The Half Trillion Dollar Crisis With The National Debt - A Near Miss For Retirement Accounts & Home Values

By Daniel R. Amerman, CFA

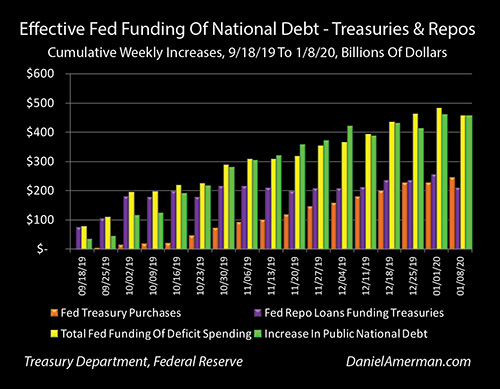

TweetIf the Federal Reserve had not created close to half a trillion dollars in new money and spent it to fund the growth of the national debt over the last four months - then there is a good chance that the values of your retirement account and home could be in freefall right now.

It was that close - but how many people are aware of that?

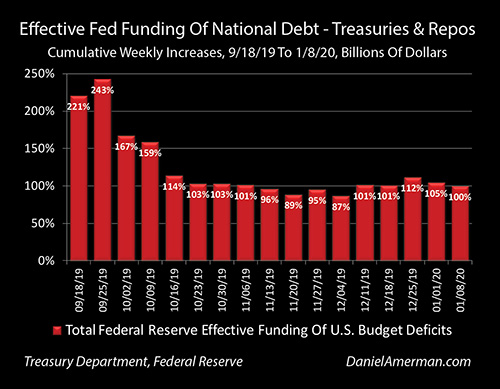

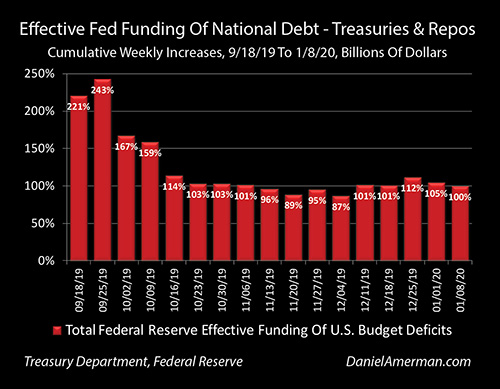

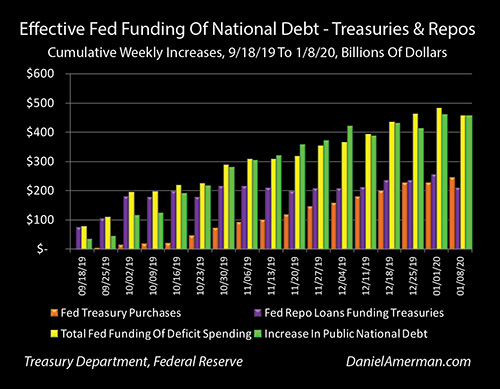

The problem was contained, at least for now. The net results as reviewed in this analysis are in fact higher stock market prices than ever, and higher home prices than ever. Those prices are not higher in spite of this near miss - but because the Federal Reserve did create the almost half trillion dollars, as shown in the graph below.

The basic issue is that the value of the nation's retirement accounts are closely tied to the Federal Reserve's ability to maintain very low interest rates. The Fed has vast powers over money and interest rates - but there is an even more powerful fundamental force that is acting against it.

The United States has a $23 trillion national debt.

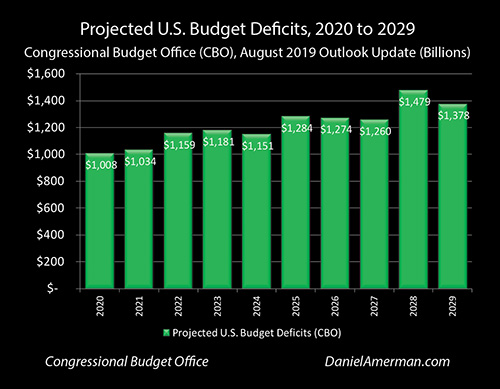

The United States government also fully intends to run over a trillion dollar deficit this year, as it did last year, and as it also intends to do every year into the indefinite future. This means that the government needs to borrow over a trillion dollars in new cash each year - which can be very difficult to do at artificially low interest rates.

