Binary Risk & The Italian Tempest

By Daniel R. Amerman, CFA

TweetShould what has happened in Italy in the last week of May matter to long term investors in the United States and other nations?

On May 28 and 29 of 2018, there was a red hot crisis in process that had the potential to break the Euro and bring down global markets. On Wednesday and Thursday, most of the fears evaporated, and it was looking more like business as normal in the United States. Then by Friday a new Italian government was formed after all, and the immediate source of the crisis disappeared.

From a pattern recognition perspective, there is a temptation to dismiss this and all of the other European financial crises in recent years as being nothing but noise. It seems like again and again an existential crisis for Europe arises that also threatens the global financial system, and then after a burst of fear and fury - the problem just goes away. All that changes in the name of the nation and the particulars of the almost crisis.

In this analysis we will examine an alternative perspective - that there is great information value in a series of crises that each have the potential to spin out of control, regardless of whether one actually does so or not.

The reason that the Italian crisis did not spin out of control - and calm was achieved so quickly - is because the Eurozone is not experiencing normality, but is rather still in the midst of one of the most extreme crisis containment environments that has been seen in all of financial history.

The European Central Bank is still quantitatively easing and creating money out of the nothingness on a huge scale, it is using this money to create what are still negative interest rates in many cases, and it has effectively become the market for many public and private bonds, buying everything that is issued as needed.

So instead of a placid normality with a series of little hiccups that a reasonable long term investor can safely ignore - we are still in unprecedented territory with two major simultaneous abnormalities. We have had a string of potential major financial crises - none of which should be occurring in normal times or normal markets. And each crisis is being contained within a framework of massive non-conventional measures, none of which should exist in normal times or normal markets.

This is a form of "binary" environment. The future could be crisis, with potentially radical price movements across all the major investment categories. Or the future could be the continuation of what we have seen for some years now with the quite stable but equally abnormal containment of crisis, which has had major asset price implications for stocks, bonds, real estate, precious metals and other assets.

Either way, investing for "normality" is ultimately a dangerous illusion, because neither crisis nor the containment of crisis are likely to produce normal asset returns over the long term.

And while the United States is not Europe - we have our own issues with potential crisis and the containment of crisis and we are not yet in anywhere close to normal times. These issues exist independently of what is happening in Europe, but could be greatly exacerbated by a financial contagion spreading from Europe and the European markets.

This analysis is part of a series of related analyses, an overview of the rest of the series is linked here.

Binary Risk & A Close Call

In understanding the crisis, it is worth reviewing highlights of a couple of Wall Street Journal articles that were published on May 29th, 2018. The first is "What to Make of Italy's Astonishing Bond Selloff."

"Market reporting is prone to hyperbole, but Tuesday's Italian bond selloff was truly astonishing. Short-dated bonds that can usually be treated as a close proxy for cash turned toxic, and bondholders showed serious panic. Prices fell and yields on short-dated bonds rose as much or more than when the euro was fighting for survival in 2011 and 2012."

"The gap between the yield at which people were willing to buy and sell on the 2-year bond was exceptionally wide at 0.46 percentage point, according to Tradeweb, backing up the idea that liquidity had evaporated. As one hedge-fund manager shorting Italian bonds put it, there has been a "buyer's strike" because foreigners were unwilling to buy, while domestic investors were scaling back holdings."

https://www.wsj.com/articles/what-to-make-of-italys-astonishing-bond-selloff-1527663600

What makes the above particularly extraordinary is that it took place not in a free market, but inside of a market that is already dominated by crisis containment and heavy handed central banking interventions.

The eurozone already has asset stabilization mechanisms in place to become the market, and buy a member nation's troubled debt if needed. Even more important is that the European Central Bank has been using quantitative easing to create a potentially unlimited amount of money for the express purpose of buying government debts at negative and other below market rates.

So market participants should have no fears whatsoever about being caught in Italian bonds with no buyers. But yet they were, and they were not just afraid but very afraid.

To have an almost 1/2 of 1% yield spread between buyers and sellers for government debt is an amazing number. It shouldn't exist - but it did. Why? An answer can be found in another Wall Street Journal article, "Italy Sparks Global Fear of Fresh Euro Crisis", that was written on the same day.

"It is unclear how much bonds can sell off and for how long, investors said, because their worth ultimately depends on a political decision to keep the eurozone together.

