medicare are linked in ways that many people don't understand. Most people can choose to get up to an extra five years of protection from excessive Medicare Part B premium increases - but it is their Social Security choices that provide that protection.

This protection is what is known as the "hold harmless" provision of Social Security, whereby annual Medicare part B premium increases can't exceed annual Social Security benefit increases for an individual - so that after-withholding benefits can't decrease. There are other restrictions, but the one that applies to most people is that to qualify for "hold harmless" protection they have to be collecting Social Security and be having their Part B premiums withheld from their benefits.

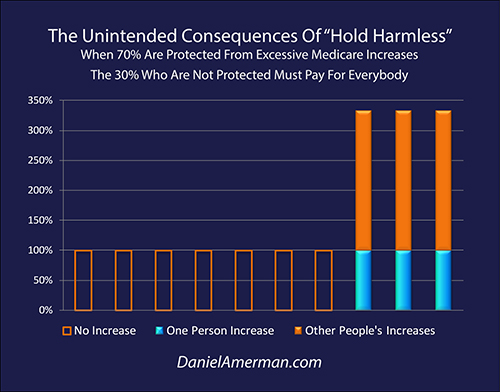

Yet, the shared pool still has to pay in full - that requirement doesn't go away. So what happens is that there is a multiplier effect - the portion of the pool that is not protected has to pick up all of the excess Medicare premium increases for the entire rest of the pool.

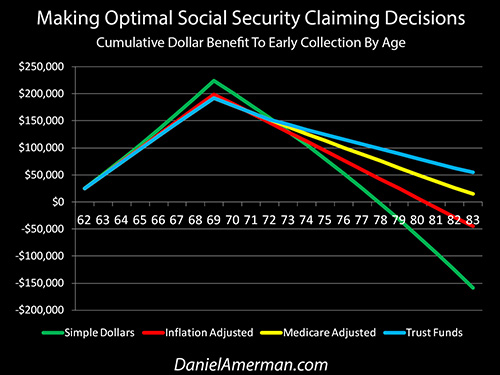

As shown in the graphic above, in years such as 2016 where there was no Social Security benefit increase but the expenses of the pool did rise, 70% of those in Medicare Part B don't have to pay any increased premiums, their orange bars are hollow. But the shared pool still has to pay - and that means the 30% who are not protected have to pay for everyone.

Since there are 2.33 protected people for every non-protected person (70/30 = 2.33), that means that each non-protected person has to pick up a total of 333% of the per person premium increase, with 100% for themselves (the solid blue bar), and 233% for 2.33 other people (the solid orange bars).

There are rules governing which people have to pick up the tab for everyone else, and how much they have to pick up. One of the primary factors is income, individuals making over $85,000 a year are not protected, or couples making over $170,000 a year, and there is an index which covers how is much is picked up at various income levels.

There is another large non-protected class which is voluntary, and that is those who are 65 and older and are in Medicare, but in the attempt to maximize lifetime benefits they are not yet collecting Social Security. Because they have no protection, they get to participate in picking up the tab for everyone else in those years when the premiums of individuals in the shared pool increase to an extent that is not covered by their individual Social Security benefit increases.

This could be considered analogous to sitting at a restaurant table with two other retirees you've never met before, and when the waiter brings the bill, raising your hand and volunteering to pick up the check for everyone.

"Just put their Medicare premium increases on my bill this year!"

It is a remarkably generous offer. This is particularly the case when you consider that not only are you picking up the tab for other people, but you are also foregoing the legal right to be able to hand your own tab to others, and say "pay it, please." Now, how many people realize just how potentially generous they are being when following the common advice to defer collecting Social Security for as long as possible is another matter.

For 2016 it literally took a one-time act of Congress to keep Medicare premiums from increasing by up to 52% in a single year for some non-protected Medicare beneficiaries, with potentially very high premium increases for millions of people in the 65-69 age bracket who were not yet collecting Social Security.

