How Planned Fed Rate Increases Impact The National Debt & Deficits

By Daniel R. Amerman, CFA

TweetThe United States national debt is currently about $20 trillion, and the federal government is paying some of the lowest interest rates in history on that debt. The Federal Reserve has raised interest rates four times now, and is publicly considering another five increases, for a total increase of roughly 2.25%.

What will be the impact on the national debt and deficits if the interest payments on the debt jump upwards because of the actions of the Fed?

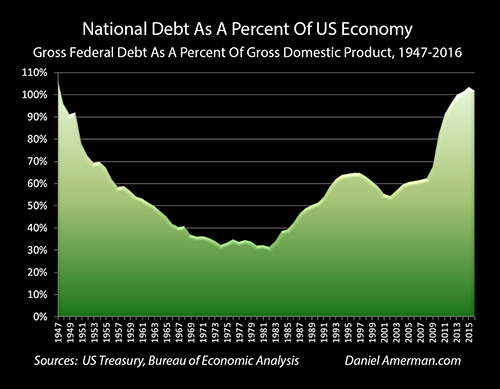

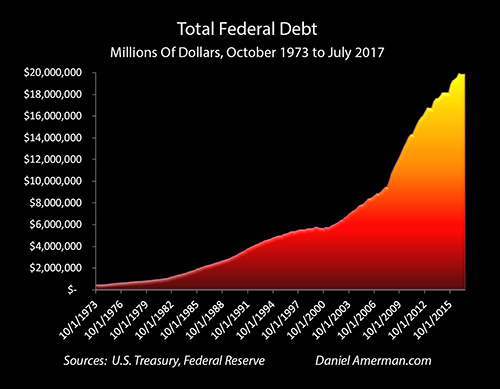

We have a history in recent decades of the Federal Reserve going through cycles of increasing and decreasing interest rates. However, these occurred when the national debt was much smaller than it is today, both in dollar terms and when compared to the size of the economy, as shown above.

This analysis examines the impact of the Fed's recent and planned future rate increases on a national debt of $20 trillion. Over time, there is indeed a powerful impact on annual national deficits and the total debt, as well as the future ability of the United States government to make promised Social Security and Medicare benefits in full.

A nation that is $20 trillion in debt has fundamental constraints when it comes to interest rates that would not exist at lower debt levels. These constraints are likely to have a powerful influence on future yields and prices in all the major investment categories, including stocks, bonds and real estate.

This analysis is part of a series of related analyses, an overview of the rest of the series is linked here.

Analysis

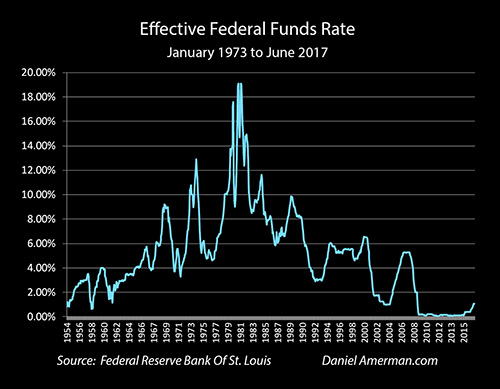

1) As shown above, effective Federal Funds rates were reduced to the lowest levels in modern financial history in the midst of the financial crisis of 2008. After remaining at record lows for seven years, with targeted rates of 0.0% to 0.25%, there have been four increases of 0.25% each between December of 2015 and June of 2017. This has brought the current target for overnight rates to between 1.0% and 1.25%.

The Fed is currently discussing raising rates by another 0.25% in 2017, and possibly making four more increases of likely 0.25% each in 2018. The amount and timing of such increases are never certain in advance, but if this or something like it happens, then there will be a total rate increase of 2.25% between the end of 2015 and the end of 2018.