Generally speaking, if a government that is already over $23 trillion in debt wants to continue to borrow over a trillion dollars in cash per year - it should expect to pay higher interest rates to do so. But if interest rates rise materially in any of the years ahead - there is a good chance that will crash both the stock and housing markets. That's the dilemma - and it's a doozy for all of us.

What has just happened was not an anomaly, or a one-off event. As the United States government continues to voraciously pull cash from the economy, the Federal Reserve simultaneously continues to have an existential need to keep interest rates at artificially low levels.

Those two extraordinarily powerful forces pushing against each other is an ongoing collision of titans - and every time a big collision occurs, there is a fork in the path.

With one fork, the Federal Reserve maintains control, and the general population can remain more or less asleep at switch, following conventional but outdated financial planning strategies that make no allowance for soaring national debts or a central bank using monetary creation to enforce the artificially low interest rates that create artificially high asset prices. Indeed, the average person can remain blissfully unaware that any of this is happening, and will perhaps even enjoy still higher stock and home prices, much as they have been doing over the last few months.

There could be a series of forks going the way of the Fed over time, but all it takes is just one fork going the other way - as could have happened the fall of 2019 - and the world changes for all of us. Fast rising interest rates could lead to plunging stock values, and the floor could fall out for prices for a decade or more, crushing retirement dreams that are based upon current historically high stock valuations. Home values could plunge if mortgage interest rates return to anything even close to historic averages, and millions of people could find themselves "underwater", owing more on their mortgages than their homes are worth.

The forks in the path could happen at any time. The forks will happen, again and again, as a necessary result of the extraordinary and steadily increasing pressure that a government with an unending need for massive sums of cash puts on interest rates and the financial system. How the forks are resolved each time, could end up being the number one determinant of financial security and actual standard of living in retirement for the tens of millions of people, most of whom have no idea any of this is happening.

In this analysis, we will take a look at the fork that just happened - and is still in process, it has not yet been fully resolved. This analysis is part of a series of related analyses, which support a book that is in the process of being written. Some key chapters from the book and an overview of the series are linked here.

Supporting Analyses - What Happened, The Price Implications

Beginning the week of September 16th of 2019, the underpinnings of the U.S. financial system and the funding of the national debt came into peril. The United States Treasury pulled over $100 billion out of the financial system to fund government spending, from the combination of corporate tax withholding payments and settlement dates for new Treasury obligations. As it turned out, the liquidity, the free cash floating around the system, wasn't there to the extent it needed to be. Interest rates very briefly spiked upwards to near 10 percent in the systemically important repo market.

The response of the Federal Reserve was to flood the markets with new cash, and to effectively fund 100% of the growth in the national debt, as shown in the graph above. I've written a series of analyses better explaining the specifics of what happened, including an update analysis that explores this recent 100% funding that is linked here. A much more detailed analysis which better explains repurchase agreements, the repo crisis, and the relationship to the national debt can be found in Chapter 18, which is linked here.

The purpose of this particular analysis is not to repeat those detailed analyses, but to consider the implications for investors, retirement account values, and home values.