At the end of 2015, Congress picked up much of the tab, avoiding the massive premium increase for non-protected pool participants that was scheduled to go into effect in 2016 as a matter of law. Basically, they just added it to the national debt instead. Whether they will do so again in the future, and to what extent, are good questions.

Factor #7: Far More Future Excess Premiums Going Back To Shared Pool

What drives the creation of significant excess premium years is the combination of 1) the size of the base Medicare Part B premiums versus the size of the individual Social Security benefit; and 2) the relative rates of growth of the Medicare premium versus the Social Security benefit increase in that year.

Triggering "hold harmless" - and putting the excess premiums back into the shared pool happens with far greater frequency with smaller Social Security benefits than larger ones. Someone with a $400 monthly benefit - whose 2% increase in 2018 would have been $8, would be putting excess premiums back much more frequently than someone with an average 2018 benefit of $1,404, who would have received about a $27 benefit increase in 2018 (with their Medicare premium increase consuming all but $2 of that increase).

So, unless there is a 0% increase in Social Security benefits as we saw in 2016, "hold harmless" is not an all or nothing event. It is normal for those with smaller benefits to be putting part of their current (or previous) premium increases back into the pool. (There is a catch-up component as well.)

However, it isn't all "sunshine & roses" for the retirees who are putting their excess premiums back into the shared pool, but rather quite the reverse. They are starting off by trying to live off of lower benefits. In order to put their excess premiums back into the pool, they have to get no net benefit increase at all - which means they have zero effective inflation indexing protection. This means the real or inflation-adjusted income of all these millions of people is falling annually at a rate equal to the rate of inflation (plus our other factors from Parts 1 through 4).

When it comes to those who are not protected, the big questions for any given year are what percentage of the pool is capping out and putting their excess premiums back into the pool to be shared by the others, and what is the size of those excess premiums?

The key relationship to understand is that Medicare premiums increasing at a faster rate than Social Security benefits means that each year (on average) the Medicare premium starts off being at least a little bit larger relative to the Social Security benefit. That means that each year it takes a smaller percentage increase in Medicare to trigger "hold harmless". Alternatively, if we look at a given percentage increase in Medicare premiums, then the larger the starting premium is relative to the Social Security benefit, the more of that percentage increase that goes back in the pool.

As the first five factors impacting the shared pool steadily increase the size of Medicare premiums relative to Social Security benefits, they will therefore also be steadily increasing both the frequency and the size of the excess Medicare premiums being put back into the pool, which then increases Medicare premiums at an ever greater rate for those who are not shielded by "hold harmless".

This then creates a bit of a feedback loop, where the higher resulting premiums mean that a still greater percentage of the pool gain "hold harmless" protection, albeit at the cost of completely losing their inflation protection. That then further narrows the pool of those who are picking up the excess premiums for everyone else (and that again increases premiums, and again the narrows the pool just a bit more).

So the percentage of the pool sharing the excess premiums will on average be declining a bit each year. This means that the multiplier effect covered in the Factor #6 section gets a little bit higher each year.

This further cripples the inflation indexing of Social Security for those with higher incomes and/or benefits. And because there is no cap on Medicare premium increases for those who are not protected by "hold harmless", that means that Social Security net of Medicare can be falling even in nominal terms (not including inflation). When inflation is included this would mean that the purchasing power of their net benefits may be falling at a faster rate than that experienced by those with lower incomes and/or benefits.

This critical issue could be called a variant on what was reviewed in Factor #3. Because Medicare Part B is a shared pool - it isn't just our health or our lifespan that matters. Even if someone individually has great genes, made great life decisions and lives to be 100 - their finances will still be profoundly impacted for decades by the sickness and mortality of all the tens of millions of other retirees in the pool, many of whom have average genes and have made average decisions (or worse).

Similarly, even if someone had a very good career and qualifies for the maximum Social Security benefits - that isn't all that matters. There are many tens of millions of people who didn't do that, who have much lower benefits, and over time will be increasingly unable to completely pay for their own premium increases. The way the rules for the shared pool are currently set up - as a matter of design - is that their financial pain travels to those in the pool who have higher benefits (particularly if they also have higher income), and this is expected to occur at an increasing rate over time.

