Will The Federal Reserve Create Two Major Investment Arbitrage Cycles?

By Daniel R. Amerman, CFA

TweetMartin Feldstein, who was chairman of the Council of Economic Advisors under President Reagan and is currently a Harvard professor, recently wrote an extraordinary editorial in the Wall Street Journal in which he strongly advocated that the Federal Reserve pursue policies that would: 1) continue to raise interest rates; and 2) thereby pop asset bubbles in the stock and commercial real estate markets; 3) which would cause an estimated $9+ trillion in investor losses; 4) possibly lead to another recession and the accompanying major job losses; and 5) would be followed by forcing interest rates down again to near historic lows.

Now, the eminently respectable Professor Feldstein and other mainstream economists are not intentionally trying to hurt investors, that is not the reason to raise rates. Quite the reverse, this is all supposed to be for our own good, and the intentions are to over the long term help economic growth and create healthier investment markets.

However, if as an incidental side effect, call it a form of "collateral damage", many millions of investors see their retirement dreams smashed along with the values of their stock portfolios, index funds, ETFs and commercial property REITs... well, sometimes making an omelet requires breaking a few eggs. (Another incidental side effect could be to help determine the results of the 2020 presidential election.)

What Feldstein is advocating will on the surface make no sense whatsoever to great majority of the people whose retirement accounts and other investments are at risk - it is entirely outside the usual ways in which most people think about investing. Yet, it is perfectly logical as a matter of monetary policy and macroeconomics, and is quite consistent with the Federal Reserve's current policy of frequently raising interest rates in practice.

This analysis has three goals:

1) To explore in detail what Feldstein is proposing and explain why he is proposing it with the best of intentions.

2) Using Feldstein's proposal as a tangible framework, understandably link what may seem esoteric to many people with the overwhelming practical implications for their personal lives and financial outcomes. We live in an age in which extraordinary and unconventional Federal Reserve actions still dominate the investment markets to an unprecedented degree - and not understanding what is happening, why it is happening and what may be coming next, provides no protection to investors whatsoever.

3) To lay out how what Feldstein is proposing (or something like it) would create a sequence of major price movements across the markets, including bonds, stocks, real estate and precious metals, that would not be a "random walk" - but can be understood in advance. This could allow for the use of two cycles of investment arbitrage strategies.

This analysis is part of a series of related analyses, an overview of the rest of the series is linked here.

"Save Low Interest For A Rainy Day"

Feldstein's editorial is titled "Save Low Interest for a Rainy Day" (linked here), and was written in response to President Trump's recent public statements urging the Fed to reverse course and stop increasing interest rates.

"In complaining publicly about the Fed, Mr. Trump is breaking decades of presidential precedent, and he is wrong on the substance. The Fed actually is behind the curve in normalizing short-term interest rates, and it should now raise the federal-funds rate at least four times a year."

While Dr. Feldstein is not part of the Federal Reserve, he is an eminent economist and a member of the Wall Street Journal's board of contributors. What he is advocating is not particularly controversial, but rather it is in the current heart of conventional macroeconomic theory, and in his editorial Feldstein is presenting the defense of the status quo against Trump's statements.

"But controlling inflation isn’t the primary reason for the Fed to keep raising the short-term interest rate. Rather, raising the rate when the economy is strong will give the Fed room to respond to the next economic downturn with a significant reduction.

That downturn is almost surely on its way. The likeliest cause would be a collapse in the high asset prices that have been created by the exceptionally relaxed monetary policy of the past decade."

It is refreshing to see such a prominent economist so succinctly describe what has been happening in an article intended for the general public rather than his peer group. As I have been writing about in analyses and presenting in workshops for a number of years, creating exceptionally low interest rates has always been likely to create surging asset prices over time as a quite predictable side effect, with possible bubbles in multiple asset categories.

Unfortunately, however, this essential process that is so critical in determining investment results is very difficult for most non-economists to grasp because it seems so counter-intuitive. Common sense would tell us that containing the lingering damage from a market and economic crisis should lead to low asset prices - but in practice, over the last 20 or so years, that is not at all how the markets have worked.

