Individual Financial Decisions & The Investment Implications Matrix

By Daniel R. Amerman, CFA

TweetThe purpose of the Investment Implications Matrix is to provide a useful analytical framework for how to make better financial and investment decisions which practically include the $20 trillion U.S. national debt and the coming multitrillion dollar growth of the Social Security and Medicare programs.

This analysis is part of a series of analyses that are linked here, which examine the extraordinary impact of the national debt and benefit promises when it comes to such basic financial and economic areas as interest rates, inflation, making better Social Security decisions, and the future chances of financial crisis. While national factors are crucial, the focus of the Investment Implications Matrix is to help individuals make better personal decisions.

This particular analysis focuses on interest rates by themselves and for reasons of brevity it does not repeat the previous analyses. Links are provided if you have any questions about those analysis.

Separation & "Normality"

The United States is currently in the midst of its first increasing interest rate cycle since before the financial crisis of 2008.

![]()

As can be seen above, after many years of the lowest interest rates in financial history, interest rates are rising again. If the Federal Reserve carries through with its current expectations as reflected in the "dot plot" (as of the writing of this analysis), rates could go up by a total of 3% between 2015 and 2020.

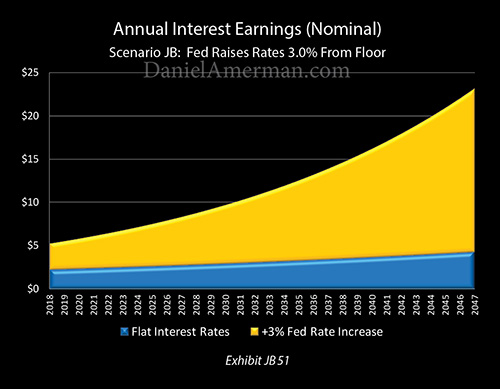

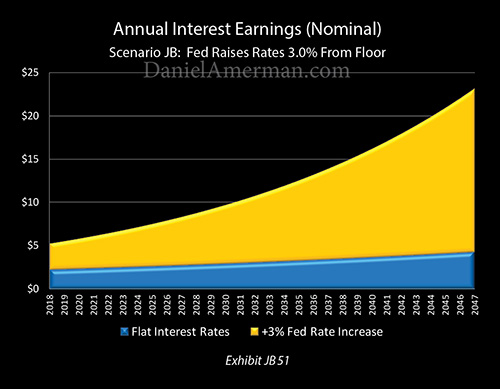

As explored in the analysis linked here, "The Wealth Machine That Rising Interest Rates Create & The Conflict With The National Debt", such a situation could have extraordinarily positive implications for savers and those invest in such instruments as bonds and certificates of deposit.

After an absence of many years, there would be a return of the wealth building machine of compound interest that used to exist, but hasn't in recent years. As explained in the linked analysis, the blue area shows interest earnings that are low and barely growing, as has been experienced by the nation in the years since 2008.

A 3% increase in interest rates creates the gold area which shows a fast climb in interest on interest earnings, that can create financial magic when given enough time to work. This could be truly life changing for many millions of people, as they build far more wealth with their retirement and other long-term savings, and are therefore able to enjoy substantially higher financial security and quality of life in retirement - as a direct result of the increase in interest rates.

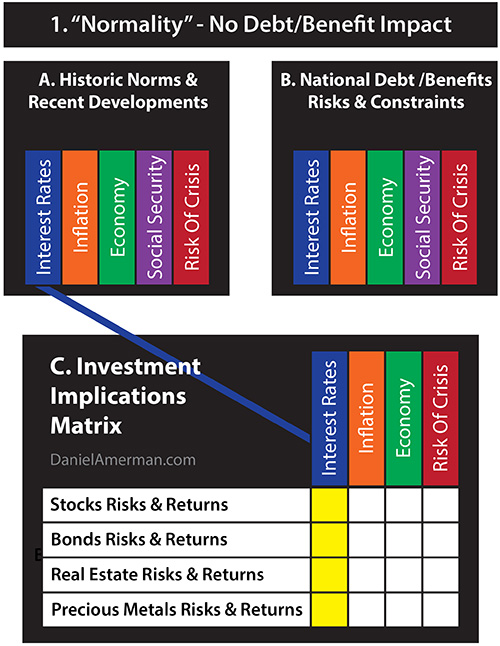

These life-changing implications are shown in the graphic above, by the blue Interest Rates box in the "A. Historic Norms & Recent Developments" section directly connecting via the blue line to the blue Interest Rates box of the "C. Investment Implications Matrix" section. What we just went over was a quick overview of the yellow matrix cell where "Interest Rates" intersects with "Bond Risks & Returns".