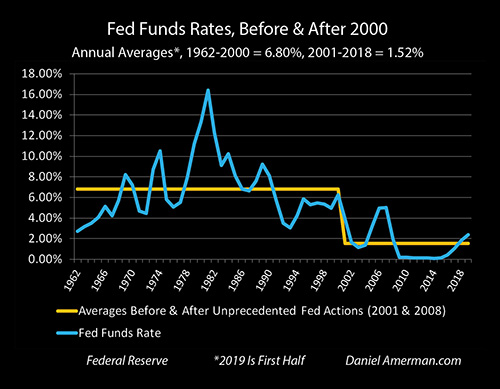

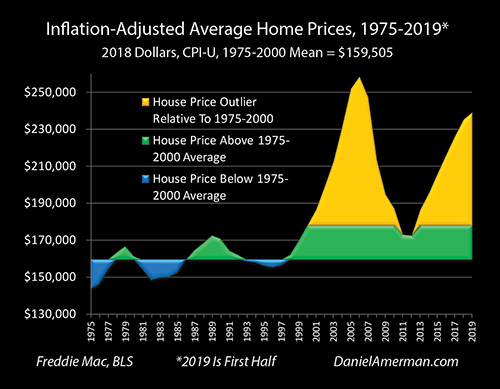

The second key bit of information needed is to fully understand the relationship between stock prices, bond prices, home prices and what the Federal Reserve has been doing with interest rates since 2001. As shown in the graph above, the Federal Reserve has forced interest rates to levels that are far below historic averages over the last almost 20 years, and particularly since 2008.

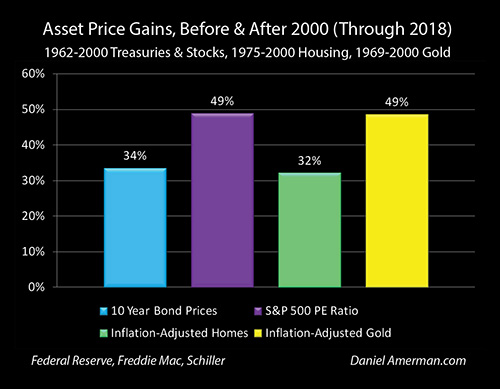

We have also seen some of the highest bond prices, the highest stock valuations for corporate earnings, and the highest values for homes that we have ever seen over those same years. As explored in much more detail in Chapter One (link here) and the chapters that follow, this is no coincidence, but it is the very low interest rates that have created the very high asset prices for stocks, bonds, and real estate.

Fork Implication One: The National Debt Nearly Changed Your Life

With a fork in the path, one of two directions is followed. When the Treasury department tried to pull too much money out of the financial system in September of 2019 - and as it has continued to do in each month since that time - it created a fork in the path.

With one fork, there is a massive intervention, and there is no damage to interest rates and markets. That is exactly what is shown in the graph above - the Federal Reserve has through the combination of purchasing Treasury obligations and funding repo loans that are themselves collateralized by Treasury obligations – funded exactly 100% percent of the growth of the national debt through January 8, 2020.

This probably all sounds like fairly esoteric stuff – why should anybody care? Let's consider the other path - if the extraordinary and fantastic had not been done, then the U.S. government's pulling staggering sums of cash out of the financial system would have increased interest rates, perhaps significantly - which is exactly what is supposed to happen with free markets.

If interest rates had jumped upwards, including mortgage interest rates, then for the reasons developed in Chapter One and the rest of the free book, the fundamental principles of finance show us that stock prices, bond prices and home prices should all be falling. When we further take into account that today's very elevated asset values are based on essentially 100% confidence by the markets that the Fed does have interest rates under control, if that confidence had been lost - asset prices would very likely be plunging right now.

The attitude of the general public towards the national debt is fascinating, as is the treatment by the media and politicians. Ten years ago, it was a huge problem, and one of the hottest political issues in the country. And then, even as the debt continued to climb, it is as if the issue almost disappeared from the public discussion.

We have crossed a threshold, the fast growth in the national debt can at any time collapse the value of the nation's retirement accounts and homes. Indeed, the natural results of trillion dollar a year deficits on top of a starting $23 trillion national debt is to send interest rates sharply upwards even while stock, bond and home prices go plunging downwards - this is how a free market would naturally react to a government spending too much.

This could happen any month, the shock waves would likely roll out on a global basis, it could change the lives of everyone reading this... and yet, it seems like no one is even paying attention. Perhaps there is a "Peter & The Wolf" principle involved, everyone got worked up a decade ago, the world didn't end after all, and now everyone is complacent about it.

Ironically, the "Wolf" really is there right now, just outside the front door, and a $23 trillion "Wolf" in early 2020 is in fact a far, far more dangerous problem than the $11.9 trillion "Wolf" at the end of 2010. However, even as the national debt has grown to a size where any given day it could fundamentally change our lives, fewer people seem to be paying attention any more, or to care about the debt. Or, at least so it seems based upon reading the media and listening to politicians of both parties. Polls do show this continues to be a major concern for many average people, but somehow the national discussion seems to be almost entirely missing.