"It’s too late to avoid an asset bubble: Equity prices already have risen far above the historical trend. The price/earnings ratio of the S&P 500 is now more than 50% higher than the all-time average, sitting at a level reached only three times in the past century. Commercial real-estate prices also are extremely high by historical standards.

The inevitable return of these asset prices to their historical norms is likely to cause a sharp decline in household wealth and in the rate of investment in commercial real estate. If the P/E ratio returns to its historical average, the fall in share prices will amount to a $9 trillion loss across all U.S. households."

As President Emeritus of the National Bureau of Economic Research, Martin Feldstein is clearly viewed by his peer group as being in the most respectable core of the economics profession. Based upon his long experience, there is simply no doubt in his mind whatsoever that we currently have major asset bubbles in at least the stock and the commercial real estate markets (with those bubbles being the result of previous Federal Reserve policies).

A simple reversion to the mean would by Feldstein's estimate trigger $9 trillion in losses and remove 33% of the current value of the stock markets. That would be a 33% reduction in investment value for every household and retirement investor in the nation who is heavily invested in stocks.

There is also the issue of the millions of retirees and retirement investors who moved to REITs in the search for cash flow, as a result of the Fed's previous zero interest rate policies. Those REITs have become the foundation of their lifestyle and financial security - and that means that if Feldstein is correct and at least the commercial property REITs are in a major bubble, there could be potentially devastating personal consequences.

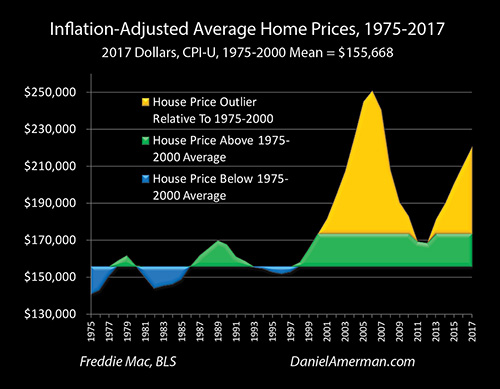

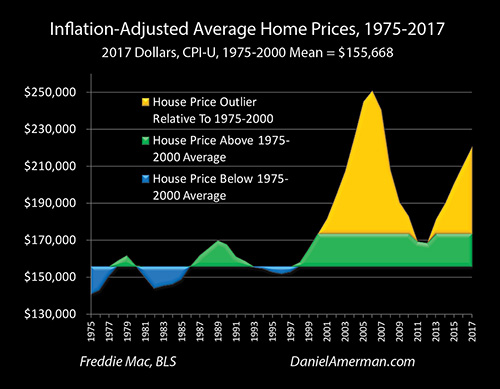

Two other relevant issues can be seen in the graph above from my most recent financial analysis (linked here). If we look at the "old style" real estate markets of 1975-2000 on the left side of the graph - then reversion to the mean does not mean just returning to average. The mean is the middle, and the other half of the time is not average but below average. So if we go down from the top, we don't usually stop in the middle but keep right on going to other side, which could easily mean a bottom to the cycle in the 50% or greater loss range, translating to a loss in household wealth in the $13-$14 trillion range or more, just from stocks alone.

Also, as can be seen in the golden spikes on the right side of the graph, the very high asset prices that can result from "exceptionally relaxed monetary policy" are not restricted to just stocks and commercial property, but extend to single family homes as well.

"Raising rates does increase the risk of bursting the asset bubble sooner than investors and consumers might hope. But the Fed has let the economy grow fragile by keeping short-term rates too low for too long. Now it must respond by raising rates enough to deal with the bubble burst when it inevitably comes."

The above excerpt is the "money quote", and has been brought been forward from the end of Feldstein's editorial because it frankly and understandably establishes causality to an unusual degree for a public statement by someone at his level. Feldstein (and his economist peers) know perfectly well that if the Fed continues with its current policies of raising interest rates an expected four times a year - thereby following his advice - that it could bring forward in time the day the bubbles pop, and could easily cause $10-$20 trillion in total losses for aggregate household net worth in the United States.

But nonetheless - with full knowledge of what would likely happen - Dr. Feldstein is still strongly advocating that the Fed continue to raise interest rates on a frequent basis.