'What is it you are trading? Your don't really know, because the implications of that tail-risk are very binary,' meaning either the euro holds together or it doesn't, said Charlie Diebel, head of rates at Aviva Investors"

https://www.wsj.com/articles/italy-sparks-global-fear-of-fresh-euro-crisis-1527596280

So, in the midst of a crisis, where did the thinking of some of the world's professional investors go? As demonstrated by what actually happened with the market in Italian government bonds, the answer is straight to two possibilities, with one being a potential financial Armageddon scenario.

Either the euro collapses or it doesn't. If it collapses, then the asset stabilization mechanisms and the purchasing power of the ECB become meaningless, and an investor stuck in Italian government bonds could indeed take devastating losses, with potential default and/or lira "redenomination" losses being very real possibilities ("redenomination" meaning the bonds could be paid with new and potentially not very valuable Italian liras).

And in our thoroughly interlinked global financial system, if the euro did fall, it would likely quickly become a global crisis.

Most individual investors in the United States likely think that the dangers of financial crisis are in the distant past at this point. But yet, many professional investors went to a quite different place almost instantly, when problems did develop. To understand why, it was worth revisiting an analysis excerpt of mine (linked here) from April of 2015. It remains valid three years later, even though the names of the countries and some of the individuals have changed.

********************************************

All It Takes Is One Election

"The single most important take away from the current Greek crisis is not the immediate effects of this crisis, nor is it the effectiveness of the financial defense mechanisms that may in fact be able to contain any damage in the near future.

What really matters is that the "powers that be" have been powerless to stop it.

Obama, Kerry, Merkel, Hollande and Cameron had no ability to change the results of the election in Greece.

Just as Yellen and Draghi also lacked that power.

Just as the New York Times and Washington Post lacked that power.

Just as Goldman Sachs, JP Morgan and Morgan Stanley also all lacked that power, as did the International Monetary Fund, and the World Bank.

We have this enormously powerful collection of financial institutions, governments, media and international organizations, all of whom were powerless to stop what triggered the current crisis. Which was simply a nation holding elections, and appropriately enough in this case, whatever else you may agree or disagree with, this did occur in the cradle of democracy.

And what that tells us is two things:

1) the defense of the financial stability of the eurozone is and always has been based on political consensus; and

2) Greece proves that this political consensus is an assumption that can't actually be controlled.

It is a proven wildcard that can bring the whole house of cards down.

Now again, we don't know if Greece will do it. Nor do we know what will happen in Spain. Or what will happen in France or other nations.

But what is plain to see is that there is a continuous and ongoing risk over the coming years. For what needs to be recognized is that the current dominant power structure can win the next 10 relevant elections, where the status quo is at risk but is preserved – and it won't necessarily matter in the end.

Because all it potentially takes is one key election.

Let's say the status quo manages to win every election between now and December of 2015 or June of 2017 – and then one party in one nation, be they of the right or the left that was supposed to never get elected – does get elected.

Right there, at that very point, regardless of how many previous elections the status quo had survived, everything we think we know about the euro could be turned upside down. With ripple effects that would quickly travel around the world and affect every other nation who is a trading partner with Europe – which we all are.

And once that happens, because the defenses of this experimental currency – as well as the global financial system – are based on political consensus, a severe crisis could develop very quickly indeed.

What is worth remembering is that politics is the "dog" and central banks and financial institutions are the "tail". Now for periods of time it may indeed appear that the tail is wagging the dog.

But, ultimately it's always the dog that wags the tail, and it is the central banks and banking systems who exist at the sufferance of whomever holds the raw political power.

Anyone who loses track of the underlying basics of the situation may find themselves facing the biggest financial surprise of their lifetimes, and perhaps much sooner than they expect.

And if such a scenario were to occur, there would be not just a massive loss of wealth – but there would also be a extraordinary redistribution of wealth

(end of excerpt)

********************************************

The sharpness of the crisis on Monday and Tuesday in Europe was based on the market's knowledge of this continuous political risk, and the fears that this iteration could be the "one" that broke the system. And when the crisis so quickly receded - it wasn't because the problem was fixed, or an indication that the world was returning to "normal", but rather the relieved collective recognition that this particular iteration wouldn't be the "one" after all.

Indeed, on the basis of fundamentals, the situation is likely significantly worse for the survival of the euro over time. The election that set the stage for this was still lost for the European establishment, and the Italian people still elected two populist and openly euroskeptic parties to power.

