Did The Fed Just Admit to Deep Uncertainty About Our Financial Security In Retirement?

by Daniel R. Amerman, CFA

Below is the 2nd half of this article, and it begins where the 1st half which is carried on other websites left off. If you would prefer to read (or link) the article in single page form, the private one page version for subscribers can be found here:

Financial Security In Retirement

There is a potentially even bigger issue, which is that the projected funding for Social Security and Medicare is based upon the assumption of historic rates of economic growth continuing into the long term future.

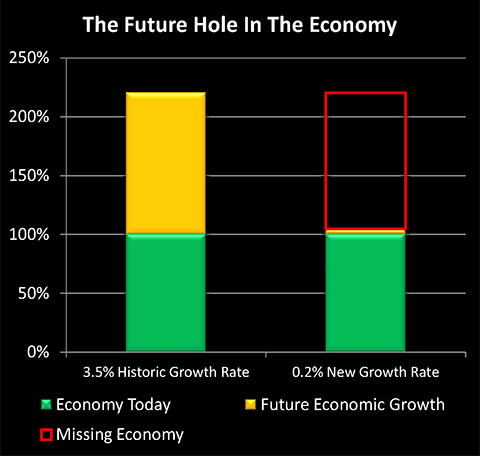

The following two graphs may be helpful in understanding this essential point. When people talk about future shortfalls, usually they are talking about projections which are themselves based upon the assumption that we know the future, and that it is one of steady economic growth at historical rates.

As shown in the first graph, and as developed in more depth in this analysis, the economy is expected to double in size in a little more than 20 years – assuming historical growth rates. There are a number of reasons why this growth might not happen, including the slower growth rates of heavily indebted nations, or the slower growth rates of nations with rapidly aging populations, or future potential economic and/or financial crises, or a shift in economic growth from the West to Asia... or it could be "all of the above" coming together into one package labeled "Secular Stagnation."

What does secular stagnation look like? That would be the hollow part of the right-hand bar. What a long-term lack of economic growth means is a necessary void in the future, an emptiness where the phantom wealth which was assumed and counted upon – fails to materialize in practice.

People don't usually think about it that way, but when we talk about the solvency of Social Security, or Medicare, or the value of long-term stock returns – those are generally all based on wealth that doesn't actually exist yet. Rather it is wealth that is merely assumed into existence, by taking historical growth for the United States during a time of economic prosperity and even world domination, and projecting them forward indefinitely into the future.

To be clear, then, to have the rug pulled out from underneath what we are told the financial future will be doesn't actually take any great crisis, or catastrophe, or collapse, or any other sort of world-changing "high drama" scenario. Oh, those could indeed happen, but they aren't actually needed for the future to unfold in an entirely different way than what the voice of financial authority tells us will be the case.

All it takes is for the assumed growth to not occur.

That's what secular stagnation truly is – not a doomsday event, but a big, gaping hole in the future. It's hypothetical wealth that simply fails to materialize. With any financial security or investment returns based on assumptions about that future wealth – also failing to materialize.

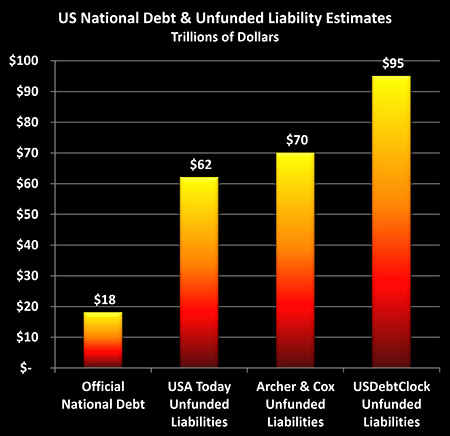

To understand the next level of risk posed by secular stagnation, we need to consider the difference between officially recognized national debts and what accountants call "unfunded liabilities". That is, when a corporation or even a state or local government takes on a financial obligation for the future, and they have not set aside the money to pay for it, then they have to recognize the cost of that promise as a debt, in current dollars.

The federal government on the other hand makes its own rules for its own accounting, and for the obvious political reasons – it chooses to ignore that requirement. Unfortunately, however, ignoring it doesn't make it go away. The three right-hand columns in the following graph are various estimates of what the real debt of the US government is after taking those unfunded liabilities into account, over and above future expected tax receipts.

As explored here, the cost per above poverty-line household is over $900,000, and that means that the rules governing retirement investment accounts are likely to be changed, and in ways that most of us are not currently expecting.

But here's what almost no one is taking into account: those towering red and yellow bars with their tens of trillions of dollars of shortfalls are all based on "normal" economic growth. They assume that most of the future cost of retirement promises will be funded by taxes on wealth that does not yet exist, but which will materialize from ongoing economic growth over the coming decades.