"Large drops in household wealth are usually accompanied by declines in consumer spending equal to about 4% of the wealth drop. That rule of thumb implies that a $9 trillion drop in the value of equities would reduce consumer spending by about 2% of gross domestic product— enough to push the economy into recession. The fall in the value of commercial real estate would add to the decline of demand. And with consumer spending down sharply, businesses would cut back on their investment and hiring."

Increasing interest rates that pop asset bubbles can lead to other consequences as well. As Feldstein explains in his editorial, there is a very good chance that a recession will follow, with the accompanying losses in consumer incomes and increases in unemployment. And because Feldstein believes an eventual popping of bubbles is inevitable anyway, he therefore implicitly saying that an eventual recession is likely inevitable as well.

"But significant monetary stimulus would be impossible to achieve if the short-term interest rate remains at the current 1.75%. And there is less room than ever for fiscal stimulus, as annual deficits will exceed $1 trillion by 2020 and federal debt will be greater than 100% of GDP by the end of the decade.

That’s why it’s important for the Fed to raise the federal-funds rate to 4% over the next two years, which would allow it to cut the rate by at least three points when the next recession begins. Such a rate reduction might not be enough to prevent a recession within the next two years, but it would maximize the Fed’s positive influence on the economy."

As Feldstein briefly touches upon, we are currently a heavily indebted country, and the extremely expensive fiscal "trick" of quickly doubling the national debt in a few years (and creating decades of subsequent financial pain) in the attempt to use massive governmental spending increases to exit recession is not available to us like it was the last time around.

So that leaves monetary policy, i.e. Federal Reserve actions - if a very long future recession or possible depression is to be avoided when the asset bubbles inevitably eventually pop. For monetary policy to shorten the coming recession and set the base for the next recovery, current economic theory demands the ability to sharply lower interest rates - by "at least" 3% in Feldstein's professional opinion.

If the Fed doesn't significantly raise interest rates before later sharply reducing them, then the only way to reduce rates by 3%+ is to go to negative interest rates (like Japan and Europe), and that is a risky and unconventional place that economists would strongly prefer to avoid.

So stuck between a rock and hard place, with interest rates far too low coming into a looming asset-bubble induced market crash and subsequent recession - a mainstream economic view (which is what Feldstein is succinctly explaining as his response to Trump) is that interest rates must be raised for the long term good of the nation, and the quite predictable near term consequences for retirement investors and retirees (and elections) be damned.

A Familiar "Movie Plot Line"

If what Martin Feldstein is writing about comes to pass, then tens of millions of lives are likely to change - and in most cases it will for the worse, at least over the next few years.

Tens of millions of people are making investment choices that are completely blind to the subject of this analysis as well as what is advocated in Feldstein's editorial. They are following what they think is the best available investment advice - the accepted conventional wisdom - which is that they need to be heavily invested in stocks as the reliable basis for their financial security in retirement.

And at this point, with the stock indexes at record or near record highs, many of these investors are feeling very comfortable and happy with their choices, with a great deal of confidence about their future financial security.

It would never occur to them that the little understood but extremely powerful institution that controls money itself would be using its powers in a way that would 1) create an "exceptionally relaxed monetary policy" that was likely to eventually create asset bubbles in stocks and real estate and predictably draw in retirement savers like moths to the flame in the process; and would then 2) more or less intentionally pop those bubbles as the necessary byproduct of raising interest rates in order to be able to better contain the crisis that is likely to result from the bubbles eventually popping anyway.

This process is happening right now, in plain sight, but the mindset involved in understanding the investment implications of the applicable macroeconomics and monetary policy is so foreign to the way most people view retirement investments, that it can't be seen or taken into account.

And what is most ironic of all is that for those of us "of an age", this is far from our first rodeo. This is our shared experience, we've seen this happen twice before in the last 20 years.

As explored back in March in my analysis "The ABCs Of Popping A Third Asset Bubble" (linked here), there has a been a familiar "movie plot line" that has dominated the markets over the last 20 years.