It needs to be carefully noted however, that a change in interest rates impacts far more than just savers and bonds. Let's take a quick look at the other yellow cells.

Many experts believe that stock market performance in recent years has been strongly impacted by the extremely low interest rates, and that prices are higher than what they would be with more normal interest rates. So a change in interest rates can over time be expected to potentially change "Stocks Risks & Returns" in a major way, and possibly reduce average stock prices and stock index values (all else being equal).

Whether we are looking at individual residences, rental properties or REITs, historically low mortgage interest rates have been an essential part of determining "Real Estate Risks & Returns" over the last decade. A substantial increase in mortgage interest rates would likely change affordability, cash flows - and therefore prices - in almost every part of the real estate ownership and investment world.

There are many factors driving "Precious Metals Risks & Returns", but one of them is opportunity costs. When interest rates are low, the foregone interest earnings involved with owning an asset that does not pay a cash return are of lesser importance. Increasing interest rates increase the opportunity cost of not earning a cash return, and can therefore drive precious metals prices downwards, all else being equal.

Again, each of the implications above are very quick overviews - a single paragraph can't give each implication the much deeper analytical exploration which it deserves.

A takeaway is that every major investment category is likely to be strongly impacted by a major and sustained increase in interest rates. Whether one is investing in bonds, stocks, real estate or precious metals - if the Fed carries through with raising interests by 3%, and that increase is sustained, then there is likely to be a major impact on financial performance in each investment category.

This impact is likely to be highly uneven - benefiting some categories and hurting others. So in coming up with a long-term financial plan which may involve allocations among the investment categories as well as more specific investment choices - an informed understanding of what is likely or unlikely for future interest rates can be of critical importance when it comes to the actual investment results over time.

There is a critical assumption underlying all the discussion above - that the financial condition of the United States government can be completely ignored when looking at future interest rates. This could be called the historic norm, in terms of how investments have been traditionally evaluated. That historic norm is however based on a government that used to be far less in debt, and was not on the verge of having Social Security and Medicare payments climb by totals that will reach trillions of dollars per year.

Could those factors change future interest rates - and thereby potentially change the Investment Implications Matrix and future performance in all categories?

Integration & The Risk Of Crisis

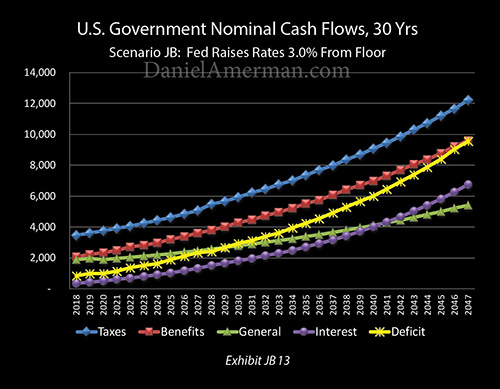

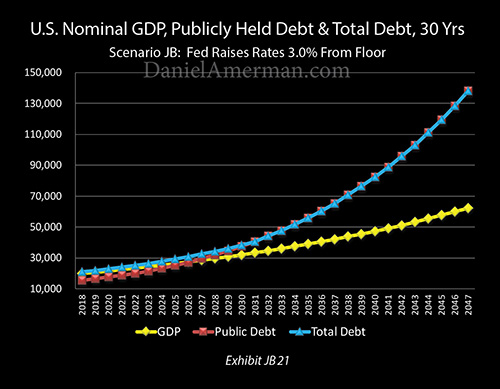

The analysis linked here, "The Potential $54 Trillion Cost Of The Fed's Planned Interest Rate Increases", uses a detailed macroeconomic model to explore the changes in federal government annual deficits and the total national debt that would occur solely as the result of the Federal Reserve increasing interest rates by 3% and (on average) leaving them there over the next 30 years.