Now obviously if that growth doesn't occur – then those taxes aren't collected. And the shortfalls grow much, much larger. Even as they move much closer in time. And that means that the day that the rules change on Social Security, Medicare, pension payments and potentially retirement accounts – also moves forward in time.

The Inadvertent Spread Of "Dangerous Knowledge"

There is a fascinating contrast between Janet Yellen and her predecessor, Ben Bernanke.

I've written about Mr. Bernanke many times, and while often in vigorous disagreement – one of the things I came to understand was just how disciplined he was. That is, he was keenly aware that one poorly chosen sentence could send a tremor through the markets, and that one of his primary roles as Fed Chairperson was one of Perception Management. I don't know that he ever spoke his actual mind in a public speech, but rather everything passed through a mental filter of sorts, screening out any thoughts or opinions that might invite negative consequences.

Ms. Yellen, in contrast, seems to every now and then – just say what she is thinking. She is a top-level economist, she is immersed in the professional puzzle of a lifetime as the nation's chief economist during difficult times, and there are so many complicated factors involved that she spends her time thinking about. And with her personality, it seems that occasionally a thought does slip through the screen, and she shares what she is actually concerned about, with an inconvenient truth thus being spoken.

One could call this habit a bit klutzy, or characterize it as a welcome breath of fresh air.

So, just as Bernanke surely was, Yellen is very well aware of the danger of secular stagnation. Of course she is! This is cutting edge stuff, with a global conversation among economists in process.

Yes, there is controversy about whether secular stagnation does exist right now, or if it doesn't – whether an aging population and heavily indebted nations will bring it about in the future. And yes, there is controversy about the macroeconomic tools to fight it, and whether they will be effective in overcoming the stagnation.

But there is absolutely nothing "obscure" about it – unless one defines "obscure" as being something the media almost never chooses to cover.

When Janet Yellen spoke of secular stagnation, she was only making a clarification about what could affect future interest rates, and she didn't pursue any further implications. Nonetheless, she publicly and inconveniently used the term – and in the process helped to disseminate knowledge into the world. She let people in on the "controversial theory" that even the highest levels of government, economics or finance don't actually know for sure what future economic growth will be, or even whether it will be positive.

Now after cutting through all the economics jargon, some might call this common sense.

Hey, guess what – maybe the "experts" don't actually know the future after all.

So maybe we should reconsider betting everything we have for retirement on wealth that doesn't actually exist yet, and which in fact may not ever materialize?

Yet, that same common sense, aka highly "controversial theory" – poses a very dangerous threat indeed to those people and institutions whose wealth and political power are aided by the current dominant belief system that assumes we know what the size of the economy will be in 2025 or 2035.

When we don't.

Let me suggest that there is an enormous difference between planning for genuine uncertainty, versus planning based on false certainties. Both can be done – but the specifics are quite different.

And what America's chief economist just let slip is that as far as she knows – there is genuine and profound uncertainty.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

What you have just read is an "eye-opener" about one aspect of the often hidden redistributions of wealth that go on all around us, every day.

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

A personal retirement "eye-opener" linked here shows how the government's actions to reduce interest payments on the national debt can reduce retirement investment wealth accumulation by 95% over thirty years, and how the government is reducing standards of living for those already retired by almost 50%.

An "eye-opener" tutorial of a quite different kind is linked here, and it shows how governments use inflation and the tax code to take wealth from unknowing precious metals investors, so that the higher inflation goes, and the higher precious metals prices climb - the more of the investor's net worth ends up with the government.

An "eye-opener" tutorial of a quite different kind is linked here, and it shows how governments use inflation and the tax code to take wealth from unknowing precious metals investors, so that the higher inflation goes, and the higher precious metals prices climb - the more of the investor's net worth ends up with the government.

When we look at all government retirement promises over the coming decades – the total is simply unpayable. As explored in the "eye opener" linked here, this means that there is a high probability of an eventual tax code "revolution" that could rewrite all the rules when it comes to the future treatment of our current retirement accounts.

When we look at all government retirement promises over the coming decades – the total is simply unpayable. As explored in the "eye opener" linked here, this means that there is a high probability of an eventual tax code "revolution" that could rewrite all the rules when it comes to the future treatment of our current retirement accounts.

If you find these "eye-openers" to be interesting and useful, there is an entire free book of them available here, including many that are only in the book. The advantage to the book is that the tutorials can build on each other, so that in combination we can find ways of defending ourselves, and even learn how to position ourselves to benefit from the hidden redistributions of wealth.