As a very quick overview (the linked analysis is much easier to follow), we've had something quite unusual happen in the 21st century so far, which is rising interest rates contributing to two previous asset bubbles popping (tech stocks and the Financial Crisis of 2008), which were followed by two recessions, the recession of 2001 and the Great Recession. This creates an A-B-C-D cycle:

A) Interest rates are pushed way down to contain the recession and start the recovery (per Feldstein's prescription);

B) The intervention works, the recession ends (eventually), the economy reboots - and the unusually low interest rates contribute to the rise of new asset bubbles (the 2001 recession was contained with the lowest interest rates in 50 years, and the Great Recession was contained with the lowest interest rates in modern history);

C) The Fed raises interest rates both to slow down the economy and to get "ammunition" (room to lower interest rates) to fight the next recession; and

D) The higher interest rates contribute to the popping of the asset bubbles, leading to market crashes, a recession, and setting the stage to return to "A" in the next cycle.

The March analysis ended by asking whether we were currently at stage C, with the Fed raising interest rates during a time of asset bubbles, and whether that would lead to D once again, with the asset bubbles popping, market crashes and a new recession?

When I first read Feldstein's editorial, I felt like I was watching a veteran director emeritus enter our shared "movie set", and begin frankly and publicly barking out directions for how to complete the familiar plot line for the third time, while setting the stage for the fourth movie.

Yes, he stipulates as matters of fact that we do have at least two asset bubbles (Act B), as a result of previous "exceptionally relaxed monetary policy" (Act A). Yes, the Fed is currently raising interest rates (Act C), and as a famous and successful 79 year director who has been living with at least somewhat related plot lines for his entire professional career, he is calling for the pace of the plot to accelerate, for the rate increases to keep coming until the dramatic climax of the plot - Act D - is (again) reached, the bubbles pop and the markets crash, the hordes of extras (retirement investors) are tragically but necessarily sacrificed, the next recession arrives - and most importantly, for the movie to end with enough "ammunition" in the form of room to reduce interest rates, that it will enable Act A to get off to a successful start in the next movie in the series, exiting crisis and rebooting the economy.

We've all seen this plot line before. We've all lived variations of this plot line before. But yet, it is a key part of the plot that when the extras get sacrificed (again), the arrival of Act D will come as a complete and total shock to most of them.

The Implications For Individual Investors - Seeing The Columns

While I understand each Act and why the script exists, I don't agree with the overall plot line, and I would love to see a complete rewrite based on different objectives that lead to different policies which don't require sacrificing the "extras" (and their very real financial security and lifestyles) every now and then. Perhaps if enough people better understood the subjects of this analysis - what is happening and why it is happening - then we would see some badly needed changes.

But, such changes seem unlikely in the near future on a reality basis, and in the meantime we have to deal with the world as it is, rather than what we want it to be.

If the nation follows Feldstein's suggested path, and we move from current rising interest rates, to possible future collapsing asset bubbles leading to market crisis and recession, followed by another round of using very low interest rates to try to reboot the economy - this is likely to be a financially disruptive and painful process for many retirement and other investors, particularly if they are following some quite traditional financial strategies.

However, the potential major and rapid market changes are not inherently "good" or "bad" for investors. They just are what they are. The tragic part comes in if Fed policies are quite likely to shred the value of bubble assets, when many investors are betting their financial futures on the prices of those bubble assets continuing to rise.