The most ironic part of all is that if the surging national debt can potentially collapse the values of our retirement accounts or homes at any time, then it should be impossible for an intelligent and informed person to make good decisions about investments, home purchases and retirement financial planning without taking the national debt into account, making it one of the centers of their decision process. But how many people even consider about the national debt at all, as even a minor factor, when it comes to retirement financial planning?

Fork Implication Two: The Federal Reserve Just Changed Your Life

The core issue is that if the Federal Reserve had not intervened and had not created this half trillion dollars to fund the US national debt then stock prices, retirement account values and home prices would all likely be in freefall right now.

Yet, the Federal Reserve did use its extraordinary powers in ways that were never done before 2008, and as shown above when comparing the yellow bars of the effective funding of the growth in the national debt, and the green bars of the actual growth in the national debt - the Federal Reserve has effectively completely funded the growth of the national debt over a period of four months.

This brings us back to the fork in the path. A major crisis loomed (even if the general public was not aware), the Federal Reserve aggressively intervened, it has continued to aggressively intervene on a weekly basis - and the net result is new record stock prices, new record retirement account values and new record home prices.

If the other path had been followed, if the Federal Reserve had not aggressively intervened, and if free markets had set the interest rates for how much the federal government should have to pay in order to get that much money - today's record stock prices, retirement account values and home prices would all likely be in freefall.

So, the fork in the path, the difference for tens of millions of investors and homeowners between record wealth and financial devastation, comes down to the Federal Reserve's aggressive and unprecedented market interventions.

Rationally speaking, it would seem that if what the Federal Reserve does is the difference between the two forks in path, between record wealth and financial devastation, should not every intelligent and informed person making investment, financial planning, and home decisions, be keenly focused on the Federal Reserve, what it is doing, and how it is determining stock, bond and home prices?

My observation is that there is a really big discrepancy here between the institutional markets and the general public. The professional investors who invest large sums of money for a living are keenly, keenly focused, on exactly what the Fed is doing day by day, and week by week, because these sophisticated investors fully understand that today's investment and real estate markets are very different from those of previous decades, with the active role of the Federal Reserve being one of the biggest differences.

But the general public? Most individual investors seem to have no idea, and understanding how the Federal Reserve is changing and completely distorting stock, bond and home prices is something that is not even remotely being taken into account.

This is understandable - but is it wise? Is it financially prudent?

Fork Implication Three: The Specifics Of Monetary Creation Just Changed Your Life

The third personal implication for us all from the fork in the path would likely be considered the most esoteric of all by many people - but it is also the most important.

If the problem with the national debt that the nation experienced beginning in the fall of 2019 had happened before 2008 - the Federal Reserve couldn't have done anything about it. The Fed simply didn't have the money to come up with close to half a trillion dollars in that short of order to fund the national debt.

So, the Federal Reserve would have had to rely on private investors to fund the growth in the national debt. Those investors would have rationally demanded higher interest rates. The highly elevated stock, bond and home prices would likely be falling fast today.

The only reason the fork exists at all - as well as today's record stock and home prices - is the Federal Reserve started doing something in 2008 that it had never done before. It started just creating the money to solve financial problems - starting with keeping the financial crisis of 2008 from collapsing the global banking system.

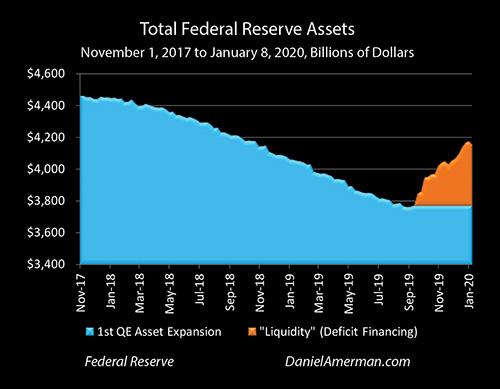

The orange area in the graph above shows the extraordinary surge in the assets owned by the Federal Reserve since the beginning of the current crisis. The Federal Reserve has in a very short period of time purchased a tremendous amount of Treasuries, while funding many more through extending loans for other parties to buy Treasury obligations.