The next level is understanding how the sharings are interwoven. It is the sharing of end of life medical expenses - among other factors - that boosts the number of pool participants who can't financially handle it anymore, which narrows the number of people who are sharing all of the excess premium increases for everyone else, which then increases the multiplier effect.

Thinking through the implications of being in a shared pool where the sharing is unequal may sound like an unusual perspective on how to make better retirement decisions - but it is a governing reality over the long term.

As shown above and covered in the optimization analysis linked here, when we take even a simple and mild version of Medicare Part B premiums being a sometimes unequally shared pool into account - it can fundamentally change basic retirement decisions, such as the best age to begin claiming Social Security.

Factor #8: Combining Medicare & Social Security With The National Debt

What we just analyzed was the 25% of the funding for Medicare Part B that is a shared expense of those who are in the pool and covered. The other 75% of Medicare Part B is funded by the government, either through payroll taxes, general taxes or borrowing. For the reasons reviewed herein - this is projected to be extraordinarily expensive over the long term, particularly when we include Parts A and D as well.

Many experts consider Medicare to be the single largest financial threat to the United States government over the long term - and there are solid reasons for that concern, as we have just conceptually reviewed. However, Medicare's problems do not exist in isolation.

What needs to be kept in mind is that the United States is starting with a $20 trillion national debt. We have rapid increases in the national debt that are expected over the coming years from rapidly rising Social Security benefit payouts as more of the Boomers retire. We also have major increases in annual deficits - and the cumulative national debt - that are likely on the way as the result of the Federal Reserve increasing interest rates, and thereby increasing the interest payments on the national debt.

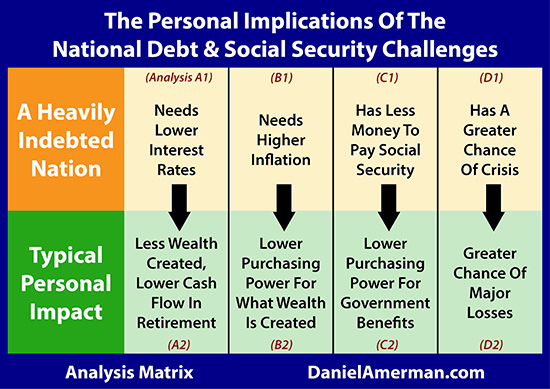

Those factors form the base - and then our financial issues with Medicare go on top of that base. These are not separate issues - but one major and thoroughly intertwined challenge. As shown in the first row of the analysis matrix below, this creates enormous financial pressure on the U.S. government over the long term to lower interest rates, increase the rate of inflation, further lower Social Security & Medicare payouts - or face the risk of a major crisis.

The analysis herein falls into the C2 family of analyses that can be found in the analysis matrix summary page which is linked here. But it does not exist in isolation. As can be seen in the other personal impact columns of the second row, those who are saving and investing to overcome the financial challenges of rising Medicare premiums need to be doing so while keeping in mind the issues of potentially lower long-term interest rates, higher rates of inflation, and the possibility of a future major crisis.

The relationship between the "B" column of inflation analyses, and the "C" column of government retirement benefits is of particular importance to this series of analyses. A core principle of macroeconomics, as explored in the "B" analyses, is that heavily indebted governments which can control the value of their own currency, have major incentives to increase the rate of inflation in order to bring down the real value of their debt, or to at least lessen the rate of growth.

As is being established in this series of analyses, the partial inflation indexing of Social Security net of Medicare Part B premiums, means that the higher the rate of inflation - the lower the average standard of living in retirement. This means that the size of the national debt will likely effectively be reducing retiree standards of living over the coming years, because of the conflict of interest over inflation. A heavily indebted government needs higher inflation, while retirees need lower rates of inflation.

Conclusions

Medicare Part B is a shared pool where premiums are driven not just by changes in medical costs - but also by changes in the composition of the pool. Just the aging of the Baby Boom tells us that major changes are on the way, as does the long history of medical cost inflation exceeding general rates of inflation.