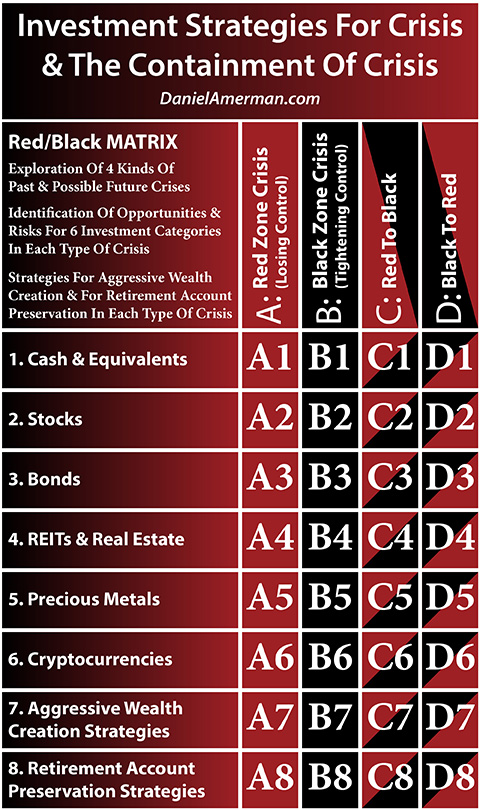

To help people visualize and understand how cycles of crisis and the containment of crisis create both risks and opportunities for investors I created the Red/Black matrix below, and the Feldstein editorial/prescription is a good opportunity to learn how to use the matrix better. In the last analysis we looked at a single row (#4), but with Feldstein we move to the columns, and how the matrix columns can interact with the matrix rows.

(Red/Black matrix pdf link here.)

The financial crisis of 2008 is an example of the red "A" column, and the containment of that crisis is an example of the black "B" column. As Feldstein notes, the Black Zone containment of crisis last time around involved "exceptionally relaxed monetary policy", which included but was not limited to exceptionally low interest rates. Feldstein does not of course use the words "red" and "black", but when he talks about how the monetary policy that was being used to contain crisis created obvious asset bubbles in stocks and commercial real estate, that is found in the matrix by looking at the intersections of the black "B" column with the #2 and #4 asset category rows, which is the B2 & B4 matrix cells.

Feldstein believes (along with many other observers) that the eventual collapse of the asset bubbles is inevitable, along with the likely following recession. So he thinks that the trip back to another Red Zone crisis is near guaranteed, even if he does not use those terms to describe it.

What Feldstein fears is that we enter that Red Zone crisis - the markets crash and recession hits - but interest rates are so low that the Fed can't effectively use its main recession fighting tool of sharply lowering interest rates. In other words, the Black Zone containment of crisis could fail this time, meaning that our aging and heavily indebted society might not be able to reboot economic growth for many years to come.

If that were to happen, we could get stuck in the Red Zone of column "A", with extraordinary real world investment implications for each of rows 1 through 6, which is matrix cells A1 to A6. Although the specifics would vary over time and by each asset category, a long term failure of economic growth would radically transform investment performance, completely shatter retirement investment portfolios and strategies that are based on traditional financial planning, and also put the financial viability of pensions, Social Security and Medicare in far greater peril than what is being projected today.

Forcing The Black To Red Cycle

To avoid that potentially much bleaker scenario, Feldstein is advocating effectively forcing a move to column "D", a Black to Red cycle of moving from the containment of crisis into crisis. Even if raising rates to 4% within 2 years is likely to pop at least two asset bubbles, likely leading to at least $9 trillion in investment losses (more realistically $10 to $20 trillion) and a new recession - it is all judged to be worthwhile so long as the Fed gets enough room to smash interest rates down by a minimum of 3% when needed, without going to negative interest rates.

What is being discussed is a central bank implementing a pre-emptive and aggressive tightening in monetary policy in order to set up a greater ability to more effectively loosen monetary policy when needed at a later point in the cycle. Unfortunately, just finishing the previous sentence is likely enough to make the average person's eyes start to glaze over. It is very difficult for most people to understand what it means, other than it sounds terribly theoretical, dry and obscure, and what it has to do with their personal lives or the value of their retirement accounts may seem completely indecipherable. (And what is a central bank, anyway?)

But yet - if Federal Reserve actions do force a Black to Red cycle, exiting the containment of the last crisis and starting a new crisis, it could be a life changing event for many millions of people. Indeed, it could be one of the most important financial changes of their lives, particularly if they are retired or close to retirement age.

The issue is that we do not live in "normal" times, at least compared to the latter half of the 20th century, and we have not for many years. Aggressive and unconventional Federal Reserve policies have created different asset prices in almost every part of the investment world, as I have been writing about for some years, and is shown in the "B" column of the Red/Black matrix, in cells B1 to B6.

As just one example, returning to the graph for inflation-adjusted single family homes from the previous analysis visually demonstrates just how differently prices have worked over the last 20 or so years, compared to the decades before then. We have seen one example of how a Black to Red cycle has impacted home prices in the past, in the 2007 to 2009 period shown above - and it created an asset price swing, with losses in this case, that were an order of magnitude above anything that was seen in prior decades. If a Black to Red cycle is (more or less) deliberately triggered again, then something like that could certainly happen again, with potentially life changing consequences for many millions of homeowners.