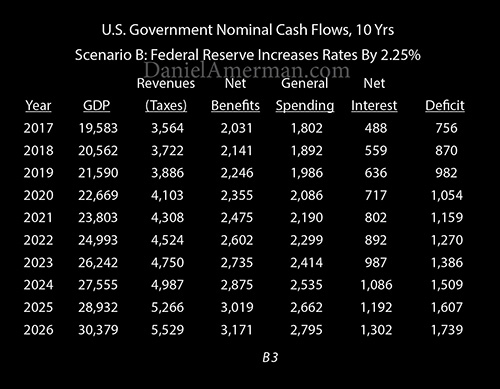

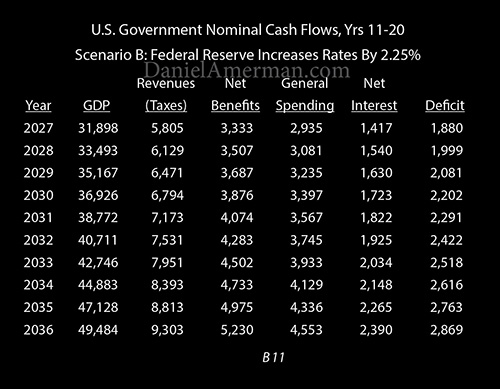

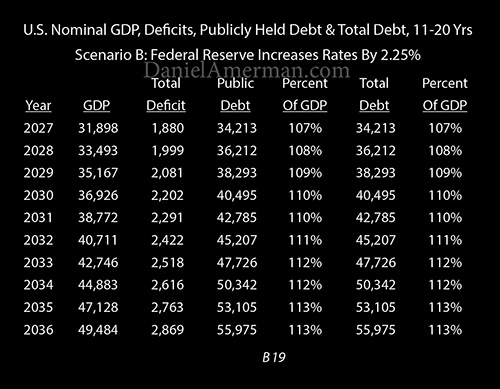

In this analysis, we will use two scenarios to examine how the Federal Reserve interest rate increases could increase future federal government deficits and the level of the national debt. For the base scenario "A", we will leave the average interest rate paid on the national debt at its current level of about 2.25%. For scenario "B", we will increase rates by 2.25%, up to a total average rate of 4.50%.

2) In understanding how the Fed increasing interest rates impacts the budget, it is critical to keep in mind that the national debt has short term, medium term and long term components, with a weighted average life of about 5.8 years. So rate increases by the Fed initially fully impact only short term borrowing, and then slowly increase the average interest rate paid by the government as medium term and long term bonds gradually mature and are rolled over at the new and higher interest rates. This analysis uses a simplified term structure for the federal debt, with an average life of 5.5 years, and assumes that all rates move together.

3) To understand the impact of interest rate increases in isolation, Social Security, Medicare and Medicaid spending is kept level as a percent of the economy at current rates. In practice, these benefits are expected to rise sharply as the Boomers grow older, which will sharply increase deficits and debts from those shown.

Deficits Over The Next Ten Years

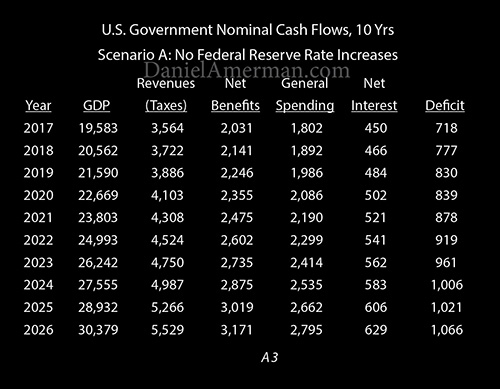

4) Scenario A, as shown above, is our base scenario, with no interest rate increases.

Scenario B shows the impact of rates going up by 2.25%. The initial increases in interest payments and the deficit are low - because most of the national debt is not initially affected. Interest payments are "only" $38 billion greater in the first year. The difference in the deficit is still less than $100 billion per year by the time we are two years out.

What this shows is that Federal Reserve has a great deal of latitude to move rates around in a moderate range over the next several years, without having any major initial impact on annual deficits or the size of the national debt. The interest paid on the national debt does not prevent the Fed from raising interest rates in 2017 and 2018 - so long as we restrict ourselves to the short term.

However, as time goes by, more and more of the "old" debt matures and is rolled over at the new and higher interest rates - and then the cost to federal government starts to grow rapidly.