The new Italian government is committed to stimulus spending that will lead to a level of deficits that will almost certainly break the rules for eurozone membership. The ultimate source of discipline is to throw the offending nation out of the euro. With that being not only perhaps exactly what the new Italian government wants - but something that would likely destroy the euro as well in the process.

The continuous exposure to elections and political risk in the eurozone nations remains and has likely been extended. For as has been recognized since the eurozone was created twenty years ago, a currency union without a political union is inherently fragile, and the only way to truly stabilize it is to move to a closer political union. The new Italian government is highly unlikely to give Germany and France greater control over its budgets and spending, which means that the chances for the political union that would solve the continuous financial risk are now lower.

Fundamentally, the "binary" risk remains - the euro will hold together or it will collapse at some point. What changed over the week was the immediacy of the risk. For this iteration, the perceived near term risk rose sharply and then just as quickly receded, and the market has moved back from potential near term crisis to a greater comfort with the ongoing containment of crisis.

What Happened & What Did Not

It now appears that the particulars of the Italian tempest that occurred in the last week of May of 2018 will likely be forgotten in the coming months and years. The details will recede into becoming minor historical footnotes, much like the particulars of the near crises before it. However, there can be an enduring information value from the week, because by examining what happened and what did not happen, we can get a better understanding of what is and what is not,

For a few hours there was indeed a borderline existential crisis that could have flashed around the world. Liquidity categorically should not collapse with government bonds, particularly when a central bank with effectively unlimited funds openly stands ready to buy the market in the event of emergency.

When that almost 1/2 of 1% yield spread developed - which is huge for government bonds - and foreign buyers evaporated, what was being communicated was there was a genuine fear among institutional investors that the European Central Bank wouldn't be there to buy the bonds.

At the height of the brief tempest, there were three key terms from the past that returned to become the subject of intense hourly scrutiny: "liquidity", "contagion" and the "doom loop". I have been writing about crisis and the containment of crisis for many years now, and as explained in an analysis I sent to readers in 2013 (linked here), this vocabulary is extremely important because those risks were identified by the International Monetary Fund in the aftermath of 2008 as being key components of the kind of financial crisis that can blow past the defenses and take down the global financial system in days.

In the last week of May, a "liquidity" shock did occur for real in one market, and while the market watched with intense interest, it turns out that only a minor degree of "contagion" briefly developed with Spanish government bonds. The "doom loop" of plunging government bond prices bankrupting banks whose bailouts would then bankrupt governments (and create another round of bank insolvencies) never got going, but was widely openly discussed again.

Those kinds of events are fundamentally incompatible with our being in normal economic and market conditions. Potential existential crisis is supposed to be a remote possibility. Italian governments have been notoriously unstable since the end of World War II, something as routine as yet another government failing should not have any global impact - but for a couple of days, it did.

Yet, within the next day or two - there was no crisis. For purportedly normal times, this quick evaporation of crisis is every bit as strange and unlikely as is the crisis developing in the first place.

If we take the perspective of normal economic times - how could this happen? If we take a doom & gloom perspective - how could crisis have been avoided this time, as well as with the previous near disasters that also didn't end up happening?

Crisis & The Containment Of Crisis

It is difficult to explain the week if we take the usual "binary" of normal economic times versus financial crises, which could also be called mainstream financial planning versus doom & gloom investing.

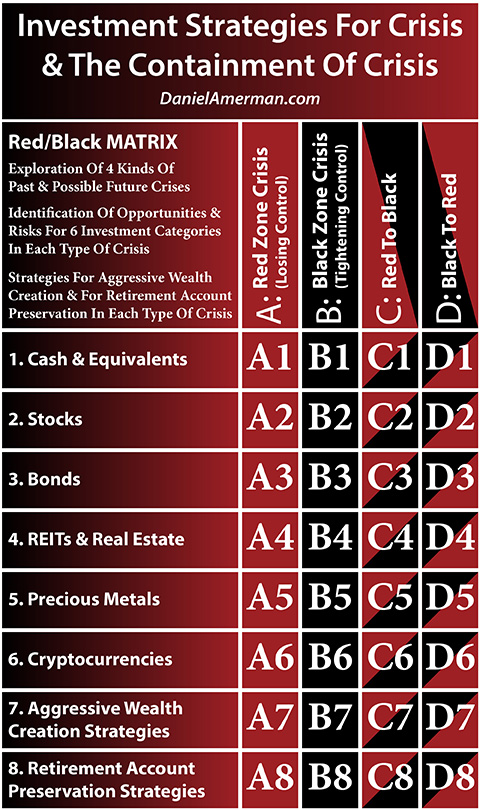

However, if we examine events using a different "binary" perspective, that of crisis versus the containment of crisis, then the week makes perfect sense. A more thorough exploration of this "Red & Black" perspective is linked here.