And that single, major event is only a portion of matrix cell D4, which is the intersection of the REIT & Real Estate row with the Black to Red cycle column. If Feldstein's predicted commercial real estate bubble collapse happens as well - that could be another source of trillions of dollars of price changes, also occurring in the D4 cell.

Anyone invested in stocks could feel the impact of the potential $9+ trillion in losses in the D2 cell. Anyone invested in bonds or who is dependent on interest income, could experience wide swings in the D1 & D3 cells. For those invested in precious metals and cryptocurrencies, some of the fastest and largest price swings of all could occur in the D5 and D6 cells.

Up and down every cell of the Black to Red column "D", if what Feldstein calls for comes to pass, then the change of state from containment of crisis to crisis could trigger rapid price changes - some losses and some gains - across not just all the investment categories, but also every aspect of financial performance and financial security for the people of the nation.

For most people and most retirement investors, if this happens it is likely to take them completely by surprise, and they will likely have no idea why it happened. Depending on the specifics of their choices and their situations, the results could be financially crippling.

Yet, for those who do understand what is happening and have given full consideration to the implications, they could identify quite a few places in the D1 to D6 matrix cells to either sidestep losses or to create potentially outsize gains.

Enabling The Red To Black Cycle

What is critical to keep in mind, however, is that the point of raising Fed Fund rates to at least 4% within 2 years is not to create a crisis - but to exit a crisis. If a future asset-bubble induced crisis is eventually inevitable anyway, as Feldstein believes, then the key is for the Fed to do everything it can to successfully create column "C", the Red to Black cycle. There has to be room (in Feldstein's opinion) to not only move rates down sharply, but to replace recession with economic growth, rescue many investment categories, and (implicitly) save quite a few retirement investors over time as well.

Again, enabling "a greater ability to more effectively loosen monetary policy when needed at a later point in the cycle" may sound quite theoretical and obscure, but the real world financial implications of a "C" column, Red to Black cycle, can be every bit as powerful in moving investment prices and every bit as pervasive in changing those prices in numerous asset categories as what is seen in a "D" column, Black to Red cycle.

Now we move our attention to the C1 to C6 matrix cells. As an example, in cell C2, if we start with devastated stock values in the midst of recession, and then slash interest rates and reboot economic growth - there can be powerful price movements over time. The same is certainly true with bonds, REITs & real estate, precious metals and cryptocurrencies.

The specifics can be entirely different within each of the C1 to C6 cells, when compared to the D1 to D6 cells. Yes, in many cases reversing the cycle and going Red to Black means reversing the investment category results, and what was bad becomes good while what was good becomes bad.

However, there is much more to it than that, as how the containment of crisis changes asset prices is less intuitive for most people than how crisis changes prices. There is also the issue that while crises can move very quickly, the containment of crisis can stretch out over a number of years, with the best opportunities moving between different asset categories and matrix cells over that time period.

The Investment Implications Of Two Sequential Applications Of Brute Force

So long as we are sticking to the examination of the potential investment consequences of Feldstein's monetary prescription, then another critical point is that the C1 to C6 cells, are not an alternative to the D1 to D6 cells, but rather follow those cells in sequence.

First there is the Black to Red cycle of moving from the containment of crisis to crisis, and the collapse of the bubbles. And then we start with the asset values in each category after the bubbles and in the midst of a recession, meaning they are likely in a quite different place from today, and then they move as a result of the quite different Red to Black cycle of crisis to the containment of crisis.

So we have not just one major price change, but two major price changes in sequence, that work differently in each of the C & D columns, and in each of the first six rows of the matrix.

Another important consideration is that while "changes in monetary policy" may sound a bit esoteric - in practice, such changes can be anything but subtle. When the Fed really wants to change the direction of the economy it doesn't tinker around the edges, but relies on the application of brute force, with ripple effects that can rapidly change results in all investment categories.