However, Medicare Part B is not always an equally shared pool. Depending on events in a particular year, up to 70% of the pool is legally entitled to pass at least a portion of their Medicare premium increases on to the as little as 30% of the pool who lack protection. This lack of protection is often voluntary, albeit unknowing. All else being equal, the financial importance of this unequal sharing is likely to become a little more important each year.

The standard of living that can be supported by Federal retirement programs is based on Social Security benefits net of Medicare premiums, with Part B premiums being one key component. If someone who is making retirement financial plans does not include Medicare premiums in their planning, then they will find that they are mistaken. The farther out in time we go, then the greater the mistake that is likely to be made, and the greater the unexpected decline in the resulting standard of living.

Unless one understands the factors and the implications of an unequally shared pool - then one can't understand or anticipate how and why Medicare Part B premiums are likely to be changing. That can be an important flaw in the financial planning process.

That said, how many people are making their long term financial plans based upon the unequal division of a shared and changing pool?

Lack of knowledge is not, however, a valid financial defense. Reality will be what it is.

The average person who is not currently retired would likely consider the subject matter of this analysis to be a deeply obscure technicality.

That brings us to the most important part of all of this Part 5 analysis - this isn't the only obscure technicality. There are other obscure technicalities, and they have been the subjects of the previous analyses in this series.

What we have been developing is that when we merge multiple obscurities together, they gain a surprising degree of strength over time. In Part 6 we will take a very mild version of what has been developed in this analysis, mathematically combine it with the other obscure technicalities, and find an even more powerful combination, which brings potentially major changes in retirement standard of living still closer in time.

This analysis is part of a series of related analyses, an overview of the rest of the series is linked here.

What you have just read is an "eye-opener" financial analysis about critically important retirement decisions, and how they can change when we take a holistic look at the future.

What you have just read is an "eye-opener" financial analysis about critically important retirement decisions, and how they can change when we take a holistic look at the future.

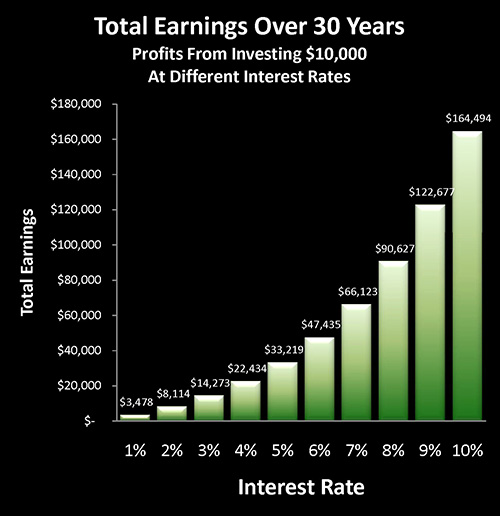

Retirement lifestyle is determined by both benefits and savings. Linked here is a related "eye-opener" that shows how the government's suppressing interest rates can reduce retirement investment wealth accumulation by 95% over thirty years, and how low interest rate policies are profoundly reducing standards of living for those already retired.

National debts have been reduced many times in many nations ─ and each time the lives of the citizens have changed. The "eye-opener" linked here reviews four traditional methods that can each change your daily life, and explores how governments use your personal savings to pay down their debts in a manner which is invisible to almost all voters.

The U.S. national debt is likely to change our daily lives in multiple ways over the coming decades, some of which are little understood by savers and investors. As shown in the first row of analyses in the matrix which is linked here, heavily indebted nations have major challenges when it comes to interest rates, inflation, financial stability and the ability to make Social Security and Medicare payments in full. As is examined in the second row of analyses, each of those national challenges can directly translate to life-changing personal challenges as well.

If you find these "eye-openers" to be interesting and useful, there is an entire free book of them available here, including many that are only in the book. The advantage to the book is that the tutorials can build on each other, so that in combination we can find ways of defending ourselves, and even learn how to position ourselves to benefit from the hidden redistributions of wealth.