As developed in that analysis, the weighted average life of the federal debt would prevent a major near term impact, but over time the purple line of interest payments on the national debt would soar upwards, as the Fed's rate increase would eventually create a compound interest problem for the United States, with ever more money being borrowed at higher interest rates, in order to make the higher interest payments.

Over time, this increase in interest payments would drive the yellow line of annual deficits steeply upwards, at a far faster pace than deficits would rise with lower interest rates.

In nominal terms (not including inflation), deficits would reach about $1 trillion per year by 2019, $2.1 trillion per year by 2026, $3.1 trillion by 2031, $4.3 trillion by 2035, $5.3 trillion by 2038, $6.0 trillion by 2040, $7.4 trillion by 2043, $8.4 trillion by 2045, and $9.4 trillion per year by 2047.

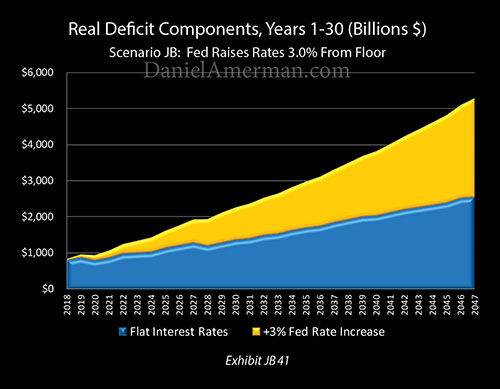

The blue area in the graph above shows future real (inflation-adjusted) deficits if interest rates were to remain at post-crisis lows, and while the deficits do grow over time as a result of the increasingly expensive Social Security and Medicare programs, the annual rate of growth is restrained.

If however, compounding interest payments for a heavily indebted nation are added on top of the growth in benefit payments, then we get the gold area of the graph and annual deficits over time that are much larger, and are increasing in size at a much greater rate.

Over thirty years, these soaring annual deficits would produce a $138 trillion national debt - which is an increase of $54 trillion over what the debt would be with lower interest rates.

The $138 trillion number assumes, however, that stability can be maintained for that period of time. And if we look at a nation that is not even remotely close to being able to make the interest payments on its own debt without borrowing that money, and where annual deficits are exceeding general governmental spending by the year 2029 - there is a very good chance that the future could be one of financial crisis instead. Indeed, each year that the financial pressure grows ever greater, then the risk of financial crisis would also be increasing.

The Investment Implications Of Integration & The Risk Of Crisis

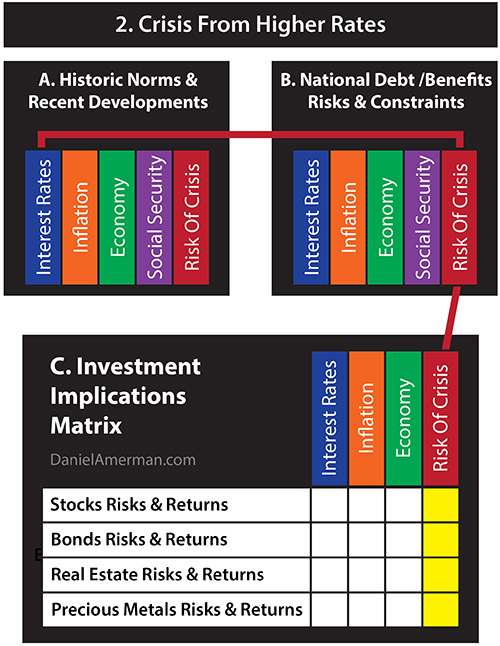

What happens to the Investment Implications Matrix when we look at a major and sustained increase in interest rates and we now include the starting national debt and the costs of Social Security can be seen in the graphic below.

We still start in the "A" section with the blue box of Interest Rates, and explore what happens if the Fed increases interest rates by 3% and keeps them there - but we don't go straight to the investment implications. Instead we take a side trip through reality, follow the top red line, and go to the "B" section of taking into consideration the risks and constraints associated with the national debt and future benefits promises.