We were in a highly distorted investment environment, albeit somewhat stable, as a result of the Federal Reserve's unprecedented zero interest rate and quantitative easing policies. The 1.75% in interest rate increases to date are already having a major impact. And if another 2.25% in rate increases do indeed bring the Fed Funds rate up to 4% - we will be in an entirely different asset valuation situation than we are right now let alone where we were two years ago.

If two or more asset bubbles are collapsed as part of that process, that is far from subtle, but will be a hammer blow, with major and swift price changes across all the asset categories.

And again, the primary reason why Feldstein is advocating for higher rates is to give the Fed the ability to really shock the economy out of the next recession with a very fast 3%+ reduction in interest rates. He wants the Fed to be able to raise the hammer high enough in the air so that when the down stroke comes it can be of overwhelming force, and the impact of such a swift and powerful blow would not just (hopefully) jolt the economy into gear, but would reverberate out and slam into all the investment asset categories as well.

Now a series of hammer blows striking so hard that they send asset prices falling or soaring in a sequential manner may sound a little overly dramatic - but remember, we've seen this before, or at least something very similar. The collapse of the real estate market bubble after 2006 was a hammer blow. The financial crisis of 2008, the more than 50% drop in the stock market, and the Great Recession were all hammer blows. The Federal Reserve reducing interest rates by 5% between July of 2007 and December of 2008 was a hammer blow.

And yes, there were some terrible losses in the process, that changed millions of lives. But the hammer blows also (eventually) produced some record profits as well, with record or near record highs in precious metals, bonds, stocks and real estate.

If Feldstein's macroeconomic prescription (or something like it) continues to be followed in practice by the Fed, then in the investment markets the complacency of recent years could be replaced by an sequence of potentially rapid hammer blows that would create an understandable sequence of major asset price swings, first in cells D1 to D6 and then in cells C1 to C6, that could include both crushing losses - and also potentially record setting new gains.

A Deliberate Strategy Is Not A "Random Walk"

Perhaps the biggest information value of all from Feldstein's editorial, is that it is not random, but rather it is a deliberate strategy with a series of targeted market interventions with anticipated consequences, each of which is likely to involve major investment price changes.

This directly contradicts the underlying assumptions of Modern Portfolio Theory - and the foundation assumptions underlying traditional financial planning. Investment prices are supposed to be a "random walk", where based upon the Efficient Market Hypothesis, supremely rational and well-informed investors seeking arbitrage opportunities make sure that all investments are always fairly priced based on the best information available at the time, which is then the theoretical foundation underlying purportedly "safe" passive index investing by completely uninformed investors over the long term.

So "deus ex machina", the intervention of an outside agency with extraordinary powers to completely change the plot line in what would otherwise be an irrational manner is not allowed, it is precluded by definition when it comes to traditional financial planning. But yet, "deus ex machina" with a small group of individuals at the Federal Reserve making an unprecedented degree of market interventions over the last almost twenty years has in fact completely transformed the markets and investment prices.

Indeed, around the world "deus ex machina" with central banks aggressively intervening in markets and economies to an unprecedented degree with zero and negative interest rates and quantitative easing are arguably now the number one determinant of investment prices and returns in all categories, including stocks, bonds and real estate.

So what this means is that interest rates are not following a random path. Stock prices are not following a random path, not if Feldstein and many other macroeconomists and market observers are to be believed. Bond prices are not following a random path, and neither are real estate or REIT prices - or precious metals prices.

Instead, there is a strategy being followed, an intention to create a sequence of events that is at least partially known in advance. Each of those events has the potential to create major prices swings across all the investments categories.

For someone who is aware of what the strategy may be - well, they won't have certainty, but they will have a major edge over those who do not.

Of course, the future is always uncertain. For instance, if the genie of financial chaos is really let out of the bottle again with potential simultaneous asset bubble collapses of stocks and at least portions of the real estate market - whether even a 3-4% reduction in the Fed Funds rate will actually be enough to put that genie back in the bottle the next time around is an open question.

And while central banks have extraordinary powers when it comes to markets and investment returns, they are far from all-powerful. Political elections, wars, trade wars, demographic changes and technological innovations are all among the list of factors that can transform investment prices in ways that supersede the influence of monetary policy decisions.