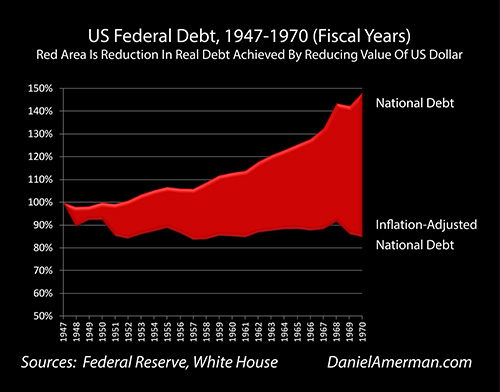

5) By five years out, the Federal Reserve raising rates by 2.25% means that the United States government is paying $802 billion per year in interest expenses, rather than $521 billion. So the Fed will have increased the annual cost of the national debt by 46%, or $281 billion per year compared to what interest payments would have been.

6) By fiscal year 2024, eight years out, the actions of the Federal Reserve would result in the government paying an additional $503 billion per year in interest payments ($1,086 - $583). So if the Fed carries through and maintains at that level, within eight years the incremental increase in the annual interest payments of the federal government will exceed the current $450 billion total annual interest expenses of the government.

7) By 2026, in the tenth year of the analysis period, the annual deficit would be $673 billion greater as a result of the Federal Reserve's actions. This means that within ten years the cost of higher interest rates will be an increase in the deficit by an annual amount that is almost equal to the current total deficit.

8) Interest rates impact every corner of the financial markets, whether we are talking about bond prices, stock prices, real estate prices, or the value of retirement savings accounts. Whether the Fed carries through and raises interest rates by a total of 2.25% from the floor, or stops before rates get that high, or raises and then lowers - will have profound implications for every part of the financial markets.

The National Debt Over The Next Ten Years

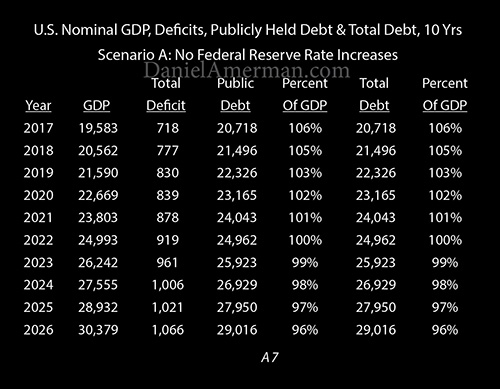

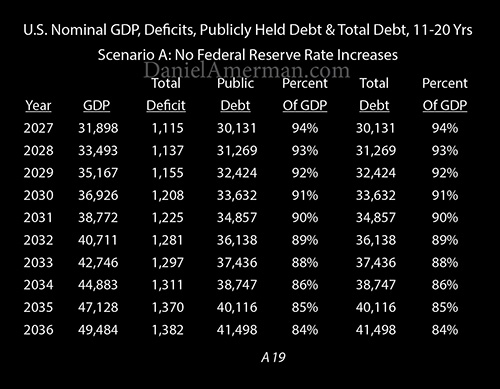

9) The Scenario A schedule above shows the annual national debt each year, in billions of dollars, with no increase in interest rates.

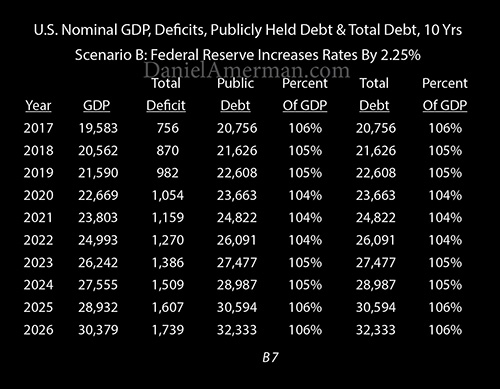

The Scenario B schedule above shows how much the national debt would increase in each year if the Federal Reserve does raise rates by 2.25%. By 2021 the national debt is $779 billion greater than it would have been with no increases. The Fed increasing rates would produce a $3.3 trillion increase in the national debt by the end of 2026, with the total debt rising to $32.3 trillion instead of $29 trillion.

Comparing these number is of critical importance. With just simple arithmetic, we would expect the increased deficit in 2026 to be 2X greater than it is in 2021 - but instead it is more than 4X greater. This is the result of three factors coming together:

A) The continuing rolling over the current national debt, as ever more medium and long term debt matures and is replaced with higher rate debts.

B) The increased interest payments on a larger national debt.

C) Most importantly, we are starting to see higher interest payments on money that was borrowed to make higher interest payments.

