Can Computer Data Entry Banish Investment Risk Forever?

by Daniel R. Amerman, CFA

Below is the 2nd half of this article, and it begins where the 1st half which is carried on other websites left off. If you would prefer to read (or link) the article in single page form, the private one page version for subscribers can be found here:

The Eventual Reconciliation

Eventually at some point – in one form or another, the day will come when the markets return to reflect economic and financial reality. Artificial stability simply cannot be maintained forever. And the most likely sources of change are not the markets themselves or some kind of investor revolution, but as previously discussed in some of my writings – political change and geopolitical risk.

Something comes up to turn the system on its side, be it a key nation experiencing a tremendous political change, a war, or some other form of geopolitical upset.

As strong as they may appear, central banks are quite weak in the face of such real and fundamental changes, and that is the most likely time when cracks will develop in stability which the central bankers will scramble to attempt to fix – but be unable to do so.

With the key question being, how long until that occurs? It could be much further off than many people expect, or perhaps not – it really all depends on what unfolds in areas that are not necessarily directly connected with finance and economics.

There is certainly the possibility that we could have this artificial and dysfunctional stability and ongoing redistribution of wealth from the "have-nots" to the "haves" for 5 years, 10 years, 15 years or more.

Yet at the very same time, political and geopolitical change is very difficult to predict, and there is currently enough geopolitical risk in the world that stability could be overturned in any given month.

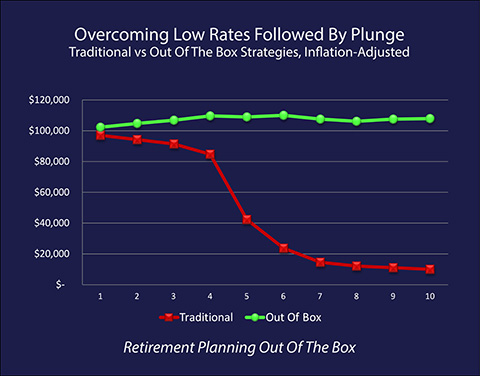

Graphic adapted from the Retirement Planning Out Of The Box DVD tutorial set.

This creates the situation shown by the red line in the graph above, where traditional investors are slowly squeezed in after-inflation terms, when it comes to what they can buy with their savings and investment assets, until the change happens (shown in this example as occurring in the 5th year). That's when the bottom drops out, reality reconciles with prices and there is a fantastic market plunge – and prices in purchasing terms don't return for many years or decades to come.

This translates to all too many millions of investors potentially dealing with the 1-2 combination of a steady squeeze on their real income for year after year as the price for maintaining temporary stability, until the day the bottom eventually drops out anyway, and their financial security is devastated.

So when the International Monetary Fund or others speak about creating a miracle effectively, which is the banishment of investment risk through massive monetary creation as central bankers simply step in and purchase as many stocks and bonds as are necessary to keep market levels stable – it needs to be understood that this can come with an extraordinary price at some point.

Now there is an alternative path for releasing the pressure that we can all certainly hope for, which is that economies grow in such a robust manner that current valuations can be justified by new fundamentals, so that the gap is closed by the creation of genuine wealth, and a future crisis need not happen.

But what needs to be recognized is that the greater the scale of interventions used to maintain artificial stability, then the more dysfunctional the economy and the redistribution of wealth, and the lower the likely real rate of economic growth – which means the less likely it is that this more positive path of surging economic growth will be what closes the gap and releases the pressure.

Be Careful What You Wish For

For many millions of individual investors around the world, the abilities of central banks and governments in the face of a developing financial disaster to simply enter a few keystrokes in a computer and potentially stop a multitrillion dollar crisis in its tracks – may offer a sense of reassurance, and indeed seem highly desirable.

If a potentially devastating financial crisis does develop, then yes – in theory – the central banks can become market makers for the global financial system. And a devastating financial blow to the face value of their investments and the value of their retirement accounts may indeed be dodged, with current and even higher price levels maintained for possibly years to come.

Now theory is one thing, but in practice and as explored here, there is also a chance that the difficulty of the execution will exceed the abilities of the economists, and the whole attempt will just blow up in their faces.

Yet, even if the intervention is successful – there is always a price.

And unfortunately the price of magic in this case is a continuation of dysfunction and the redistribution of wealth, with an even greater crisis still waiting down the road.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

An "eye-opener" tutorial of a quite different kind is linked here, and it shows how governments use inflation and the tax code to take wealth from unknowing precious metals investors, so that the higher inflation goes, and the higher precious metals prices climb - the more of the investor's net worth ends up with the government.

An "eye-opener" tutorial of a quite different kind is linked here, and it shows how governments use inflation and the tax code to take wealth from unknowing precious metals investors, so that the higher inflation goes, and the higher precious metals prices climb - the more of the investor's net worth ends up with the government.

Another "eye-opener" tutorial is linked here, and it shows how governments can use the 1-2 combination of their control over both interest rates and inflation to take wealth from unsuspecting private savers in order to pay down massive public debts.

Another "eye-opener" tutorial is linked here, and it shows how governments can use the 1-2 combination of their control over both interest rates and inflation to take wealth from unsuspecting private savers in order to pay down massive public debts.

If you find these "eye-openers" to be interesting and useful, there is an entire free book of them available here, including many that are only in the book. The advantage to the book is that the tutorials can build on each other, so that in combination we can find ways of defending ourselves, and even learn how to position ourselves to benefit from the hidden redistributions of wealth.