Before 2008 - the Federal Reserve couldn't have done this. Since 2008, the Federal Reserve has just created the money when needed.

Had the Federal Reserve not been able to do so - the financial security of almost every person reading this would likely be in a very different place right now. Indeed, if we were to "rerun" the last decade - and take away the Fed's seemingly magical ability to just create money as needed and move the markets - then the last decade would have likely

been almost entirely different.

Now, the really interesting part is that the Federal Reserve does not actually run a printing press, or wave a magic wand to create the money. Those or the equivalent have been tried in the past in many nations, and the result has always been high rates of inflation, which hasn't happened this time.

Instead, the Federal Reserve has been using a complex, careful and limited process of reserves based monetary creation (which I sometimes refer to as "Benjamin Bernanke's Magic Money Trick"). QEs or quantitative easings aren't what really matter here, they are how the money is spent, what really matters - and limits the process - is where the money actually comes from, and that is primarily from reserves based monetary creation.

I know, I know, that may be sounding a little technical - but I'm not the one who decided to play complex games here, and base the integrity of the U.S. financial system, the value of lifetimes of savings and the standards of living in retirement for many millions of people on an experimental monetary tool, that is unproven over the long term. That was the decision of the Federal Reserve.

Even if the vocabulary may sound a little complex, the bottom line is fairly basic. So long as the Fed can continue to use this complex underlying process to SHAZAAM!! create what seems to be trillions of dollars out of thin air as needed in order to fund the national debt or stabilize the economy or the markets, without triggering high rates of inflation - then today's very elevated stock, bond and home prices can potentially continue and perhaps even go quite a bit higher over the coming years.

If the process fails at some point - then the floor drops out, with life changing implications for the nation.

There's a problem - the current extremely high rate of growth in the national debt. The Federal Reserve has limits on how much of the national debt it can fund without exceeding the boundaries of the very careful and controlled process through which monetary creation can be used to fund the debt without triggering high rates of inflation.

The Federal Reserve is using up those limited abilities, right now in real time, as it struggles to reestablish control, and keep the growth in the national debt funded at the very low interest rates needed to maintain high stock, bond and home prices, without coming up with all of the money itself.

So, if the only reason that the fork in the path exists at all is the ability to fund the national debt using monetary creation in a new process that didn't exist in the U.S. before 2008, and the loss of that limited ability could have potentially catastrophic consequences for stock prices, retirement account values and home prices - should the average person be... maybe... taking that into consideration when it comes to financial planning decisions?

How many people are?

The Bigger Fork In The Path For Us All

As we look to the future, then we could continue to have problems - and the Fed could continue to contain the problems and prevent general crisis through the most heavy-handed interventions yet.

As explored in the book, this could lead to what most people would consider to be a glorious scenario (for so long as it lasts) with the highest retirement account values and home prices ever seen, perhaps far better than even today.

Or, if the Fed loses control, prices could go into freefall along with the economy, and we could end up with a recession and market crisis that could make 2008 look like a walk in the park on a sunny day.

The difference between the two paths comes down to three factors:

1) The Fed’s ability to use monetary creation; to

2) maintain artificially low interest rates; while

3) funding up to $1 trillion a year that the Federal government is spending beyond what it is taking in from taxes.

Whether the Federal Reserve succeeds or fails in this extraordinary attempt to fund massive deficits via monetary creation could be the number one determinant of financial security and standard of living in retirement in the future.

Yet, ironically enough, almost nobody is looking at this, and this is particularly the case when it comes to average individuals. This book and this series are intended to help close that gap, and I hope that you have found them useful so far.

Learn more about the free book.

********************************************

My newest set of DVDs is "Gold Out Of The Box, 2020s Edition", and it contains quite a bit more about the limitations of "Benjamin Bernanke's Magic Money Trick" and why the 2020s are likely to be very different for precious metals investors than the 2010s. More about the DVDs can be found in the brochure, linked here.