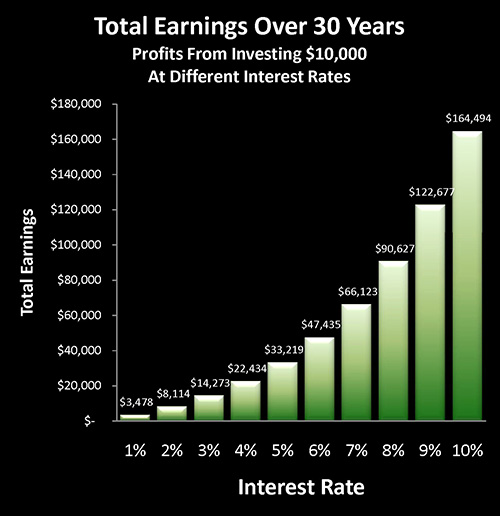

When running deficits where the money is borrowed to make all interest payments (as it is), the federal government has a compound interest problem. Compound interest is much more powerful at higher interest rates than lower interest rates. And by increasing interest rates - the Federal Reserve creates a much more dangerous compound interest problem for the United States government.

Deficits Over The Longer Term

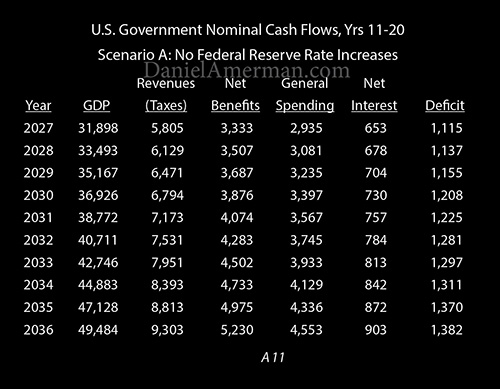

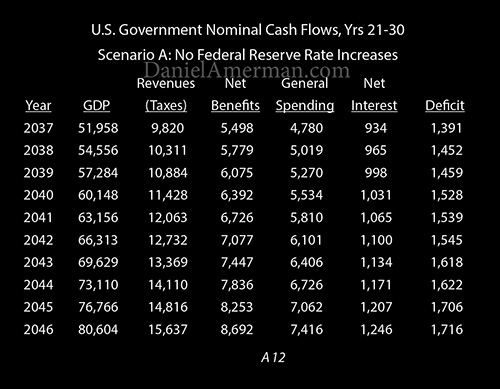

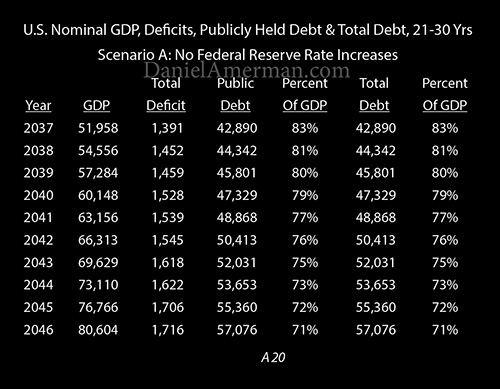

10) As shown in Scenario A above, even if the Fed had not increased interest rates at all, the deficit would still steadily grow over time, meaning an ever larger national debt, and ever larger interest payments on that debt.

11) The Federal Reserve acting to increase interest rates means that by fiscal year 2031, fifteen years out, annual deficits are up to almost $2.3 trillion a year, which is an increase of over $1 trillion per year relative to the no interest rate increase scenario.

12) The impact of Fed rate increase by 2036, 20 years out, is to more than double the annual deficit. Even with no increase in rates, the annual deficit would have been almost $1.4 trillion per year, but because of the 2.25% increase the annual deficit is over $2.8 trillion per year instead.

13) The initial impact on deficits of the Federal Reserve raising rates is very small, because it is only a little over 2%, and most of the national debt is not yet impacted. However, over time and unless there is a rollback - even a 2.25% increase in interest rates is by itself enough to be financially crippling for a nation that is starting out at about $20 trillion in debt.