But yet, while certainty is necessarily missing, we are still in a new "deus ex machina" world where extraordinary central banking interventions are a dominating influence in the financial markets. Those interventions are not random, but are based on strategies and theories.

As the macroeconomic strategies and theories guide the economic and market interventions, they can cause major changes in investment prices in a logical sequence that are not random and are not part of the quite different field of traditional investment theory. This can give someone with knowledge of the strategies and sequences a major advantage over someone who is blindly investing without that knowledge.

If something like what Feldstein prescribes does come to pass - and the current Fed "dot plot" of anticipated interest rate changes has strong similarities - then two cycles of investment arbitrage opportunities will indeed be created in sequence, Black to Red followed by Red to Black, with major (but quite different) investment opportunities in each cycle.

A Convergence Of Indicators

This is the longest the United States has gone without a recession in the post-war era.

The only two previous times in the last 20 years that the Fed has gone through a cycle of increasing interest rates - then asset bubbles collapsing, devastating market losses and recession have followed each time, as reviewed in the analysis linked here.

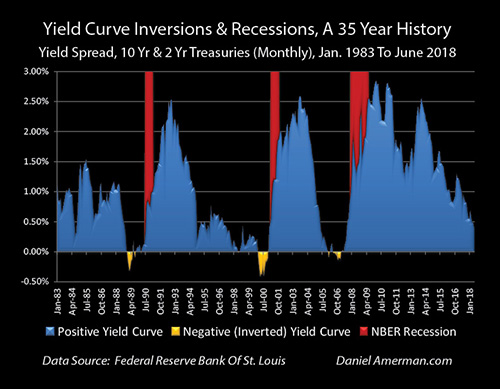

While the yield curve has not yet inverted (and it may not), as reviewed in the analysis linked here, we are the closest to a yield curve inversion that we have been in more than ten years. And as shown above, every time the yield curve has actually inverted over the last 35 years (and more), a recession has followed each time.

And now, as reviewed herein, we have a highly prominent and respected economist writing a rebuttal to President Trump for the Wall Street Journal, in which Feldstein says the Fed must have the freedom to continue raising interest rates without interruption, even though he fully expects both market crashes and recession will result (likely before the 2020 elections), because he thinks the crashes and recession are on the way regardless, and we need the higher rates to work with if the nation is to swiftly emerge from the coming recession.

None of those are by themselves definitive. But taken as a group, they are more compelling, and they become still more compelling each the time that Fed raises interest rates in practice, as it is expected to do twice more this year.

In this analysis, we used the prescription that Dr. Feldstein provides as a tangible framework for exploring what many people would be consider to be very esoteric and theoretical, which is the relationship between the obscure principles of central banking monetary policy, and the quite concrete financial implications for individual investors.

That very framework could certainly come to be. It is far from the only path, there are certainly other possibilities - but what creates the framework is also the center of the mainstream of economic theory when it comes to how central banks rely upon the ability to substantially and swiftly lower interest rates when needed for the purposes of escaping recession.

So we have a very strong track record of rising interest rates leading to bubbles popping, markets crashing and recessions over the last couple of decades. And then we have a perfect track record (it is THE strategy, not just a correlation) of the Fed forcing down interest rates to escape recession.

In just focusing on market crash versus no crash, or recession versus no recession, I think too many people are missing half the picture. Understanding both cycles together, and how D1-D6 are followed by C1-C6, is where most of the money will be made under that scenario, across all the asset categories.

Professor Feldstein has a very different perspective than most people, and is so intently focused on thinking ahead to the next stage and trying to achieve a successful economic recovery for the nation, that he is in what I assume to be complete good faith, willing to bring forward in time and actually trigger $9+ trillion in investor losses if that is what it takes to get there. He is far from alone when it comes to seeing the world in those terms, and his macroeconomist peer group includes the central bankers of the world who do have the votes to change interest rates and thereby global prices and returns.

Seeing investments from that perspective is uncommon among non-economists, but I believe it is critical information for investors in a world that is still dominated by unconventional central banking interventions to an unprecedented degree. I hope this analysis has helped you to better understand the relationships between monetary policy, the value of your savings and the existence of a potential sequence of opportunities.

*******************************