When we do that - we see that the likely investment outcome may be something entirely different than what would be expected if we look only at sustained higher rates in isolation. Instead, the outcome may be ever increasing chances of another major financial crisis, perhaps even larger than what was seen in 2008.

This opens up a new avenue into the "C" section of the Investment Implications Matrix, and we follow the red line down to the Risk Of Crisis box - and four quite different yellow matrix cells.

For stocks, we are now looking at what happens when an elevated stock market runs into deep financial crisis - and the results could be a plunge. For all the retirement investors who have been dodging low rates by investing heavily in a rapidly rising stock market - this could be personally catastrophic. This is particularly true when we take into account sequence risk, and a potential inability to recover from an eventual return to historic norms within a retiree's remaining lifespan.

For bonds it would depend on whether the crisis can be contained by central banking actions or truly goes out of control, but the potential annihilation of prices in a crisis would produce entirely different outcomes than the return of the reliable building of wealth through compound interest.

Real estate could see another plunge in prices, with houses and investments going "underwater" across the nation, and being further impacted by a potential radical increase in mortgage rates a result of crisis.

For precious metals - this is exactly the kind of reason for why people buy precious metals. It could be a lucratively profitable vindication of long held personal beliefs about deficits, the national debt, and the financial direction of the nation.

Again the preceding one paragraph descriptions are quite inadequate for fully exploring those four yellow matrix cells, but what they do show is entirely different outcomes for every major investment category - depending on whether or not we take the national debt and benefit promises into account.

The Investment Implications Of Preventing Crisis With Low Rates

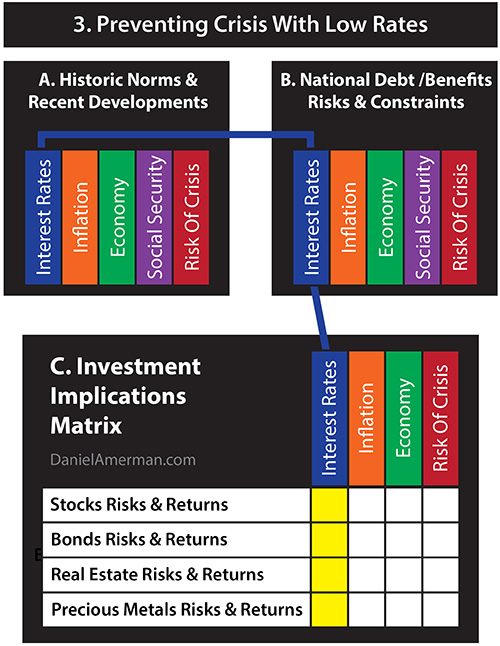

That said, the national debt and future benefits promises could have a quite different relationship with future interest rates. It could very well be that if paying more normal interest rates on a rapidly rising national debt causes major financial problems for the federal government even as Social Security and Medicare payments continue to rise - the government may be driven to take actions to prevent crisis.

One of the most effective actions the government could take in that situation would be to lower interest rates back down again, to far below historically normal levels. In other words, rates can go up for a while to being closer to what they were historically, but the influence of the national debt and benefit promises is to necessarily drive them back down again in order to avoid crisis.

This path is shown in the top blue line above, where the line no longer leads from the "A" section of historic norms & recent developments to the red box of Risk Of Crisis in the "B" section - but to the blue box of Interest Rates. Taking the debt and benefit promises into account means that rates have to go back down again in the future.

There is a new path, the blue line, from the risks & constraints box down to the Investment Implications Matrix, and while they are in the same locations, the contents of the yellow matrix cells are quite different than what they were with our first scenario.

The magic of compound interest is now gone for potentially a very long time, and all savers and interest rate based investors see a massive loss in future income, as the gold area of compound interest is compressed down to the blue area of almost no interest income. Perhaps for a generation or more, one of the primary drivers of wealth creation is simply no longer available.

That said and keeping in mind that bond price movements are the inverse of bond yield movements - we could see a "whipsaw" effect where a long bear market in bonds is eventually followed by another sustained bull market, as the government's existential need for lower interest rates pushes bond prices back up into record or near record levels.

Increasing rates followed by decreasing rates could have a similar and powerful "whipsaw" effect in the real estate ownership and investment areas, where bargain prices are created in the short term by rising mortgage rates, only to be driven back up with major capital and cash flow gains as interest rates are pushed down on the other side to maintain governmental financial solvency.