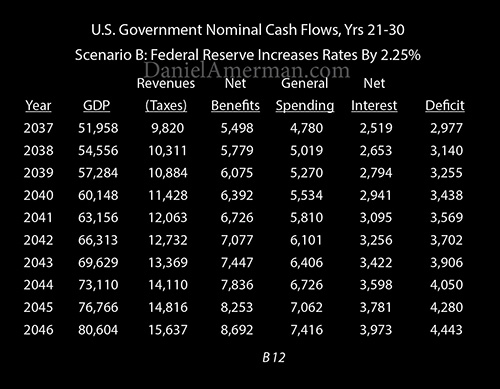

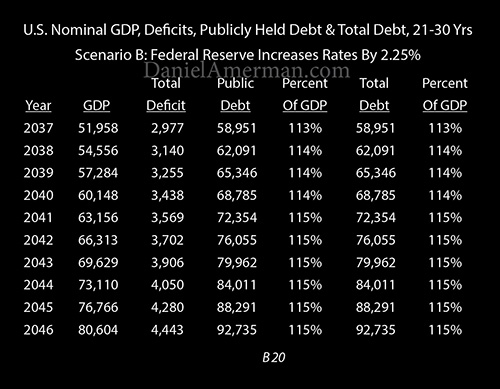

14) With Scenario B, interest payments on the national debt have reached $3 trillion per year by 2041, or 25 years out, which creates an annual deficit of about $3.6 trillion. When we compare the scenarios, the annual deficit is up by over $2 trillion a year - solely because of the Fed rate increase. This is $2 trillion per year that is not available for education or defense - or for Social Security or Medicare - because the interest on the debt must be paid.

15) Most people likely see little connection between the size of the national debt, or Federal Reserve interest rate changes, and their day to day quality of life and standard of living. And if we look at just one point in time, the relationship may indeed seem abstract or theoretical.

But yet, the financial mathematics that drive this over time are both fundamental and overwhelming. And paying different and higher rates on a starting $20 trillion national debt is over the long term enough to change the day to day quality of life and standard of living for most of the nation. Even if the process by which this occurs is never noticed by the average person, or discussed in an election.

And the farther out in time we go, then the more powerful this becomes. By 2046, the increase in deficits caused by increased interest rates is up to over $2.5 trillion per year, which is an increase of 159% over Scenario A.

Long after the debt has rolled over, there is still a continuing acceleration in the increase in the deficit, that is being driven by the difference in compound interest between 2.25%, and the 4.50% that is the Fed's target (assuming the average rate on the debt increases in synch with the effective Fed Funds rate).

The National Debt Over The Longer Term

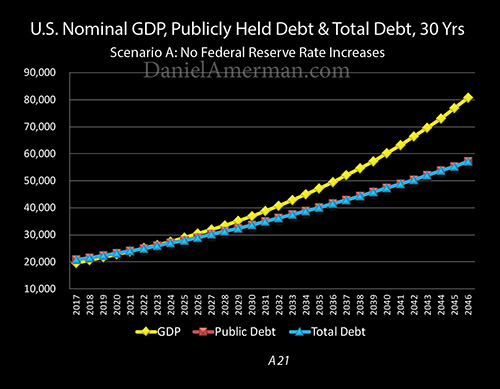

16) With the passage of time, ongoing deficits, and inflation, the national debt would be expected to reach almost $35 trillion by 2031, even with no interest rate increases. This seems very high, but so long as there is sufficient economic growth (which is a big "if"), then the debt would actually be more affordable than it is now, as a percent of the national economy.

However, with the Federal Reserve's interest rate increases - if they all go through and they are (on average) maintained - the national debt grows to almost $43 trillion, which is an increase of almost $8 trillion over the lower rate scenario A.

Importantly, by the time 2036 is reached - the national debt is over $14 trillion greater as a result of the Federal Reserve actions.

So it takes 15 years to reach an $8 trillion difference. But it only takes another five years to reach a $14 trillion difference. The increase in the increase of $6 trillion is 75% of what took 15 years to achieve - but it happens in only 5 years.

This acceleration is another example of the long term dangers of increasing interest rates on a very high national debt. It occurs because 4.5% interest rates have a much higher compounding rate than 2.25% interest rates, and the farther out in time one goes, the more dramatic the difference.

Now the average person may not think much about compound interest, if they understand it at all. And the difference between exponential compounding at a 4.50% rate versus a 2.25% rate might seem like truly obscure and geeky stuff.