The euro nearly collapsed in the depths of the hot Red Zone Greek crisis in 2012.

Collapse was prevented by (among other measures) vastly increasing the powers of the European Central Bank, which gave it a far greater ability to create money, to buy bonds and other securities, and to manipulate interest rates.

These interventions to contain crisis did not stop, but have carried forward to today in Europe (and in the United States to a lesser extent). These interventions are in no way "normal" economic times, and have created bond prices, stock prices and real estate prices that are quite different than what would exist in "normal" markets.

It is also important to note that Black Zone crisis containment can be a long term process which produces the placid surface of a remarkable amount of financial stability as well as unusually elevated asset prices. This long term stability will become "normality" for most people, even if the basis is quite different from normal economic times.

What is psychologically fascinating is that a series of brief crises that all end up being contained, can actually reinforce confidence in the financial situation and economy for many people, because the "doom & gloomers" keep getting excited and are then proven wrong, again and again. So if we are looking at a binary or false dichotomy (linked here) between mainstream and doom and gloom, the process of containment sends a steady false signal.

To have a potentially existential crisis for the financial system develop in "normal" times should be an extremely unlikely event, that would then have substantial market ramifications for months or years afterwards.

On the other hand, if the environment is one of crisis containment because of numerous major underlying issues, then a series of crises should be popping up every now and then over time. Those potential crises and their containment are indeed the reasons for the historically bizarre and pervasive central banking interventions with regards to money, interest rates and government financing.

Every now and then however, a particularly bad crisis can arise, that can at least briefly test the tools being used to contain crisis. As it happened, the markets feared that a potential new Italian election in September would reinforce the political power of the euroskeptics, and possibly collapse the euro in the near term - which would collapse the containment of crisis. So there was an open loss of faith, and a developing potential Red Zone crisis very briefly flared into life.

Talks of the formation of a new Italian government, and then the actual formation of that government quickly allayed those fears. As soon as the immediacy of the political threat to the euro was removed, then the ECB regained its awesome powers of Black Zone crisis containment.

And the situation returned (mostly) to where it had been, very quickly. The underlying problems are still there in full, including that any one of a long string of political elections in the coming years could destroy the euro and the containment of crisis. Italy will now be governed by populist euroskeptics. So, the risks were not removed, but the power at least temporarily shifted back to the containment of crisis.

In other words the status quo was restored, and that may be the greatest information value in the Italian tempest.

If we were in normal and stable economic times, then events which call into question the very existence of the euro and ECB should be extremely unlikely. The critical importance of the terms "liquidity", "contagion" and "doom loop" in such a situation should be reserved for graduate students studying financial history, not the subject of hourly analysis. In the shocking case that a "near miss" does occur, the consequences should be long-lasting when it comes to markets and investor behavior, because clearly there is far more risk in the system than markets were pricing in.

But if we are in a cycle of crisis and the containment of crisis, then a crisis developing now and then is more or less expected as part of the status quo. The containment of that developing crisis is also part of the status quo. So there is no huge shock or surprise factor, there is no need for a change in behavior or perceptions, and a week or two later it may seem like nothing happened at all.

What makes this so important for investors is that there is no "normal" pricing, but rather "binary" abnormal pricing for all asset categories, including stocks, bonds, real estate and precious metals. In the United States as well as Europe, investors have grown accustomed to the long term stability of often elevated asset prices that have been created not by true free market conditions, but rather by long term policies of crisis containment.

If we move to a Red Zone crisis in the future, then there are likely to be radical price movements across multiple asset categories that can best understood through using the binary of crisis and the containment of crisis.

If that new crisis is then defused by yet another Black Zone crisis containment, there will likely be a second series of radical asset price movements that are also not "normal" but are best understood using the binary of crisis and crisis containment. That 1-2 combination of sharp and abnormal asset price movements in sequence can be financially devastating or lucratively profitable, it all comes down to the understanding and the positioning.

*******************************************