There could be a reverse "whipsaw" effect with precious metals, where rising expectations of crisis create a powerful new bull market, that ultimately begins another long fall as the perceived certainty of crisis recedes with lower interest rates.

When we look at stocks, the return to historically abnormal low interest rates may mean that stock prices never do return to the "normal" levels associated with normal interest rates. Instead they may be in a new long-term "normal", with perhaps higher prices, lower dividend yields and lower total returns than simple historic averages would lead one to expect.

Using The Investment Implications Matrix

The norm is to treat the national debt, deficits and future total Social Security and Medicare payments as being purely political issues, rather than financial planning issues. This perspective is deeply ingrained in many people, and they can have trouble seeing the issues in other terms.

With some previous analyses in this series, I have received some intense feedback - but it often was not about the financial subject matter. Instead, people understandably vent about what are often their deeply held beliefs about how national politics and politicians need to change.

Now, I personally wholeheartedly agree about the need for change - but I don't know how you or I as individuals can practically do anything about it.

The problem with viewing these issues as purely political is that we risk focusing entirely on something that we individually do not have any control over, while missing the potentially life changing implications for something we do have individual control over - which is our personal financial decisions.

In the #1 analysis herein, we took the usual approach and completely ignored the financial constraints on the United States government. Instead - and this is the norm for the financial media and many commentators - we looked what happens if the actions of the Fed take us back to more "normal" times. This has enormous financial implications for performance in each of the four major investment asset categories, as well as the asset allocation decisions for how much to invest in each category.

In the #2 analysis, we asked a simple question that is a tad complex to answer - what does a 3% increase in interest rates by itself do to the future deficits and debts of the United States government, all else being equal? The answer on a national basis is eventual financial catastrophe - in the somewhat unlikely event we ever reach that point - and an ever growing risk of financial crisis as the pressure builds in each year before then.

The next step was the most important - we used the Investment Implications Matrix to move from the national to the personal in all four of the major investment categories.

When we do this, we can see that the national is indeed the personal, and the risks and constraints posed by the national debt and benefit promises is enough to completely transform our personal outcomes in each category. The past is gone, we can't go back there from here, not without the debt and benefit promises changing. And if the past can't come back, but we invest on the assumption that it will anyway - the personal financial penalties could be severe.

Whether we are looking at stocks, bonds, real estate or precious metals - we have entirely different personal outcomes in each category. We therefore have major financial incentives to change our asset allocations between the investment categories. This has the potential of entirely changing our financial outcomes, as well as our future standard of living and financial security. It simply doesn't get more personal than that.

In the #3 analysis, we looked at what happens if the government decides to avoid crisis. As my long-time readers know, this is the possibility that I have primarily focused on for many years now, and it is also - until recently - the path that the government has traveled in practice.

When we move from "B", the government containing crisis, to "C", the Investment Implications Matrix, from the national to the personal, then we again get a complete transformation of personal outcomes in each category. Which then changes our asset allocation decisions.

This also - intriguingly - opens up the potential "whipsaw" scenarios, where prices are driven down (or up) until they are necessarily driven back up (or down) in order to avoid crisis. If that is what actually occurs in practice, then understanding the Investment Implications Matrix and the intersection between the national debt and specific investment category performance could become a quite lucrative fundamental source of wealth creation in one of a variety of ways.

Reality is holistic. There is not one world where investments endlessly repeat their historical performance from previous decades, and an entirely different and isolated world where the United States government has some new and huge financial issues. Instead, our personal financial outcomes will be found in one world, where the national debt and Social Security and Medicare promises may become dominant factors for all investment asset categories.

This analysis is an example of one way of using the Investment Implications Matrix looking at only one factor, that of changes in interest rates. While a simplified version it is nonetheless intended by itself to be able to provide new perspectives and useful information for readers. Hopefully you have found it to be helpful.

The full version of the matrix with an integration of all of the factors and a much deeper level of analysis is a key component of Daniel Amerman's financial workshops. A brochure with more information about this expanded usage is linked here. The first presentation of the new generation analyses will take place in the Chicago area, on the weekend of April 28-29, 2018.