But in fact, given a larger enough starting debt (which we have), and enough time, the difference can become life changing for the citizens of an entire nation. People may not understand the process of how they are getting there. But the necessary reductions in government payments in all categories - or increases in taxes - that may be caused by this will likely be felt by all.

17) The farther out in time we go, the more powerful the impact. The Fed's rate increase would produce a debt that is $23 trillion greater 25 years out - an increase of $9 trillion in five years. And moving rates up 2.25% today and keeping them up would produce a deficit that is $35 trillion greater in 30 years - an increase of $12 trillion in those five years. The total national debt at this time would exceed $92 trillion, and would be rapidly closing in on the $100 trillion mark.

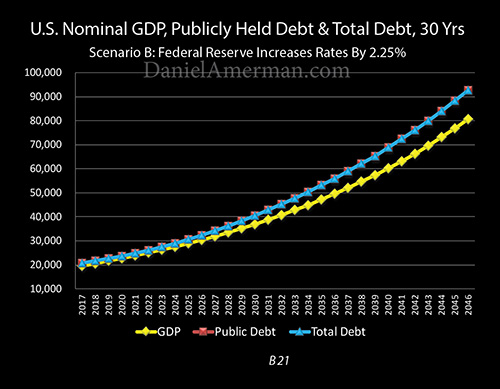

The stark difference between the two scenarios is visually obvious. With no Fed rate increases, the economy accelerates away from the national debt over the years.

But with the Fed's potential 2.25% higher rates, the reverse happens, and it is the debt that begins to accelerate away from the economy over time.

Conclusions

18) When the United States national debt effectively doubled between 2007 and 2014 as a result of the government actions taken to contain the damage from the financial crisis - our financial futures changed as well.

Over the short term of the next 1-3 years, the weighted average life of the national debt does indeed allow the Federal Reserve a great deal of latitude when it comes to raising interest rates. This is because most of the national debt is not initially impacted.

Within 5-11 years, however, maintaining higher interest rates comes at a very high cost as ever more debt rolls over at the new interest rates, and this would have the effect of doubling the interest payments on the debt, while drastically increasing the size of the annual deficits.

When we go to the longer term of 15-20 years and beyond, the Fed's stated plans would create a financial catastrophe scenario, because of the higher compounding rate of 4.5% versus 2.25%.

When we look at future stock prices, or bond prices, or real estate prices - interest rates will be of crucial importance. The timing aspects identified in this analysis have critical implications for the price paths that are likely to be traveled by all the major asset classes in the short and medium term.

Over the longer term, we know that the United States government has an existential interest in keeping rates low for many years to come. Which means that the future is indeed likely to be different from the past when it comes to price and yield performance across all the major investment categories.

19) When looking at this future, it is important to keep in mind that nothing in this analysis is likely to come as any sort of surprise for the Federal Reserve. As professional macroeconomists they know with clarity what the general public does not, which is the relationship between large national debts, interest rates and inflation. As explored in the analysis linked here, oversized national debts have been brought under control in many nations before - including the United States in the post-World War II era - and the formula used by economists is not at all friendly for many traditional investment strategies.

20) When it comes to individuals, there is likely no group that will be more impacted by the increase in the national debt than current and future retirees and retirement investors. This is true when it comes to the value of retirement investments as well as the levels of retirement benefits.

The reliable compounding of investment income is the mathematical core which traditional financial planning for retirement is predicated upon. Yet, as explored in detail in the analysis linked here, the doubling of the national debt created a profound conflict of interest between the government and the interests of retirement savers. The very yields that are traditionally assumed to be available to reliably create wealth for retirement investors - also financially cripple the U.S. government. And the suppression of yields that preserves the financial viability of the government - financially cripples many retirement investment strategies.

21) To isolate and make understandable the impact of potential Federal Reserve interest rate increases, many simplifying assumptions were used in this analysis - and perhaps the largest one was that Social Security and Medicare payments would remain level as a percentage of the national economy.

However, we already know that this is not the case. Just the aging of the Boomers means that the government expects the costs of Social Security and Medicare to skyrocket in the coming years, with potentially transformative effects by as soon as the early 2020s.

While few people are taking this into account, there is a close relationship between Social Security and Medicare and interest payments on the national debt. Dollars that go to make higher interest payments are not available to make benefit payments. Conversely, dollars that go to make rapidly increasing benefit payments in full - are not available to make interest payments on a national debt that is simultaneously also rapidly increasing.

