How The National Debt, Interest Rates, & Inflation Can Change Investment Outcomes (Series Overview)

By Daniel R. Amerman, CFA

TweetCan A Nation $20 Trillion In Debt Afford Higher Interest Rates & Will This Change Our Retirements?

The United States government is heavily in debt, and is going still deeper into debt as the result of high annual deficits. Because interest has to be paid on that debt, a sustained increase in interest rates could send both deficits and the debt spiraling upwards out of control.

At the same time, retirement investors and other savers badly need higher interest rates to build wealth. Indeed, even after recent increases, interest rates are still at some of the lowest levels in modern history.

What is explored in the analysis linked here is that record setting national debts and very low interest earnings for savers are not separate issues but rather they're two sides of the same coin. For there is an extraordinary financial conflict of interest between savers and the government, as explored in this introduction to the series.

When we understand this essential point, we can see that massive national debts dramatically and directly impacting the lives of many millions of people is not something to anticipate in the distant future, but rather it is happening right now just as it did last year, and just as it will likely happen again next year.

The Potential $54 Trillion Cost Of The Fed's Planned Interest Rate Increases

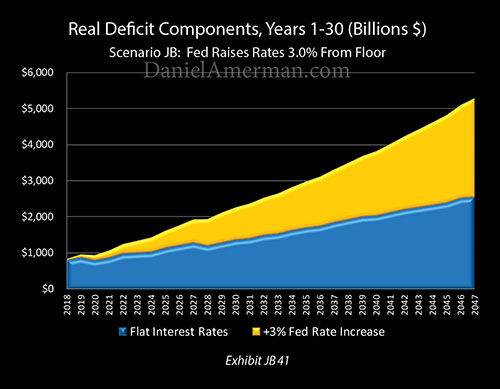

This analysis uses two scenarios to examine how the Federal Reserve's plans to continue to raise interest rates could increase future federal government deficits and the level of the national debt. For the base scenario "JA", the average interest rate paid on the national debt is left unchanged at its current level of about 2.25%. For scenario "JB", interest rates are increased by 2.25%, up to a total average rate of 5.25%.

As shown in the graphic above and as developed in the analysis linked here, the Federal Reserve increasing interest rates will have a building and eventually explosive impact on the annual deficits that are run by the federal government. The blue area shows what annual deficits would be if the Fed were not raising interest rates, and even in inflation-adjusted terms those would eventually climbing to over $2 trillion a year anyway, primarily as a result of increasing Social Security and Medicare costs.

The yellow area is the increases in deficits that occur solely as a result of the increases in interest rates. As can be seen, the initial impact is small, but the damage quickly escalates. Near $2 trillion a year deficits are now reached in ten years, and then rapidly increase to over $3 trillion, then over $4 trillion, then over $5 trillion a year by 2046. In later years, this is more than twice what the deficits would be without the rate increases.

The increase in deficits sends the national debt soaring upwards - even as the interest rates paid on those larger debts are higher than they otherwise would be. This then creates a compound interest problem for the United States government. As analyzed herein, the Fed increasing interest rates by itself could increase the national debt by an additional $54 trillion in thirty years (in nominal dollars).

The Wealth Machine That Rising Interest Rates Create & The Conflict With The National Debt

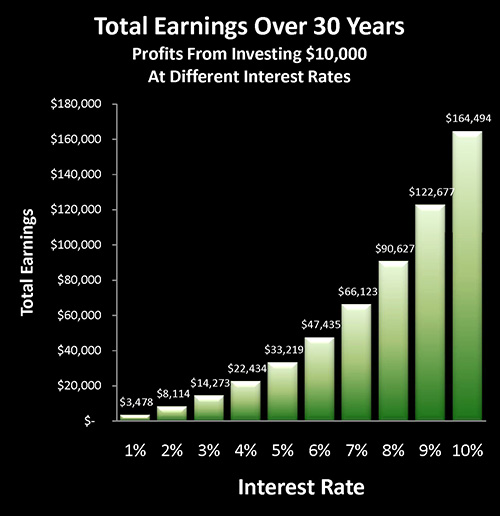

Compound interest is an extraordinarily powerful financial tool, and reinvesting the cash flows received from investments has historically been the single most reliable way of building wealth over the long term.

However, compound interest is not a constant - it is not always of equal power and it is not always available. The near zero percent interest rates of the decade since the financial crisis of 2008 essentially wiped out the historical norm of individual investors being able to create wealth by simply reinvesting their interest payments again and again over the years.

The times have been changing recently, however, and the Federal Reserve is currently rapidly increasing interest rates. As explored in the analysis linked here, if the Fed carries through with its planned interest rate increases through the year 2020 and then keeps rates at that new level - it will be sufficient to cause the return of a wealth creation "miracle" for every saver and investor in the nation.