The conflict of interest is absolute - and understanding the implications is of critical importance for those who are planning on funding their retirements with the combination of private retirement savings and Social Security and Medicare benefits.

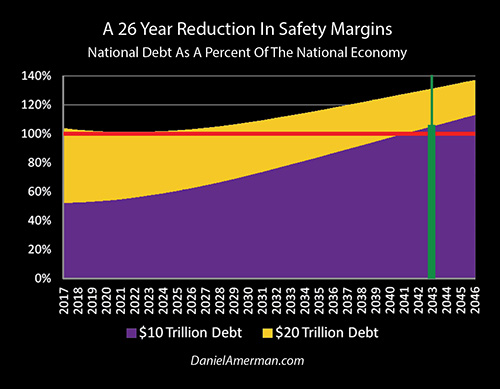

As explored in the analysis linked here, the doubling of the national debt removed 26 years of safety margin for the Social Security and Medicare programs. If the debt had not doubled, then every dollar of Social Security, Medicare and Medicaid payments could have been paid in full until 2043, and the nation still would have been in better financial shape for the entire time than it is today.

What is missing from the dialogues on the national debt and retirement benefits is that those are not two separate issues - but are two parts of the same issue. The personal cost to you of the rapid doubling of the debt is the lost retirement security which you could have otherwise enjoyed in the 2020s, 2030s and 2040s. The difference could end up changing your day to day standard of living and entire life during those decades.

When the national debt did rapidly double, even as the largest generation in U.S. history neared retirement - the future changed for the nation. What is realistic to expect for retirement investment income changed. What is realistic to expect for Social Security and Medicare benefits changed. And those who wish to be realistic with their personal plans can either adjust for the changes - or they may be facing a long series of "surprises" that could change their day to day quality of life for years or even decades to come.

This analysis is part of a series, an overview of the rest of the series is linked here.

What you have just read is an "eye-opener" financial analysis about critically important retirement decisions, and how they can change when we take a holistic look at the future.

What you have just read is an "eye-opener" financial analysis about critically important retirement decisions, and how they can change when we take a holistic look at the future.

Retirement lifestyle is determined by both benefits and savings. Linked here is a related "eye-opener" that shows how the government's suppressing interest rates can reduce retirement investment wealth accumulation by 95% over thirty years, and how low interest rate policies are profoundly reducing standards of living for those already retired.

National debts have been reduced many times in many nations ─ and each time the lives of the citizens have changed. The "eye-opener" linked here reviews four traditional methods that can each change your daily life, and explores how governments use your personal savings to pay down their debts in a manner which is invisible to almost all voters.

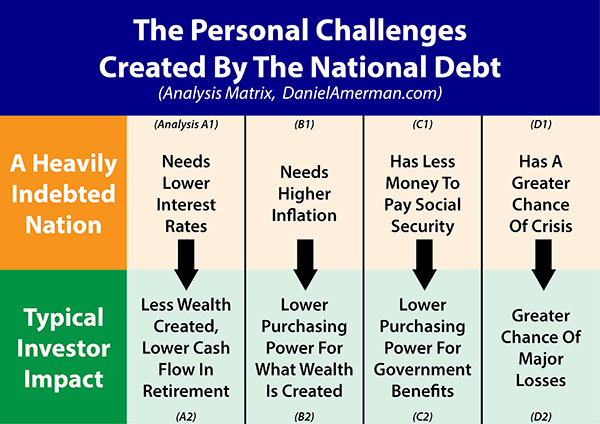

The U.S. national debt is likely to change our daily lives in multiple ways over the coming decades, some of which are little understood by savers and investors. As shown in the first row of analyses in the matrix which is linked here, heavily indebted nations have major challenges when it comes to interest rates, inflation, financial stability and the ability to make Social Security and Medicare payments in full. As is examined in the second row of analyses, each of those national challenges can directly translate to life-changing personal challenges as well.

If you find these "eye-openers" to be interesting and useful, there is an entire free book of them available here, including many that are only in the book. The advantage to the book is that the tutorials can build on each other, so that in combination we can find ways of defending ourselves, and even learn how to position ourselves to benefit from the hidden redistributions of wealth.