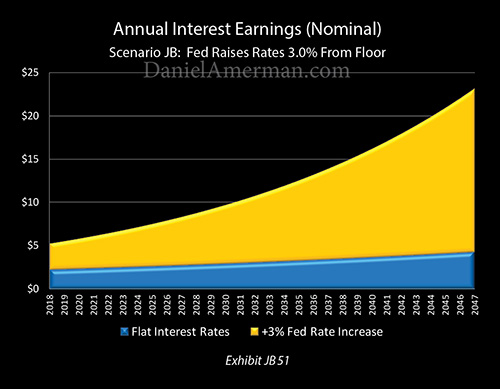

The graph above represents interest earnings for a $100 investment over 30 years. The blue area is where we were with bottomed out interest rates over most of the last ten years. The gold area shows the explosion in wealth for the average saver that will return if the Fed carries through with raising rates and keeps them there.

The sharp upward tilt in the top of the gold area as it pulls away from the blue area with increasing speed - is the return of the near miraculous power of compound interest.

Individual Financial Decisions & The Investment Implications Matrix

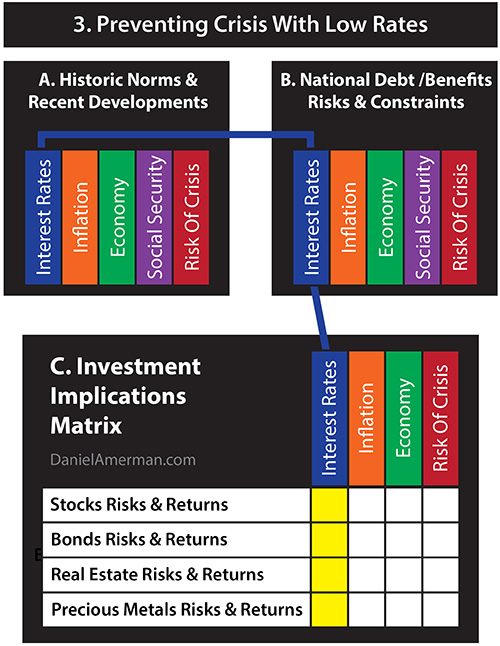

The purpose of the Investment Implications Matrix linked here, is to provide a useful analytical framework for how to make better financial and investment decisions which practically include the $20 trillion U.S. national debt and the coming multitrillion dollar growth of the Social Security and Medicare programs.

The norm is to treat the national debt, deficits and future total Social Security and Medicare payments as being purely political issues, rather than financial planning issues.

However, the problem with viewing these issues as purely political is that we risk focusing entirely on something that we individually do not have any control over, while missing the potentially life changing implications for something we do have individual control over - which is our personal financial decisions.

Reality is holistic. There is not one world where investments endlessly repeat their historical performance from previous decades, and an entirely different and isolated world where the United States government has some new and huge financial issues. Instead, our personal financial outcomes will be found in one world, where the national debt and Social Security and Medicare promises may become dominant factors for all investment asset categories, including stocks, bonds, real estate and precious metals.

Higher Interest Rates May Force Higher Inflation Rates

The Federal Reserve acting to increase interest rates would ordinarily create severe financial problems for the government over time, due to sharply rising interest payments on the debt. There is, however, a loophole for the federal government.

As examined in the analysis linked here, so long as rates of inflation increase - then the United States government can remain financially healthy while increasing interest rates. Indeed, it could even be said that for heavily indebted nations - higher rates of inflation are mandatory with higher interest rates, all else being equal.

Because of the particular exposure of retirees to inflation, the governmental need for higher inflation rates to enable higher interest rates may have a dramatic impact on retirement investments and standards of living.

Five Economic Tools That Use Our Personal Savings To Pay Down National Debts - Without Our Knowing It

When a nation becomes much more heavily indebted - then the inflationary challenge necessarily becomes that much greater for retirement and long-term investors. Because the government now has an extremely powerful motivation to (on average) increase the rate of inflation over time.

This has happened many times in many nations, and it is fairly basic macroeconomics - heavily indebted nations which control the value of their own currencies create inflation in order to reduce the real value of their own debts.

When people think about using inflation to wipe out national debts, they often jump straight to hyperinflation, and think of examples such as Zimbabwe or Argentina. They assume a false dichotomy where either things are "normal", or it is straight to monetary catastrophe.

However, as explored in the analysis linked here, there is another alternative which is the use of low interest rates and moderate rates of inflation in combination to gain control over the national debt, and this alternative is a key part of the financial history of the United States. Few people understand it today, but for a period of decades both the interest rate and inflation "dials" were twisted to restrain the growth of the national debt (as shown above), while the economy grew, and the nation slowly emerged from its heavy World War II debt burden. Even as the other major economies of the West were doing the same thing.

There is a very well established set of economic tools that are used by heavily indebted nations. These tools can also completely change the investment playing field and investment outcomes. This analysis provides essential information for savers and investors about the quite different investment environment that history would indicate may be ahead of us.

Social Security Purchasing Power & Quality Of Life In Retirement (Series Overview)

Social Security is not fully inflation indexed, and this is particularly true when we take into account the critical interrelationships between Social Security benefits and Medicare premiums. The in-depth series linked here provides essential information for Social Security decision making as well as financial planning for retirement.